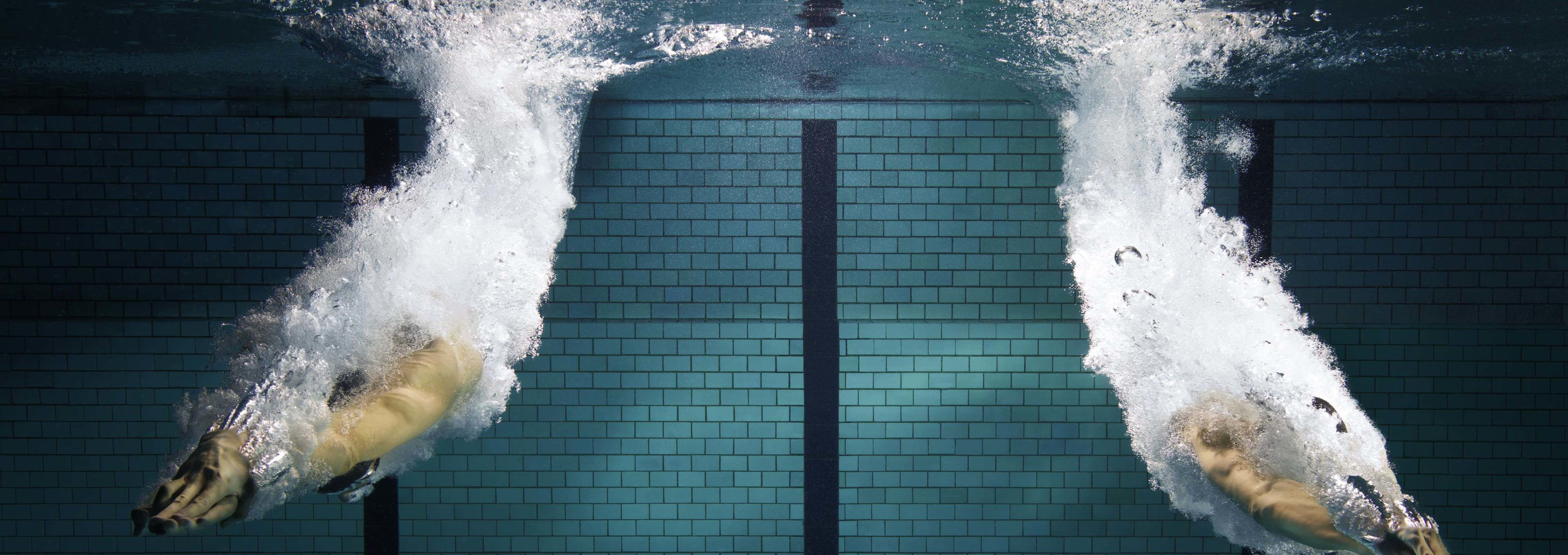

Indices insights: In the race of returns, factor premiums often win the day

Research shows that some market segments, like undervalued or high-quality companies, consistently yield higher returns. But how do these factors, like Value and Quality, really perform over time? In this Indices Insight, we'll let the data speak for itself and shed light on how these factors stack up against their counterparts. Spoiler alert: while their returns can be a roller coaster ride, factors often cross the finish line ahead of their counterparts.

Past studies reveal a range of factor premiums that go beyond just the equity premium. Here, we’re talking about the value premium, momentum premium, quality premium, low-risk premium, and the size (or small-cap) premium.

Let’s briefly look at each factor one by one. The value effect is like backing the underdog. Stocks that seem underpriced or cheap, as measured for example by the book-to-price ratio, tend to outpace their more expensive (growth) counterparts.1 The momentum effect, on the other hand, is all about betting on a winning horse. Stocks that have been doing well lately (winners) are likely to keep up the good work2 more than the losers.

Then there’s the quality effect: trusting in strong performers. Stocks with high profitability and low investments (high quality) usually outdo those with low profitability and high investments (low quality or junk)3. The low-risk effect4 is the financial version of ‘slow and steady wins the race’. Low-risk stocks have a knack for yielding higher risk-adjusted returns than high-risk stocks. Finally, the size effect, though not as prominent as the others, shows that small-cap stocks often outperform their large-cap counterparts.5

These factor premiums, though their exact definitions6 spark quite some debate, are backed by evidence from extensive periods. This includes US data going back to the 60s or even the 20s, and international data from the 90s. In our visualization below, we stick with generic definitions7 and base our data on US stock returns.

