Consumer trends in 2025: Retail media, entertainment and injectable aesthetics

In an ever-changing consumer landscape, two trends we see gaining traction in 2025 are retail media and injectable aesthetics, while digital entertainment and travel spending are likely to remain strong.

Summary

- Consumer spending resilient with travel and digital entertainment buoyant

- Retail media leverages channel data to drive sales

- Injectable aesthetics: Beauty more than skin deep

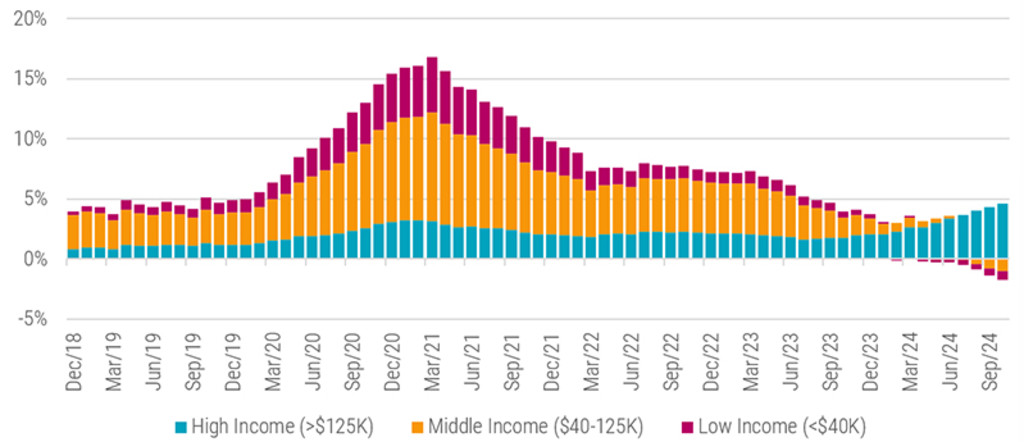

We remain constructive on consumer spending and the outlook for our long-term themes in 2025. US consumer spending was very resilient in 2024 as can be seen in Figure 1, although spending is mostly being driven by the high-income consumer. This affluent cohort has been supported by rising asset values, while the low/middle income consumer slowed in 2024 despite healthy wage growth, as they were disproportionately impacted by inflation. We expect these trends to continue into 2025, although moderating inflation should give more room to spend for the lower end consumers. While recent sideways inflation readings have disappointed the bond market, the key indicator to watch in our view remains the US labor market. With the US unemployment rate still hovering around the historical low 4%, we believe job security will sustain buoyant spending levels.

Figure 1: Contribution to sales growth by income across large US retailers

Source: Numerator, Barclays, December 2024.

