Nordic nations sweep top spots in country sustainability ranking

Finland, Norway and Sweden continue to dominate the upper ranks while Sub-Saharan Africa is gaining ground. Meanwhile, country case studies from Europe and Africa reveal added value of sustainability research for sovereign investing and government engagement.

Summary

- Higher renewable uptake and lower emission intensities help define top 10

- Country case studies reveal the power of ESG performance

- Government engagement efforts see positive progress

Robeco has released the spring edition of its semi-annual Country Sustainability Ranking, which measures and ranks the performance of 150 countries on material environmental, social, and governance indicators that can impact economic growth and development.

Robeco’s country scores are a rich source of data and insights for investors seeking to comprehensively assess the risks and opportunities associated with sovereign bonds.

Complete scores and rankings are available on Robeco’s SI Open Access portal.

In the latest rankings, Nordic nations continue to toggle for a lead that hinges on thousandths of a decimal differences. Decimals this time favored Finland (9.04), which held on to the top spot, while Norway (9.03) narrowly edged out Sweden (9.029) to claim the second position.

Ocean Health Index scores deteriorated slightly for both Sweden and Finland, lowering environmental performance relative to Norway whose score remained stable. On the social front, the trio saw income inequality widen in recent years while gender equality advanced.

Increased renewable energy uptake and lower GHG emission intensities were decisive in defining the rest of the top ten. New Zealand returned to the top ranks after a brief exit in late 2023, while Iceland, a long-standing top-ten performer, unexpectedly dropped out due to appreciable declines in climate and energy criteria.

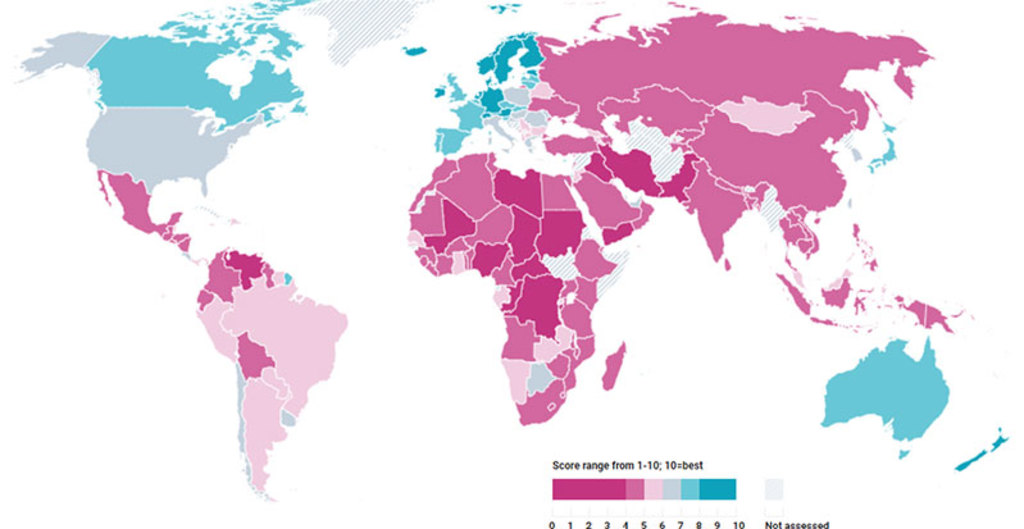

Figure 1 – the global overview of ESG scores

Source: Robeco Country ESG Scores as of April 2024.

The ranking round-up

Zambia and Mongolia were the biggest gainers, jumping 15 and 16 spots, respectively. Zambia’s performance improved across the board thanks to higher renewable energy uptake, improving economic equality, and strengthened political stability. A number of other Sub-Saharan African nations also improved their scores, including Liberia (+0.24), Uganda (+0.13), Burkina Faso (+0.15), Eswatini (formerly Swaziland; +0.18), and Burundi (+0.11).

Conversely, Hong Kong (-0.36), Malaysia (-0.22), Mexico (-0.23) and China (-0.19) all dropped by several notches. In the bottom ranks sit Yemen, Libya and Iraq which continue to score poorly across all ESG measures.

Scores of the world’s largest sovereign debt issuers stayed roughly the same. Japan (ranked 22nd) slightly improved its overall score (+0.02), while the US (ranked 41st) slightly declined (-0.09).