What's clear from our analysis is that since 1967, the majority of factors consistently win out over their counterparts in almost all three-year spans. This is evident from the fact that most of the time, most of the factors (be it three, four, or all five) yield a higher return than their alternatives. But this isn't to say that factors always have a smooth ride. They can underperform at times, like during the dotcom boom when IT-centric growth stocks outdid value stocks from more conventional businesses. Even as recently as between 2017 and 2020, several factors lagged behind their counterparts over a three-year period. But factors have a history of bouncing back, and that's exactly what they've been doing from 2021 onwards.

Our visual is based on monthly US stock returns courtesy of Professor Kenneth French.8 Our results are based on portfolios sorted according to market capitalization quintiles and other quintiles, which look at book-to-price ratios (value vs growth); return over the prior twelve months excluding the last month (winners and losers); univariate market beta over the preceding five years (low beta and high beta); operating profitability (high profitability vs low profitability), or change in assets between the last two fiscal years (low investments and high investments). We then average the top and bottom quintiles across all size groups to determine the final factors and their counterparts.

For example, the value factor is based on averaging over the five size-sorted portfolios with the highest book-to-market ratio. Similarly, for the growth counterpart, we average the five size-sorted portfolios with the lowest book-to-market ratio. This same procedure is repeated for the other factors and their counterparts. We then calculate the high-quality factor and its low-quality counterpart by equally weighting the resulting high profitability and low investment portfolios and low profitability and high investment portfolios respectively. The small-cap factor is based on the lowest market capitalization quintile and its large-cap counterpart is based on the highest market capitalization quintile.

Returns are the annualized three-year returns, denoted in USD from January 1969 to March 2023, updated every three years and interpolated between observations.

Subscribe - Indices Insights

Receive an update as soon as a new article is available with insights about sustainability, factors or markets.

Conclusion

The proof is in the pudding for the existence of factor premiums. Our analysis shows that despite some ups and downs over a three-year period, factor premiums more often than not pull ahead.

The sources of the images in the visualization, in order of appearance:

AP Photo/Horst Faas (CC BY 2.0), Library of Congress/Thomas J. O'Halloran (Wikimedia Commons), White House Photographic Collection (Wikimedia Commons), Library of Congress/Bernard Gotfryd (public domain), Unsplash/Jose Francisco Fernandez Saura (public domain), Library of Congress/Carol Highsmith (public domain), Unsplash/Breno Assis (public domain), Urban~commonswiki (Wikimedia Commons), InvadingInvader (Wikimedia Commons), Unsplash/Markus Spiske (public domain), Pexels/Mathias Reding (public domain).

Footnotes

1 See, e.g., Fama, E. F., & French, K. R. (1992). The cross‐section of expected stock returns. Journal of Finance, 47(2), 427-465.

2 See, e.g., Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance, 48(1), 65-91.

3 See, e.g., Fama, E. F., & French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics, 116(1), 1-22.

4 See, e.g., Black, F., Jensen, M.C., and Scholes, M. (1972), The capital asset pricing model: some empirical tests. Studies in the Theory of Capital Markets, Praeger. Or, more recently, Blitz, D.C., and van Vliet, P. (2007), The volatility effect. Journal of Portfolio Management, 34(1), 102-113.

5 See, e.g., Banz, R.W. (1981), The relationship between return and market value of common stocks. Journal of Financial Economics, 9(1), 3-18.

6 For an overview on different quality definitions used, see, e.g., Kyosev, G., Hanauer, M.X., Huij, J., and Lansdorp, S. (2020), Does earnings growth drive the quality premium?. Journal of Banking and Finance, 114, 105785.

7 It is not in scope of this Indices Insights article to have a discussion about how factors are best defined or how factor strategies are best implemented in practice. For the interested reader, we have a lot of research available upon request.

8 See https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Indices Insights

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.