Heat pumps – creating more than just a lot of hot air

Replacing fossil-fuel blasting boilers with electric heat pumps creates a win-win-win for curbing inflation, securing energy autonomy and decarbonizing an emission-heavy building sector.

Summary

- Energy crisis creates renewed urgency for affordable, reliable and cleaner heat

- Heat pumps are key for electrifying and decarbonizing buildings

- Sweeping regulations and incentives supply strong signals for market expansion

Energy to heat homes, offices, schools and factories accounts for 10% of annual global emissions. Natural gas is the leading form of energy for building heat, meeting 42% of demand globally, most of which (70%) is used for space heating. Although decarbonizing buildings relies on a number of solutions (including renewably sourced energy and energy-efficient renovations), electric heat pumps will be key in making building heat not only cleaner but also more secure and affordable.

Heat pumps are three‐to‐five times more energy efficient than natural gas boilers. That means up to a fifth less energy is needed to heat the same space. It also means significantly lower end-user consumption, driving down demand and driving up savings for millions of households suffering under the weight of energy-driven inflation (See Figure 1).

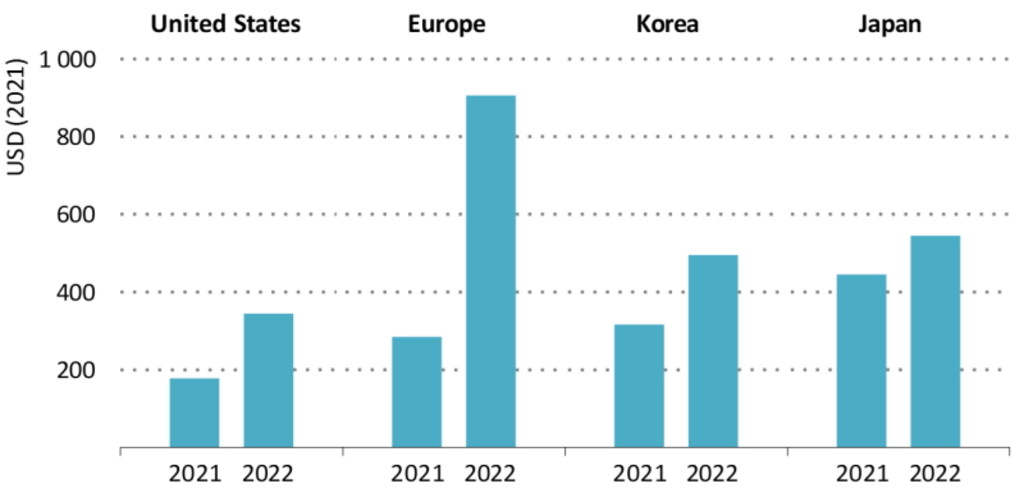

Figure 1: Switch and save – households reduced energy bills by using heat pumps vs gas boilers

In 2021 and 2022, heat pumps reduced energy costs and helped cushion households from soaring gas prices in major markets worldwide.

Source: IEA, The Future of Heat Pumps 2022

Energy security – the game changer

Recognizing the benefits for energy supply, price volatility and net-zero goals, policymakers are employing a carrot-stick approach of subsidies and mandates. Subsidies are now available in regions that account for more than 70% of global space heating demand in residential buildings. In addition, authorities in many countries are tightening building codes for new and existing structures that range from stricter minimum energy performance standards to outright bans on fossil-fuel boilers. Nation-wide bans are already in place in Denmark, France, the Netherlands and Norway, and legislation is pending in other member states.1

