Investing that is pro-diversity on the surface and under the hood

Whether green, pink or blue, companies have become highly skilled at washing over and dressing up their sustainability credentials. The increasing prominence of social issues makes gender and other forms of social washing a tantalizing target for attention and customers. Through rigorous investment tools, voting and engagement activities we seek to promote diverse, inclusive and bias-breaking workforces.

Summary

- Sustainability-washing is a superficial way to capture consumer attention

- Gender and social causes are tantalizing targets for misleading claims

- Robeco uses rigorous investment tools to promote social equality

From climate change and environmental pollution to social inequalities and institutional discrimination, in recent years, the world has awakened to a broad set of sweeping sustainability challenges. As the visibility of ESG issues have caught the public eye, they have also attracted the attention of companies hoping to polish their own reputations. For some, that entails serious efforts by management to address ESG risks and create positive impact on environment and society. For others, however, it is no more than a superficial, unsubstantiated topcoat of marketing sheen bereft of effective action.

Across sectors – from automakers to asset managers, bean-rich baristas to capital-rich banks – companies have been called out for greenwashing their efforts on environmental challenges, pinkwashing or rainbow-washing their support for LGBTQ+ causes or blue-washing associations with the UN SDGs. Examples include marketing that signals company support for human rights while failing to address abuses within their own supply chains; bannering support to protect the environment while lobbying against climate data disclosure; or simply overstating claims in an attempt to capture the capital of sustainably conscious investors.

Given the rise in social inequality, genderwashing and pinkwashing are areas packed with marketing potential. Companies can reap positive reputational effects and profit from supporting gender, diversity and inclusion causes while doing little to advance inside their own walls. A high-profile case this year pitted hundreds of pro-gender activists against the UN for a partnership with a well-endowed asset manager with a questionable record on gender rights globally1.

Given the rise in social inequality, genderwashing and pinkwashing are areas packed with marketing potential

Marketing hype is easier to produce than material progress. But for the governments and companies that assume the pain and shoulder the hard work of targeted action, the long-term payoffs are substantial. Governments that have legislated the largest gender-based reforms have also experienced the greatest gains in female workforce participation2. For business, studies show gender diversity and equality can build workforce resilience, reduce risk-taking, generate higher earnings and raise stock values and shareholder equity3.

Gender lens investing (GLI) as a way to advance diversity and equality in the economy is also on the rise but assets are still relatively small (12.3 billion AuM in Q2 2022). Asset size, however, masks the significance of diversity, equity and inclusion (DEI) for mainstream consumers and investors. A 2020 analysis of US consumer financial data showed women already controlled nearly USD 11 trillion (31%) of total US household financial assets4. Another study on female spending found that as of 2019, women purchased USD 31 trillion in goods and services5.

The economic might of other marginalized groups is also expanding. Recent surveys in the US reveal 5-10% of the population identify as LGBTQ+, which represents consumer purchasing power of up to USD 5.3 trillion. Increasing population diversity will mean large shifts in consumer purchasing and investment behavior. Paint-brushing support for social causes dear to these groups, though tantalizing, is a doomed strategy if not followed up with real action.

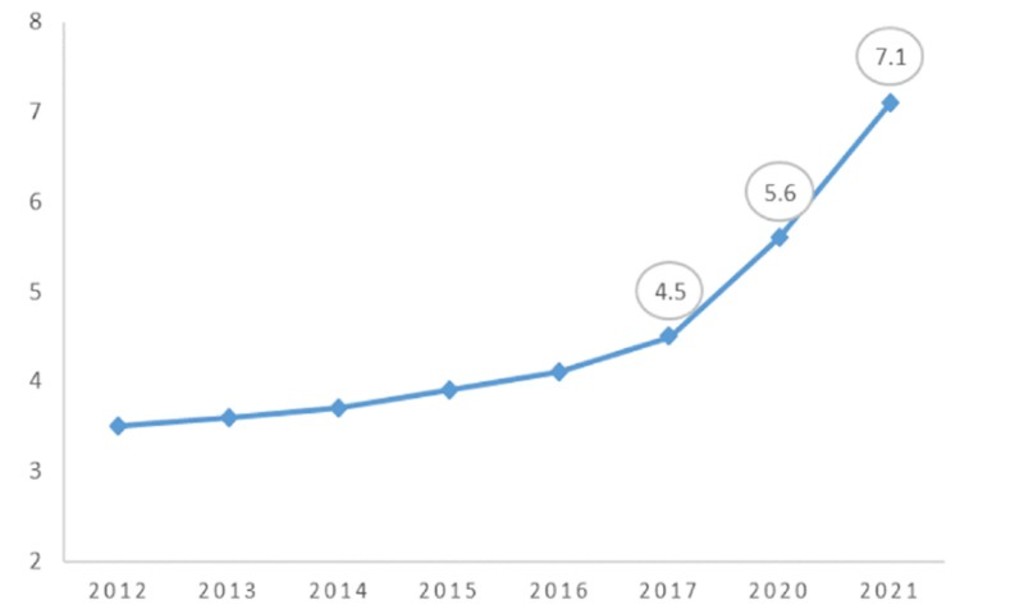

Figure 1 Social demographics are becoming more diverse

The percent of adults that identify as LGBTQ+ in the US has doubled in the last decade, from 3.5% in 2012 to 7.1% in 2021. Source: Gallup, Credit Suisse

Hard data, no hype

Since 2015 the RobecoSAM Global Gender Equality strategy has invested in companies that are reducing gender inequalities and building environments where all employees feel valued. Together with leading advocates of corporate gender equality, we designed an empirically based methodology to identify and invest in companies that ‘walk the talk’ in promoting well-being and equal opportunities for all employees.

