Bending the curve: Investing in biodiversity as an economic necessity

Biodiversity is a complex arena for sustainable investors that is growing in importance due to the vital role of nature in the global economy and in many investment strategies. Yet it often takes a back seat in investment decisions and often is not on asset managers’ radar at all. In this long read taken from the Essentials of Biodiversity Investing e-learning module, we explain why ‘bending the curve’ forms the base of tackling the five main drivers behind biodiversity loss, and the investible solutions available for them.

Summary

- How over half of global GDP and most asset management is nature-dependent

- The five drivers of biodiversity loss, led by land and sea use and climate change

- The solutions that investors can use to transition to a nature-friendly economy

Preserving biodiversity is not just an issue of saving an endangered frog in South America or a rare orchid in Asia – important though that is. There is growing awareness that it has become an economic necessity, and investing can help.

More than half of the world’s economic output – valued at USD 44 trillion – is at least moderately or highly dependent on nature in some way, according to the World Economic Forum (WEF). For food production, the ratio is even higher, as more than 75% of global crops, including fruit and vegetables, rely on pollination.1 If natural systems collapse due, for example to the loss of bees and other pollinators, so will our economic and financial systems.

And yet it is disappearing so fast – led by rampant deforestation that is still ongoing in many parts of the world – that scientists believe we are now in the middle of the sixth great extinction. It is also a key component of climate change, since biodiversity has a role in absorbing carbon from the air. Preserving biodiversity, particularly in reversing deforestation, is seen as a solution to global warming.

Aside from the irreversible loss of certain species, it represents an economic loss of at least USD 479 billion per year.2 Droughts shut down river transport in Europe in 2022 with the attendant loss of industrial goods that could not be shipped. Meanwhile, much real estate is becoming uninsurable due to the threat of floods or forest fires, or landslips in coastal regions.

Extinction risks on the International Union for Conservation of Nature (IUCN) Red List. Source: IPBES

What is biodiversity exactly?

The Convention on Biological Diversity defines it as “the variability among organisms from all sources, including terrestrial, marine and other aquatic ecosystems, and the ecological complexes of which they are part. This includes diversity within species, between species, and of ecosystems.”

Ecosystems are functional units of the living (plants, animals, microorganisms) and the non-living (air, minerals, water) all interacting together to form forests, wetlands, grasslands, coral reefs or other natural masses. ‘Nature’ includes the living and non-living, though in practical terms, nature and biodiversity tend to be used interchangeably.

Ecosystem services are the goods and services that we harvest and extract from nature, such as food, water, fibers, timber and medicines, along with cultural services such as gardens, parks and coastlines. Nature’s processes also preserve and regenerate soil, control floods, filter pollutants, assimilate waste, pollinate crops, maintain the hydrological cycle, regulate the climate and fulfil many other functions.

In sum, biodiversity is essential for healthy ecosystems, while its loss erodes their foundation. Without ecosystem services, our economy and society as we know it would not be possible. The interactions between biological elements that create our food chains have ensured that the planet has been habitable for its multitude of species on land and sea for millions of years.

Five drivers of biodiversity loss

But now it is under threat, as never before. The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Service’s (IPBES) Global Assessment of 2019 identified five main drivers of biodiversity loss: 3

Land, freshwater and sea use: This has been led by deforestation and agricultural expansion on land, and over-fishing at sea, to meet the increasing demands of the rising global population. Around 420 million hectares of forest – an area half the size of the US – and 86% of wetlands have been lost since 1990, while 23% of land has been degraded globally. Around 30% of fish stocks are becoming endangered through overexploitation.

Climate change: Due to the relentless emissions into the atmosphere, the world has warmed by 1.2 °C since the begin of the Industrial Revolution in the 18th century. This is causing more extreme weather such as more powerful hurricanes, forest fires, floods and droughts, with little time left to achieve carbon neutrality by the 2050 deadline.

Pollution: The emission of chemicals and toxic waste is deadly for biodiversity. The use of pesticides is killing bees and other essential pollinators that are critical for our food systems. There is now so much plastic in the ocean it is set to weigh more than the fish in it by 2050, while 80% of all wastewater including human effluent is untreated.

