Healthy Living - a defensive alternative to blistering markets

Volatile markets are sinking some investors and whiplashing others. Alternatives are available for investors seeking smoother rides over the long run.

Summary

- Market gyrations increase focus on more defensive equity strategies.

- Defensive sector company earnings less sensitive to market swings

- Exposure to Healthy Living themes helps stabilize long-term returns

Uncertainty is the constant in today’s market. Ongoing Covid flare-ups, inflation, supply chain disruptions and now war are further intensifying an already volatile mix that’s spooking markets.

To reduce exposure to volatile market movements, investors are considering more defensive strategies. Classic defensive sectors furnish essential goods and services which consumers are unlikely to give up even in a downturn. With a steady focus on ‘healthy essentials’, RobecoSAM Sustainable Healthy Living is a thematic equity strategy that typically outperforms in down market cycles while still capturing the upside potential provided by long-term growth trends.

Amid general market misery, thematics with defensive characteristics are faring much better than other growth-focused strategies

Amid general market misery, thematics with defensive characteristics are faring much better than other growth-focused strategies. As David Kägi, portfolio manager for the RobecoSAM Sustainable Healthy Living Equities strategy, explains, “Defensive sectors generally provide stable earnings that are uncorrelated with the overall stock market. They even tend to outperform when broader markets are falling.”

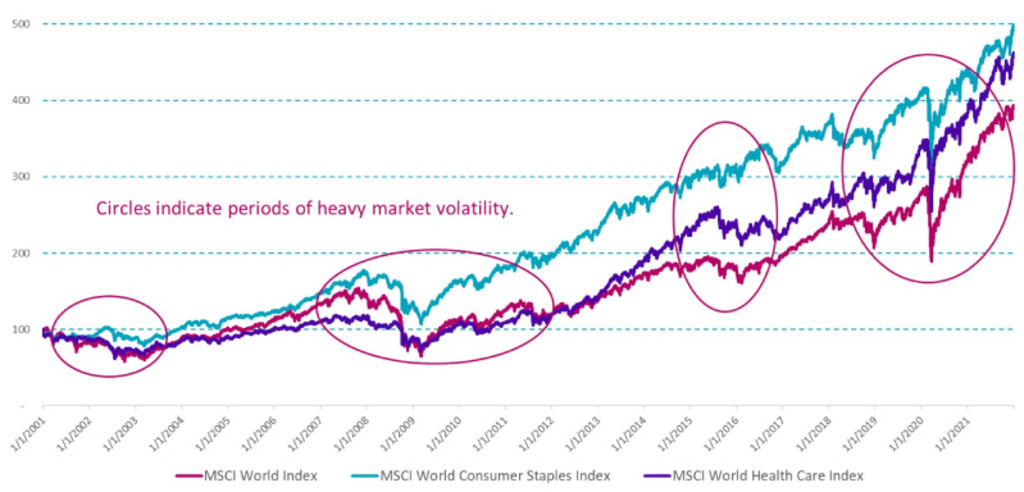

Figure 1 | When market volatility rises, defensive sectors generally outperform

Over the last two decades healthcare and consumer staples stocks have provided steady above-market returns, further burnishing their reputation as safer bets in times of market turmoil. Here, high market volatility has been defined as periods when annualized market absolute volatility is 10% or more.

Source: Bloomberg, Robeco

Stable, risk-adjusted performance comes from a strong tilt towards healthcare and consumer staples sectors

Kägi credits his strategy’s less volatile, risk-adjusted performance with its strong tilt towards healthcare and consumer staples sectors. Together these account for around two-thirds of the portfolio. “Consumer staples stocks function in a noncyclical manner, meaning they offer investors safety during recessionary climates. Food, grooming and cleaning products are typical staples that tend to generate solid profits even in slow-growth economies.” He notes consumer staples companies thrived during the pandemic’s early stages when markets overall were tanking.

Meanwhile, he describes his other defensive allocation, healthcare, as a perennial pursuit. “Demand for healthcare services is inelastic. People don’t ignore their health because of a dip in the business cycle. Healthcare stocks can expand earnings even in down markets.” He references healthcare costs in the US which are nearly 18% of GDP and says that globally, healthcare expenditures are rising, approaching USD 10 trillion annually.