Mexico – bright prospects, shadow risks

Mexico is a classic case of the value of ESG scores to signal potential risks when everything else is coming up roses. It boasts a well-diversified economy with on- and offshore oil fields, a thriving agricultural sector and an expanding manufacturing base. Moreover, its close proximity and good relations with the US make it a nearshoring target for companies eager to reduce supply chain headaches by moving away from China and other emerging Asian countries, and closer to end markets. If fully realized, nearshoring could boost Mexico’s GDP by nearly 3%.1

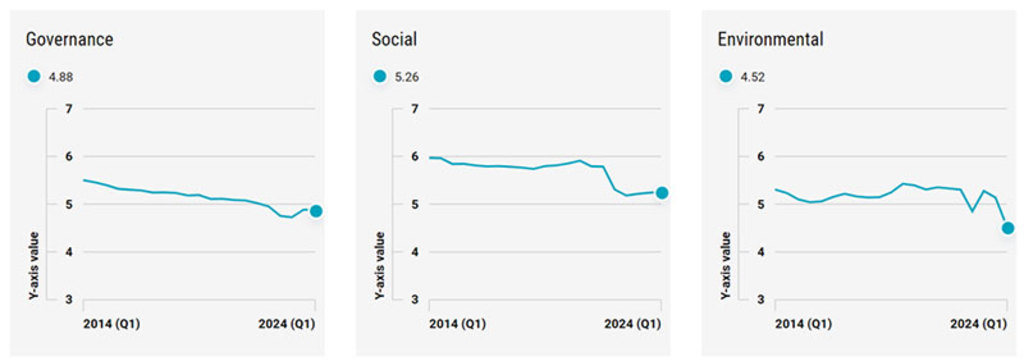

But a decades-long decline in the country’s ESG score should give investors pause. Rampant organized crime, systemic corruption of public agencies, and ineffective law enforcement have weighed heavily on social and governance performance. Moreover, increasing water scarcity, pollution, deforestation and exploitation of natural resources are reducing environmental scores and stoking tensions in local communities already suffering from poverty, unemployment, and limited education and healthcare access.

Mexico must strengthen internal governance and social cohesion in order to boost investor confidence and fully capitalize on the long-term windfalls which nearshoring opportunities present.

Figure 2 – Mexico’s declining ESG scores could cause roadblocks to growth

Source: Robeco, Country Sustainability Scores, April 2024.

Portugal’s renewable powerplay

While Mexico attempts to seize windfalls, Portugal is using windfarms to help it build a robust economic future. Through shrewd fiscal management, it reduced public spending but still managed to prioritize investments in renewable energy. The renewable push has already generated much-needed jobs and economic growth across construction, manufacturing, installation, and infrastructure maintenance in a vibrant, next-generation sector. Long-term, it is helping build future economic resilience by reducing Portugal’s dependence on energy imports and increasing its control over energy pricing for citizens and industries.

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

Gender equality enhances economic potential

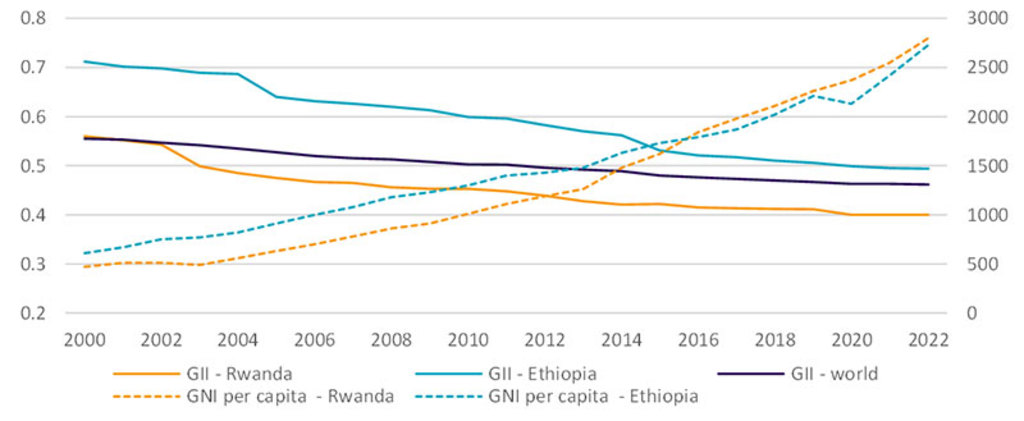

Treating women and girls fairly is not just morally right, it’s economically profitable. Persistent gender gaps reflects an environment where human capital is underdeveloped, underemployed and less productive. So it is unsurprising that countries with a better gender balance also tend to have more income and a brighter outlook.

Giving women and girls equal access to education, training and employment opportunities is only part of the solution. Access to quality health and family planning guidance are also important to reduce maternal mortality and adolescent birth rates.2

Ethiopia and Rwanda are illustrative of the economic power of parity-boosting policies. Over the past two decades, substantial increases in gross national income (GNI) per capita have paralleled substantial improvements in the GII scores for both countries, making it a material topic for those interested in sustainable economic development as well as sovereign investment research.

