Quality: the underappreciation of well-managed businesses

Persistent human errors when forming future earnings expectations for companies give rise to the Quality premium. As the newer kid on the factor block, Quality has become established on the back of robust evidence and its resilience post publication.

Summary

- Quality is one of the four key equity factors

- Risk characteristics do not cause the quality premium

- Unfounded pessimisms on the future profitability of high Quality firms drive premium

The quality factor encompasses several firm characteristics related to firm profitability, earnings quality, investment policy and corporate governance. Various academic papers demonstrate that high quality companies tend to generate significant outperformance relative to the market that cannot be explained by other common factors.

This result may seem counterintuitive at first. If the high quality of fundamentals is deemed as a desirable feature when selecting stocks, then they would command a higher price and, therefore, result in lower expected returns. However, numerous studies reveal why high quality firms deliver strong returns in the absence of elevated (materialized) risks.

For instance, a seminal paper1 published in 1996 illustrated that stock prices failed to fully reflect the information contained in accruals and cash flows until it had an impact on future earnings. It therefore deduced that companies with conservative accruals management policies (low accruals) tended to outperform the market.

In another study2 in 2008, the authors found evidence that share issuance data – public offerings, share buybacks, stock mergers – exhibited an ability to predict stock returns. Meanwhile, asset growth – related to a firm’s investment and financing activities – was also shown to have an effect on predicting future stock returns, according to a research paper3 published in 2008.

In 2013, an academic paper4 outlined the association between high gross profitability and strong future returns, notwithstanding the generally poor valuation characteristics (for example, elevated price-to-book ratios) exhibited by highly profitable companies. In fact, the researcher argued that profitability and value are two sides of the same coin.

But it was not until 2015 that the quality factor arguably saw the biggest increase in interest. This coincided with the inclusion of quality characteristics (investment and profitability) into the Fama-French five-factor model.5 This ‘stamp of approval’ from the renowned academics spurred a series of research papers that either challenged the robustness of the quality factor, or tried to define what it entailed and how best to implement it in live portfolios.

In a publication6 released in 2018, for example, the authors demonstrated how a quality factor – based on a composite of measures designed to capture the growth, profitability and safety characteristics of firms – generated significant risk-adjusted returns in the US and globally across 24 countries.

Risk-based theories fall short in their explanations of the Quality premium

In our view, the academic research that argues in favor of the quality premium being driven by risk is unconvincing. Most notably, the seminal Fama and French paper5 failed to strongly link the investment and profitability factors to risk. The paper represented a clear departure from the findings in their preceding three-factor model,7 where they argued that the factors stemmed from exposure to distress risk. Not only is it difficult to associate quality with distress risk, but multiple studies8 have also shown that the relationship between distress risk and returns is actually negative.

In a Robeco research paper,9 the authors outlined the shortcomings of the Fama-French five-factor model. One of the issues pertained to a number of robustness concerns regarding the two new factors. In particular, it was surprising that the investment factor was defined as asset growth, which Fama and French had considered to be a ‘less robust’ phenomenon in their earlier work.10

The five-factor model also failed to explain a number of variables that are closely related to investment and profitability. Moreover, it was unclear whether the two new factors were effective before 1963, which has since been demonstrated in another publication11 that shows evidence of the quality factor dating back to the 1940s.

Another concern revolved around the economic rationale for the model. Fama and French did not even attempt to explain that investment and profitability are plausible risk factors. Instead, the two factors were included as they proxy expected returns based on a rewritten dividend discount model.

In another publication,6 the authors showed that high quality stocks appeared to be safer and not riskier than their low quality peers during distressed market conditions. But due to their defensive characteristics, concerns were raised that the quality premium could actually be the low-risk premium in disguise. However, a Robeco paper12 highlighted that quality and low-risk factors are distinct.

Furthermore, another Robeco study13 illustrated that the similarity between the low-risk and quality factors is mainly found in their short positions as poor quality stocks also tend to be very volatile. But when observed from a long-only perspective, the two factors are quite distinct.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Quality anomaly is driven by behavioral biases

In 2012, Robeco launched a project that was aimed at evaluating why quality investing works and how it could be implemented efficiently in portfolios. The key insights were subsequently published in an academic paper.14 The researchers showed that the quality factor worked across global equity and credit markets.