He adds that more stable performance returns, many defensive stocks pay substantial dividends which have reliably increased through past market cycles. Their longevity is a strong signal of a high-quality stock backed by strong consumer trust, brand value, and good management. These same attributes also help staples navigate the changing challenges across economic cycles.

Pandemic effects

Early on in the pandemic as markets were falling, many segments of healthcare were resilient and displayed strong performance, from sophisticated biotech and pharmaceuticals churning out vaccines to makers of protective gear. Stocks of diagnostic and testing equipment benefited as well. Moreover, Kägi says pandemic pressures accelerated digitalization trends in healthcare, which has historically been slow to adopt new technologies. From vaccine development and clinical trials to telemedicine and health tracking apps, the pandemic catalyzed new avenues of growth across the healthcare supply chain. He is certain that new revenue channels will continue to grow even as the virus abates.

In consumer staples, he says demand for hygienic items like hand soap, disinfectants and anti-microbial wipes surged, as did over-the-counter retail medications and home remedies to relieve viral symptoms. Here too he is convinced that many Covid-induced attitudes and behavioral changes will stick post-pandemic, providing steady returns for the Strategy’s defensive stocks and clusters.

Spot on for long-term growth

Also underpinning the Strategy’s long-term growth potential are its focus on sustainability challenges that transcend market movements and mayhem over the longer term. “Society is confronting a series of serious health-related issues from rising healthcare costs and aging populations to the increasing prevalence of chronic illness.” He’s confident investments in preventative measures such as good nutrition and staying active will help reduce disease rates and curb healthcare’s cost creep.

Kägi says a focus on health across the entire human lifespan sets the portfolio apart from other healthcare theme funds that tend to be treatment oriented. “We’re investing in companies that promote healthy living early on so that populations remain active and healthy well beyond retirement.” The Strategy’s convictions on shifts in consumer spending and preferences are so far spot on, as healthy changes in the UK’s consumer price index demonstrate. Donuts and men’s suits are out while lentils and sports bras are in.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Low risk, low gain, less pain

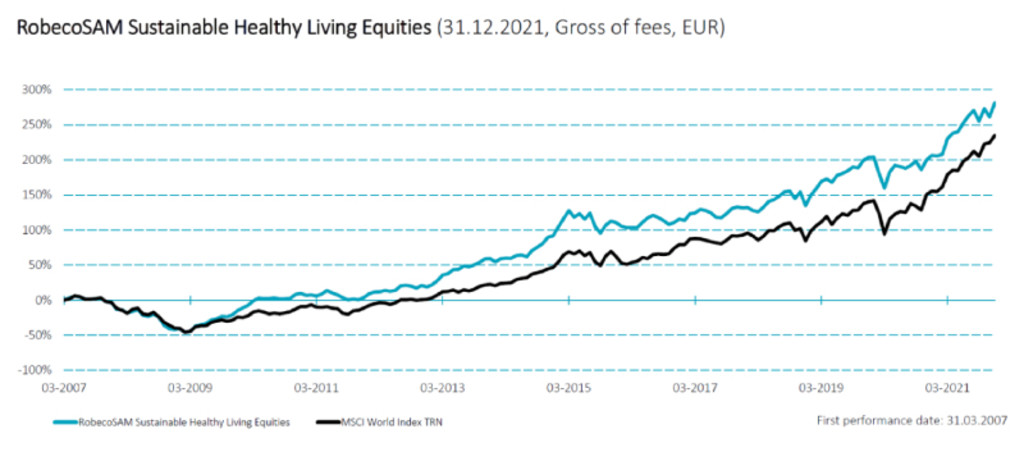

The cumulative performance since inception shows the Healthy Living Strategy has captured returns superior to those of global equity markets (MSCI World TR) over the long-term. What’s more, this cumulative outperformance has been achieved at lower volatility and risk relative to the benchmark – a hallmark of defensive strategies.

