The key consumer trend of 2019: health and wellness

There is no denying that young consumers care about their health. This is reflected in a variety of choices – about diet, sports, wellness and leisure, work, travel and even clothing.

Summary

- Millennials and Gen Z care about having a healthy lifestyle, and are willing to pay a premium for it

- This is disrupting the traditional food industry, which tends to favor cost efficiency over quality

- Drivers of the trend are the rise of local brands, social networks and e-commerce

Millennials and Gen Z use fitness trackers and smart watches to track training data and health information. They are willing to spend more money on interesting sporting goods and athleisure brands, such as the running and cycling app Strava, Allbirds shoes, which are made from natural materials, or an Apple smartwatch, just to name a few. And they eat more natural and organic foods with healthier ingredients and fresh herbs and spices.

“For millennials, wellness is an ongoing commitment,” says Robeco portfolio manager Jack Neele. Particularly noteworthy is Gen Z’s attitude to consumption, which has become more like an expression of individual identity, and a matter of ethical concern.

The healthy consumer space is truly diverse with subthemes ranging from fitness to food ingredients. It also includes corporate wellness, beauty, sleep, personalized care, athletic apparel, personalized nutrition, travel and hospitality, and mental wellness.

Within this vast universe, the industry of healthy and organic food is growing the fastest. For example, low-calorie sweeteners and vegetable snacking are becoming increasingly popular. And the demand for plant-based protein, as can be found in meatless sushi and vegan takeaway meals, continues to gain momentum. Many large traditional packaged food companies invest in this space, such as General Mills (Beyond Meat), Nestle (Impossible Foods), and Unilever (De Vegetarische Slager).

The organic food industry has multiple drivers

The industry has a few underlying drivers, the most important one being the strong growth of small and local brands, particularly in emerging markets. The health and wellness trend also reinforces it as it drives the need for more high-quality ingredients. The rising demand for convenience is another contributing factor, whether it be for on-the-go meals or shorter average meal preparation time.

The healthy consumer trend as a whole is also driven by the internet, which has lowered the barriers to entering the market. This has happened in all areas of the business – manufacturing, branding and distribution.

The trend has also received a boost from startup proliferation, which has made possible new and innovative ways of producing food. The era of social media also has also given it a push, as platforms like Instagram & Snapchat have made it possible to target specific audiences with advertising. And finally, with the help of e-commerce and logistics, any firm can now deliver its products to the customer’s doorstep.

Any firm now can deliver its products to the customer’s doorstep

Traditional packaged food companies are under pressure

These days, young consumers eat healthy and rely on the internet to find the healthiest foods. As a result, the producers of traditional packaged and processed food are finding they have to reinvent themselves, as merchants offering fresh and organic foods, meal delivery services and online grocery business models do a better job catering to millennials’ demands.

Moreover, the advancement of internet and e-commerce have lowered barriers to market entry for startups in this area. “It has never been easier to launch a brand and advertise it on networks like Instagram,” says Neele. All these factors have disrupted traditional food producers. “For years, they have been focused on efficient manufacturing and lowering prices often at the expense of quality and health characteristics,” says Neele.

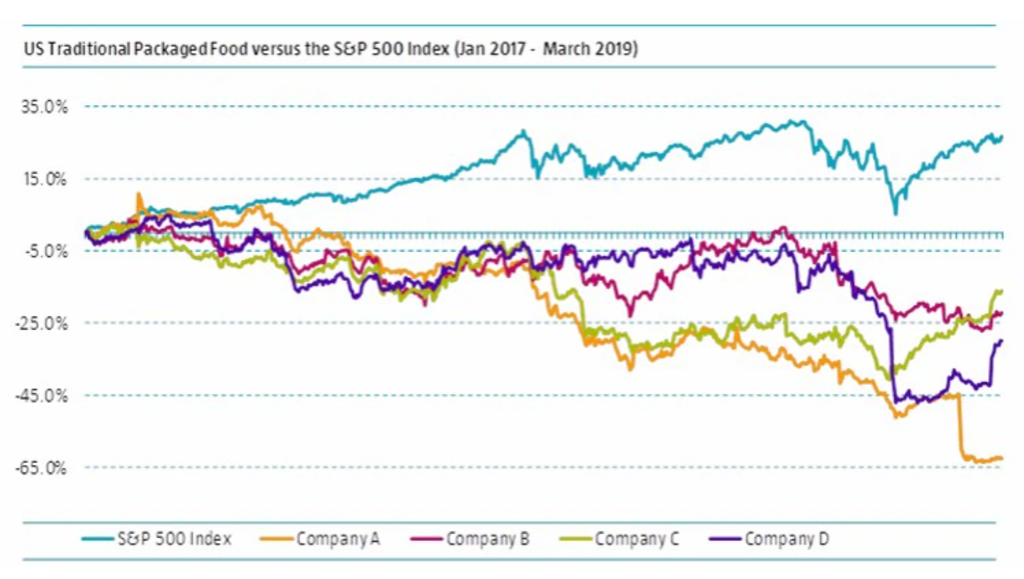

Yet, consumers are now much better educated and are choosing different brands and products. So it comes as no surprise that the returns of most of the US-based traditional packaged food producers have been falling compared to the S&P 500 Index since at least 2017. Many of these companies are aiming to pivot their portfolios through acquisitions.

Source: Robeco Trends Investing

Global Consumer Trends D USD

- performance ytd (30-9)

- 11.90%

- Performance 3y (30-9)

- 20.37%

- morningstar (30-9)

- SFDR (30-9)

- Article 8

- Dividend Paying (30-9)

- No

What are the implications for investors?

Investors can benefit greatly from having an understanding of the healthy consumer universe. The structural winners in this trend could either be new entrants which are able to benefit from it, or traditional food producers with a well-rounded product portfolio. This trend was one of the key themes covered at a media roundtable on Trends Investing organized by Robeco in Amsterdam last month.

“We believe that within the space, the specialty ingredients market is seeing significant growth and presents an important investment opportunity,” says Neele. The production of the enzymes necessary for making probiotic yoghurt is just one example. The specialty ingredients market is currently worth around USD 75 billion and is still in its infancy compared to the large packaged food industry. But it is growing faster and faster, and delivering high margins and returns.