Planet of the fur babies: Pet sector still thriving

Divining consumer trends is more complex in an inflationary environment, but there’s one sector we follow where future direction is clear. Pet care is benefiting from strong demographic and structural tailwinds as the bond between pets and their families grows tighter across the developed world.

Summary

- Pet expenditure is growing per pet, and it’s a very sticky form of consumption

- Pet nutrition and healthcare remain the dominant segments

- Defensive characteristics of pet exposure offer resilience in a subdued economic environment

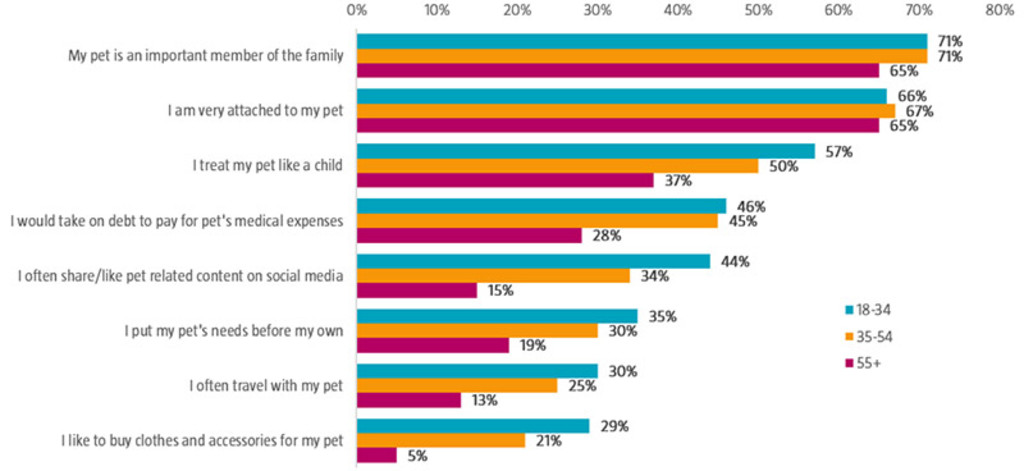

The pet care industry has been enjoying long-term growth as the popularity of keeping pets has increased. It’s now estimated that 66% of family units in the US keep a pet, up from 56% in 1988. More impactful still is how the industry is evolving with demographic and lifestyle changes encouraging more spending on products and services to help care for a pet, especially dogs and cats. In 2021, a survey, commissioned by animal pharmaceuticals company Zoetis and the Human Animal Bond Research Institute, of 16,140 dog and cat owners, and 1,357 small animal veterinarians from nine countries, showed 95% of pet owners consider their pet a part of their family, and 92% would take any intervention necessary to prevent their pet from undergoing pain. This was reinforced by a 2022 study (Figure 1) which shows younger cohorts in the US are more invested emotionally in their pet.

