Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

The Covid-19 pandemic suddenly accelerated some of the shifts our Global Consumer Trends strategy aims to benefit from. For this year and the following ones, we now see the most promising opportunities at the intersection of consumption and health. We outline two areas of focus for 2021: the future of commerce and the caring economy.

Covid-19 and the resulting economic turmoil have led to significant changes in the fabric of the economy. Companies have been forced to rapidly move their businesses online, remote working has become commonplace, and many things have changed in the way things get done. For investors in our Global Consumer Trends strategy, these changes offer long-term investment opportunities.

For this year and the following ones, we see the most promising opportunities at the intersection of consumption and health. Health and wellbeing have become centerstage over the past few years, and Covid-19 only exacerbated this in 2020. As we enter 2021, we outline two promising areas of focus for investors: the future of ecommerce and the caring economy.

Subscribe to our newsletter for investment updates and expert analysis.

The future of commerce will probably be a hybrid mix of online and offline shopping

The first focus area for us in 2021 is the future of commerce. The pandemic triggered a surge in digitalization, that shows how important ecommerce has become in the daily lives of consumers across the globe. In the initial weeks of the first wave of contagions, consumers stockpiled basic goods, like toilet paper, hand sanitizer and long shelf life food items, like dry pasta.

But, as it became clear the mobility restrictions would remain in place for much longer than initially anticipated, consumers started to change their behavior. For one, a new cohort joined the online ranks: the elderly. These shifts are likely to persist, even when economies fully reopen, and consumers go back to their normal life.

Many consumers have actually indicated that the convenience of the shopping experience is more important for them than the price of the items. Therefore, the future of commerce will probably be a hybrid mix of online and offline shopping.

The rise of ecommerce during the crisis boosted online retailers, like Amazon in the US, Alibaba in China, or Mercadolibre in Latin America.1 But there have been many other, perhaps even surprising beneficiaries of the ecommerce boom. Since many retailers had to close down their physical stores, the online channel became their only lifeline.

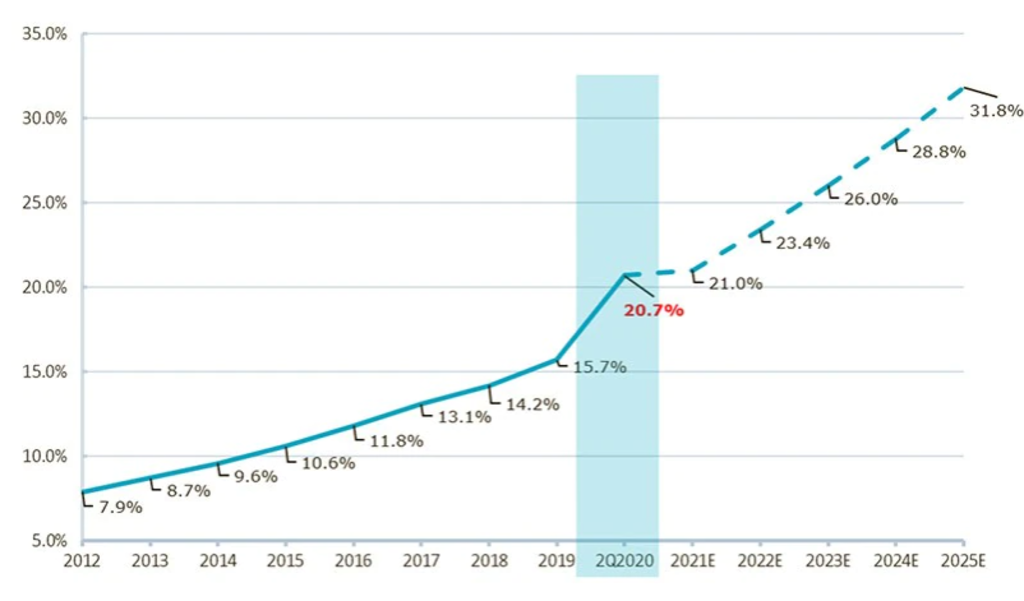

Source: US Department of Commerce, J.P. Morgan, Robeco.

Other non-essential items, like beauty products, household appliances and even dog food also moved online. Meanwhile, other types of goods, like groceries, which remained relatively underpenetrated by ecommerce before the pandemic, also saw a massive boost in digital penetration.

Finally, demand for local products also exploded last year. Consumers have indicated their intention to support companies and brands they want to see survive. This is another indication of increased customer loyalty towards their favorite brands. Companies that enable sustainable and local e-commerce also stand to benefit from this change.

Not only has the pandemic triggered a digital surge, but it also has intensified competition. While Amazon hired 400,000 employees to address soaring consumer demand, many smaller-sized digital firms and web shops attached to physical retailers managed to grow even faster. More than ever, investors must therefore strive to uncover the future winners.

The current enhanced focus on wellness and hygiene is expected to lead to a sustainable increase in consumer spending on personal care

The second main theme for this year is a topic we call the caring economy. The caring economy refers to an economy that cares for both people and the planet. Covid-19 has forced governments around the globe to put public health at the center of their policies. For example, people in many countries have been made aware of the need to wash their hands frequently or use hand sanitizer.

This enhanced focus on wellness and hygiene is expected to lead to a sustainable increase in consumer spending on personal care, childcare and even pet care. We expect current trends supporting the global home and personal care sector to remain strong in 2021, as enhanced home cleaning and personal hygiene routines persist.

Source: Euromonitor, Robeco.

Although consumers have the tendency to switch to cheaper brands during economic downturns, we see the current pandemic as a special case, where trusted, premium brands are likely to remain resilient. We expect categories like disinfectant, surface cleaning wipes, hand sanitizer, and other categories to hold up well even as public health risks fade, and economies reopen.

The caring economy also encompasses the growing childcare market. This expanding industry has steadily grown over the last decade, supported by the rising share of women in the workforce and a growing focus on early-childhood education and quality childcare. Despite the Covid-19 shock, long-term drivers for the childcare market are intact and represent attractive investment opportunities.

The employer-sponsored segment of the childcare market has attractive dynamics due to its highly-recurring, annuity-like revenues, as long-term contracts of sometimes up to fifteen years are frequent. Meanwhile, the employer-sponsored day care market is very capital light as corporate customers often provide the premises.

Besides human care, we also see plenty of opportunities in pet care. The latter has shown to be a recession-proof industry in the past. Consumer spending on pet care grew during the 2008-2009 financial crisis, as pet owners cut back on other non-essential items before trading down on pet food or cutting back on supplies.

Covid-19 has changed many consumer habits. Habits are automatic routines people follow while not thinking much about the tasks they perform. We think this is especially the case with regards to ecommerce and the caring economy. Automated consumer purchasing decisions are highly interesting from a business standpoint and well-positioned firms are poised to benefit from them.

In 2020, the direct impact of the Covid-19 pandemic may have kept these changes in consumer behavior away from the spotlight. But as the recovery unfolds in 2021, their longer-term implications should become even more visible, and we believe our portfolio is well positioned to benefit from these shifts.

1The information provided in this article does not constitute an investment recommendation or advice to buy or sell certain securities or investment products and/or to adopt any investment strategy and/or legal, accounting or tax advice.