Nowcasting growth to enrich the factors used for government bond selection

We have added a quality measure for the selection of government bonds. It is constructed using nowcasting, to capture timely signals about economic growth.

Summary

- Innovative method to capture timely signals about economic growth

- Enriching the factors used for government bond selection

- Its low correlation with existing factors enhances performance

Our multi-factor bond strategy uses well-known factors like value, momentum, low risk and quality to select government bonds and credits with superior risk-adjusted returns. The portfolio construction algorithm aims to efficiently harvest these factor premia while keeping the top-down risk profile in line with the index and ensuring a strong sustainability profile.

We now add a quality measure for the selection of government bonds. This measure uses nowcasting to capture timely signals from the plethora of macroeconomic data that are continuously released.1

Quality is widely used in equity and credit selection. It favors stocks and bonds of companies with strong fundamental characteristics like profitability. The equivalent characteristics for government bonds are country fundamentals associated with good returns from government bonds. Our research shows that the appropriate factor to consider is the quality of the macroeconomic environment for bond investors. Here, economic growth is one of the relevant fundamentals: bonds from countries with moderate growth are a better-quality investment than bonds from countries with an overheating economy.

Capturing the state of the economy

To select high-quality government bonds we thus want to compare the state of the economy across countries. There are some challenges to gaining timely data on the state of the economy, though.

The official data series for economic growth is GDP, a comprehensive measure of economic activity. The drawback of this series is that, for most markets, it is updated only quarterly, with a publication lag of at least a month. Moreover, the data is prone to substantial revisions. This means that a bond selection process in early July would either use first-quarter data, showing which economies were growing strongly four to six months previously, or would need to be delayed by a few weeks until the publication of the first estimates of second-quarter growth – and maybe even longer as these numbers might be revised later on.

Fortunately, many macroeconomic data series are released more frequently and with a shorter publication lag than GDP. However, these indicators typically relate only to specific parts of the economy. To get the full picture of the overall economy, it is necessary to combine several data series.

For this we use nowcasts, daily estimates of current growth based on a wide variety of data series. In early July, many data series give information about May, and some already for June; survey data can shed some light on what could be expected in July. This is an advantage compared to the traditional GDP numbers: by combining data series that are updated faster and more frequently, one can create a comprehensive measure of activity that leads the latest published GDP data by up to several months.

Capturing growth as quickly as possible

To ensure that the nowcast reflects changes in activity as quickly as possible, one further step is taken. As mentioned, the nowcast combines data from several data series. However, one does not have to wait for all data series to be published. When early data releases point to a slowdown in some parts of the economy, the linkages between different parts of the economy can be used to infer what this likely means for parts of the economy for which data has not been published yet.

A true nowcast uses a model of the relationships between these parts of the economy – a dynamic factor model – to ensure that all information is extracted from a data release: not only the explicit information about that part of the economy, but also the implicit information about related parts of the economy.

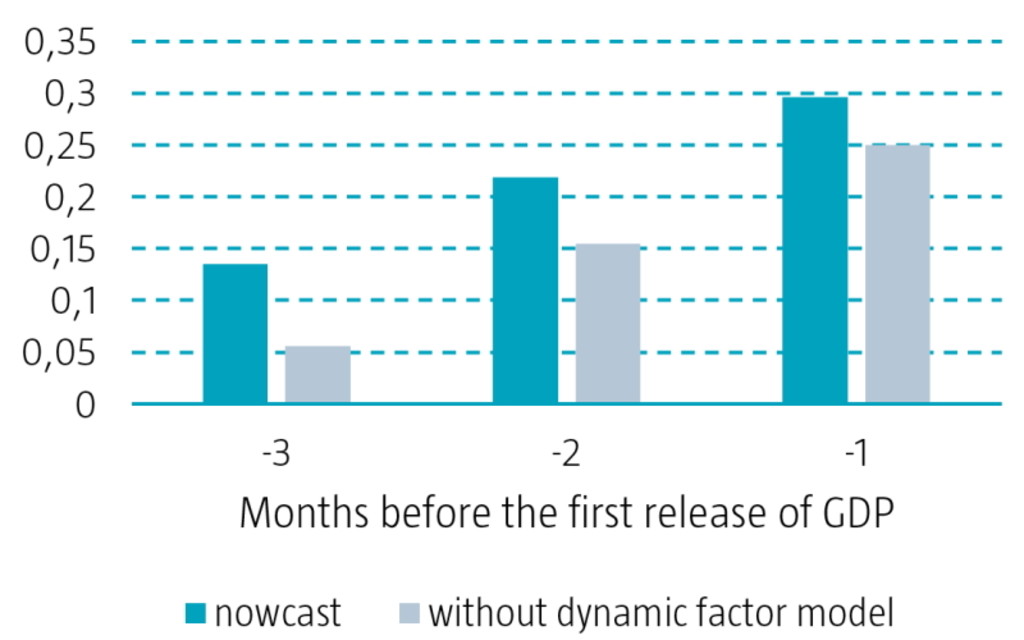

Figure 1 | Correlation to GDP-based rankings for nowcast, with and without dynamic factor model, 2008-2022

