Open your portfolio to the power of themes

For over 25 years, Robeco has been a pioneering leader in constructing thematic strategies. We recognized early on the power of megatrends to drive structural change and the potential of themes to harness them for long-term growth. Our convictions push us to dive deeper and explore farther to discover diverse sources of returns for client portfolios.

- 3

- 13

themes

- ∼1,300

companies

The core of thematic investing

We live in a world of constant evolution. Scientific discoveries, technological breakthroughs, demographic shifts, and geopolitical alliances are all examples of megatrends – the strong structural forces that impact how we live, work, communicate and consume.

Financial markets are reflections of these changes but often with a substantial time lag. This creates timely opportunities to enhance attractive long-term performance for client portfolios. Thematic investing spots early patterns in the data, anticipates their game-changing potential and begins building early positions in tomorrow’s leaders ahead of the market.

Putting themes to work for your portfolio

We believe three megatrends will direct and dominate future economic growth – Preserving Earth, Changing Socio-demographics, and Transforming Technologies. We have built a comprehensive suite of thematic investment strategies that draw from a combined investment universe of more than 1,300 companies to capture that growth for client portfolios.

Discover the theme which is right for you:

Biodiversity

Investing through a pro-nature lens

Clean water

Addressing water scarcity and quality

Sustainable energy

Powering the transition to a low-carbon future

Smart materials and manufacturing

Making manufacturing leaner and cleaner

Circular economy

Cutting the waste out of growth and profits

Sustainable mobility

Charged and ready for an electrifying future

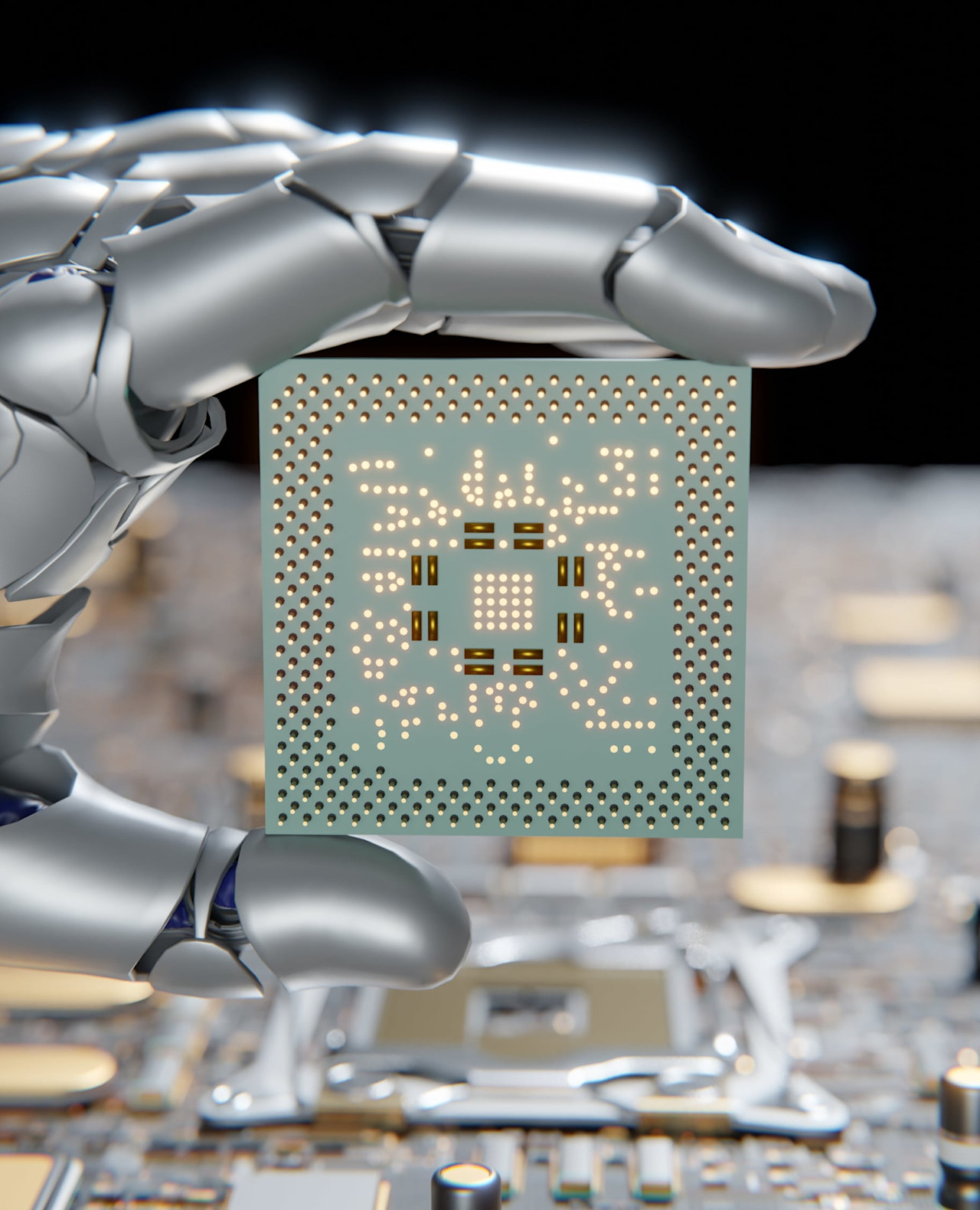

Digital innovations

Capitalizing on the digital transformation of enterprise and industry

Fintech

Digitization and democratization are shaking old pillars of finance

Finance

A thematic approach to investing in the financial sector

Consumer trends

Consumers appetites are changing, your portfolio should too

Healthy living

Investing in health to generate a lifetime of wealth

Fashion

A tailored approach to investing in the future of fashion

A blended approach

The best of all themes in one portfolio

Integrating multiple themes for enduring growth

This video isn't available to you because you have not accepted our advertising cookies yet. If you accept them, then you'll be able to view all content:

A picture is worth a thousand words

In addition to our monthly highlight, we publish daily key trends shaping global markets and our world.

The benefits of Robeco’s thematic investing approach

Gear your portfolio for a compelling future

Many mainstream and benchmark-based portfolios are backward-looking and over-exposed to yesterday’s legends whose business models face stagnation or outright disruption. Our thematic strategies focus on leading companies successfully monetizing a theme in today’s market as well as the newcomers who are poised to become tomorrow’s thematic champions. This enables investors to benefit from quality stocks now while also positioning them to capture forward-looking growth.

Discover hidden gems and avoid flashy hype

Innovation is everywhere. But beyond high-priced tech stocks, few investors know how to access it, or how to separate hyped-up fads from the truly transformative trends. Deep thematic knowledge, specialized analysts, targeted research and proprietary investment tools give us an edge in detecting emerging technologies with enduring profit potential and the companies best able to translate innovation into increased earnings, market share, and shareholder value.

Stay ahead of the market

Thematic investing is narrow by design. It helps investors efficiently target areas of the economy with high-profit potential where they can zoom-in on tomorrow’s industry champions. The pure-play approach applied to many of our strategies leads to investments in ‘off the radar’ companies that are under-researched and undervalued. Timely access at lower valuations means enduring upside growth as trends and companies develop and mature.

Robeco's thematic investing team

Our thematic investment team is comprised of more than 30 investment professionals, each dedicated to a specific investment theme. Specialization enables us to perform the focused research necessary to spot patterns and trends missed by broader markets.

Thematic investing teams also leverage the in-house capabilities of Robeco’s world-class SI, quant, credits and fundamental equities teams. Collaboration enables us to share knowledge and ignite innovation to generate superior risk-adjusted performance for client portfolios.