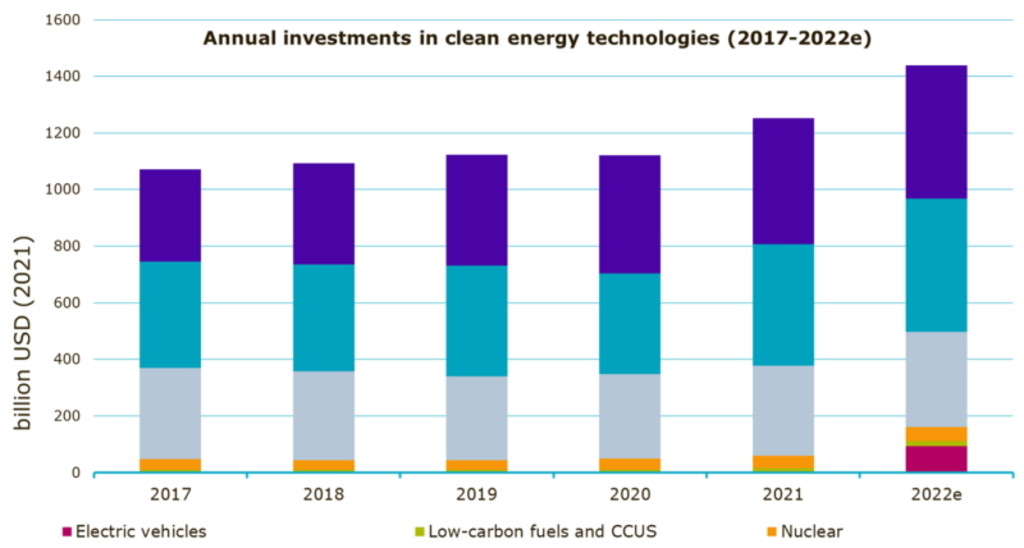

The recently passed, US Inflation Reduction Act (IRA) – which increases the value of the individual “Energy Efficient Home Improvement Credit” to 30% – is also expected to dramatically accelerate heat pump installations from consumers and developers across the US market. Worldwide, clean energy investments have jumped markedly since 2020 (see Figure 2), with estimated inflows to energy-efficient technologies nearly on par with renewables in 2022 (USD 470 billion to USD 472 billion).

Figure 2: On par with renewables – investments in energy-efficient end uses such as heat pumps nearly match renewables

Investments in energy-efficient technologies such as electric heat pumps nearly match those of renewable energy. N.B. 2022 annual totals are estimated.

Source: IEA, World Energy Investments 2022

The market opportunity – heat pump scale-up

Heat pumps are a proven technology with 190 million units of installed capacity worldwide. Over the last three years, seven million heat pumps were sold in Europe representing a compound rate of 40%. In addition, REPowerEU is expected to drive 20% CAGR up to 2030. Nordic regions illustrate the growth opportunity: financial incentives combined with regulations have led to 40-60% household penetration in Sweden, Finland and Norway, compared to 20% in the rest of Europe.