Retail media: The next leg of digital advertising

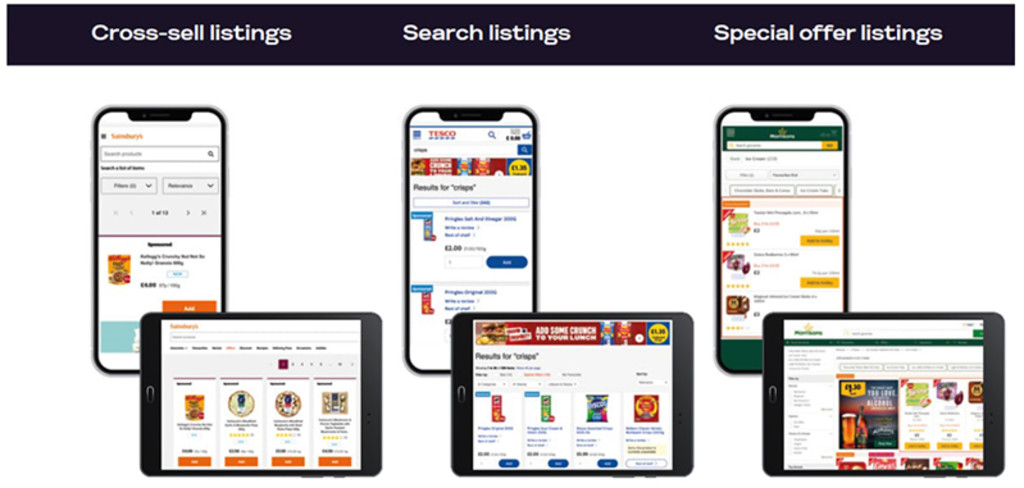

In November, Procter & Gamble’s Chief Brand Officer Marc Pritchard described retail media advertising as a ‘game changer’, noting it delivers up to four times higher returns than other forms of advertising. By ‘retail media’, he means an emerging form of advertising operated by retailers or with retailers’ first-party data. Brands selling through the retailer buy ads that are displayed on the retailer’s website and app. Alternatively, brands buy first-party data from the retailer to reach customers on third-party channels, like social media or other websites and apps. We show a few examples below.

Figure 2: Retail media advertising is ‘changing the game’

Source: Robeco

Similar to investors, advertisers are always on the lookout for the highest return opportunities, which is why retail media is rapidly attracting substantial advertising spend. One particularly promising innovation for Procter & Gamble is shoppable ads, which allow customers to make one-click purchases. This seamless experience eliminates the gap between communication and purchasing, a significant improvement over traditional TV ads that rely on consumers remembering the product when shopping.

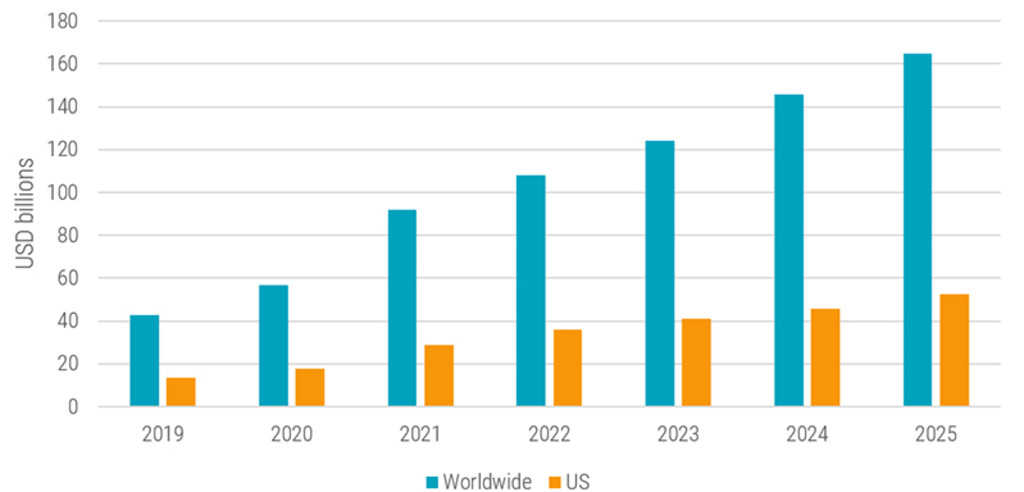

Worldwide, retail media advertising revenues have surged, growing nearly threefold from USD 43 billion in 2019 to USD 124 billion in 2023. According to advertising agency Magna, retail media revenues are expected to increase by 18% in 2024 and 13% in 2025. In the US and Europe, ecommerce giant Amazon has spearheaded the growth of retail media, expanding its advertising revenues from USD 9 billion in 2018 to an anticipated USD 56 billion in 2024. Notably, these revenues come with high profit margins. Inspired by Amazon’s rapid success in building this lucrative revenue stream, other retailers are racing to establish their own retail media businesses. Walmart, for example, has seen its advertising revenue grow by about 30% in 2024 while Costco reports brands lining up to advertise. This trend illustrates how the world’s largest retailers are leveraging high-margin advertising revenues to complement their traditionally low-margin retail operations.

Consumer spending on ecommerce, where most retail media ads are displayed, is the primary driver of retail media advertising growth. Another critical factor is the evolving landscape of ad targeting. Apple’s restrictions on user data sharing and Google’s phase-out of third-party cookie tracking in its Chrome browser have complicated ad targeting for brands and retailers. In contrast, retail media offers a solution: retailers’ investments in high-quality first-party customer data enable more effective ad targeting. Additionally, because retail media integrates advertising and purchasing within the same ecosystem, it facilitates closed-loop measurement – allowing brands to precisely evaluate their return on ad spend. This capability is especially appealing to advertisers, who have become somewhat addicted to precisely measuring their performance.