Figure 1: Emotional importance of pets is increasing in younger age cohorts

Source: Alphawise, Morgan Stanley Research – August 2022

Spending like fat cats

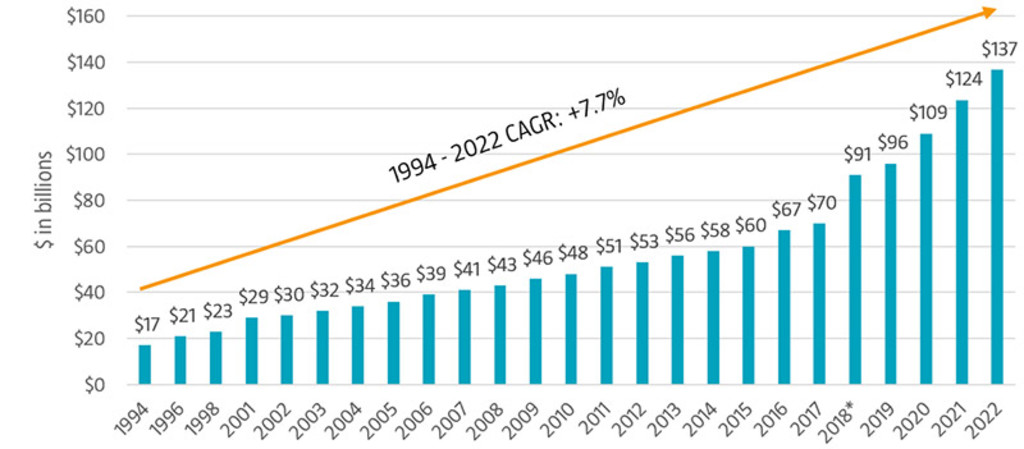

Emotional investment in a pet translates directly to consumption of pet care products and services. According to survey data, millennials spend more on their pets than older pet owners do, especially on premium food and services. This is potentially related to the decline in marriage and the established trend towards starting a (human) family later, if at all. It’s no surprise that this is also reflected in empirical data. While pet ownership is estimated to have increased approx. 1% per year from 2010 to 2020, expenditure on pets increased much faster (Figure 2).

Figure 2: Pet spend was accelerating before Covid

Source: American Pet Products Association (APPA). Note: 2018 and beyond metrics were restated to include products and services that were previously excluded as reliable data was previously difficult to obtain.

Fido comes first

One obvious thing that leaps out from Figure 2 is that pet care expenditure is recession-proof with no dip in 2008/2009 like almost all other consumer sectors. The reason for this is embedded in survey data with pet carers repeatedly reporting they were happy to forgo consumption on themselves to benefit their pet. In a February 2023 survey of 1,500 US-based pet carers conducted on behalf of consumer finance company Synchrony, both generation X and generation Z pet carers said they would rather save up to spend on their pet than save up for a holiday. More bizarrely, 49% of millennial pet carers agreed they would “even brave the winter weather and sleep outside in the snow,” to give their pet an extra year of life. 1

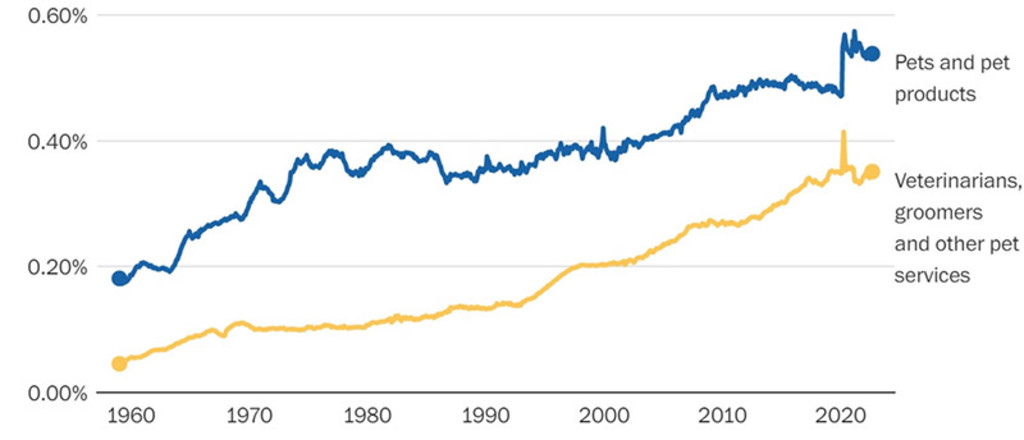

Regardless of that seemingly unlikely claim, the expenditure data shows that pet care demand has become less discretionary over time. The trend of humanization of pets also has led to the development of luxury niches in pet care, with the sector taking a rising proportion of consumer spending and this combination of growth and defensive characteristics is valuable.

Figure 3: US personal consumption on pet care vs total personal consumption (including non-pet owners)