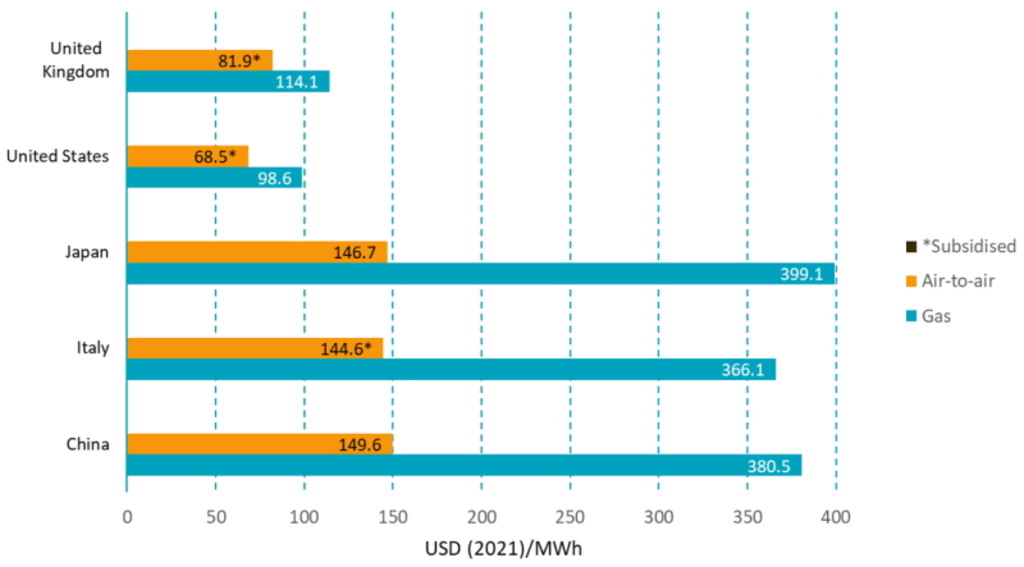

One advantage of higher fossil-fuel prices is they sharply reduce the total lifetime costs and payback times of heat pump and related investments compared to traditional gas furnaces and boilers (see Figure 3). That’s good news given emission reductions require existing building renovations to triple from their current run rate of 1% per year to around 3% per year over the period to 2050.

Figure 3: Pumped up savings – heat pumps are competitive with gas in major markets

Represents the levelized cost of heating and cooling of residential heat pumps and gas boilers in selected countries, 2021. The levelized cost of heating and cooling estimates the average cost of providing 1 MWh of heating or cooling over the lifetime of the equipment, considering the capital cost of the equipment and installation; operating expenditures include the cost of fuel and regular maintenance.

Source: IEA, The Future of Heat Pumps 2022

Short-term gloom creates long-term boom for heat pumps

The EU Emissions Trading Scheme (ETS) is a central pillar in the EUs net zero plans. However, it raises the price of high-carbon activities such as space heating and indirectly burdens household budgets as price spikes are passed through to end consumers. The EU plans to extend the ETS to cover heating fuels – an area which covers commercial office and process heat from industrial activities – meaning potentially more economic distress for EU citizens.2

Faced with new rules and higher prices, some gas-intensive EU regions are reconsidering decisions to use natural gas as a short-term transition fuel, preferring to leapfrog directly to heat pumps for space heating.3 Heat pump penetration in fossil-friendly Poland grew by 88% in 2021 and sales growth doubled in other member states including Austria, Italy, and the Netherlands.4

Sustainable energy

Overcoming the bottlenecks

Not all heat pumps are created equal and regional temperature and infrastructure variation presents adoption challenges. Heat pumps that convert heat from external water and ground sources are more efficient than air-sourced versions but also have higher installation costs. Unsurprisingly, 85% of all building heat pumps sold are air-sourced models. They are particularly popular in regions where outside air temperatures are milder in winter and the process can be reversed for cooling in summer.

Though heat pump technology is mature and production scalable, several bottlenecks are hampering uptake. Despite lower lifetime costs overall, the need for sophisticated equipment and complex installation means the costs of the most energy-efficient models (ground and water source pumps) are heavily front-loaded. Moreover, building permit delays, a shortage of skilled installers, poor surrounding insulation and integration with legacy grids complicate heat pump deployment.

Urgency-induced investment cycle

Innovation to resolve these challenges is proceeding at a rapid clip, particularly in regions like the US and Europe where governments are supplying healthy financing incentives. The outlook is promising as globally, investment in heat pump start‐ups and scale‐ups increased nearly six-fold between 2016 and 2021. Moreover, ambitious policies, such as US IRA and REPowerEU, are boosting pump uptake and signalling strong future demand for manufacturers and installers. In the EU alone, leading manufacturers announced more than EUR 4 billion in investments (2022-2026) to expand heat pump production.5

Governments globally are stepping up regulations and subsidies that are stoking heat pump production, penetration and R&D from both private and public sector actors. Heat pumps are key enablers of the energy transition and in the coming years we expect consolidation in as well as significant capital flows to companies in the heating technology value chain from upstream equipment manufacturers to downstream installers and distributors.

Footnotes

1 European Heat Pump Association. 15. December 2022. “Which countries are scrapping fossil fuel heaters?”

2 Euractiv. “EU approves CO2 tax on heating and transport, softened by new social climate fund.” 20 December 2022.

3 Euractiv. “Gas Crisis driving heat pump boom in Europe.” December 2022.

4 IEA, The Future of Heat Pumps 2022

5 IEA, The Future of Heat Pumps 2022. Table 3.4

Facts you didn’t know about the energy transition

Unleashing the power of Smart Energy!

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.