Figure 2 | Healthy returns over the long run

Source: Robeco1

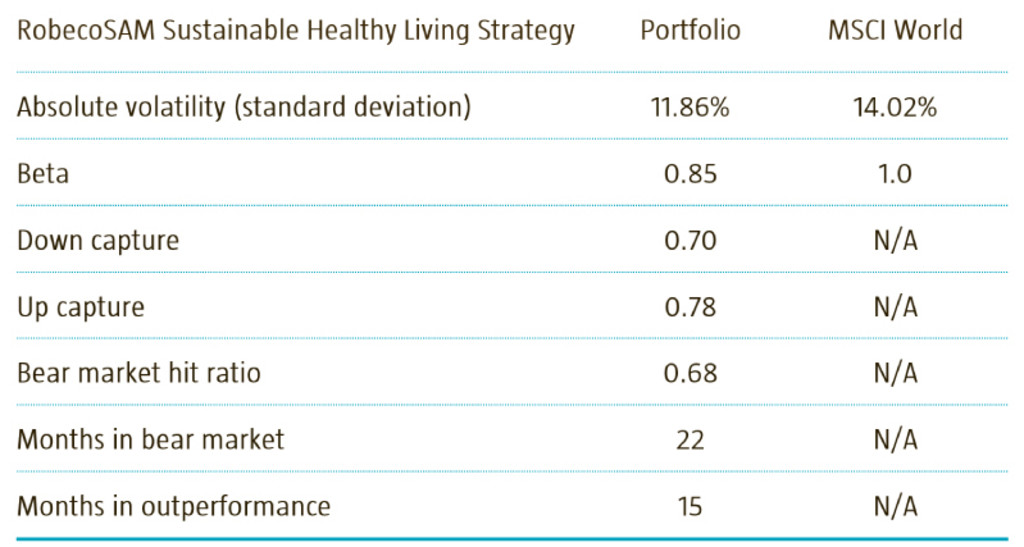

The portfolio maintains a low beta coefficient, a key measure of its sensitivity to market fluctuations, as well as low absolute volatility, which means returns have avoided wild swings relative to broader markets (see Table 1).

Table 1 | Solid performance with low volatility indicators

Source: Robeco

Key risk performance indicators from the Robeco Sustainable Healthy Living Equities (EUR) D-share, Gross of fees. Beta shown has been annualized since inception, April 2007. All other data has been annualized over 5 years ending February 2022.

Meanwhile, solid risk-adjusted performance is also demonstrated in solid upside and downside capture ratios. The Strategy’s downside capture ratio was 0.70, meaning it has reduced the portfolio’s exposure to market losses by 30%. Meanwhile, its upside capture ratio over the same time period stands at 0.78, meaning it has captured nearly 80% of the positive returns generated when markets are rising.

For conservative investors seeking solid performance without the volatility, the Strategy presents an interesting alternative. Its tilt towards noncyclical sectors helps reduce exposure to losses in down market cycles while its unique approach to rising healthcare costs allows it to benefit from long-term sociodemographic shifts already underway. For growth-oriented investors, it provides active exposure to diagnostic and digital innovation that’s opening new frontiers in health maintenance and delivery for patients and health-conscious consumers. With these features, it’s well suited for investors concerned as much with the journey as the destination.

Footnote

1 Gross of fees performance in EUR for the RobecoSAM Sustainable Healthy Living Equities Strategy as of 31.12.2021.

The currency in which the past performance is displayed my differ from the currency of your country of residence. Due to exchange rate fluctuations, the performance shown may increase or decrease if converted into your local currency. Periods shorter than one year are not annualized. The value of your investments may fluctuate. Past performance is no guarantee of future results. Returns gross of fees, based on gross asset value. Values and returns indicated here are before cost; neither consider the management fee as well as other administration costs related to the fund nor the fees and costs which may be charged when subscribing, redeeming and or switching units. These have a negative effect on the returns shown. Effective October 29, 2020, select RobecoSAM equity funds were merged onto the RCGF SICAV platform and received new inception dates, share classes, and ISIN codes. All performance prior to the RCGF SICAV merger have been calculated based on the investment policies, fees and share classes of the respective sub-fund under the previous SICAV.