Overall, retail media advertising is poised for sustained growth in the coming years. Retailers are eager to expand this high-margin revenue stream, while brands are equally enthusiastic about deploying their budgets in channels that deliver superior returns on investment.

Figure 3: Retail media advertising revenues

Source: Magna, eMarketer, December 2024.

Travel: Air passenger traffic surpasses 2019 levels

After a steep drop during the pandemic, global air passenger traffic in 2024 surpassed volumes recorded in 2019. Although some areas are still recovering, particularly international outbound traffic from China, consumers continue to express a strong interest in exploring the world. Led by a 15.6% jump in Asia-Pacific, global air passenger traffic rose 10.7% year-on-year according to the International Air Transport Association (IATA). Also according to the IATA, after bottoming at 31.9 in 2020, an index of revenue passenger kilometers (RPK) rose to 103.6 in 2024 relative to a baseline of 100 in 2019. In the US, the Transportation Security Administration reported that checked air passengers rose 5% year-on-year in 2024 to just under 904 million, a level 6.3% above 2019.

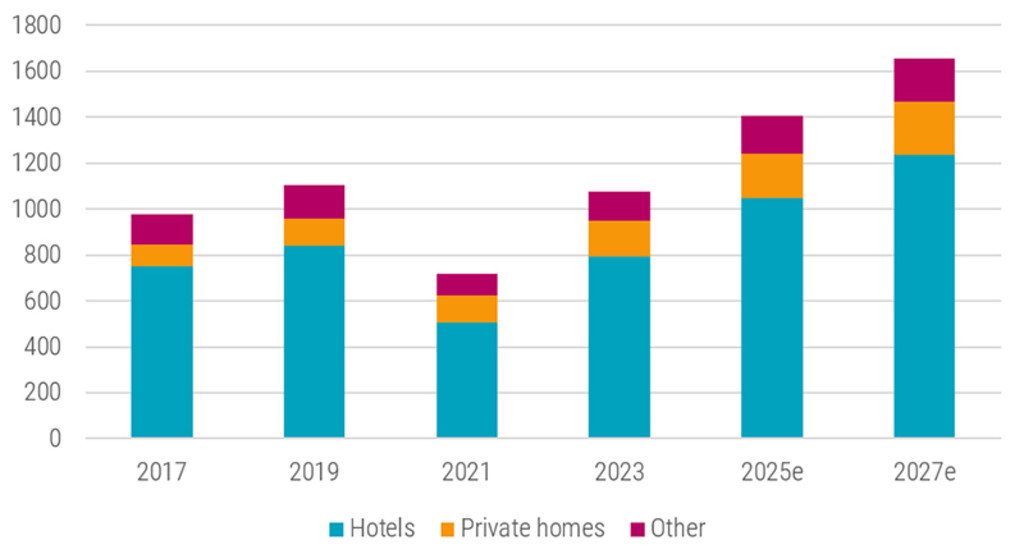

Consumer spending on accommodation has helped push total industry revenue up 12% relative to 2019. With consumers increasingly seeking unique experiences, services like Airbnb and VBRO have redefined the accommodation market by making second home inventory available for rent online. Spending on these alternative accommodations has grown 49% since 2019, according to McKinsey. That said, hotels still account for 74% of travel accommodation spending. Tapping into the demand for differentiation, bookings at boutique hotels are expected to nearly double by 2032, according to travel technology provider Amadeus.

