Navigating bond markets in times of stagflation

High inflation and central bank tightening are already leading to rising yields and negative bond returns. At some point, though, higher yields and weaker growth will offer opportunities for bond investors.

Summary

- Bond markets torn between high inflation and weaker growth

- Deep-sample evidence includes high inflation and stagflation periods

- Dynamic Duration strategy well-positioned for current challenging environment

Stagflation is hitting the headlines again: high inflation and central bank tightening are already leading to rising yields and negative bond returns. At some point, though, higher yields and weaker growth will begin to offer opportunities for bond investors. To capture these opportunities when they arise, while also protecting portfolios against rising yields, active duration management is needed. But how do we know whether a strategy that was successful in recent decades will also work in a completely different environment?

To answer this question, we use the long-term back-test described in our academic paper ‘Predicting Bond Returns: 70 Years of International Evidence’. The back-test demonstrates that quant duration management works in an environment of high inflation and weak growth. Typically, it works best when bond markets move most – a positive finding given that the current environment is likely to cause significant market moves.

The risk of stagflation is clear as commodity prices have surged due to the war in Ukraine, and energy supply is threatened. US inflation has already reached levels unseen since the early 1980s and growth will be weaker as high energy prices hurt disposable income and force energy-intensive companies to reduce their production. Strict lockdowns are again implemented in economically important parts of China, while Covid-related supply chain disruptions and chip shortages are already limiting growth. Fiscal policy might cushion demand, but the resulting higher bond issuance could push yields even higher. Monetary policy has supported the growth rebound from the 2020 lows, but this support is now being withdrawn.

Back-test using a deep historical dataset

Robeco’s Dynamic Duration strategy aims to protect against rising yields and benefit from declining yields. Since its inception in 1998, the duration positioning of this strategy has been determined by a quantitative model. When the research leading to the creation of this model was performed in the early 1990s, the limited availability of historical bond market data was one of the challenges. Most academic research on bond market timing uses data sets starting in the early 1980s, a period characterized by a secular decline in interest rates. Periods of high inflation or stagflation are rare in these data sets and, as a result, evidence for bond market timing in such conditions was scarce.

In recent years, however, a much wider set of historical financial market data has been made available, thanks to researchers digitalizing archives of exchanges, central banks and newspapers. We recently published a paper in which we present evidence for bond market timing using a deep historical dataset. This back-test includes decades with higher inflation and periods of stagflation. In this article, we use the dataset from that paper to analyze the performance of bond market timing in different growth and inflation regimes, including periods of stagflation.

