The power of chips: The most strategic commodity in the world

Semiconductors are set for a resurgence in 2024 as their role in sustainable energy becomes ever-more important, says multi-asset investor Arnout van Rijn.

Summary

- Chips play a vital role in renewable energy, electrification and sustainability

- Stock prices have rallied 30% over 12 months amid optimism for demand in 2024

- New strategic manufacturing plants to be set up to reduce dependency on Asia

He says chips are effectively now a commodity in their own right that will prove crucial for renewable energy, electrified transport and smart grids. They have been in the doldrums for several years after the Covid pandemic hammered demand and sent prices plummeting.

Now, a combination of factors including the prospect of massive new manufacturing plants is set to boost both demand and supply, says Van Rijn, Portfolio Manager with Robeco Multi Asset Solutions. This makes them an ideal play for multi-asset strategies along with their increasing importance in bespoke sustainability investment products.

“Last year at this time, close to the bottom of the equity market correction, we dared to be upbeat on the outlook for what are seen as pinnacles of cyclicality: chips and ships,” Van Rijn says.

“A quick reflection shows that prices of the basic goods and services have continued to be very weak – memory chips are down 45% and shipping rates down some 40% – and contrary to our expectation, we have seen some losses in the industry.”

“The equity market is forward looking, however, and chip producers have rallied about 30% over the past 12 months, comfortably outperforming global equity indices (+18%). The Philadelphia Semiconductor Index (SOX) is up by even more (+40%), so we can be proud of our bold and prescient call.”

He says supply discipline has been key when growth in ‘bit demand’ – the total computing power of chips – dropped to single digits in 2022 and 2023, having seen growth of more than 20% in 2020 and 2021.

“For 2024, a solid demand recovery is on the cards, supported by a PC upturn, the resumption of server growth and the wave of enthusiasm for artificial intelligence (AI) that will likely add 5% alone to global bit demand,” Van Rijn says.

“The 2024 optimism has been the main reason for the stocks rallying in 2023, though recently, we have witnessed a pullback in the sector, due to the reversal of some Covid-era imbalances resulting in fading pricing power for those that can ship the chips.”

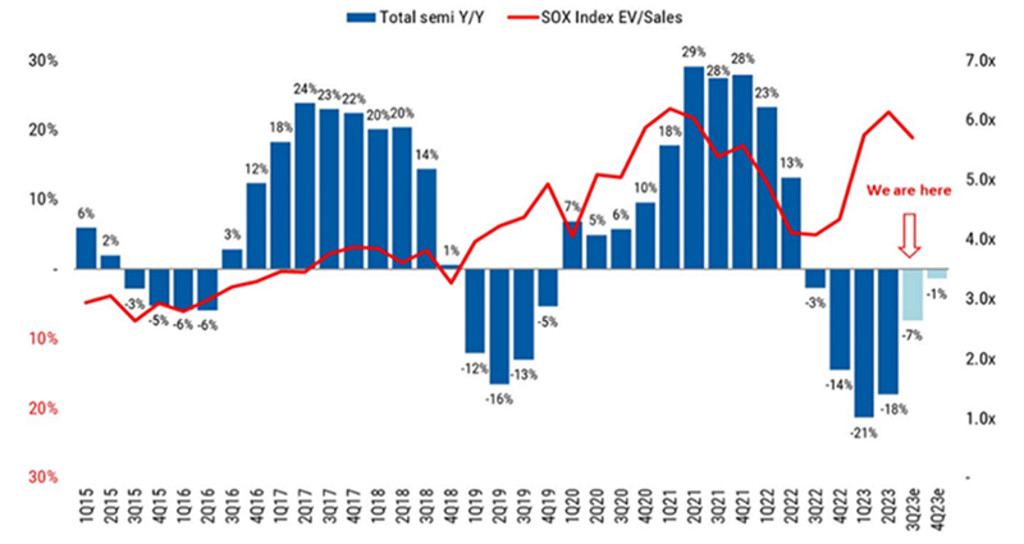

This can be seen in one measure of how stocks are valued, using a multiple of enterprise value (the company’s market capitalization plus its net debt) over sales. Multiples for semiconductor companies have expanded to 5-6 times this metric, as margins on the more sophisticated semiconductors are deemed to be higher and more sustainable. This is shown in the chart below.

The ratio of enterprise value over sales has risen since 2022

Source: Refinitiv, OECD, SIA. Morgan Stanley Research, October 2023.

And its long-term future is undoubted. “The Robeco Sustainable Multi Asset Solutions team has been heavily involved in following this market now that we offer a number of multi-thematic solutions to clients,” Van Rijn says.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Role in energy transition

“Semiconductors are a big driver of innovation, and are essential to the energy transition: they are key elements of solar panels, electric vehicles, power inverters and storage devices. They comprise nearly 15% of our impact-orientated equity allocation in the Multi Asset Sustainable strategy and up to 38% of Robeco’s bespoke Smart Energy and Smart Mobility strategies.”

He says semiconductors have many commodity-like characteristics, such as market pricing, fungibility, standardization, liquidity and their trading patterns in global markets. But unlike mined or farmed commodities, semiconductors are man-made, and with increased complexity and design features – it is no longer a homogenous market. “While anyone can make a DRAM, only one company can make a graphics processing unit (GPU) that can run your AI,” he says.

“And an important new feature of semiconductors as commodities is their historical significance. We used to fight wars over gold, copper and iron ore. Now, next to the risk of wars over lithium and cobalt for our batteries, we also see strategic tensions and trade wars between the US and China over (access to) semiconductors.”

“Semiconductors can safely be said to be staples for global economies. They are considered of strategic importance to future economic development, while most production now comes from Asia. The US and Europe are marginalized in this, but Europe at least holds the trump card of being the champion in the lithography needed to facilitate further miniaturization.”

Inevitable international tensions

This kind of growing market power means semiconductors will inevitably become the subject of international tensions. “Now that free global trade is no longer a given, the major economies want to be independent when securing their energy supply, but also for their chip supply,” Van Rijn says.

“It is risky to have chip manufacturing done by an outsider, let alone by a company that is based in Taiwan, an island to which China lays claim. Politicians have belatedly realized this vulnerability and have come up with big plans to reduce it. European and American governments are now offering very large subsidies to foundries to be built on their home soil.”

This can be seen in the European Chips Act which came into effect last month and aims to invest more than EUR 43 billion, with the ambition of getting back to a 20% market share in global chip production from less than 10% today, most of which is at the lower end.

The US Chips and Science Act is more geared to preventing advanced chips reaching China, but here too foundries are being enticed to produce leading-edge chips in the US. Of the three leading-edge foundries, Intel plans to build two fabrication plants (fabs) in Germany at a cost of EUR 30 billion, including EUR 10 billion in subsidies, while TSMC will invest USD 40 billion in two Arizona fabs by 2026. Samsung will invest USD 17 billion in a US fab but has no plans in Europe yet.

An above-average premium

So, order chips with everything? “For thematic investors, the near-term outlook is not an easy call because an upturn may already be priced in, strong pricing power due to tight supply has passed its peak, and sales multiples have gone up. The long-term strategic importance of the sector, however, clearly justifies a premium above historical averages for companies that have defensible intellectual property.”

“Finally, as the world evolves and semiconductors become such a strategic commodity, we would like to make a case for a futures market in memory chips. It has differentiated cycles and thus offers nice diversification benefits. It can also offer an insurance against any further geopolitical upheaval, just like oil used to do.”

“Though purified water usage is very high for many fabs, the fact that a memory chip is silicon based means it at least has a carbon footprint that is a lot lower than oil.”