Consumer trends in 2022: the subscription economy and the metaverse

Megatrends keep unfolding. Last year’s experience confirmed that the ‘great acceleration’ seen in 2020 for most of the trends on which we build our thematic strategies was not a temporary blip. On the contrary, while we initially foresaw some mean reversion in these trends, after the impressive surges seen during the onset of the pandemic, in areas such as ecommerce or mobile payments, that prediction proved too cautious.

Summary

- Subscription economy & the metaverse are the themes to watch in 2022

- Subscription businesses typically offer resilient revenue and profit growth

- In many ways, the metaverse can be seen as the next step of the internet

Ongoing socioeconomic shifts may have slowed down as economies gradually reopened, but they largely remain in place as new habits persist beyond the stop-and-go recovery. For 2022, we expect these trends to continue to unfold at rapid pace, even as economies continue to recover from the initial Covid-19-related shock and the situation gradually normalizes. As we enter the new year, we outline two promising areas of focus for investors: the subscription economy and the metaverse.

Subscription-based business models are not new, having been around for many decades. However, they have experienced a tremendous boom in recent years

The subscription economy refers to all the products and services people can think of made available through a subscription scheme, as opposed to traditional casual buying. It therefore often implies a shift from ownership to usership. Good examples are the popular music and video streaming services. But it can be virtually anything, from a box of fresh vegetables delivered weekly, to a car or a pair of blue jeans that may be renewed, and eventually recycled, on a regular basis.

Ultimately, the subscription economy is a way for companies to eventually build stronger and longer-lasting relationships with their clients. This involves putting customers first and tying them to their products and services in various ways, such as providing better value for price, enhanced flexibility and personalization, or improved customer experience relative to classic buy-and-own offerings.

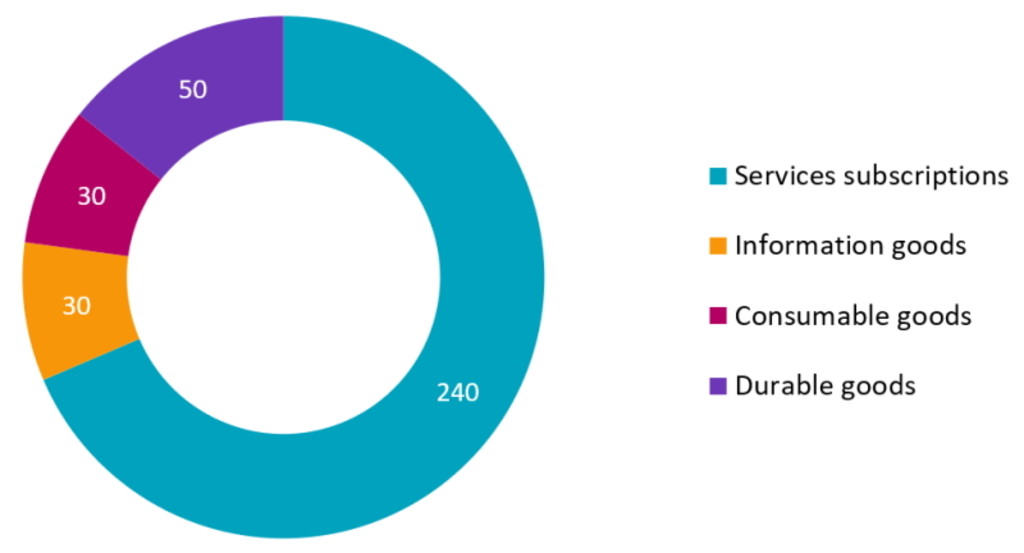

Subscription-based business models are not new, having been around for many decades. However, they have experienced a tremendous boom in recent years. While essentially having been limited to the media industry until only a couple of decades ago, they gradually expanded, first into a few niche areas, such as telecommunications, software and information technology services, and then into the wider economy (see Figure 1).

Figure 1: Annual European subscription expenditure in billion euros

Source: ING, Bernstein analysis, August 2021.

