Power play – why lithium remains the unchallenged champion of battery metals

Structural supports, low cost and proven performance in EV markets make lithium ideal for exposure to electrification and decarbonization trends.

Summary

- Strong EV market growth will continue to drive strong lithium demand

- Lithium offers right mix of chemistry and costs among battery storage solutions

- Demand and supply dynamics should support future prices

Electric mobility is charged and accelerating its disruptive march into the automotive landscape. Global EV sales reached 3 million in 2020, or 4.3% of all cars sold globally. And growth for this year signals a similar trajectory with mid-year EV market share at 8% globally. Conversely, traditional combustion engines continue their steady descent in markets worldwide. In Europe, EVs even outsold diesel vehicles for the first time in the third quarter (18.9% vs 17.6%).

Electric vehicles’ global popularity and penetration rates have been helped by decisive regulatory actions. In response to urban pollution and climate change, governments in major economies worldwide have introduced emission limits for carbon and other greenhouse gases. Europe has seen the greatest tightening and has also witnessed the fastest EV uptake. Since 2009, the EU has phased in increasingly stringent CO2 emission targets inducing some Member States to imposed outright bans on petrol/diesel vehicles over next 10-30 years.

Advances in lithium-ion battery technology have also been crucial in bringing EV costs down, paving the way for consumer adoption and increased market penetration. For this reason, most of today’s battery electric vehicles (BEVs) are powered by lithium-ion chemistry. Yet costs are not the only factor in lithium’s ascent. Its status as the “battery-of-choice” in EV markets stems from its superior performance across a mix of key variables which include high energy density (which translates to high electric power capacity), light weight, low volume constraints, operational safety, and scalable manufacturing.

Moreover, lithium’s continued battery market dominance may not be limited to mobility. The same performance characteristics that make lithium-ion batteries popular for cars are also making them a viable option for much wider energy storage applications that can help electrify and decarbonize other industries beyond transportation.

Advances in lithium-ion battery technology have been crucial in bringing EV costs down

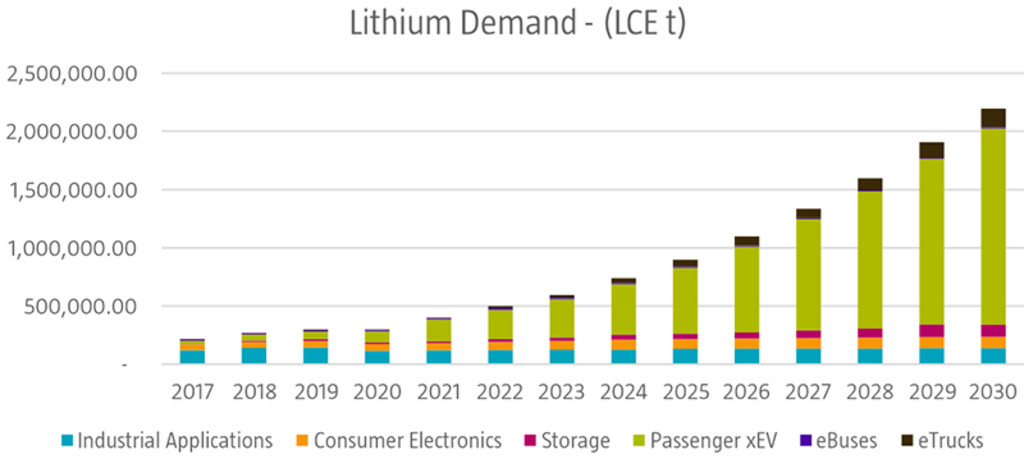

Figure 1 Booming business – lithium demand in electric vehicles continues to rise

Source: Robeco, Bloomberg NEF, Avicenne Energy

Present directions of EV battery research

Lithium (Li) is not without shortcomings. Supply issues, coupled with consumer “range anxiety” have driven the search for alternative solutions. Lithium’s high energy density mean Li-ion batteries (LIB) will remain unrivaled in EV markets in the years to come. As a result, battery research efforts have been centered not on replacing Li but rather on pairing it with other cathode metals like nickel (Ni), aluminum (Al), manganese (Mn) and iron (Fe) to enhance performance factors. For example, increasing LIB nickel content further increases energy density and improves driving ranges. Yet drawbacks are also present: high-nickel cathode chemistries pose challenges in terms of temperature stability, increasing the risk of fire and raising safety concerns. In addition, they are more costly to produce compared to other LIB alternatives. Accelerating advances in R&D make it difficult to predict which cathode chemistries will prevail. What is clear is lithium’s continued dominance within battery raw materials.

In contrast to lithium, a metal that EV markets would like to eliminate is cobalt. Cobalt functions to stabilize battery performance. Ironically however, ESG risks surrounding its sourcing, extraction and production threaten to destabilize EV supply chains. Most of the world’s cobalt is sourced from the Democratic Republic of Congo, a politically unstable country, with chronic governance issues and a history of human rights abuses. Moreover, cobalt mining is dangerous to human health and environmentally polluting, further increasing the social and environmental costs associated with its production. Reducing reliance on cobalt is also helping drive research to find raw materials that stabilize battery performance without the associated ESG and supply chain risks.

Present focus of much battery-related research is on eliminating cobalt from EV supply chains

Li – at the low and high end of battery technology

Cheaper production and lower material risks largely explain why less technologically sophisticated batteries are experiencing a significant surge. Lithium iron phosphate (LFP) batteries are on the rise in China and favored by the likes of Tesla, which recently announced their use in standard-range models. LFPs are heavier and have a lower energy density, resulting in shorter driving ranges. However, they are cheaper, safer and have a long shelf life. In addition, given LFPs contain less lithium and zero cobalt, they have less exposure to ESG and supply chain risks.

Solid-state batteries are considered the next-generation of cutting-edge battery technology that promise to provide more energy power, better safety, increase durability and longer life compared to current battery technologies that are liquid-based. But even here, lithium is making its mark, dramatically enhancing solid-state battery performance with no additional weight or loss of space. Positive performance results are driving partnerships between car and Li-ion battery manufacturers to further develop solid-state technologies for the coming decades

Demand and supply lower risk of commoditization

Lithium demand is expected to rapidly accelerate to over 2 million tons, creating significant structural shifts through 2030 and beyond. EV batteries account for 30% of annual lithium demand and within ten years will exceed 80%. Demand increases should also drive investments to increase supplies, leading many to suggest the commoditization of lithium and falling prices as more supplies become available.

However, although lithium resources in the Earth’s crust may be abundant, they are buried within other mineral ores making them difficult to mine. Extraction and refinement come at great complexity and cost. Future investments to secure upstream supplies will only be undertaken if prices justify the expense. Moreover, extreme variations in quality grades to meet industry specifications should further mitigate the risk of commoditization and price declines.

Conclusion

Despite initial skepticism, the electrification of the transportation sector is firmly fixed and steadily accelerating as EVs continue their disruption of the automotive industry.

Strong demand, limited supplies, superior performance and increasing visibility as a critical element in transportation’s transition to a low-carbon economy mean companies across the lithium value chain are ideally positioned to benefit from future trends in mobility electrification.

Energy and supply chain shortages emphasize need for Smart solutions

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.