Investors’ engagement and Enel: a success story

Utilities lie at the proverbial coal face of reducing the world’s reliance on fossil fuels. As suppliers of electricity, they have for decades burned coal, gas and oil to meet the growing needs of society. But they can also become part of the solution – as Enel has shown.

Summary

- Engagement supported acceleration of Enel’s decarbonization plan

- First utility to commit to stop using gas power generation by 2040

- Enel is tackling Scope 3 emissions, aims to end all gas sales

Robeco has been engaging with the Italy-based multinational power producer for more than six years to encourage the utility – the largest in Europe – to accelerate its move away from the fossil fuel model. This has helped produce some spectacular change, led by commitments to phase out coal and reduce Scope 3 emissions, and putting a wind power expert on Enel’s board.

Now the utility is talking about becoming one of the first in the world to source its energy entirely from renewables, thereby generating absolute zero rather than just net zero direct emissions, while following a clear net zero target by 2040 across all scopes.

So, how did this all happen? Many utilities are highly reluctant to change, citing the need to secure power supplies and the unreliability of renewables, which won’t work if the wind isn’t blowing or the sun doesn’t shine. Carola van Lamoen, Head of Sustainable Investing and the founder of Robeco’s engagement capability in 2005, takes up the story.

“Our focus on utilities started in 2015 when we saw the trend of transition to a lower-carbon future and that the utilities sector was going to be impacted by this the most in the near term,” she says.

“At the time we were focusing on European utilities to see where we could assist in their transition away from coal. Enel was an obvious candidate for engagement because they are the largest utility in Europe, and they had significant exposure to coal at the time.”

The Active Ownership team began research to see exactly where Enel was with their own decarbonization plans. Most engagement does not start from scratch; a company usually already has some kind of policy in place to become more sustainable. Investor feedback can then help highlight what areas are of most concern.

