Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Broad-based socio-demographic shifts are among the structural changes that form the focus of our Global Consumer Trends strategy. They include the rise in pet ownership and increasing amount pet owners spend on their loyal companions. This trend has proved to be recession-proof in the past and is expected to remain resilient during the current Covid-19 downturn.

The pet care market offers moderate but stable growth prospects, helped by a constant rise in pet ownership and increase in spending per pet. Currently estimated to be worth over USD 190 billion, researchers expect the global market to grow by an average of close to 5% per year between 2019 and 2025.

The main drivers of this growth are the rise in pet ownership worldwide and a consistent increase in spending per pet, resulting from – for example – an increased spending on fresher and healthier food or the growing prevalence of zoonotic diseases, which is driving up animal healthcare expenses. Another key factor is that owners increasingly treat their loyal companions like family members, with all the perks and benefits this brings.

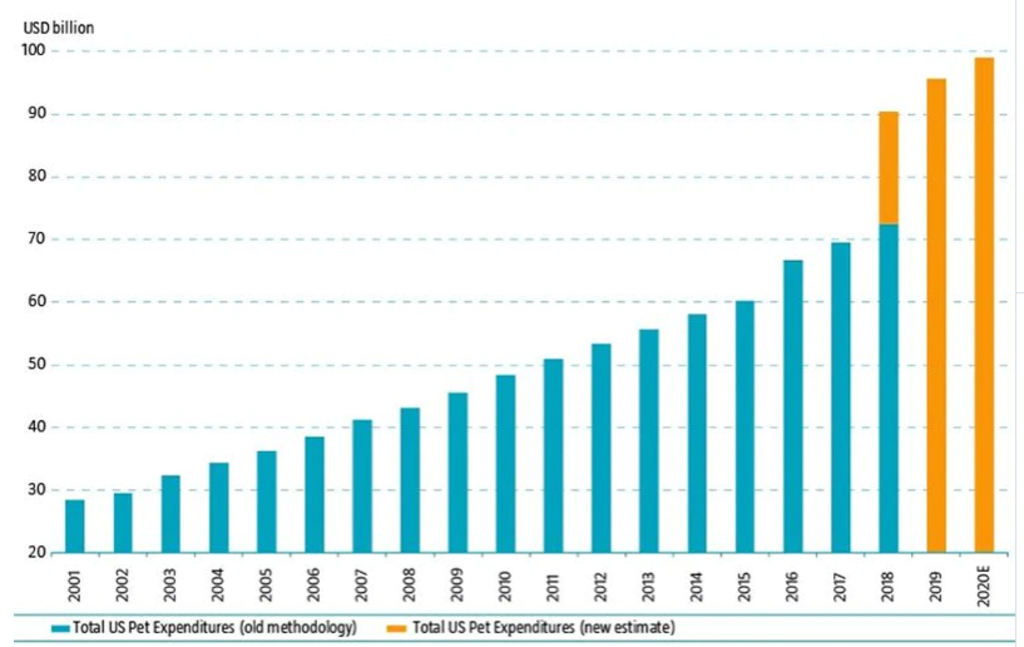

In addition to moderate growth prospects, the pet care market also features a relatively resilient profile. In the US, for example, pet care spending continued to grow even during the 2008-09 financial crisis (see Figure 1). The sector encompasses a number of strong, defensive brands and, despite some recent mergers and acquisitions, remains relatively fragmented. Further consolidation is likely.

Pet owners increasingly treat their loyal companions like family members, with all the perks and benefits this brings

Source: American pet product association (APPA), February 2020.

Subscribe to our newsletter for investment updates and expert analysis.

The US is by far the largest pet care market globally, with an estimated USD 95.7 billion spent in 2019, up 5.7% from 2018. This year, the US pet care market is expected to continue growing, albeit at a slower pace than in previous years. Industry experts estimate that pet-related spending will increase by another 3.5% in 2020 and reach USD 99 billion by the end of the year.

Other smaller but significant markets include large developed European countries such as Germany, the UK and France. Outside the US and Europe, pet ownership levels remain much lower. However, some countries are catching up fast. For instance, the Chinese pet care market is expected to grow by over 14% per year on average between 2019 and 2025, helped by the rapid rise in pet ownership.

In recent years, the rapid increase in pet care spending in large developed markets such as the US, the UK, Germany and France has also been accompanied a surge in demand from newer and more dynamic markets, particularly in Asia. Emerging countries such as China, South Korea and India have seen their pet populations grow rapidly, with pet care spending growing even faster in most cases.

The pet population of South Korea, for instance, grew from 4.9 million in 2014 to 7.5 million in 2018, which is a compound annual rate of 10.8%. Meanwhile, the number of cat and dog owners in China is estimated to have risen by 8.4% from 2018 to 2019, reaching 61.2 million. While this may look like a large number, it is still only a tiny fraction of the country’s overall population.

In many countries, millennials are increasingly seeing pets as a genuine alternative to children. In the US, for example, they represent the largest demographic group of pet owners for all pet types. The APPA defines millennials as being born between 1980 and 1994. Although pets require some investment, they generally cost less and require less dedication than children.

Finally, another interesting recent development has been the emergence of new types of offerings, in particular from the online retail sector. Subscription deals for regular food shipments, such as Chewy.com’s “Autoship” offering, and birthday gift boxes are a case in point. These have given an additional boost to the rise of ecommerce in the pet care segment.

As the Covid-19 crisis unfolds, the key question for investors is whether the increase in pet care spending will change. For now, the short-term effects of the pandemic have been mixed. Containment measures have forced many veterinary practices to remain closed for weeks. The closure of adoption centers in some countries could also slow the rise in pet ownership.

Yet the situation is not homogenous across geographies. While many European countries have kept their animal shelters closed for adoption, shelters in the US have remained open and been emptying as people confined to their homes have been adopting or fostering animals en masse. A similar phenomenon seems to have taken place in other countries, including Australia.

These developments bode well for future spending as a higher proportion of the expenditure is incurred during the initial years, on things like vaccinations. This could be a tailwind for the veterinary sector, offsetting part of the initial disruptions. While it is still too early to draw conclusions, it is clear that the impact of Covid-19 will not necessarily be negative in the short term and may well be positive in the longer term, as well.

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.