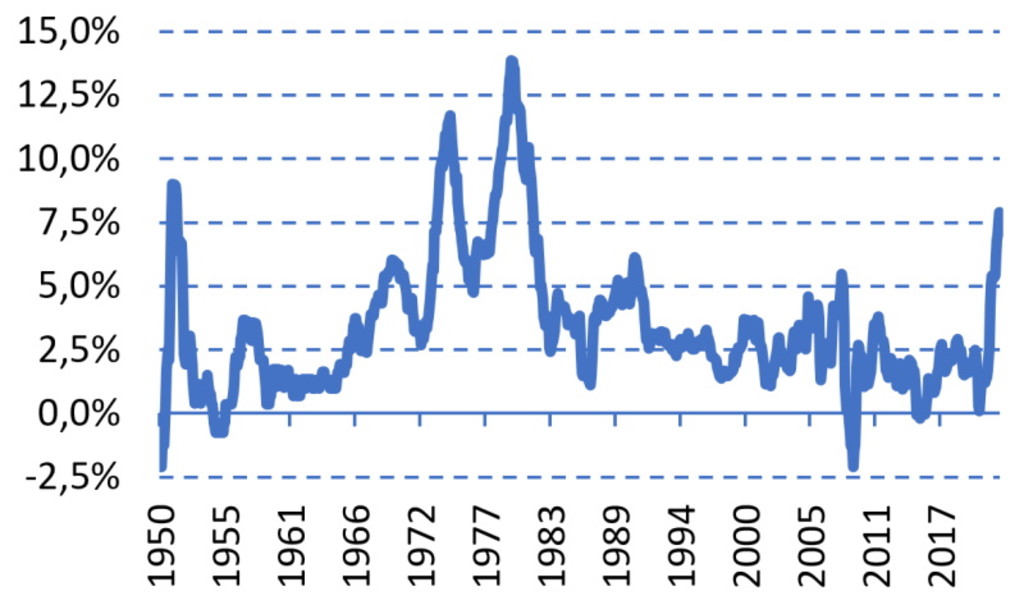

Figure 1 | US inflation, 1950 – February 2022

Source: Bloomberg, Datastream, Global Financial Data

Figure 1 shows the development of US inflation from 1950, and we can see immediately why we need to examine more than just the most recent decades: current inflation is higher than anything seen since the early 1980s. The combination of high inflation (above 4%) and a recession is very rare in recent decades, occurring in less than 5% of the time after 1982.

Our deep sample allows us to better study stagflationary environments: these occurred 23% of the time in the 1950-1982 period, mainly between the late 1960s and the early 1980s. We use a global dataset that includes six large bond markets (the US, UK, Germany, Japan, Australia and Canada) to study bond market timing all the way back to 1950.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Performance in times of stagflation

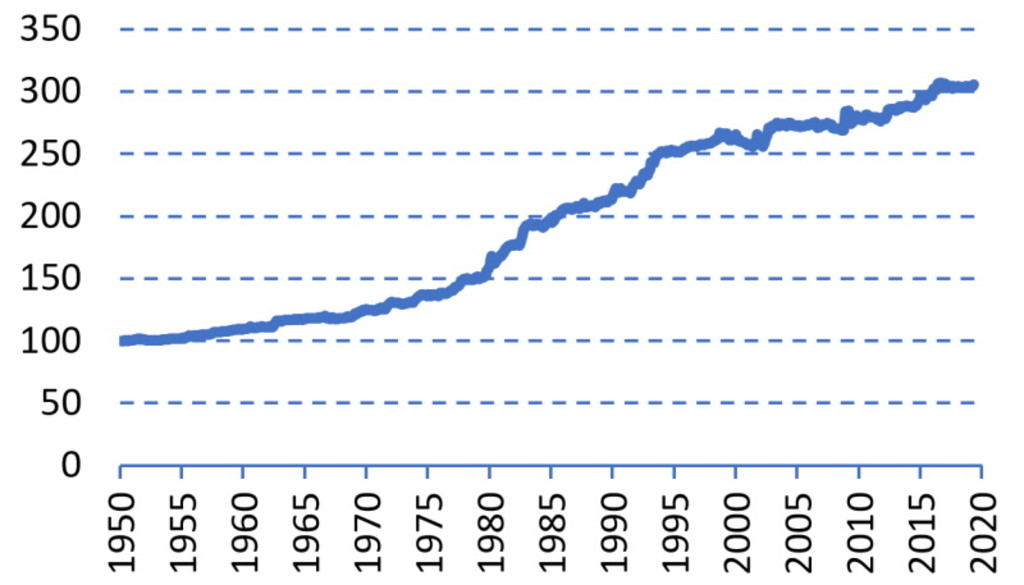

Our academic paper shows that bond market returns can be predicted using a combination of four variables: bond trend, yield spread, equity return and commodity return. This finding is robust over markets and over time periods. Figure 2 shows the cumulative back-tested performance of this strategy.

Figure 2 | Cumulative back-tested performance, 1950-2019

Source: Robeco

This figure indicates that the back-tested performance is good in the period with rising yields before 1982, as well as in the period of the secular decline in yields after that. In the paper, we provide formal evidence that the strategy’s performance is good in both these sub-periods, in recessions and expansions, and in periods of high inflation and low inflation.