Travel booking was one of the first retail markets to become digitally delivered, as online travel agents subsumed the once ubiquitous travel agency office. As the digital travel market evolved, search engines became the first stop for travellers planning a trip, and airlines and hotels invested to entice consumers to book directly. Looking ahead, the roll-out of AI will be an interesting trend to watch. Increasingly, travellers are turning to services like ChatGPT to help plan travel itineraries. An upcoming wave of AI agents that can not only provide ideas, but also take action and make reservations on one’s behalf could further disrupt the industry.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Figure 4: Accommodation booking value by type, in USD billions

Source: McKinsey, May 2024

Technology: Digital entertainment is taking over

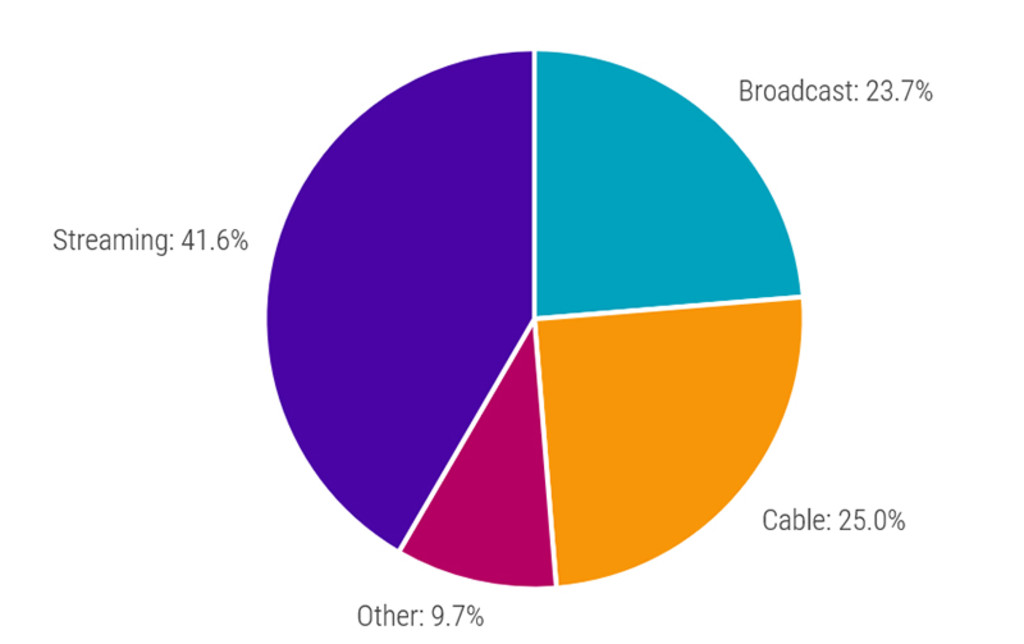

A decade ago, video streaming was a niche source of media with a low single-digit share of consumers time spent watching television. At that time, most industry observers assumed that Internet distribution would remain niche or Hollywood studios and television networks would overtake the upstarts, aided by a vast catalogue of established franchises. Today streaming accounts for 41.9% of television viewing hours in the US and streaming services like Apple, Amazon, and Netflix are consistently earning Emmy and Oscar award nominations. In response, incumbent media leaders rushed to launch competing streaming services generating billions in losses while the pace of subscriber cancellations to expensive cable-TV bundles accelerated. A wave of consolidation ensued and over the past five years the valuation of incumbent media and cable-TV firms have fallen by more than a third. To make matters potentially worse for legacy media, streaming services are now attacking the USD 163 billion global television ad market which accounts for nearly 60% of the remaining offline advertising market.

Figure 5: US TV viewing share by platform

Source: Nielsen, December 2024

Similarly, while the growth of interactive entertainment remains stalled post-Covid, the biggest entertainment release of 2025 will likely come not from a Hollywood movie studio, or a musical artist, but rather from a video game. More than a decade in the making, the scheduled 2025 release of Take Two Interactive’s Grand Theft Auto VI is expected to generate USD 2.5 billion in retail sales. For comparison, the leading film last year, Disney’s Inside Out 2 generated USD 1.7 billion in ticket sales and Taylor Swift’s Eras Tour took in USD 2 billion over its two-year run. Further, the expected launch of the Nintendo’s next console coupled with Sony’s and Microsoft’s continued push into subscription gaming should help revive growth for the USD 180 billion industry.