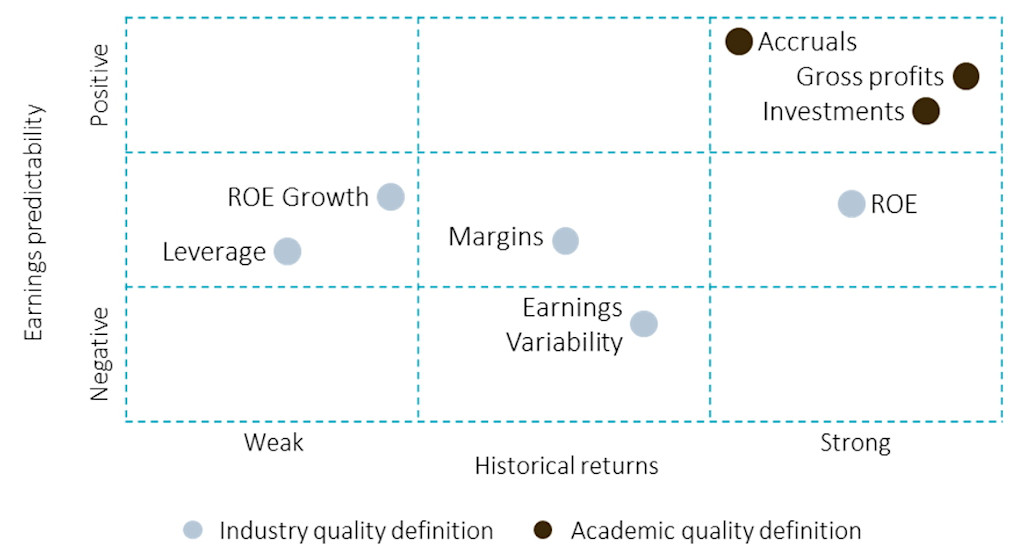

However, they noted that not all quality definitions were created equal. In terms of their findings, they observed that the quality measures documented in the academic literature – gross profitability, operating accruals and investments – were more robust measures than more commonly used metrics in the industry such as earnings variability, leverage, margins or return on equity growth.

The study dived deeper into the reasons why this was the case. In particular, the researchers noted that the quality measures that were associated with high future returns worked well as they could forecast high future earnings. They found that this information was not properly discounted in current market prices. In other words, market participants, on average, underreacted to information embedded in past profitability, operating accruals and investments.

Figure 1 depicts the relationship between returns and earnings forecasting power of the various quality metrics. As indicated in the top-right corner, the accruals, gross profits and investments measures do well in predicting future earnings and returns. Meanwhile, the results for the other metrics are mixed.

Figure 1 | How different quality measures stack up in predicting future earnings and returns

Source: Robeco and Kyosev, Hanauer, Huij and Lansdorp (2020). “Does Earnings Growth Drive the Quality Premium?” Journal of Banking & Finance. The graphs show returns vs earnings predictability of long/short portfolios sorted on different Quality measures. The sample period is from January 1986 to December 2015 for global equity markets.

In another research paper,15 four authors provided further proof that behavioral biases drive the quality factor. They used analyst forecast data to show that financial analysts are, on average, too pessimistic regarding the future profits of highly profitable companies. In their view, this gives rise to the profitability anomaly, which they also find to be particularly strong for firms with persistent profits.

Another recent study16 also presented evidence in support of a behavioral explanation for the profitability factor. It outlined that investors tend to assign similar price-to-earnings multiples to stocks with similar expected growth. This simplistic approach leads profitable companies to outperform in the future when less profitable firms are forced to issue additional equity to fund their growth. In turn, this dilutes the claims of existing investors to future cash flows.

Conclusion

All in all, we believe that behavioral biases linked to persistent human errors when forming future earnings expectations for companies give rise to the quality factor. This premium is consistent over time and across markets, while it is also distinguishable from other factor premiums.

In the previous articles, we touched on low volatility, momentum and value.

Footnotes

1 Sloan, R. G., July 1996, “Do stock prices fully reflect information in accruals and cash flows about future earnings?”, The Accounting Review.

2 Pontiff, J., and Woodgate, A., 2008, “Share issuance and cross-sectional returns”, Journal of Finance.

3 Cooper, M. J., Gulen, H., and Schill, M. J., July 2008, “Asset growth and the cross-section of stock returns”, Journal of Finance.

4 Novy-Marx, R., April 2013, “The other side of value: the gross profitability premium”, Journal of Financial Economics.

5 Fama, E. F., and French, K. R., April 2015, “A five-factor asset pricing model”, Journal of Economics.

6 Asness, C. S., Frazzini, A., and Pedersen, L. H., November 2018, “Quality minus junk”, Review of Accounting Studies.

7 Fama, E. F., and French, K. R., June 1992, “The cross-section of expected stock returns”, Journal of Finance.

8 Dichev, I. D., June 1998, “Is the risk of bankruptcy a systematic risk”, Journal of Finance; Griffin, J. M., and Lemon, M. L., October 2002, “Book-to-market equity, distress risk, and stock returns”, Journal of Finance; and Campbell, J. Y., Hilscher, J., and Szilagyi, J., December 2008, “In search of distress risk”, Journal of Finance.

9 Blitz, D., Hanauer, M. X., Vidojevic, M., and Van Vliet, P., March 2018, “Five concerns with the five-factor model“, Journal of Portfolio Management.

10 Fama, E. F., and French, K. R., August 2008, “Dissecting anomalies”, Journal of Finance.

11 Wahal, S., February 2019, “The profitability and investment premium; pre-1963 evidence”, Journal of Financial Economics.

12 Blitz, D., and Vidojevic, M., September 2017, “The profitability of low volatility“, Journal of Empirical Finance.

13 Blitz, D. C., Baltussen, G. and Van Vliet, P., 2020, “When equity factors drop their shorts”, Financial Analysts Journal.

14 Kyosev, G., Hanauer, M. X., Huij, J., and Lansdorp, S., May 2020, “Does earnings growth drive the quality premium?”, Journal of Banking and Finance.

15 Bouchaud, J., Kruiger, P., Landier, A., and Thesmar, D., October 2018, “Sticky expectations and the profitability anomaly”, Journal of Finance.

16 Erhard, R., Sloan, R. G., August 2019, “Explaining the profitability anomaly”, working paper.