Subscription businesses grew nearly six times faster than firms of the S&P 500 Index over the 2012-2020 period

For investors, subscription businesses typically offer reduced uncertainty regarding revenue and profit generation in the long term, relative to more traditional business models. Moreover, these companies tend to generate a constant stream of data that can be used to improve service, raise customer satisfaction, and identify complementary business opportunities. This generally leads to relatively stable growth over time.

Admittedly, subscription businesses may not be appealing to all investors, as they incur customer acquisition costs – such as sales and marketing, or software development – upfront, while revenues are recognized over time. This combination leads to a misalignment of revenues and expenses, understating the true financial health of the company. However, as long-term investors able to look beyond short-term cashflow generation, we see this as an opportunity rather than a challenge.

Subscription businesses grew nearly six times faster than firms of the S&P 500 Index over the 2012-2020 period, driven by rising consumer demand for subscription services, according to Zuora, a subscription management platform.1 The Covid-19 pandemic further increased the gap. Many subscription businesses experienced a strong growth acceleration, as consumers moved from fixed towards variable costs, and companies focused on their core operations while outsourcing the rest.

In 2020, revenues of subscription businesses tracked by Zuora grew by 11.6%, while those of the companies in the S&P 500 Index declined by 1.6%. Admittedly, lockdowns and other safety measures taken in the first quarter initially seemed to slow subscription revenue growth. But when lockdowns returned in the last quarter, subscription revenue growth accelerated, suggesting that subscription companies had been able to adapt their offerings quickly.

We expect this trend to continue in the coming decades, essentially driven by the ongoing digitalization of the economy. According to recent estimates by UBS Wealth Management and Bernstein, the digital subscription economy is currently a USD 650 billion market and is set to more than double by 2025 reaching a market size of USD 1.5 trillion.2 This represents an impressive 18% compound average growth rate.

New technology now enables businesses from virtually all economic sectors to offer membership services to their customers. On the corporate side, rapidly falling costs of data storage and rising computing power have enabled businesses to offer consumers access to their services at a very low cost. Meanwhile, the ubiquity of online services has enabled consumers to be in touch with content, services and even other members at all times.

Another important tailwind for the coming years is the unavoidable generational transition, as millennials and generation-Zs3 tend to be keener on subscription and usership schemes than older cohorts.4 Consumer surveys suggest that, for younger generations, the promise of always getting the latest product, the lack of associated maintenance, as well environmental concerns often tend to player a larger role in the purchase decision making than traditional ownership considerations.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

The metaverse gradually becomes investable

The metaverse became a popular buzzword in 2021, as key players in the technology arena announced important steps in this area. In particular, the public listing of gaming platform Roblox and the renaming of Facebook into Meta Platforms were key milestones. But beyond the current hype around this concept, we think it reflects a number of structural trends unfolding at the intersection of the internet-of-things, social media and mobile computing.

Indeed, the metaverse is much more than a fancy pair of virtual-reality goggles, or a new way to play online games. Broadly speaking, the metaverse refers to the many aspects of our digital lives and their interactions.5 It includes obvious elements, such as digital gaming worlds, or social media, for example. But it also has less obvious ones, such as digital financial services, remote working tools and applications, as well as all the daily digital services accessible online.

In many ways, the metaverse can be seen as the next step of the internet, where increased connectivity will further integrate digital and physical lives. It is therefore not something predefined, but a constantly changing concept. This means that while it is difficult to envision precisely what the metaverse will look like ten years from now, developments in this area are ineluctable. A growing number of companies have been communicating around the metaverse.

Admittedly, the metaverse is still in its early stages and therefore requires a cautious approach from investors. However, we expect investments in this area to rise significantly over the coming years, as companies will position for increased computing needs – including hardware and software – and develop testing and learning capabilities on potential use cases for both corporate and retail customers.

