Staying the course: the magnificent appeal of thematic investing

They may be long-term trends that will ultimately direct the course of humanity, but investing in them isn’t always easy.

Summary

- Thematic portfolios have had trouble trying to beat the Magnificent Seven

- Important thing is to focus on outperformance over the business cycle

- Structural trends like climate, digitalization and health will last for decades

It’s been a difficult few years for thematic investing, faced with headwinds from the growth-to-value rotation, underperformance of everything outside the `Magnificent Seven’, and the harsher reality of war. Many thematic portfolios have subsequently underperformed wider markets over the past three years, producing outflows as investors sought higher returns elsewhere.

But the longer-term outlook is much rosier, providing that investors can keep the faith in the undisputed structural themes, say Robeco’s thematic experts. One of the challenges with trying to beat benchmarks, however, is that the two global indices most commonly used, the MSCI World and the S&P 500, are dominated by just a handful of tech stocks – the so-called Magnificent Seven of Alphabet (owner of Google), Apple, Amazon, Meta Platforms (Facebook), Microsoft, Nvidia and Tesla.

Six of the seven have market caps above USD 1 trillion. They more than doubled in value in 2023, partly on the back of excitement over the potential for AI, accounting for more than 70% of the total returns of the MSCI World. This was even more pronounced for the MSCI USA Index, where they generated more than 95% of returns but just 26% of the index weight itself. The MSCI’s factor indexes, which have little or no exposure to these tech behemoths, significantly underperformed. 1

Over at the S&P 500, the Mag7 is now 29% of the index, the highest concentration of tech stocks in its history, accounting for more than 80% of all returns.2 It means portfolios investing in other companies are essentially trying to outperform the Mag7 rather than an index.

Take for example our Sustainable Water Equities strategy, which celebrated its 22nd anniversary in 2023. It invests in solutions that address global challenges related to scarcity, quality, and allocation of water. The strategy was able to significantly outperform global markets between 2019 to 2021 by more than 15% cumulatively, because investments from governments and corporates in water were increasing.

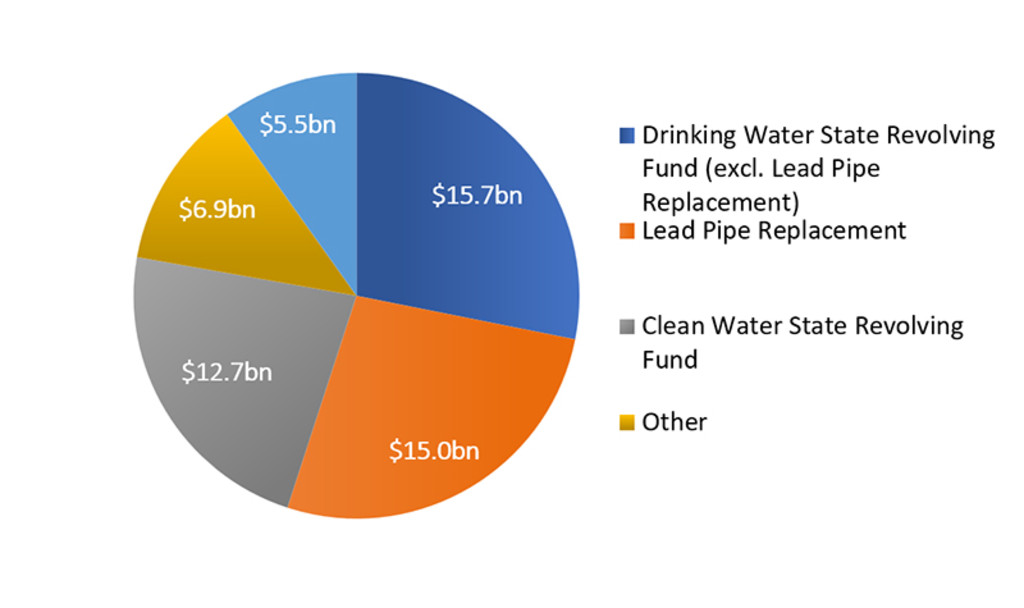

Improving water quality and availability is a natural growth area and a structural trend that will only become more important as demand for clean water increases worldwide. The funding for water investments from the US Infrastructure Investment and Jobs Act (2022-2026) alone is worth many billions of dollars, as shown in the chart below.

Source: US Congress, Robeco, March 2024.

