Rotterdam, 20 September 2022 – Robeco has published its twelfth annual Expected Returns report (2023-2027), a look at what investors can expect over the next five years for all major asset classes, along with macro-economic predictions.

Against the backdrop of many moving and unpredictable market parts, including the energy and food crises, double digit inflation in developed countries, and China’s trajectory as the largest contributor to global growth, Robeco is framing the years leading up to 2027 as 'The Age of Confusion'. The continued pandemic related fiscal stimulus, supply chain problems, and the Russia-Ukraine war have contributed to unexpectedly high inflation over the past year. Only veteran investors have previously experienced the devastating effect that such high levels have on purchasing power and investment portfolios.

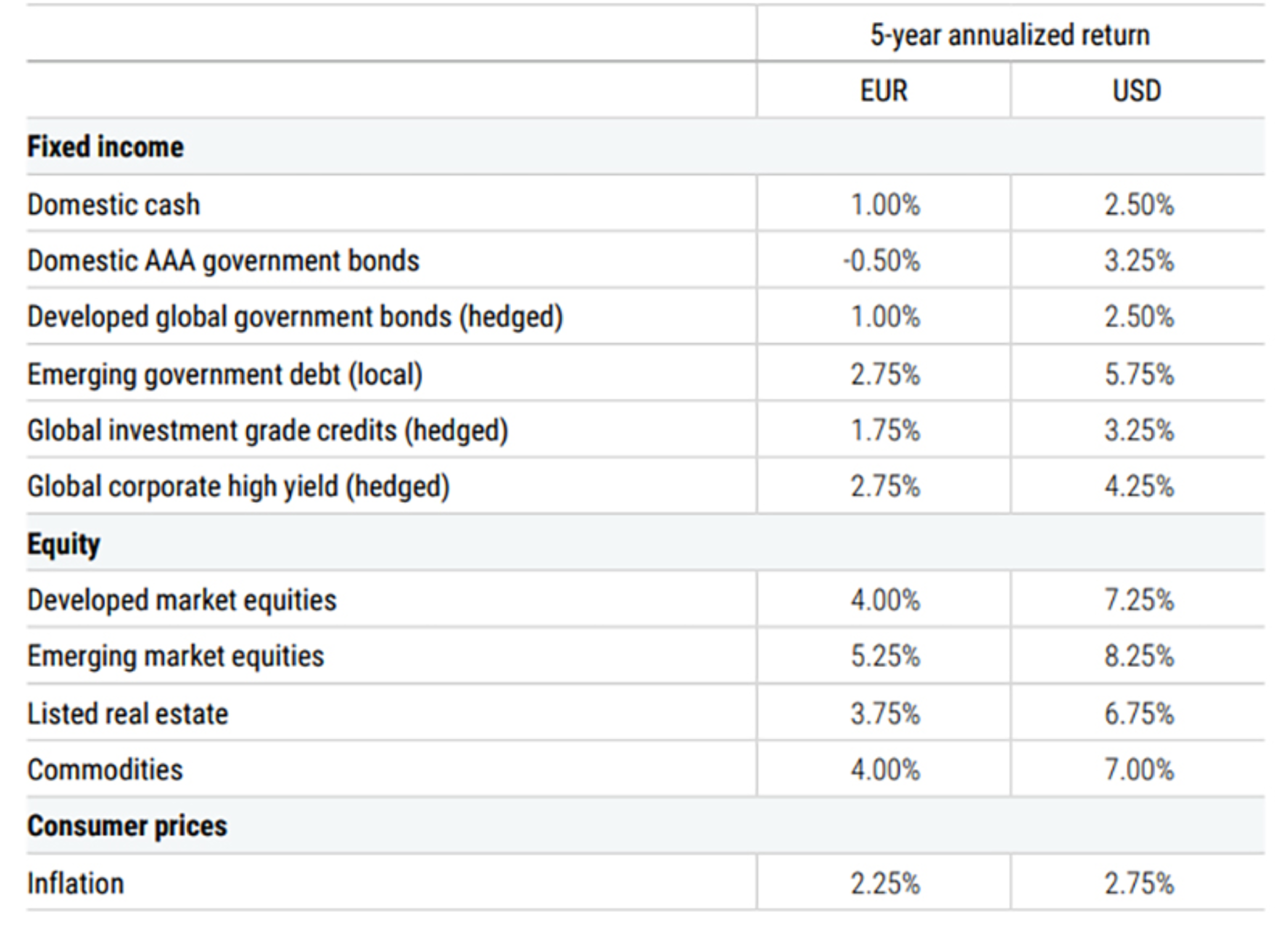

Accordingly, we expect asset returns to remain below their long-term historical averages over the coming five years, mainly due to the low risk-free rate. It’s worth noting that the expected equity risk premium of 3%, for the first time in the 12-year history of the Expected Returns publication, will be below its long-term average of 3.5%. For US dollar-based investors with an international portfolio, perspectives are rosier as other currencies are expected to appreciate against the US dollar, with the USD bull market coming to an end in the next five years.

With its impact permeated the Expected Returns, climate risk has been an integrated part of Robeco’s five-year outlook since last year’s edition. Robeco foresees little to no impact from climate change on developed government bonds and investment grade corporate bonds. For developed market equities, there is a slightly negative signal due to both lower economic growth and physical risks. Commodities are the only asset class to receive a positive climate signal, mostly because the energy transition and physical climate risks will put upward pressure on commodity prices.

In addition to the five-year outlook, the report also covers four special topics, related to the theme:

The emerging trade-off in global trade

Gaining an edge with alternative data

The energy transition comes with a price tag

(No) food for thought

Peter van der Welle, Strategist Multi Asset at Robeco: ”We find that the bar for inflation becoming entrenched is pretty high and recessions, which we expect one way or another, are highly disinflationary. However, a right-hand skew to the expected inflation frequency distribution for developed economies is a key thread for 2023-2027. "

Laurens Swinkels, Researcher at Robeco: "In this ‘age of confusion’, the future has become less predictable and that includes the consequences of climate risk. The exact magnitude of climate change over the next decades is uncertain, and its impact on asset prices is even more unclear. However, what we do know is that asset allocators need to seriously consider the long-run impact of climate change on asset class returns."

Read the full report Expected Returns 2023-2027: ‘The Age of Confusion’ here.

Read the Executive summary here.

Press contact

Maurice Piek

Senior Manager External Communications

T: +31 (0)6 30 38 2911

E: m.piek@robeco.nl