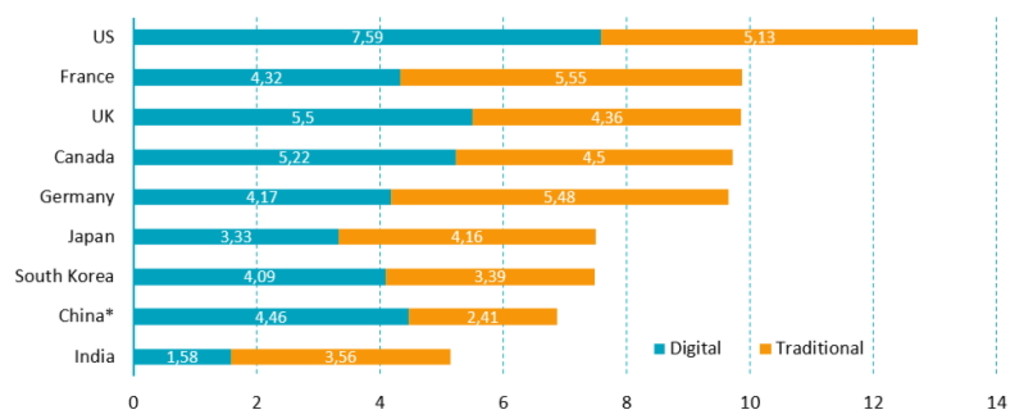

Figure 2: Average time spent with media in selected countries in hours:minutes per day

Source: eMarketer, April 2021. Note: ages 18+; included digital (desktop/laptop, mobile nanovoice and connected TV streaming), print (magazines and newspapers), radio, TV and other; included all time spent with each medium, regardless of multitasking; *excluded Hong Kong.

We therefore advocate a so-called ‘picks and shovels’ approach, investing selectively in companies that enable these developments

Global consumers show appetite for services featuring metaverse-related characteristics. Social media platforms already boast billions of users across the world, that could eventually be drawn to the metaverse. Popular platforms such as Facebook, YouTube and WhatsApp, for example, boast billions of users across the globe. Moreover, many of these users already spend a very significant share of their time every day on digital media, mainly through their mobile devices (see Figure 2).

Bernstein analysts recently estimated that, although the timing and scope of metaverse-related developments remain uncertain, the combined annual run-rate of the most relevant markets is already USD 2 trillion and growing.6 Among the most obvious areas bound to benefit from the development of the metaverse over the coming years are digital ads, semiconductors, mobile phones and infrastructure software, for example.

But the impact will likely be much more broad-based, with many other, perhaps less obvious segments of the economy also set to benefit from the advent of the metaverse over the coming years. These include ecommerce, media, digital payments and even education, to name just a few. In a recent note to clients,7 Goldman Sachs analysts estimated the metaverse market opportunity could reach somewhere between USD 2.6 trillion and USD 12.5 trillion.

For investors, we think that while it is still early days and some caution is warranted, the metaverse’s promising prospects should not be overlooked. Admittedly, the number of investable companies directly involved in the advent of the metaverse remains relatively small. We therefore advocate a so-called ‘picks and shovels’ approach, investing selectively in companies that enable these developments. These include a wide array of companies, from social media platforms to chip makers.

Footnotes

1Zuora, 3 March 2021, “Subscription business revenue grows-437% over nearly a decade as consumer buying preferences shift from ownership to usership”, press release.

2Bernstein, 11 August 2021, “Sign me up! Why consumers are increasingly subscribing rather than buying”, client note.

3While there is no official definition of what ‘boomer’, ‘millennial’ or ‘generation Z’ consumers are, the Pew Research Center describes them as follows: boomer = people born between 1946 and 1964; generation X = people born between 1965 and 1980, millennial = people born between 1981 and 1996; generation Z = people born between 1997 and 2012

4See for example: Scuncio, J., 7 May 2019, “Millennial spending drives the growth of the subscription economy”, Zuora blog article.

5The term metaverse was initially coined by Neal Stephenson in his 1992 novel Snow Crash, defining it essentially as a computer-generated universe.

6Bernstein, 7 December 2021, “Bernstein enters the metaverse: A primer on what it is, the size of the prize, and why you should care”, client note.

7Goldman Sachs, 10 December 2021, “Framing the Future of Web 3.0 - Metaverse Edition”, client note.

Consumer Trends in 2024: The resilient shopper

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.