Ten years of successful factor investing in credit markets

A decade of live track-records shows that our factor-based credit investing approach delivers improved risk-adjusted returns compared to the market. Here’s our story.

Summary

- Ten-year live track record shows strength of factor credits strategies

- Systematic approach enables style diversification and more sustainability

- Multi-factor credit selection performed well across market environments

Evidence from our ten years of live factor-based credit investing, combined with more than twenty years of research and innovation in this field, shows that our approach provides improved risk-adjusted returns relative to the market, performance resilience, style diversification and greater levels of sustainability compared to passive and fundamentally managed credit portfolios.

Our first standalone factor credit portfolio was launched a decade ago, in 2012. Today, Robeco’s factor credits capability oversees nearly EUR 5 billion in assets under management, across 15 live portfolios.

Robeco has been actively researching the existence of factors in credit markets since the late 1990s. With the growth in European credit markets at the time, it was a natural step to investigate the efficacy of equity factors like value and momentum in credits, too. The research resulted in an academic publication in The Journal of Portfolio Management in 2001 titled “Successful Factors to Select Outperforming Corporate Bonds”.

A number of academic contributions followed in the subsequent period and then, in 2017, we published a ground-breaking paper which was the first to document how portfolio managers can successfully implement a multi-factor approach in their credit portfolios.1

Initially, factor-based credit selection models were used as idea generator for Robeco’s fundamental credit mandates. This changed in 2012, when we won the first external mandate for factor credits. The mandate was from an insurer, to build a conservative multi-factor portfolio that reduces the credit volatility while maintaining market-like returns.

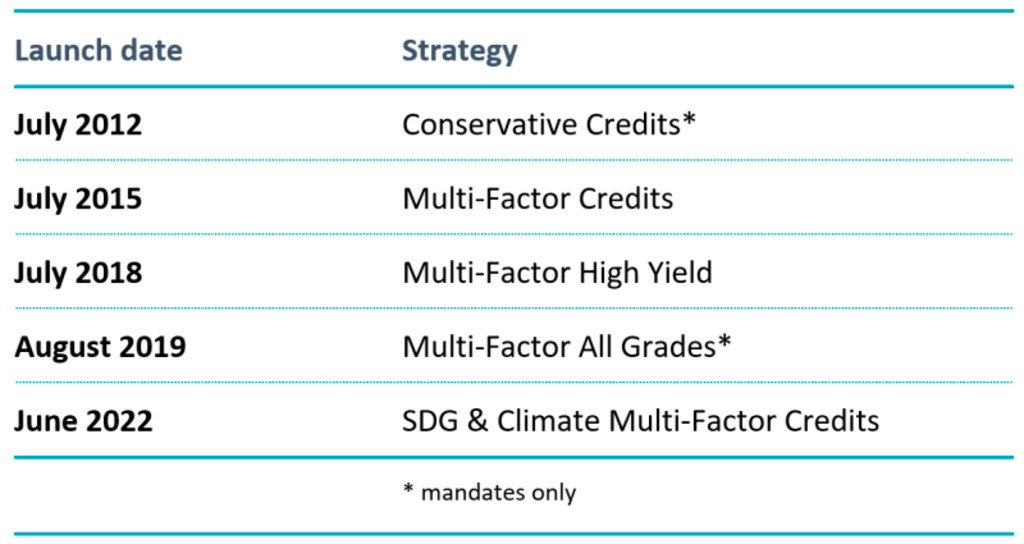

The introduction of our first multi-factor credits strategy in 2015 and our first high yield-focused multi-factor strategy in 2018 were further milestones, followed in 2019 by a mandate to apply factor credits to both investment grade and high yield in one portfolio. This year we launched a sustainable version of the multi-factor credits flagship strategy, which contributes to the Sustainable Development Goals (SDGs) and is aligned with the Paris Agreement.

Table 1 | Launches of factor credits strategies

Tracking the live performances of our factor credit strategies

Our factor-based credit portfolios have provided superior risk-adjusted returns compared to the market. Importantly, our live portfolios have achieved results similar to those in the original empirical research, pointing to the robustness of our research as well the execution in live portfolios.