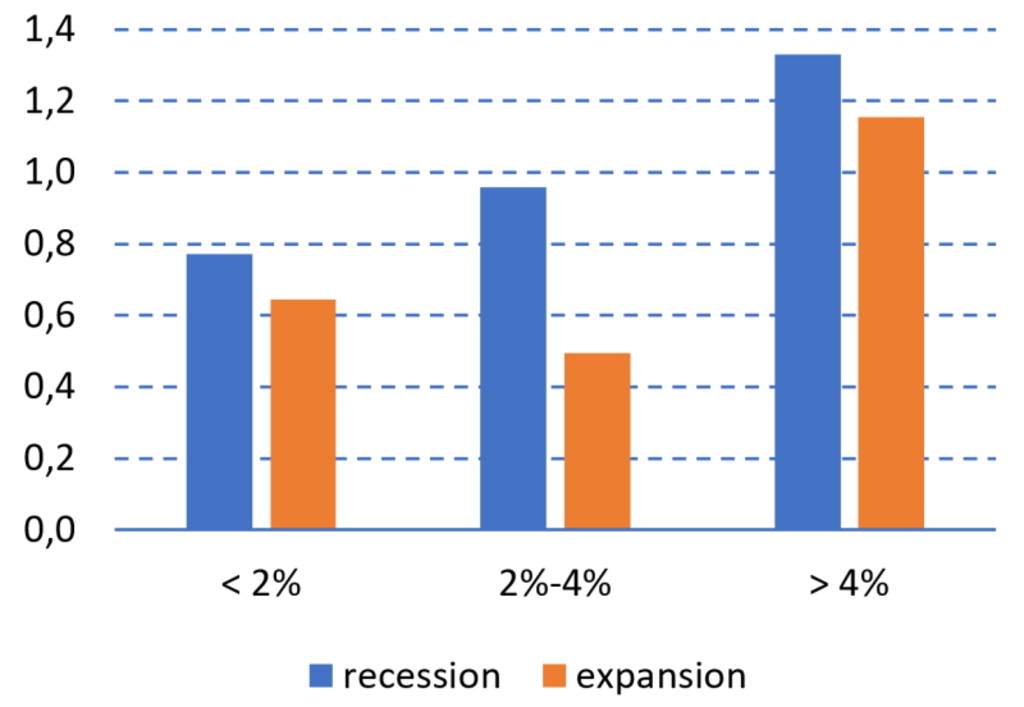

In this article, we now take that analysis one step further by classifying periods based on a combination ofgrowth and inflation. We distinguish periods with low, moderate and high inflation (below 2%, between 2% and 4%, and above 4%) in recessions, and do the same for expansions (following the same classification of recessions as in our academic paper). Figure 3 shows the model performance in these 3 x 2 = 6 categories.

Figure 3 | Model Information ratio in times of recession and expansion, and different inflation levels

Source: Robeco. Period: 1950-2019

The blue bars denote the information ratio of the bond market predictability strategy in recession periods, the grey bars in periods of expansion, with the bars (from left to right) showing the results in periods with low, moderate and high inflation. The figure shows that the back-tested strategy worked in all environments. Bond market predictability is especially strong in periods of stagflation, where inflation is high in a recession.

Adding most value when markets move most

The strategy’s strong performance in times of stagflation is in line with the academic paper’s general conclusion that the strategy also works well in adverse economic and market environments, for example in periods with falling equity markets. Typically, the model generates most return when bond markets move most – also because its signals are more reliable (higher success ratio) in periods when markets move strongly. The Dynamic Duration strategy has also generated above-average outperformance in the periods with the largest moves in bond markets (for up as well as down moves) throughout its 24-year live track record.

The current environment combines several potential drivers of strong moves in bond markets: high inflation, central bank tightening and increased bond issuance (to fund investments in defense and alternative energy supply) could push yields higher, while these higher yields and downside risks to growth could also offer opportunities for bond investors. Dynamic duration management can help to navigate these markets, both to offer protection against rising yields and to benefit when bonds rally again. The deep-sample back-test described in our academic paper shows that bond market timing works well in adverse environments, including during periods with high inflation and low growth.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.