Circular solutions – a triple threat for supply chain challenges

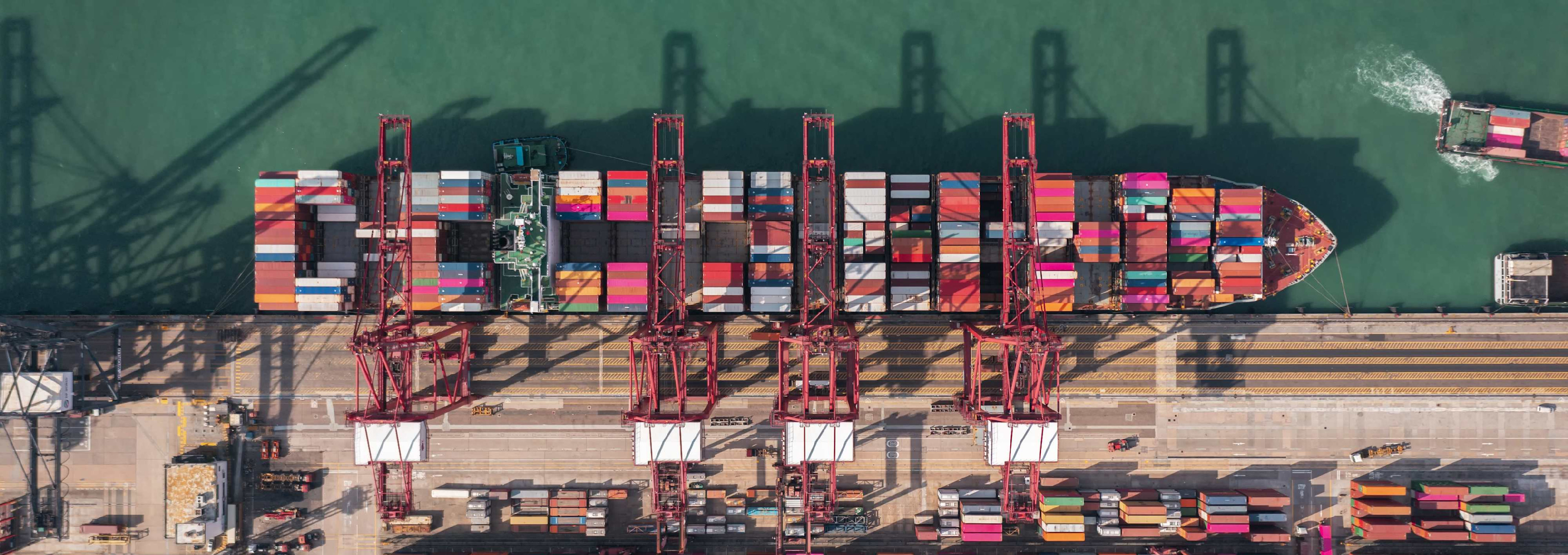

The certainty of climate change combined with the uncertainty of geopolitics means risks to supply chains are greater than ever. Circular solutions can help companies increase resource security, reduce supply chain complexity and create sustainable long-term value.

Summary

- Supply chains are increasingly concentrated offshore

- Recent crises have revealed supply chain vulnerability

- Circular solutions help reduce supply chain risks and increase resource security

The impact of supply chain disruptions has been inescapable for businesses, consumers, and economies. Covid contagion continues to roil regions globally, triggering lockdowns that shutter factories, jam ports, paralyze trucking fleets, and reduce the flows of goods internationally.

Supply shortages underscore just how fragile and vulnerable manufacturing supply chains have become. They have grown so long, complex and fragmented that many downstream customers have no real read on the root causes of bottlenecks and breakdowns. It is typical for inputs to be mined, processed and assembled upstream across multiple manufacturing players in multiple geographies before final shipment to downstream customers. For example, a solar PV cell starts with mining quartz-sand in China. From there it is melted and cast into ingot blocks, sliced into wafers, and finally assembled onto solar panels by workers in factories spread across Malaysia, Cambodia, Vietnam and Thailand.

Over the last two decades, China’s manufacturing might has increased considerably. It is now the world’s largest exporter, representing 12% of a global merchandise trade market valued at USD 28.5 trillion in 2021.1,2 Though global consumers benefit from more goods at lower prices, it also means the world’s manufacturing activity is increasingly concentrated in and dangerously dependent on Chinese suppliers.

Moreover, the availability of cheaper inputs has made it easier for manufacturing to follow a linear production path that begins with the extraction of virgin resources, ends with their disposal by the end-user. Not only is value embedded in the product lost, but new production pathways are initiated, requiring more raw materials, processing, and logistics. A new cycle of environmental and supply chain risks begins again.