The Robeco Conservative Credits strategy, which is tilted to safer bonds from safer issuers, has realized 48 bps annual outperformance relative to its risk-adjusted benchmark,2 with a Sharpe ratio of 0.76 compared to 0.50 for the benchmark.

Robeco Global Multi-Factor Credits realized 45 bps annual outperformance, with a Sharpe ratio of 0.36 compared to 0.25 for the benchmark, and an information ratio of 0.70. In 2022 to date, which marks yet another volatile period, the strategy has outperformed by 51 bps.

Robeco Global Multi-Factor High Yield has lagged by 31 bps annually, with a lower Sharpe relative to the benchmark, at 0.20 vs. 0.25. The strategy lagged in 2020, but has been recovering ground since. The strategy performed in line with its benchmark over the current year to date.

Robeco Global Multi-Factor All Grades has outperformed by 82 bps per annum with a Sharpe ratio of 0.19 versus 0.06 for the benchmark. In 2022 to date, the strategy has outperformed by 49 bps.

Performances until the end of April 2022. The currency in which the past performance is displayed may differ from the currency of your country of residence. Due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. The value of your investments may fluctuate. Past performance is no guarantee of future results. Returns are gross of fees, based on gross asset value. All figures in EUR. In reality, costs (such as management fees and other costs) are charged. These have a negative effect on the returns shown. Robeco Conservative Credits is based on a Robeco Euro Conservative Representative Mandate and benchmarked against the risk-adjusted Bloomberg Euro Aggregate Corporates index. Robeco Global Multi-Factor Credits is based on Robeco QI Global Multi-Factor Credits IH EUR share and benchmarked against the Bloomberg Global Aggregate Corporates index (hedged to EUR). Robeco Global Multi-Factor High Yield is based on Robeco QI Global Multi-Factor High Yield IH EUR share and benchmarked against the Bloomberg Global High Yield Corporates ex Financials index (hedged to EUR). Robeco Global Multi-Factor All Grades is based on a representative mandate and benchmarked against a Custom Bloomberg Global Credit incl HY benchmark (hedged to EUR). The inception dates for each strategy are shown in Table 1.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Demonstrated style diversification