Source: US Bureau of Economic Analysis, Washington Post

Fueling the fur babies

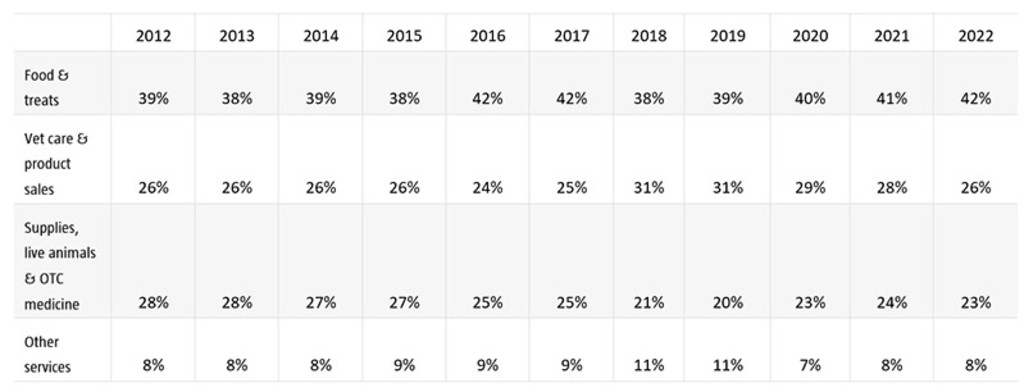

It’s no surprise that food and veterinary expenses are the biggest segments in pet care, but it’s significant that they continue to grow fast. The pet food market has evolved considerably with the premium segment expanding, which makes sense given pets’ enhanced emotional status. According to an Oliver Wyman survey, quality, health & nutrition, and ingredients are the three most important criteria for premium pet food purchasers, well ahead of price.2 There has been an explosion in the number of brands and start-up businesses operating in pet food, especially using e-commerce channels. Other segments within the ‘petconomy’ are also growing, especially services, but these are less investable, so far.

Consumer Trends

Table 1: Pet food and vet services are the biggest consumption segments

Source: American Pet Products Association (APPA). Note: 2018 and beyond metrics were restated to include products and services that were previously excluded as reliable data was previously difficult to obtain.

All creatures great and small

Just as with pet food, pet healthcare is experiencing growth as the numbers of pets increase overall and more treatment is sought or becomes available. Entry barriers are high in this segment with veterinarians and veterinary centers the primary distribution channel. First, vets are viewed as an important resource for all aspects of pet care and second, pet owners interact with vets regularly and intentionally, and not just for illness. Third, vets play a central role in fulfilling pet prescriptions with limited alternative knowledge sources, or channels, relative to human medicine where there is a more established over-the-counter market.

Figure 4: Vets remain the most trusted source of pet care knowledge

Source: Alphawise, Morgan Stanley Research

Veterinary clinics in the US have seen a steady increase in consolidation with smaller veterinary clinics joining a large group organization of clinics, often owned by private equity companies. National Veterinary Associates Inc., a provider of veterinary services with more than 1,400 veterinary clinics (owned by JAB Holdings) said that around 20-25% of US practices are consolidated. These vet networks also represent a higher share of the total marketplace, amounting to 40-45%, and increased consolidation of veterinary clinics by professional organizations could shift the dynamics in pricing power, operationalization and efficiency endeavors. This in turn could either serve, or threaten, companies that supply veterinarians, depending on their positioning.

Hedging your vet bills

Another clear investable opportunity is pet insurance which has a very low penetration rate, especially in the US, but we believe the increasing price of pet medicines and therapeutic care could change that. Statistics from other countries give the pet insurance penetration lead to Sweden with 40% of pets insured, the UK at 25%, Netherlands at 8% and France at 5% according to Bank of America. The US and Canada are notoriously low, with respectively 2.5% and 2.7% penetration. These numbers used to be even lower, but in the US the sector has seen steady growth in recent years.

Global Consumer Trends D USD

- performance ytd (30-9)

- 11.90%

- Performance 3y (30-9)

- 20.37%

- morningstar (30-9)

- SFDR (30-9)

- Article 8

- Dividend Paying (30-9)

- No

Pedigree landscape

The pet care sector is a deep and diverse investable universe and we are gradually increasing exposure to pet care as part of our Health & Wellbeing trend, especially at the moment given its defensive characteristics. Part of that exposure is via FMCG names that are better known for other product categories but play a signficant role in this growth sector.

Figure 5: The pet care universe we analyze

Source: Robeco (not all companies listed are current components of the Robeco Global Consumer Trends strategy)

Finding the best in show

We have been investing in pet care since before the Covid pandemic, but what’s notable right now is that the sectoral developments that we saw intensify through the pandemic have continued to manifest. We are focused on finding the structural winners in the pet care trend, whether they be the entrenched leaders or new entrants in areas like retail, ecommerce, premium pet food or pet insurance, and the whole sector will play a growing role in our consumer strategy.

Footnotes

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.