Will emerging markets breathe some fire in the Year of the Dragon?

Emerging market assets remain cheap compared to their developed market counterparts, but a re-rating depends on what happens this year in the US, says multi-asset investor Aliki Rouffiac.

Summary

- EM assets have generally underperformed against developed markets

- US rate movements and the impact on the dollar will be key in 2024

- Export-orientated economies better placed to benefit from global growth

The asset class has long been considered the Wild West – or perhaps more accurately, the Wild East – by investors looking to diversify portfolios, particularly as developed markets were hit first by Covid and then by the inflationary aftermath of the Ukraine war.

While emerging market equities led by the growing influence of China can occasionally produce rich pickings, they have been more likely to generate disappointment over the past decade. Currencies have similarly underperformed as the US dollar benefited from US exceptionalism, while EM debt is highly vulnerable to rate rises.

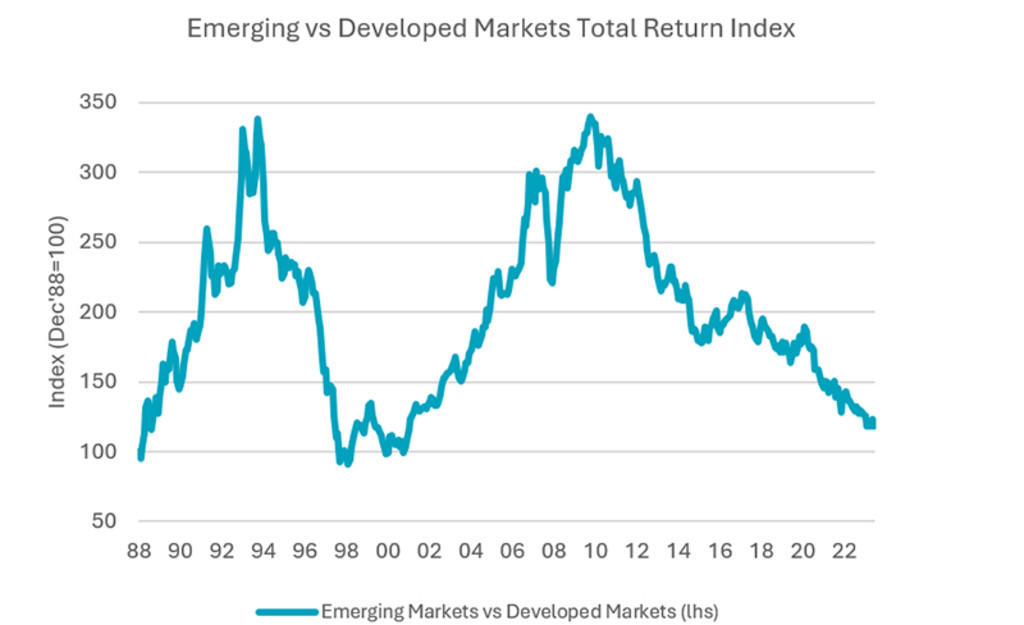

Returns for emerging market equities over the 10-year period to the end of June 2024 have lagged those of developed markets by an annualized average of 7% a year. After outperforming in the 2000s, underperformance has been a feature of the EM versus DM comparative market since the 2010s, as seen in the chart below.

Source: Robeco, Bloomberg, Refinitiv Eikon. Data to May 2024.

A stronger dollar has also led to emerging market currencies underperforming by as much as 6% per year, based on the relative returns of the JPM Emerging Market Currency Index versus the dollar.

There are richer pickings in fixed income, as yields of 6.6% for the GBI-EM Global Diversified Local Currency Index are well above the 3.4% on offer for Global Developed Governments. However, the gap between the two has been closing, as central banks around the world have been in a rate-hiking mode over the last year.

So, will emerging market assets finally breathe some fire in the Year of the Dragon? “Despite the better economic growth rates for developing economies over the past decade, emerging market assets have failed to deliver meaningful outperformance across the equity, fixed income and currency spectrums,” says Rouffiac, Portfolio Manager with Robeco Sustainable Multi-Asset Solutions.