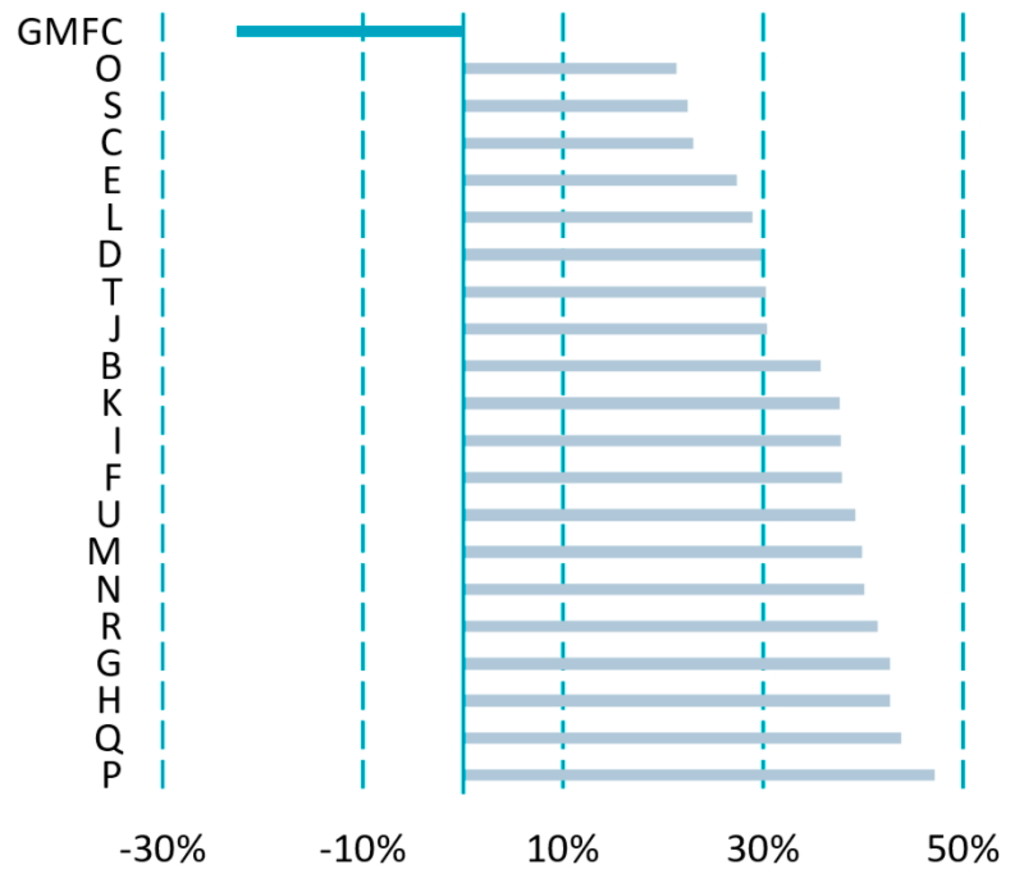

The live track-records of the various factor-based credit strategies show a further important benefit: low correlations with traditional actively managed credit portfolios. A peer group study (conducted in 2021) that analyzed the live period of Robeco QI Global Multi-Factor Credits found that its relative returns have a -23% correlation, on average, with the relative returns of fundamental global credit managers.

Figure 1 | Average outperformance correlation among global credit strategies

Source: Morningstar Direct, Bloomberg, Robeco. Period: July 2015-June 2021. GMFC = Robeco QI Global Multi-Factor Credits (EUR-hedged) live track-record. B to U are 20 anonymized global credit strategies (all euro hedged). Outperformance is calculated vs. Bloomberg Global Aggregate Corporates (euro hedged). The currency in which the past performance is displayed may differ from the currency of your country of residence. Due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. The value of your investments may fluctuate. Past performance is no guarantee of future results. Performance gross of fees, based on gross asset value. In reality, costs (such as management fees and other costs) are charged.

This means that incorporating a factor-based credit strategy into a multi-manager pool of fundamentally managed portfolios adds valuable diversification benefits. See our article “Multi-Factor Credits: Continued style diversification after Covid-19 crisis” for more information.

Innovating in the realm of sustainable investing

The systematic nature of factor credit portfolios means they lend themselves well to sustainability integration. And, indeed, sustainability has been a key consideration in our factor credit strategies since inception, and our approach has continued to evolve over time.

Credit analysts have assessed ESG risks in our factor-based credit portfolios since these strategies were launched in 2012, as part of human oversight of the systematic investment process. In 2013, we started supporting client-based exclusion lists, and have been applying Robeco’s Sustainability Inside exclusion list since 2015.

A further step was taken in 2016, with the decision to ensure that the average ESG scores of our strategies are better than those of the benchmarks. Carbon emission constraints were introduced to the portfolios in 2020. Similar constraints on water use and waste generation have been applied since 2021.

Outlook

There is a growing body of research on factor investing in credit markets, from academia, brokers and index providers, while new competitors are entering the market. These developments are similar to what we saw in equity markets several years ago and augur well for a proliferation of factor investing in credit markets.

We believe the ability of factor-based credit portfolios to integrate multiple sustainability dimensions at the same time will further accelerate the adoption of systematic, factor-based portfolios.

Our aim is to maintain our leading position with a continued focus on research, innovation and sustainability. We will continuously look for ways to improve existing factors and explore new types of data sources and techniques, including natural language processing and machine learning. The launch of the new RobecoSAM QI Global SDG & Climate Multi-Factor Credits is testimony to our desire to stay ahead by introducing innovative strategies that contribute to a more sustainable future and at the same time deliver attractive risk-adjusted returns for our clients.

Footnotes

1 Houweling, Van Zundert, 2017, “Factor Investing in the Corporate Bond Market”, Financial Analysts Journal, Vol. 73, No. 2, pp. 100-115.

2 As a result of the lower risk of Conservative Credits compared to its benchmark, the strategy usually outperforms in bearish credit markets and underperforms in bullish credit markets. To neutralize this effect, we use a risk-adjusted benchmark for performance analysis. This risk-adjusted benchmark has the same degree of interest rate risk and credit risk as the portfolio.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.