As in the equity market, the number of factors is also growing in the corporate bond market. To date, the most common factors in the credit market are size, value, momentum, and low risk. We have also analyzed the quality factor and came to the conclusion that, in the corporate bond market, the quality factor is a natural extension of the low-risk factor: part of quality’s alpha is subsumed by low-risk, but quality still adds value to the factor mix.

Discover the value of quant

Subscribe for cutting-edge quant strategies and insights.

What is Carry?

In general, carry is defined as the expected return of an asset when market circumstances stay the same. In the credit market, carry can be defined as the credit spread in its simplest form (the additional yield of the corporate bond on top of the Treasury bond yield), or as the credit spread plus the roll-down. The rol-down is the expected return of a bond after rolling down the curve, which is assumed to stay the same. We believe the latter is more complete.

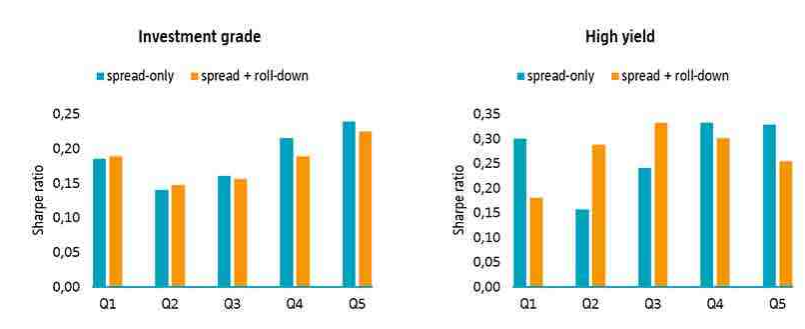

We have evaluated the performance of the carry factor over the period from January 1994 to June 2016. In each month, we sorted bonds on their carry (credit spread + roll-down), divided them into five equally-weighted portfolios, and held them for 12 months. We observed that while the returns generally increase from the lowest carry bonds (Q5) to the highest ones (Q1), their volatilities disperse even more widely and monotonically. As a result, the Sharpe ratio (return per unit of risk) does not increase from Q5 to Q1. This dispersion in volatility is also observable through other risk measures. The bonds with the highest carry in investment grade are those with the highest risk: higher duration, lower credit rating, higher beta, and lower Distance-to-Default (DtD). Similarly in high yield, high carry is characterized by lower rating, higher beta, lower DtD, but lower duration, which indicates a downward-sloping credit spread curve. We thus conclude that high-carry bonds earn not only higher returns, but are also substantially more risky than low-carry bonds.

Figure 1 shows the Sharpe ratios of carry portfolios for investment grade (IG) and high yield (HY). If carry were a successful factor, the Sharpe ratios would be monotonically decreasing as we would move from the highest carry to the lowest carry portfolio. However, in both universes, the highest carry portfolio does not show a superior Sharpe ratio to the other four portfolios. The Sharpe ratio of Q1 in IG is 0.19 and in HY is 0.18. Based on these results, carry should not be considered as a factor by an investor to build a credit portfolio.

Figure 1 | Sharpe ratio of Carry (pick-up + roll-down) quintile portfolios in USD investment grade and high yield

Source: Robeco, Barclays. Sample period: January 1994 - June 2016.

De-risking the Carry factor would make it Value-like

One could argue that the tendency of the carry factor to select more risky bonds could be mitigated by constructing the portfolios in a more risk-neutral manner. However, doing so would make the carry factor very similar to the value factor. Recall that value in the credit market is defined as the credit spread of a bond relative to the underlying risk. By construction, credit spread is the overlapping variable in both the carry and the value factor. If all bonds with the same credit spread would be equally risky, then carry and value would be equal. Thus, if we were to correct the carry factor for more and more risk measures, and construct a risk-neutral carry portfolio, it would become more and more similar to a value portfolio. One could argue that the tendency of the carry factor to select more risky bonds could be mitigated by constructing the portfolios in a more risk-neutral manner. However, doing so would make the carry factor very similar to the value factor. Recall that value in the credit market is defined as the credit spread of a bond relative to the underlying risk. By construction, credit spread is the overlapping variable in both the carry and the value factor. If all bonds with the same credit spread would be equally risky, then carry and value would be equal. Thus, if we were to correct the carry factor for more and more risk measures, and construct a risk-neutral carry portfolio, it would become more and more similar to a value portfolio.

No place in the zoo

In regressions of carry on the credit market, on value, and on value, size, low risk and momentum, we do not find significant alpha, which confirms our previous findings. Moreover, we find economically large (0.82 to 1.06) loadings on value, which are also highly statistically significant. This indicates that the value factor subsumes the carry factor. Therefore, given the existence of the value factor, we conclude that there is no place for a carry factor in the corporate bond factor zoo.