Building on the basics

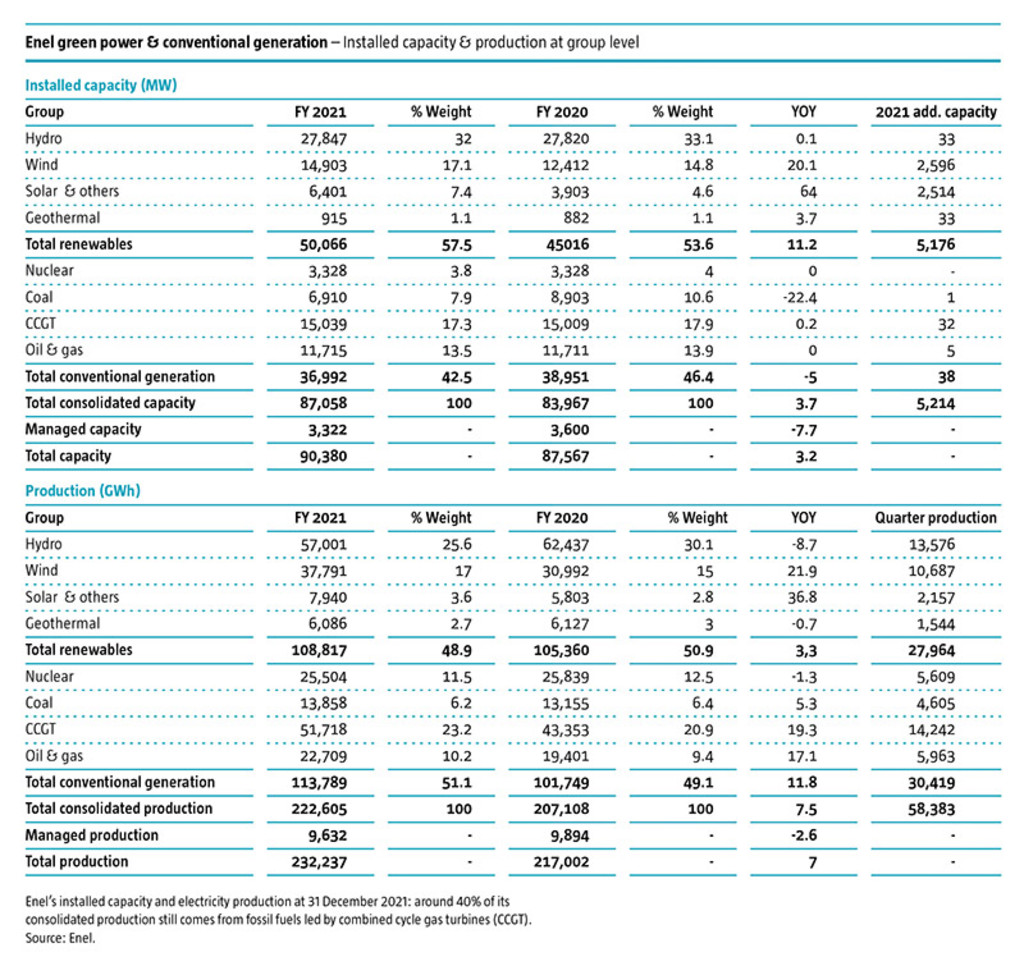

Enel had already seen which way the wind was blowing – literally in its case – in starting to swap coal for wind and other clean energies. In 2015, coal-fired plants accounted for around 20% of Enel’s total installed capacity. This has been more than halved to less than 8% in December2021, and partly thanks to the engagement, the company has committed to a full coal phase out by 2027.

“Enel was maybe one of the earliest companies to realize the seismic shift that was taking place in the industry,” says Van Lamoen “Some of the basics were already there. In 2015, they had already committed to net zero emissions and had set a science-based target for cutting emissions by 2020.”

“They had also committed to no new coal development and had started closing down some of their coal-fired power plants. They didn't have everything ironed out, but they had already seen the direction of travel that they needed to go, and that was really helpful.”

“What they lacked was a disclosed climate strategy to deliver on their net zero emissions ambition. Much of our role has been communicating what our priorities are as an investor, outlining our expectations in what we wanted to see, and always trying to help them take the next step.”