Cosmetics: You are never too old to become younger

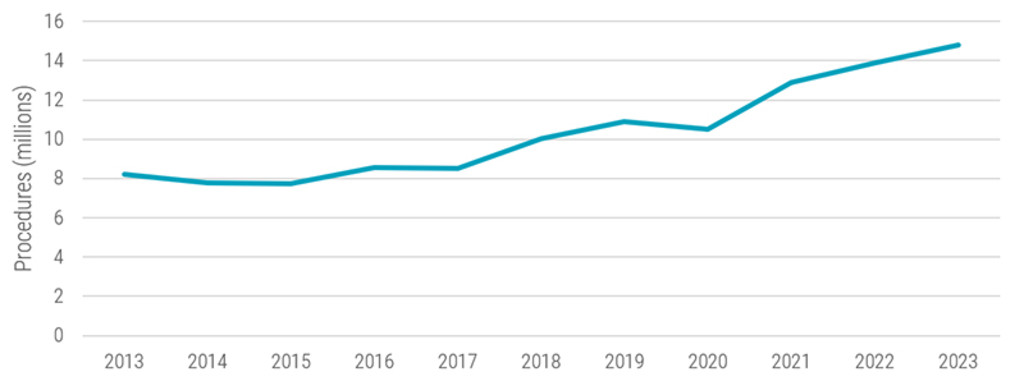

Every year in the weeks leading up to the US Thanksgiving holiday, there is a noticeable spike in Google searches for ‘botox.’ It appears people seek to refresh their appearance before reuniting with family and friends. This Thanksgiving spike underscores increasing consumer demand for beauty products that provide immediate and noticeable results. In 2023, approximately 15 million injectable aesthetic procedures were carried out, of which 9 million were botox and 6 million were so-called fillers (see Figure 6). The main purpose of botox is to reduce wrinkles while fillers are mostly used to restore facial volume and contours.

Between 2019 and 2023, the number of worldwide injectable aesthetic procedures, including botox and fillers, increased by a remarkable 36%, far outpacing the overall beauty market’s growth of 14% during the same period. L’Oréal, the world’s largest beauty company, is taking notice and acquired a 10% stake in Galderma, a Swiss company that sells injectable aesthetic products that listed in the beginning of 2024. Growth is across regions, cultures, genders, and age groups. Notably, procedures among younger people saw the most dramatic increase, with a 56% rise in individuals aged 19-34 and a 51% growth among those aged 35-50. This reflects growing consumer awareness about maintaining a youthful appearance and addressing signs of early aging.

Social media is amplifying awareness and normalizing injectable treatments. Influencers and medical professionals frequently showcase these procedures, often emphasizing their safety, effectiveness, and convenience. Platforms like Instagram and TikTok, with their visual focus, have popularized ‘before and after’ transformations. Regional trends also paint an interesting picture of global adoption. The US leads in injectable aesthetic procedures, with 3.3. million performed in 2023. Emerging markets in Asia and Latin America are also experiencing rapid growth, driven by expanding middle classes and increasing consumer spending on self-care. Additionally, men are becoming a key demographic, with procedures among men rising significantly, accounting for approximately 15% of total treatments globally in 2023.

The growing popularity of injectable aesthetic procedures aligns with broader consumer trends toward products that promise guaranteed and near-immediate results. Whether it’s for a special occasion or as part of a long-term beauty regimen, injectables offer a compelling combination of convenience and efficacy, making them an increasingly important part of modern beauty culture.

Figure 6: Worldwide injectable aesthetic procedures

Source: International Society of Aesthetic Plastic Surgeons, June 2024.

Investment implications

The Global Consumer Trends strategy is invested in the opportunities we have identified for 2025 via our three overarching themes. Digital transformation of consumption represented 50% of the strategy’s holdings at the end of 2024, including beneficiaries of Digital entertainment and Retail media subtrends (Netflix, Alphabet and Amazon). Our health & wellbeing theme, which made up 32% of the strategy at the end of 2024, includes fast-growing companies benefiting from the aesthetic injectables trend. Finally, the rise of the middle-class theme, which made up 18% of the strategy at the end of 2024, contains fast growing local brands that are less exposed to trade barriers, and retailers that are already benefiting from the growth in Retail media.