“Catalysts on whether the Year of the Dragon will prove to be the turning point for emerging market assets could play out over the course of the second half of 2024, providing a more supportive backdrop for future performance.”

“Growth differentials have historically led to better equity performance in emerging markets, with the recent reversal to more positive levels seen as a prospective supportive factor for EM stocks.

What will the dollar do?

Much also depends on the mighty greenback and the effect that any rate cuts by the Fed would have on it. A rate cut usually makes the domestic currency less attractive to foreign investors, weakening the dollar against emerging market counterparts. This particularly benefits the many developing nations who produce commodities that are sold globally in dollars.

“Tactically, the behavior of the dollar will also be an important driver for emerging market assets, be it equities or fixed income,” Rouffiac says. “As the Fed embarks on a rate-cutting cycle, the prospect for more gradual and less steep rate cuts over the next 12 months amid a benign global economic environment would bode well for emerging market asset performance.”

“In the meantime, the trajectory and speed of inflation moving to more sustainable levels of about 2% would pave the way for more accommodative policies. This is occurring in a period when the focus remains on elections (particularly in the US) that have the potential to ignite short-term volatility and create opportunities within the EM space.”

China versus everywhere else

China continues to play a major role in the overall performance of the asset class, as it has a 25% weight in the MSCI EM Index, causing a considerable divergence with the rest of the index when China is excluded. The performance differential between Chinese and EM ex-China equities since the Covid era has reached almost 50%.

This can be partly attributed to domestic drivers such as the headwinds facing the Chinese property market. But it is also due to market structure differences, as the Chinese equity index is significantly underexposed to the technology sector – one of the biggest beneficiaries of the AI boom – with an exposure of just 5.9% compared to 31.5% for the MSCI EM ex-China Index.

This divergence is also seen in the fact that the correlation between the MSCI EM ex-China Index and Western equity markets has risen close to 70% over the last 12 months, but fallen to 56% versus the China equity market.

Who we are

We are a global asset manager with strong capabilities in quant, credits, emerging markets and sustainable investing. Research is at the heart of everything we do, driving active investment strategies that aim to maximize alpha generation.

A more favorable profile

“From a risk perspective, the convergence of emerging market versus developed market volatility over the last year has created a more favorable profile for emerging equities,” Rouffiac says. “This changing correlation dynamic within the EM universe is reflective of the varying degrees of diversification of these exposures in global equity portfolios.”

“Looking ahead, the valuation argument for emerging relative to developed market equities as a whole remains compelling, with EM ex-China now trading at a 25% forward discount, while the 40% discount of Chinese equities against the West stands close to its 20-year historical low.”

“Arguably, the case for attractive relative returns over the medium term is strong, while the recent turn of the global manufacturing cycle – global PMI surveys have risen above 50 since the beginning of the year – could provide a more positive backdrop for earnings. This is particularly true in export-oriented economies with a large manufacturing base, which are better positioned to benefit from an improving global growth outlook.

It all goes back to the Fed

However, much still depends on what happens in the West, and the old adage of when the US sneezes, the rest of the world catches a cold. This is particularly true of emerging markets debt, which is more sensitive to what happens in the US than its own locales.

“The balance of risks in emerging market fixed income assets lies in the speed and magnitude of central bank policy shifts toward a more accommodative stance,” Rouffiac says. “The US is unequivocally in the driving seat and is setting the tone in terms of the overall attractiveness of emerging market local currency debt.”

“Despite the higher yield of the EM local currency bond index, the pivot to a lower-rate environment in the US would be key for the asset class’s performance for the rest of the year. Investors will need to favor countries where carry opportunities are enough to compensate for short-term uncertainty, a likely slower disinflationary trend, and potentially higher premia due to the upcoming US election.”

“In a similar vein, as currency volatility has been relatively subdued since the start of the year, cheaper and under-owned currencies should fare better relative to the dollar as interest rate differentials normalize in line with the future pace and timing of rate cuts.”