However, the portfolio unsurprisingly has no exposure to the Mag7 or any AI stocks, and so underperformed global markets in 2023. Across the peer spectrum, similar strategies with higher allocation to utilities notably outperformed in the down market of 2022, but lagged in the rebound of cyclical industrial companies from the water space in 2023.

Open your portfolio to the power of themes

For over 25 years, Robeco has been a pioneering leader in constructing thematic strategies.

Digitalization does better

This is not a problem facing our Global Consumer Trends Equities strategy, which follows three themes: the digital transformation of consumption, the rise of the middle class, and health and well-being. As part of the digital theme, it does have exposure to AI and the Mag7.

The strategy performed well in 2023, (up 28.42%) and so far in 2024 (up 9.48%), following difficult years in 2021 and 2022 when growth stocks were in the doldrums. It has enjoyed an annualized return of 15.4% after fees since it began in 2009, which is far above the category average (10.46%) and the MSCI World Index benchmark (11.54%).3

But it remains a long-term approach, across business cycles that can last decades. “Thematic strategies invest into a very focused part of the market; the aim is to capitalize on long-term structural trends and outperform broader markets over a full cycle,”” says Ralf Oberbannscheidt, Head of Thematic Investing at Robeco.

“Unlike a global or regional equity strategy which will overweight or underweight specific regions or sectors and aim to slightly beat the benchmark in every single year, thematic strategies will by nature show strong outperformance in some years, but can also post meaningful underperformance versus global markets in other years. The key thing is achieving outperformance over the full cycle.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Decarbonization: A real long-term theme

It's also vital to focus on whether a trend is truly going to last, or become another fad. Few would doubt that the move away from fossil fuels toward renewable energy is the ultimate theme if the world is to combat global warming. An estimated EUR 5 trillion in investment is needed every year to meet net-zero goals. But the theme still remains vulnerable to the vagaries of market sentiment over the shorter term.

Our Smart Energy Equities strategy directly invests in the energy transition, from renewables to the grid infrastructure, power management and energy efficiency solutions. The Smart Materials Equities strategy focuses on the minerals and processes necessary to achieve wider electrification, such as lithium and highly specialized manufacturing processes that produce batteries for electric vehicles, for example.

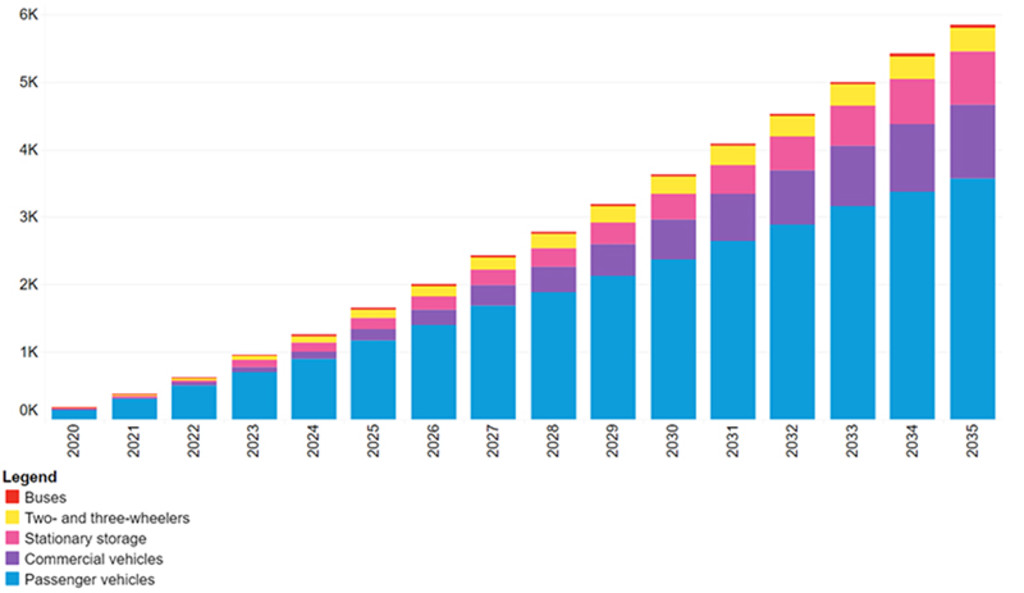

The EV market is virtually guaranteed to grow if governments make good on promises to ban new fossil fuel powered cars by the 2030s. The expected rise in battery demand is shown in the graph below.4

Source: BloombergNEF.