We use a unique quantitative scoring system to get under the marketing shimmer and uncover gender-leading, diversity-friendly companies throughout the economy. All portfolio companies provide diligent disclosure of gender data and score high on key gender performance metrics such as women on the board, women in key leadership positions, gender pay equity and gender “stay” policies (i.e. policies that not only attract but further develop and retain women at each stage of their careers).

To capture company performance on diversity and inclusion, our scoring system includes metrics that cover employee well-being and satisfaction. The mosaic of indicators reviewed are key evaluators as companies vie for diverse, experienced managers throughout its ranks – from entry level to C-suite positions.

We use a unique quantitative scoring system to get under the marketing shimmer and uncover gender-leading, diversity-friendly companies throughout the economy

Amplifying signals

Superficial pandering rather than serious promotion of gender diversity and inclusion reduces a company’s competitive potential and creates social risks such as media backlash and product boycotts. To sharpen a company’s leadership savvy, Robeco’s proxy voting policy requires a minimum level of gender diversity on global boards. In North America and Europe that means 30% of female diversity on supervisory boards. But paper-based compliance only goes so far. When we feel boards fail to live up to shareholders’ expectations in terms of DEI objectives, we use our voting powers to send management a strong reminder.

In contrast to many of our larger peers that evade and even obstruct shareholder causes, Robeco has been a consistent outperformer on gender proposals and labor rights issues. Last year, we voted in favor of 96% of social resolutions considered materially relevant by ShareAction, compared to 29% which constitutes the pro-vote average of the world’s six largest asset managers6. This year, our voting continues to align with our convictions. In the 2022 proxy voting season, Robeco supported 75% of shareholder proposals specifically focused on social and diversity-related topics.

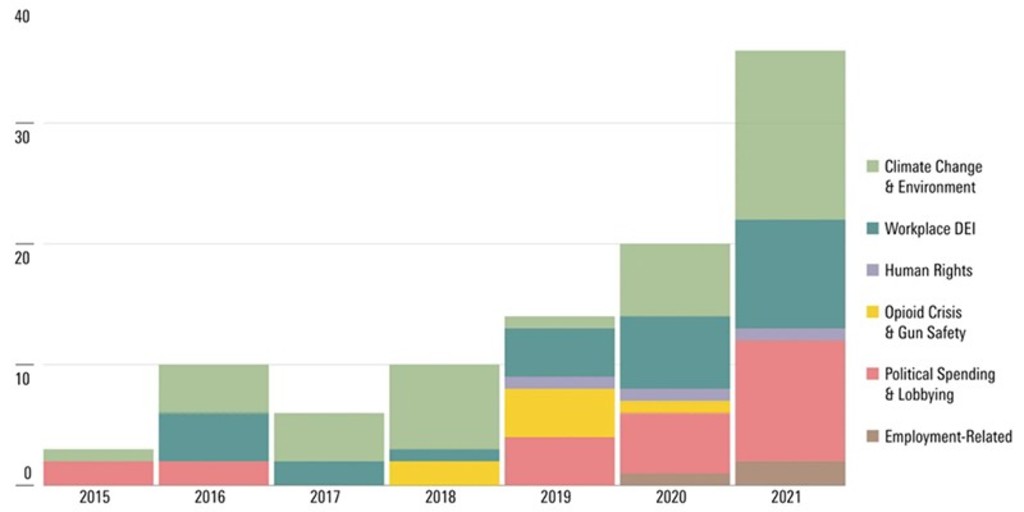

Figure 2: Climate and diversity among top concerns for shareholders

Majority supported shareholder resolutions during the 2021 voting season. Shareholder resolutions related to climate, the environment, workplace diversity, equity and inclusion are growing. Note: Average support calculations based on vote results as reported. Source: Morningstar Proxy Database, data as of July 30, 2021

In autumn 2022, we will launch a D&I engagement, collaborating directly with company leaders across geographies and sectors to help them understand the risks and benefits of DEI, develop talent management strategies, establish granular data metrics and publicly disclose progress on diversity-related issues such as pay parity and representation ratios.

Robeco has been a consistent outperformer on gender proposals and labor rights issues

Toolbox vs paintbrush

We are convinced that embracing equity and diversity inspires confidence, commitment and contribution in the workplace. Rather than rely on paintbrushes, we have bolstered our investment toolbox and intensified our engagement engines. As a result, we are better equipped to identify and select those companies that are building a competitive edge through their human capital investments.

1 Bloomberg, “UN women’s group ends partnership with BlackRock after criticism.” 26 August 2022. Association for Women’s Rights in Development (AWID), https://awid.org/news-and-analysis/feminists-demand-end-un-womens-partnership-blackrock-inc

2 World Bank, Women, Business and the Law Index, https://datatopics.worldbank.org/sdgatlas/goal-5-gender-equality/

3 “Gender Diversity improves ROE, lowers risk.” (2018). Bank of America/Merrill Lynch Research. Morgan Stanley Research, (2019). Credit Suisse 3000 Report (2021).

4 McKinsey & Co., “Women as the next wave of growth in US wealth management.” (2020).

5 CNBC, “Women are gaining power when it comes to money.” 3. May 2022

6 ShareAction. “Voting Matters: Are asset managers using their proxy votes for action on environmental and social issues?” (2021).

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.