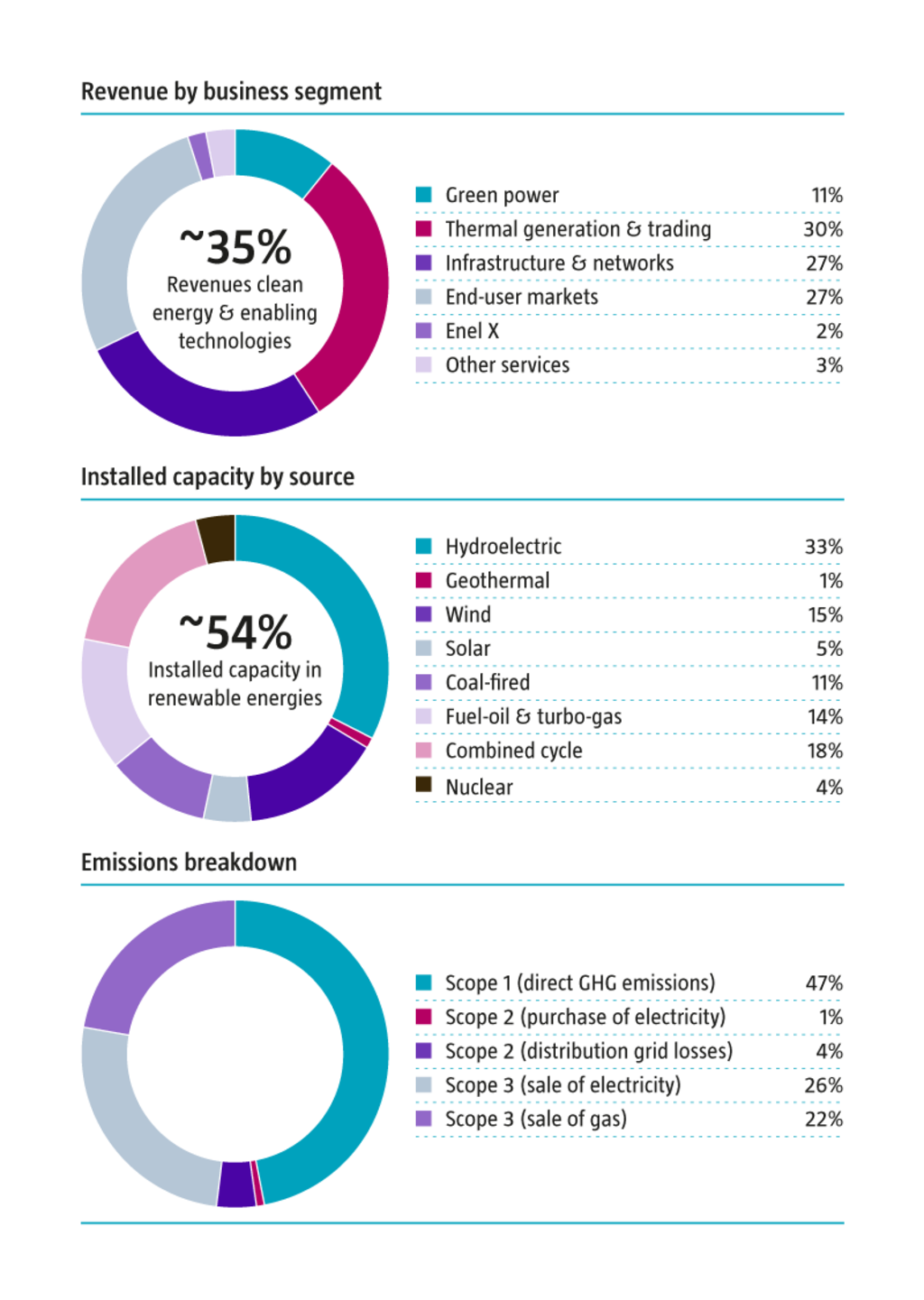

Enel in a nutshell. The figures refer to eligible activities according to the EU’s Technical Expert Group (TEG) recommendations. Source: Enel, Robeco

Going green in ’16 – green energy goes mainstream

It didn’t take long to see results, as Enel was quick to show that it was serious about renewables. They say that true sustainable investing is not possible unless it comes from the very top, and Enel had just the right man at the helm.

Francesco Starace was chief executive officer of Enel Green Power from 2008-2014, listing it on the Milan and Madrid Stock Exchanges in a celebrated EUR 8 billion IPO in 2010. He became CEO of the whole group in 2014 and put renewables at the heart of the company’s strategy. In 2016, the company delisted Enel Green Power and incorporated it fully into the group.

“So the fact that the CEO of the renewables business became the group's CEO really set the tone,” says Van Lamoen. “He has been very important in the transition, and he's still driving that today.”

“If you already have top management with that conviction, then that really helps our engagement, because you have a company that is open to discuss these topics.”

Phasing out coal

With the commitment to renewables firmly in place, the attention turned back to Enel’s reliance on fossil fuels. A large part of its installed capacity comes from legacy thermal plants, including combined cycle gas turbines (CCGT) and oil and gas installations, together with a few remaining coal-fired plants.

“For the first years of the engagement, the main task we had for them was getting a plan in place to phase out coal,” says Van Lamoen. “We were critical about some of the investments they were making because they were still investing in upgrading fossil fuel plants that were at risk of a shortened life.”

“The problem they had was that you can’t just shut down power plants – they needed regulatory approval in order to secure the energy supply. So, at first, the company was not very confident about communicating anything until they had more certainty from the regulators on what they could and could not do.”

“They started with phasing out the less efficient coal-fired plants and were asked to convert some of the others to natural gas to maintain adequate energy supplies. In later years, they committed to phasing out their coal-fired plants by 2030, and then brought that forward to 2027 – all with the blessing of the regulators.”

Enel’s installed capacity and electricity production at 31 December 2021: around 40% of its consolidated production still comes from fossil fuels led by combined cycle gas turbines (CCGT). Source: Enel.

From informal to formal

After the initial few years of establishing the basics, the Active Ownership team member handling utilities left Robeco, and a new person was needed to take charge of it. The team chose Cristina Cedillo Torres, who had joined Robeco three years earlier in 2014, was a specialist in transition pathways, and was looking for a challenge.

As she explains, engagement usually starts off informally with talks with staff from the company’s sustainability and investor relations departments, which was already in place. It then graduates to more formal talks with top management to obtain binding commitments. This brought a change of emphasis that would prove fruitful in the following four years.

“When we started the engagement, it was mostly having calls with members of Enel’s Investor Relations team to gain an understanding of what their thinking was, and to introduce ideas about what we wanted to do as a shareholder,” says Cedillo Torres.