Thematic: a popular alternative

“Thematic investing has become a popular alternative to mainstream investing, and especially during the Covid pandemic, when investment solutions addressing meaningful and appealing investment narratives, often with a sustainable angle, gained a lot of traction in the market,” Oberbannscheidt says.

“The pandemic, increased geopolitical tensions and an aggressive interest rate hiking cycle all led to more volatility causing investors to focus more on the short rather than the long term. As this coincided with a turnaround in the relative performance of thematic investing, outflows were the result.”

A patient and disciplined approach

This was picked up in a study by Morningstar, which rates investment products according to their sustainability and other factors, including Robeco’s. The study stated that investors need to be “patient and disciplined and a buy-and-hold thematic strategy is more likely to deliver superior outcomes for most investors”. Holding one’s nerve of course is easier said than done when markets are spooked by war.

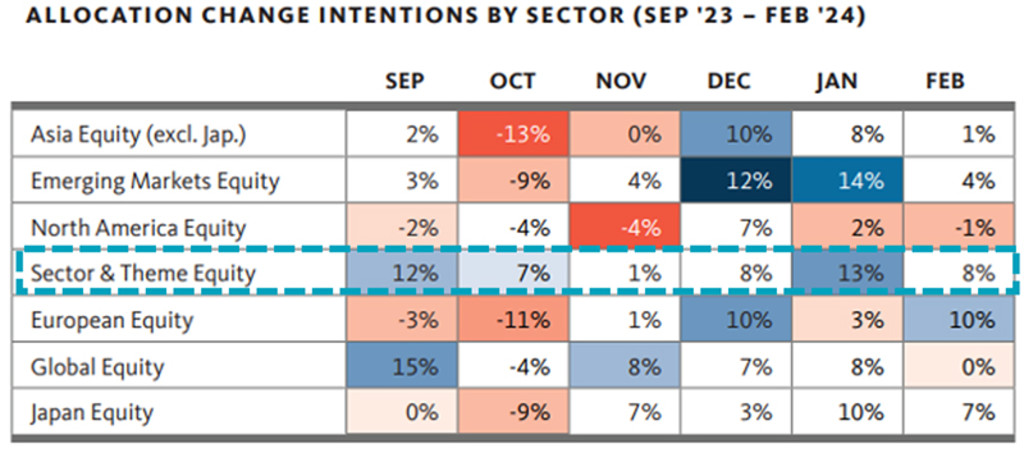

Many are doing so, however. The Broadridge PIP Monthly Barometer of March 2024 showed that the number of investors intending to increase their allocations toward sector and theme equity has remained positive since September 2023. In February 2024, 8% of respondents said they intended to raise allocations within the next 12 months. This is shown in the chart below.

Source: Broadridge PIP Monthly Barometer, March 2024.

“In the end, all thematic strategies follow a similar philosophy of identifying long-term structural themes and providing solutions driven by the overarching megatrends of technology, socio-demographics such as an aging population and rising middle class, and sustainable developments such as the need to combat climate change,” says Oberbannscheidt.

“These themes are undisputed, and so we remain confident they can provide outperformance over the full cycle. We have the expertise to identify the long-term winners in our various themes, though it can be frustrating in the short term when the hard work seems unrewarded.”

“So, we’re sticking to our refined processes of stock selection and ongoing portfolio management. It’s a marathon, not a sprint, and finishing a marathon is magnificent!”

Footnotes

1https://www.msci.com/www/quick-take/magnificent-seven-drove-the/03914829683#

2https://www.forbes.com/sites/greatspeculations/2024/01/22/2023-in-review/

3Performance figures as of 29 February 2024 for the I EUR Class, net of fees. Source: Robeco, MSCI. The currency in which the past performance is displayed may differ from the currency of your country of residence. Due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. The value of your investments may fluctuate. Past performance is no guarantee of future results. Returns net of fees, based on gross asset value.

4Transport-related battery demand is based on Bloomberg NEF’s Long-Term Electric Vehicle Outlook 2023 Economic Transition Scenario. Stationary storage battery demand through 2024 is based on BNEF’s 2H 2023 Energy Storage Market Outlook, and a compound annual growth rate assumption for 2031-35.

Global Multi-Thematic

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.