Direct exploitation of natural resources: Industries such as mining are responsible for the loss of habitat that have become the main threat to the survival of species on land. Restoring just 15% of ecosystems could cut extinctions by 60% while also benefiting local economies.4 Paradoxically, extracting materials that are vital to the net zero transition such as lithium used in electric car batteries often comes at the expense of the environment.

Invasive species: A consequence of the global economy, along with the growth of modern tourism, the introduction of non-native species has contributed to 40% of extinctions since the colonial era began in the 17th century. The cost of invasive pests in colonized parts of the world including Australia, Brazil and the US are estimated to be USD 137 billion per year.5

Relationship with climate change

Biodiversity loss is inextricably linked with climate change – indeed, they are often seen as two sides of the same coin. Oceans are the world’s greatest carbon sink, absorbing emissions while creating oxygen at the same time. Its increasing acidification along with relentless pollution has led to 40% of the world’s oceans becoming ‘disturbed’, according to IPBES.

Deforestation is making climate change worse, since billions of tons of greenhouse gases are emitted when trees are felled, particularly if they are burned for land clearance. The loss of the trees simultaneously reduces one of the world’s greatest carbon sinks which, like the oceans, both absorb emissions and generate oxygen. Deforestation alone accounts for about 17% of global warming, according to the World Economic Forum.6

The conservation of forests and other ecosystems such as peatlands is therefore seen as critical to achieving the 2015 Paris Agreement goal of limiting global temperature rises to 2 °C by the end of this century, and more ideally to 1.5 °C. Reforestation could potentially cut emissions by up to 11.7 gigatons of CO2 equivalent per year by 2030, over 40% of what is needed to limit global warming, IPBES says.

Bending the curve

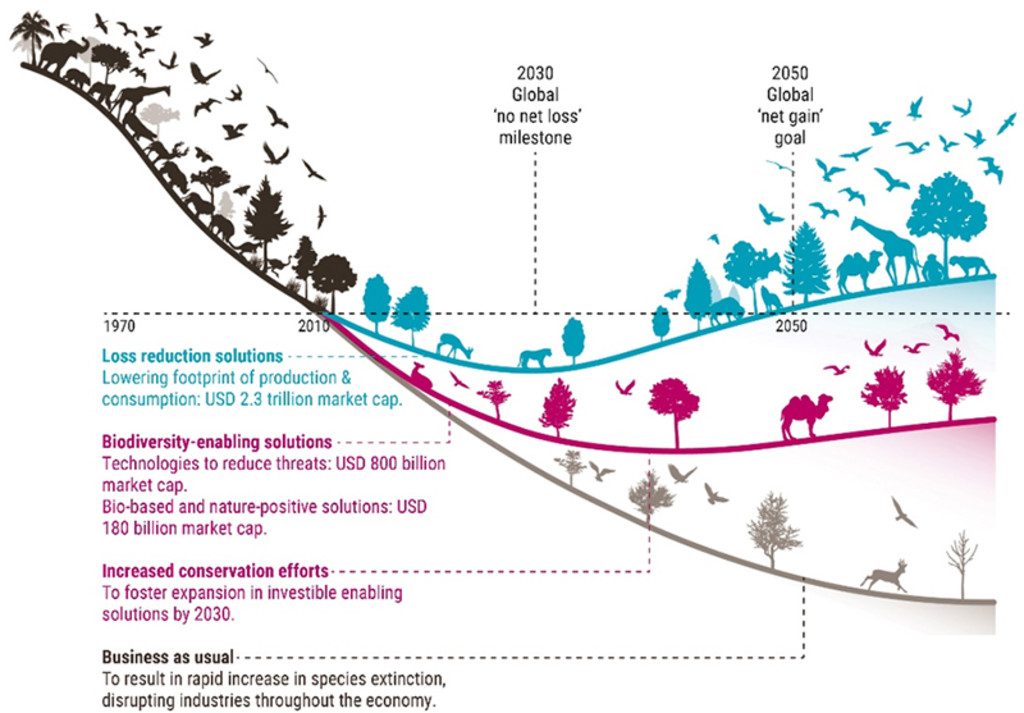

The solution lies in ‘bending the curve’ – halting and reversing the five drivers of biodiversity loss by scaling back the footprint of human production and consumption. The Kunming-Montreal Global Biodiversity Framework signed in 2022 by 188 countries agreed that bending the curve before 2030 was essential. This is illustrated in the chart below:

Source: Robeco, Bloomberg.7

As with the Paris Agreement on climate, the agreement requires countries to develop and execute plans and targets that can transition society to a more nature-positive economy. Companies and investors are expected to disclose risks and opportunities and to align their businesses and investments. Subsequently, the Kunming-Montreal agreement implies an overhaul of our ways.