Source: Robeco

In our Multi-Factor Bonds strategy, we use the nowcast to differentiate between bonds from different countries, based on economic growth in these countries. Figure 1 shows how well we can rank countries based on growth, using the nowcasts available one to three months before the release of the official GDP growth numbers. To show the added value of the dynamic factor model, we compare the nowcast to a similar combination of data releases that doesn’t use a dynamic factor model. The ranking based on the nowcast correlates better with the ranking based on GDP growth than the ranking produced without the dynamic factor model. The ranking produced with the nowcast, three months before the GDP publication, is as accurate as the ranking produced without the dynamic factor model one month later.

Performance

Nowcasting can thus be used to get timely information on the state of the economy. But is this enough to select government bonds with superior risk-adjusted returns? To answer this question, we performed historical backtests. Ideally, we would only use nowcasts that had actually been published at that point in time, but these have a limited history. We therefore extend our dataset by using nowcasts that are carefully reconstructed. As this process requires a large variety of economic indicators, with their exact historical publication dates, there are limits to how far back in time one can go, and the backtest is therefore fairly short.

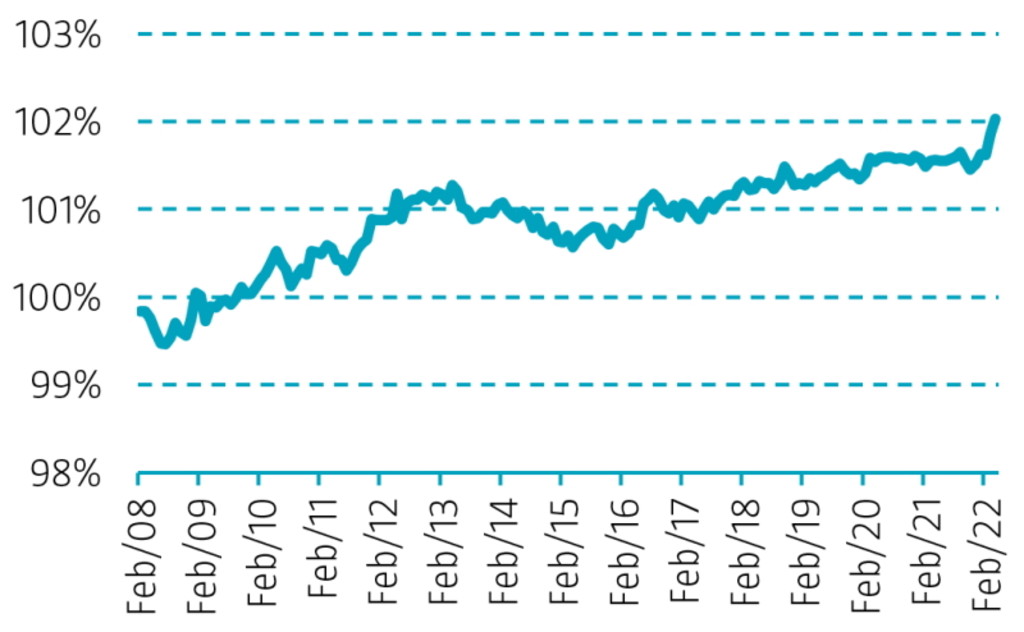

Figure 2 | Cumulative performance of government bond selection based on nowcast, 2008-2022

Source: Robeco

Figure 2 shows the cumulative performance of a long-short portfolio based on the nowcast. This portfolio has long positions in bonds from countries where growth is moderating and short positions in bonds from countries where the economy is heating up. The portfolio is rebalanced monthly.

We find that the nowcasts generates attractive risk-adjusted returns. Furthermore, this performance is largely uncorrelated with the factors we already use for government bond selection. It thus adds value to our multi-factor government bond selection. Out of prudence, we add this new quality measure with a somewhat lower weight than other measures, to reflect the shorter history over which we can assess its performance. For other factors we have much longer backtests, extending beyond 200 years. For deep-sample evidence on the existence of value, momentum and low-risk factors, please refer to Factor Investing in Sovereign Bond Markets: Deep Sample Evidence.

Conclusion

Bonds from countries experiencing moderate growth are a better-quality investment than bonds from countries with an overheating economy. To select high-quality government bonds, we thus want to capture differences in economic growth. Nowcasting allows us to do so in a timely manner.

Selecting government bonds based on this quality measure generates attractive risk-adjusted returns. Its performance is largely uncorrelated to that of the other factors. It thus adds value to our multi-factor government bond selection.

Footnote

1 This article is based on a more detailed paper by the same authors, entitled “Nowcasting growth: quality in bond selection”, July 2022.