Breaking the chain

In contrast to linear production, circular business models loop production cycles. Products are not discarded but rather reintegrated into product supply chains. As a result, production and sales are less dependent on procuring offshore quantities and more focused on innovation for onshore quality. That means designing products that are not only built to last but also exhibit a competitive edge.

With circular models, production and sales are less dependent on procuring offshore quantities and more focused on innovation for onshore quality

Circular solutions come in many shapes and sizes that can be adapted based on each industry’s features and flows. Equipment refurbishing allows manufacturers to fix up and re-sell high-end equipment to customers in lower market segments. Products as a service (PaaS) models lease physical products so that customers can rent-a-service rather than own-a-product. Manufacturing and repair organizations (MROs) provide customers with vast inventories of small parts so customers can repair rather than replace costly machinery.

At the heart of each of these solutions is the circular principle of keeping products in use longer so their value can be used to generate satisfaction from customers and revenues for companies. Moreover, keeping products in service longer has the added benefit of de-materializing and de-risking manufacturing supply chains.

Keeping products in service longer has the added benefit of de-materializing and de-risking manufacturing supply chains

Out with the new, in with the old

Though it borders on the basic, some of the world’s most sophisticated industries are using refurbishment in manufacturing. Semiconducting equipment manufacturers (SEMs) routinely disassemble, repair and refurbish machines from high-end customers for use in less sophisticated market segments. This enables them to supply bleeding-edge technologies (think metaverse and cloud systems) while still providing capacity to lower-end customers (passenger cars and electric appliances). One leading SEM boasts that even after three decades, 90% of its machines are still used in semiconductor fabrication plants (fabs) around the world.3 For SEMs, circular production provides additional revenue streams with minimal need for the raw materials, processing, assembly and transport logistics typical of manufacturing phases.

Figure 1 | Reducing the length, strengthening the chain

Refurbishment, PaaS leasing, and MROs help reduce manufacturer’s dependence on offshore suppliers. As a result, upstream inputs are reduced, supply chains are simplified and disruptions minimized.

Source: Robeco

A similar method is increasingly being employed by manufacturers of less sophisticated but nevertheless technologically advanced products in healthcare and life science research. From MRI scanners for diagnostic testing to mass spectrometers for drug discovery, refurbished machines provide an easy way for hospitals and science labs to combat rising costs without compromising outcomes. The global market for used medical devices is anticipated to reach USD 10.5 billion by 2027 (CAGR of 10.3%).4 Moreover, in some industries, margins for circular product lines exceed those of new ones and we are seeing commitments to increase revenues from circular products from major business-to-business players.5

Capitalizing on the intangible

Embedded sensors and cloud technologies mean manufacturers using PaaS models can stay digitally connected with their physical products, capturing data and enabling customized services like never before. In this way, profits are generated not from producing higher volumes of tangible products but by enhancing the quality and value of those already in circulation. From the mundane (light bulbs, carpets, and tires) to the complex (jet engines, electric grids and wind turbines), companies are embracing the PaaS model, creating diverse opportunities across retail, commercial and industrial suppliers.

Industrial supermarkets

Maintenance and repair organizations (MROs) are like one-stop supermarkets for industrial manufacturers, providing massive inventories spanning millions of parts and technical know-how via dense networks of engineers and technicians. If a machine or part breaks, manufacturers can trust their MRO to fix it instead of ordering it anew from a supplier based in a distant location. Moreover, near and onshore presence means procurement and manufacturing and logistic risks from offshore suppliers can also be reduced, if not eliminated entirely. From utilities and power distribution to robotics and industrial automation, building materials and construction to chemicals and packaging, specialized MROs are providing diverse investment opportunities across sectors.

As the examples above demonstrate, circular solutions are best suited for industries with high-margin products that have significant IP and R&D costs. Most interesting for us are the investment opportunities at the business-to-business level. Due to their fast-moving, low-margin nature, food and fashion are currently not in scope. That may change along with shifting consumer preferences. Younger generations are demanding more flexible purchase options, superior service features and sustainable processes that are free of carbon emissions or human rights abuses. Circular supply chains equipped with digital intelligence could help companies stay in front of these building forces. As a result, we could begin to see innovative products emerge even in the retail space.

Circular economy models are turning out to be not just a triple threat but an all-out arsenal for combatting multiple risks and discovering diverse opportunities.

Footnotes

1UNCTD (United Nations Conference on Trade and Development). 2022

2Bloomberg, 2022. China’s Covid crisis threatens global supply chain, chaos for summer 2022.

3ASML Annual Report 2021

4i-healthcare Analyst, 2022. “Global pre-owned medical devices market.”

5McKinsey, Remaking the Industrial Economy, 2014. Toward the Circular Economy, Ellen MacArthur Foundation, Philips Annual Report 2021.