Increasing our conservation efforts will not be enough though to get us on the path of no net loss of biodiversity. We need to critically change how we produce and consume goods. We need to allow nature to replenish the demands we place on it so it can continue to provide all the services and benefits we need. We depend on nature to provide a habitable and healthy planet: without one, we cannot have a healthy society or economy. There is no ‘Planet B’.

Heatmap assessments

Doing nothing is not an option for investors. The first step is to assess the exposure to potential nature related risks. In line with the recommendations of Task Force on Nature-Related Financial Disclosures (TNFD), Robeco assessed how much of our assets under management (AuM) at the end of 2023 was invested in sectors with a high or very high impact and dependency on nature.

We classified sector impacts and dependencies by combining third party data and our in-house sustainability expertise. We also took into account high-priority sectors as defined by external organizations such as the TNFD. The analysis showed that:

45% of our AuM was invested in sectors with a high or very high impact. These include Consumer Staples, Energy, Materials, Banks and Pharmaceuticals. The Utilities, Transportation and Real Estate sectors also figured strongly as impacting nature.

19% was in sectors with a high or very high dependency on nature itself. These were led by the obvious candidates of Food and Beverages and Household Products along with Biotechnology and Life Sciences itself, but also included less obvious industries such as Telecommunications.

Source: Robeco, 31 December 2023

Trillions in business opportunities

At the same time, nature offers many opportunities which are being increasingly recognized. Transitioning to a more nature-positive economy could unlock USD 10 trillion of business opportunities and create 395 million new jobs by 2030, according to the WEF’s Future of Nature and Business report.

Potential investment opportunities in biodiversity. Source: Robeco.

There are two major opportunities. The first is in the biodiversity transition; changing production and consumption methods affects an industry with a market capitalization of USD 2.3 trillion. The second lies in the solutions available. So, how to go about it?

Here we can go back to ‘bending the curve’ – lowering the biodiversity (and carbon) footprints of production and consumption – using the five main drivers of biodiversity loss, as follows:

Land, freshwater and sea use: This is by far the biggest area for reducing biodiversity loss. Investment opportunities take many forms, from more efficient land cultivation and forest or wetlands restoration, to greater production of organic food and developing alternatives to meat. It is also about reducing food waste, redesigning products and recycling materials to reduce the use of virgin materials in construction, apparel, chemicals, and other extractive industries.

Investment opportunities target crop, fruit and vegetable farming, developing alternatives to pesticides and nitrogen-rich fertilizers, and building more green infrastructure. The market for eco-friendly furniture sourcing wood from sustainable sources is growing by 7% per year to USD 38 billion. Natural personal care products that use bio-based compounds instead of chemicals is a market worth around USD 13 billion.8

The organic food and beverages market was worth about USD 350 billion a year in 2023 and is expected to reach USD 500 billion by 2026, growing at 30% per year since 2019. Part of the attraction of this market is that buyers – often led by Millennials – are willing to pay a premium for food that hasn’t been produced with pesticides.

The projected market for organic food. Source: Robeco

Climate change: Led by solar and wind power, the biggest market is in renewable energy and the technology behind it. Expanding the electricity grids needed to distribute electricity is essential, accounting for 30% of all the investment needed in the renewable energy transition. Green hydrogen is also a potentially massive market, particularly for heavy transport such as HGVs and shipping.

Electric cars offer a way to slowly convert the 1.2 billion petrol-driven vehicles across the world. Carbon capture and storage (CCS) – which stops CO2 from entering the atmosphere – is still a small market worth about USD 1.2 billion, though it is growing at about 20% per year. More than 300 CCS projects are planned worldwide, with the target of capturing 220 million tons of CO2 per year by 2030. Nascent technologies like direct air capture – which extracts CO2 directly from the atmosphere – are expected to grow, projected to capture 60 million tons of CO2 by 2030.9

Pollution: The best way to address pollution is to stop it entering the atmosphere or watercourse in the first place. The market potential for technological solutions making single-use plastic bottles redundant is huge. Currently, 80% of single-use plastic bottles are discarded after the product is consumed, and much of it ends up polluting the oceans. Solutions here focus on recycling technologies, and building reusable, biodegradable containers that can be discarded without harming the environment.

