start of successful track record

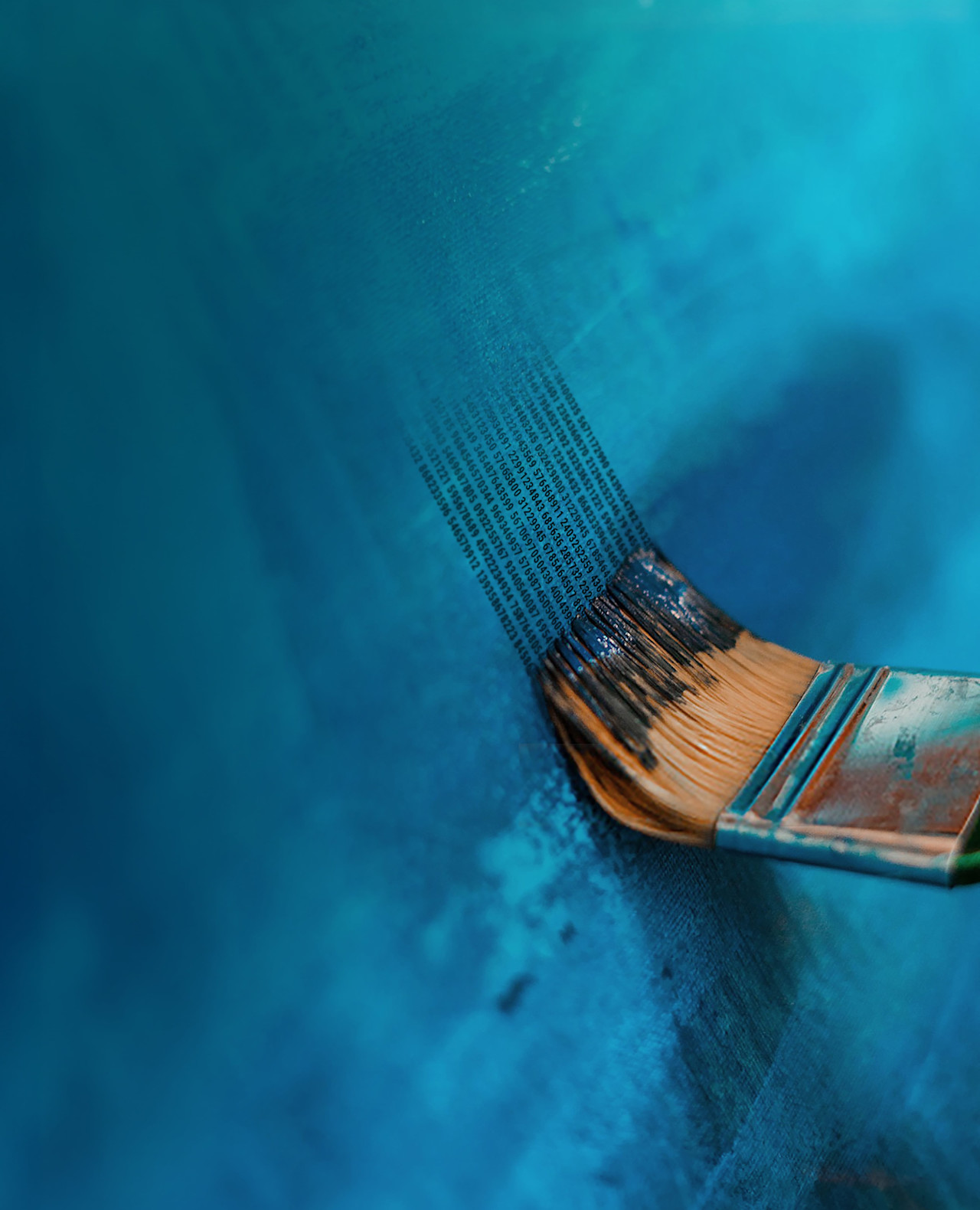

The smarter solution for core allocations

Enhanced Indexing is your answer to the limitations of passive investing. This strategy delivers broad market exposure while aiming for better returns and risk management. With its integration of sustainability and advanced techniques, Enhanced Indexing is designed to meet today’s investment challenges. Optimize your core allocation with a solution that truly performs.

Advantages of Enhanced Indexing

Passive investing has several advantages, such as efficient exposure to the market premium, predictable risk-return characteristics and low fees. Since 2004 our enhanced indexing strategies offer all the advantages of traditional passive investing, but strive to generate better returns than passive vehicles after costs, and integrate sustainability criteria as well as the latest academic research.

- 2004

- 54bn

EUR assets in funds and mandates

(June 2025) - 20years

of tailor-made experience

*Please note that these figures apply to our Enhanced Indexing Equities strategies

Sustainable Enhanced Indexing

Excludes sustainability laggards

Integrates ESG in company selection

Aims to achieve significantly lower ESG risk rating relative to the benchmark

Targets substantially lower environmental footprints in three ways: carbon emissions, waste generation and water usage

Tailor-made solutions for client demands

Client-specific portfolio design with bespoke country, sector or relative risk levels

Client sustainability preferences through bespoke criteria

Definition of investment universe according to client