“Once we had established a relationship with the company and were getting to know them better, we started sending them letters with more formal requests. We had – and still have – very open lines of communication with Investor Relations, who have been very, very helpful in giving us access to top management.”

“There has also been a lot of interaction more informally between myself and Investor Relations throughout the past years.”

Italy’s National Electricity Board

Enel is Italy’s principal electricity utility, the largest in Europe by market capitalization, and the second largest in the world by revenue after China’s state power company. It is an acronym for Ente Nazionale per l'Energia Elettrica (National Electricity Board). The company was listed on the Italian stock market in 1999.

The company made a net ordinary income of EUR 5.2 billion in 2020, the latest year for which full-year figures are available, on revenue of EUR 65.0 billion. It has 84,000 mega Watts of consolidated capacity in its operations around the world in 2020, including 26,400 MW in its home market of Italy.

The majority of its power is generated by hydroelectric plants (a capacity of 27,800 MW) with a substantial amount from wind and smaller amounts from solar power and geothermal.

However, much of its electricity still comes from fossil fuels, including 15,000 MW of capacity from combined cycle gas turbines (CCGT), coal, oil and gas. Coal still accounts for around 6% of Enel’s power generation.

A new collaboration in 2018 – Climate Action 100+ is launched

A new chapter opened in 2018 with the launch of Climate Action 100+, a collaboration of investors targeting the world’s highest carbon emitters for engagement. Not surprisingly, most of the largest emitters are companies involved in the energy industry, including utilities.

“When the Climate Action 100+ initiative was launched, we were asked if we wanted to lead engagement for the coalition as we were already engaging with Enel and other utilities, and so we became the lead investor for them on this collaborative engagement,” says Van Lamoen.

“Enel has always been very open to dialogue, and having the support of these investors has further strengthened our engagement. Acting as a coalition of investors has helped amplify our message and deliver it at board level.”

“Engaging under the initiative means that all signatory investors are pursuing a common set of objectives across all companies. Communicating a concrete set of expectations to all companies has been an important success factor of the initiative.”

November 2019 – meeting face to face

But after almost four years of engagement, now as part of a major international investor collaboration, the personal touch was still missing. No one from Robeco’s Active Ownership team had actually met anyone from Enel in person. That was to change in 2019 with the realization that both sides were attending the same conference with the Principles for Responsible Investment (PRI).

“November 2019 was the first time that I met the CFO in person,” says Cedillo Torres. “We met in Paris because we were both attending the PRI in Person conference. It was so nice to actually meet them face to face after doing so much by email or over the phone.”

“It worked well, because in the following month, the CFO visited Robeco’s office in Rotterdam and presented their new strategy. So several colleagues in investment teams here were able to personally meet him. But then the lockdown happened and it was no longer possible to meet anyone face to face.”

May 2020 – nominating a board member

Covid proved no obstacle, however, in furthering the engagement, as another milestone was reached when Robeco successfully nominated a renewable energy expert as independent director to Enel’s board. In May 2020, Samuel Leupold, the former CEO of Wind Power at DONG Energy, was appointed as a non-executive director. He had played an important role in transforming the Danish company from a fossil-fuel player into the world’s largest offshore wind developer.

“Corporate governance over climate was one of the areas that we wanted to enhance at Enel, as indeed we do at other companies,” says Cedillo Torres. “With the CEO coming from the renewables business, clearly he has a lot of expertise.”

“But when we looked at the board composition, we were missing the expertise on climate and the energy transition among independent directors somewhat. So we asked ourselves what can we do to help enhance the skills-set of the board?”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

A great system in Italy

This led to a fabulous opportunity that the Active Ownership team was quick to embrace.

Independent directors at listed Italian companies are nominated by shareholders, including the government where the state retains a stake. The company gets two lists of nominees – one from the government and the other from minority shareholders. The process to submit the list from minority shareholders is coordinated by the Investment Manager’s Committee with the support of Assogestioni, the association of Italian asset managers.

“Italy actually has a great system because it allows minority shareholders like us to nominate members of the board,” says Cedillo Torres. “That’s where I really saw an opportunity for us to get involved and exercise this legal right.”