The industrial wastewater treatment market is worth USD 12.5 billion, while hazardous waste management is much larger at USD 70 billion. Developing more natural fertilizers is seen as key to solving the nitrogen crisis, in which the nitrogen seeps into watercourses and gradually degrades soil quality. Acidification prevention solutions that also neutralize the effects of pesticides and fertilizers can further help reduce habitat degradation in rivers.

Direct exploitation of natural resources: Reforestation and sustainable forestry have become a major investment opportunity, along with incorporating biodiversity into infrastructure. For example, the market for green roofs, where plants are incorporated into the flat tops of buildings, is growing at about 15% per year. Planning green spaces into urban developments is also now compulsory in many countries.

Another market is in traceable materials, which focuses on more sustainable production of foods and fibers, and the more efficient use of raw materials. Certifying palm oil to ensure that plantations are run sustainably, and new growth does not cause deforestation, has been quite effective in reducing pressure on this valuable resource.

Where the environment has already been damaged by industries, such as mining and environmental remediation, the clean-up of former industrial sites is a market estimated to be worth USD 92 billion. And an increasingly important way to deal with this driver is not to exploit natural resources in the first place, but to recycle or refurbish existing resources – moving gradually to a more circular economy.

Invasive species: The investment opportunities for tackling invasive species are much more specialized, and center around ‘biosecurity,’ stopping non-indigenous animal or plant life from entering the territory in the first place. Investments include companies making detection technology to spot insects traveling in containers with fruit that can then disrupt the native wildlife should they make it onto land.

Tracking parasites found in the ballast water of ships that then enter the local watercourse is another means of invasive species prevention. Biosecurity technology can also monitor species already there with a view to managing or lessening their impact.

Channels for institutional investment

Institutional investors looking for an efficient means of targeting all these opportunities can do so in three main ways. The first is to look for a bespoke biodiversity investment product that directly targets the equities of the companies offering solutions to the five drivers. Robeco launched its own Biodiversity Equities strategy in 2022. Many now exist on the market, though the arena is still considered niche and relatively new.

Another way is to look for investment funds that target the Sustainable Development Goals (SDGs), since three of the 17 goals are directly connected to biodiversity – SDG 13 (Climate action), SDG 14 (Life below water) and SDG 15 (Life on land) – while several others cover related issues, such as SDG 7 (Affordable and clean energy) and SDG 12 (Responsible consumption and production). These funds target companies that can make a positive contribution to one or more of the goals.

A third way is to view biodiversity investing either thematically, or as a form of impact investing, and look for themed funds or funds-of-funds that particularly cover the environment. An added bonus is that many of these are classified as Article 9 under the EU’s Sustainable Finance Disclosure Regulation (SFDR), offering a measurable means of showing an investor’s commitment to long-term sustainability.

Stay informed on Climate investing

It’s now a must-have, not an add-on

In summary, preserving biodiversity offers huge investment opportunities, and is becoming a must-have rather than as a niche add-on for mainstream sustainable investors. Like climate change, maintaining a status quo will simply lead to huge economic losses in the future, and continue to affect our way of life. We can use the market system to make a positive impact and still make financial returns. But first we must learn to work with nature, and not against it.

Footnotes

1Herweijer et al 2020, Nature Risk Rising: why the crisis engulfing nature matters for business and the economy, World Economic Forum

2https://naturalcapital.finance/wp-content/uploads/2020/06/Beyond-Business-as-Usual-EN.pdf

3https://www.unep.org/news-and-stories/story/5-key-drivers-nature-crisis

4Restoring Converted Land Could Help Mitigate Climate Change (azocleantech.com)

5Invasive Pests and Diseases (usda.gov)

6https://www.weforum.org/agenda/2017/06/drones-plant-100000-trees-a-day/

7Illustration adapted from Leclère et al, Nature, 2020, Adam Islaam International Institute for Applied Systems Analysis (IIASA), Citi Research & Global Insights.

8Sources for market sizes: Robeco analysis, Global Market Insights GrandView Research, EMR, MENAFN, Allied Market Research, OMR . Assessment as of Q1 2022.

9https://www.iea.org/reports/direct-air-capture

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.