For this SI Dilemma column, I will be referring to some of our specialists in Robeco’s SI Center of Expertise who have written about progress in their respective areas: climate change and the Sustainable Development Goals (SDGs).

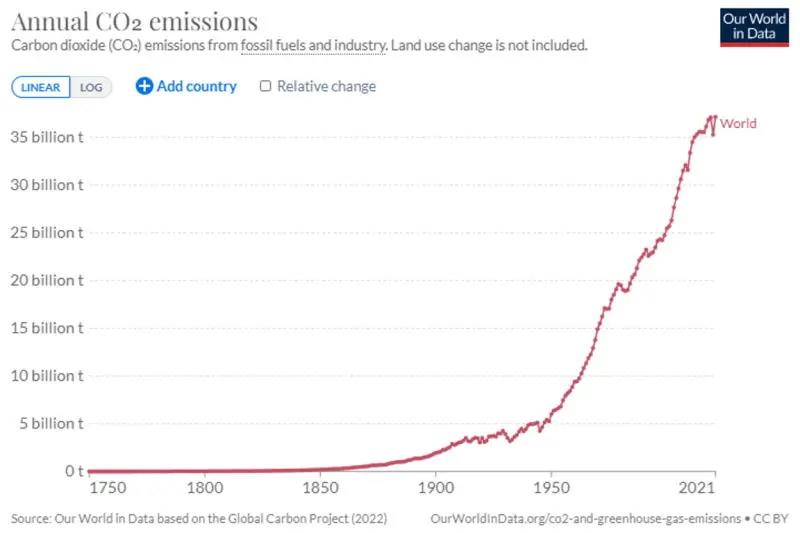

Carbon emissions are still growing

Despite efforts to move to cleaner technologies in producing energy, and despite a global pandemic, which caused global emissions to reduce for one year, CO2 emissions are back at pre-Covid levels. The carbon intensity of our economies has decreased, but due to economic growth, emissions are still increasing, as can be seen in the graph below. And this graph excludes land use change which is a big contributor to climate change as well.

As our climate strategist Lucian Peppelenbos wrote in his column on the Intergovernmental Panel on Climate Change (IPCC) report that was released last year: We are not on track in tackling global warming, but we do hold the answer. With the right leadership, the world can avoid dangerous climate change. That’s still the key message from the UN Climate Science Panel’s IPCC report.

For investors, there is an urgency to respond to the IPCC’s assessment that the financial sector is not sufficiently pricing in climate risk. The IPCC concluded that there must be a massive shift in investments over the next 5-10 years towards low-carbon energy, transport and urban infrastructure.

Another article1 mentions that the COP27 summit at the end of 2022 did lead to plans to create a fund for developing countries to finance decarbonization, but did not produce much in terms of concrete solutions, and climate policies still fall short. If all plans are met, the summit leaves us heading for 2.5 °C of global warming.

How do companies and countries score on sustainability?

Explore the contributions companies make to the Sustainable Development Goals and how countries rank on ESG criteria.

Mixed picture on the SDGs

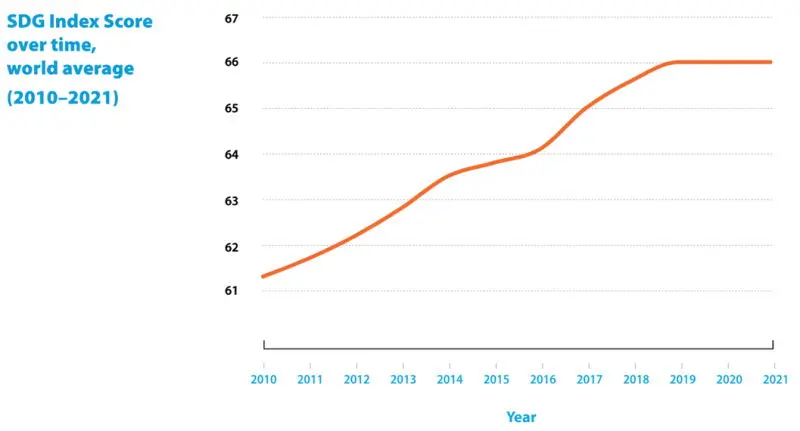

Looking beyond climate change to a broader set of sustainability goals, the UN SDGs, there is a mixed picture. The goals were established in 2015 and should be achieved by 2030. At half time, our SDG strategist Jan Anton van Zanten tallied up the progress.2

As can be seen in the SDG index, he concluded that progress is being made over time to achieve the goals, but it has been far too slow, and is now even decreasing slightly. No country is on track to achieve them by 2030, partly due to Covid.

Beyond the pandemic, what is now particularly worrying are the negative trends on environmentally focused SDGs. If we do not address climate change and halt the loss of biodiversity embodied in three of the goals, it is unlikely that we will achieve any of the other SDGs, given that all social systems depend on the natural environment.

Optimist, pessimist or realist?

‘I always like to look on the optimistic side of life, but I am realistic enough to know that life is a complex matter’ – Walt Disney

As mentioned above, these matters are indeed complex and interlinked. For example, solving SDG 2.1 to end hunger and ensure year-round access to safe and nutritious food by all people, in particular the poor and people in vulnerable situations, will be difficult to achieve while also simultaneously solving SDG 15.1.

This seeks to ensure the conservation, restoration and sustainable use of terrestrial and inland freshwater ecosystems and their services, in particular forests, wetlands, mountains and drylands, in line with obligations under international agreements or many of the other climate and biodiversity-related targets. Growing more food to meet SDG 2.1 makes this much less likely.

Better global regulation

In recent years, the financial sector has woken up to ‘sustainability’, and focused on integrating financially material ESG factors into portfolios, to make better-informed investment decisions. However, there are two issues with this. What the IPCC mentions in its report about the underpricing of climate risk also goes for other externalities such as the loss of biodiversity, poor labor conditions, poor governance and poor community relations.

This should be solved by better global regulation, which puts a price on these issues and makes sure that investors and corporates internalize these external costs. If not, then ESG integration (as long as not everyone is doing it in the same way or using the same information) could help to create better investment decisions, but would not directly benefit sustainable development.

Moving to impact investing

Or we need to find a way to go beyond ESG integration and move to impact investing, creating structures that can fund the trillions of dollars in investments needed (in emerging markets) to create sustainable development. A start was made at COP27 with the creation of a loss and damage fund by wealthier countries. But this still needs to be operationalized.

Green, social and sustainability-linked bonds are also good instruments for large investors to create impact on the ground. The end-investor needs to be vocal about their desire to not only optimize wealth, but also well-being. We are not there yet. Only a small part of all assets under management goes to directly funding corporate projects that help sustainable development.

No other option

It felt good to let the ‘pessimistic me’ out of the closet for this column. It is important to take stock of what is happening in the real world from time to time. And there is not a lot of reason for optimism.

At Robeco, we have a 50-strong SI Center of Expertise through which all investment teams integrate financially material ESG information into the investment process. We spend a lot of time and effort in researching, integrating and engaging on sustainability issues as well as supporting our clients on this topic. And there is a handful of asset managers and asset owners that have been doing the same as us for many years.

We will never know where we would be if we had not done that. We know we have had some successes with engagement, most notably in getting some board members elected that had the right knowledge, and were able to start transition processes at some of the companies we invest in. And whereas COP27 left us heading for 2.5 °C of global warming, five years ago, we were heading for 4 °C.

So, to end with another quote from Churchill, which also applies to me: “For myself, I am an optimist – it does not seem to be much use to be anything else.”