“Every year the Committee searches for potential candidates across Italian listed companies, so I asked them if we could work together to get someone with climate expertise on Enel’s board. They were pretty excited about it, and so I joined their nomination committee.”

A team effort

The Active Ownership team’s corporate governance expert, Michiel van Esch, was drafted in to assist with the nomination process. “Michiel has a lot of experience with the nominations of directors, so he advised us on how to pursue the nomination, and helped Cristina with how to go about it,” says Van Lamoen.

“Our collaboration with the Committee also made the nomination possible, as they facilitated the entire process, helped reach the number of shares needed to file the nominee list thanks to its investor network, and provided legal advice.”

“Finding the right person was the most challenging problem because the nominee needed to be an Italian speaker, and that narrowed down the pool really quickly. We were lucky to find that this former wind energy executive actually spoke Italian, even though he's not Italian (Leupold is Swiss), so I think that was indeed one of the great outcomes that we had.”

September 2020 – the Net Zero Benchmark

Another progressive step was the use of Climate Action 100+’s Net Zero Benchmark, which assesses companies’ transition readiness across ten indicators. The benchmark clarifies investor expectations on what elements a corporate climate strategy should address, and provides concrete goals that companies can work towards.

“The benchmark helped our engagement tremendously,” says Cedillo Torres. “We received very positive feedback from Enel on the use of it, and they genuinely engaged with it right from the start.”

“By using the Net Zero Benchmark, our engagement also became more formal. It enabled us to approach the board and top management with a concrete set of requests. This has been mostly in the form of written correspondence, which provides investors with confidence that the company is taking it seriously.”

November 2021 – expanding the scope

Another accomplishment came from noticing that Enel was very good at reducing emissions for Scope 1 and 2 but less so for Scope 3. Scope 1 emissions are generated by the company, while Scope 2 are caused by the energy used to make the electricity. Scope 3 are generated by end-users of the product – in Enel’s case, the sale of gas to customers for heating – and are much harder to mitigate.

Engagement on this issue set in motion a chain of events that would lead to an historic pledge in November 2021. “One of the gaps in their reporting when working towards the net zero benchmark with them was related to Scope 3 emissions target – I remember flagging this to them when we met them personally in 2019,” says Cedillo Torres.

“They had a net zero target for 2050 but it explicitly only covered Scope 1 emissions; for a utility like Enel, Scope 3 is also important.”

Phasing out gas

“These emissions are derived from the sale of gas to customers for heating and cooking. They are significant – probably around 20% of their total footprint. Enel only had set an intermediate target for 2030 but had not yet disclosed its strategy for net zero emissions by 2050, and had not made a clear commitment to achieving it.”

“So, we asked the management and the board to consider setting a Scope 3 target and to explain how they're going to address Scope 3 if they truly want to become carbon neutral, since they could not do so without it.”

“That became one of the major areas of attention for them in 2021. And they did listen. In November 2021, the company brought forward its net zero target to 2040 from 2050 across all scopes, setting intermediate 1.5°C aligned targets for both Scope 1 and the main Scope 3 emissions in gas and power retail. They also confirmed their commitment to be coal-free globally by 2027, while keeping a pledge to become coal-free in Italy by 2025.”

Creating a world leader

It has all led to Enel finally setting the most ambitious target of all – something that had not been thought possible back in 2015. And perhaps this is the greatest achievement of all after six years of hard work.

“A really important feature of the 2040 strategy is to only generate electricity from renewable energy sources – they plan to rely fully on renewables and batteries – to fully decarbonize Scope 1,” says Cedillo Torres

“In that sense, this is not so much about achieving net zero emissions, but actually having absolute zero emissions from energy generation. In order to achieve this, they have a target to reach 154 gigawatts of renewable energy capacity by 2030.” “That is the most ambitious target seen so far – if they do indeed install that amount of renewable energy capacity, they will strengthen their global leadership position in the renewables space.”

Leaving a legacy

It has left a significant legacy. “Enel’s wider plan to become carbon neutral by 2040 by stopping selling gas to customers as energy production is electrified is perhaps the biggest triumph of all,” says Van Lamoen.” Enel is the first utility to make this commitment, so it's very, very significant.”

“It’s been an amazing journey with Enel over the past six years, and it proves that engagement works. We’re really pleased about what we have achieved, and how far they have come.”

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.