Figure 3 – Empowering women and national income in Ethiopia and Rwanda

Source: World Bank, UNDP, 2022. Rwanda and Ethiopia’s Gender Inequality Index (GII) scores are on the left axis. Purchasing Power Parity -adjusted GNI per capita is on the right axis. Data is from 2000-2022.

Country scores inform government engagement

Robeco’s Active Ownership and Engagement teams leverages its influence as investors to push for positive action on sources of risks that can negatively impact the profitability of portfolio companies or the economic development of sovereign investments. Country ESG research and rankings inform those efforts by providing objective data points of country and peer-group performance across a wide range of significant socioeconomic variables.

More specifically, climate change and biodiversity present urgent material risks to countries that demand the kind of large-scale action that only governments can provide. Robeco’s collective engagement efforts as part of the Investor Policy Dialogue on Deforestation (IPDD) in Brazil have moved the country one step closer to establishing a national registry to trace and track land clearing and livestock production practices in its powerful cattle industry, a major contributor to deforestation and biodiversity loss.

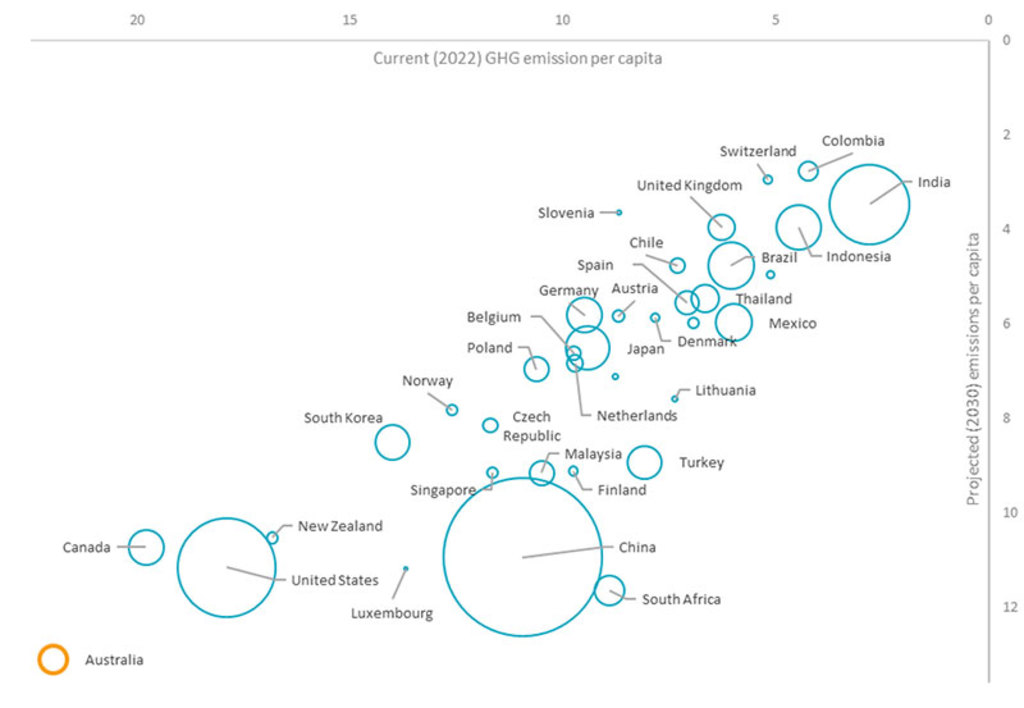

Together with the PRI3 , Robeco is also taking part in engagements with Australian authorities to address widening gaps between their Paris-aligned commitments and actual emission intensities. The group held 36 meetings during 2023 across a large range of federal departments, state treasuries, government advisory bodies and think tanks involved in the country’s climate policy decisions.

Figure 4 – The Australian outback is an outlier for emissions per capita

Source: EDGAR, Climate Resource, Robeco. Bubble size represents the magnitude of total GHG emissions per country. Current (2022) emissions per capita are plotted on the y-axis (top) vs. projected (2030) emissions per capita by country are on the x-axis (right). Source data as of 2023, the most recent available. Robeco analysis as of 2024.

For more details on country scores and rankings, visit Robeco’s SI Open Access portal.

Footnotes

1 Deloitte, Nearshoring in Mexico. July 2023.

2 As part of its social criteria, the Country Sustainability Framework uses the UNDP’s Gender Inequality Index (GII) which measures maternal mortality ratios, adolescent birth rates, share of women parliamentary seats, and differences in male and female education levels to determine a country’s overall gender equality performance.

3 Begun in 2000, the Principles for Responsible Investing (PRI), is an investor-led platform and the world’s leading proponent of responsible investment.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.