Consumer trends in 2023: Consumer health and sustainable consumption

Two trends we see gathering momentum in 2023 are consumer health and sustainable consumption.

Summary

- Consumers are spending more on their own health and also on sustainable products

- Novel weight loss solutions, skincare and optical health are growing categories

- Technological advancements and new incentives drive electric vehicle and solar affordability

In 2022 the Robeco Global Consumer Trends strategy added more weight to areas like consumer health, and we also see a bright future for companies serving customers with more sustainable products and services. These are two of the themes to watch for in 2023 and beyond.

Improving solutions for body mass, dermatology, and vision drive consumer health trends ahead

First, recently approved, effective weight loss drugs have sparked interest among consumers, medical professionals and healthcare providers. Second, five billion people and growing live with poor or corrected vision, offering substantial opportunities for vision correction companies. Third, dermocosmetics are gaining popularity thanks to their efficacy and clever marketing by beauty companies. In general, post-Covid consumers are taking a more proactive approach towards their health and well-being. These trends are also supported by demographic tailwinds with Millennials and Gen Z in the US spending at a rate six to seven percentage points higher than the average consumer on wellness products and services, according to McKinsey.

Increasing consumer interest in weight loss drugs

We expect consumer interest in weight loss drugs to increase substantially in 2023 as health insurance coverage expands, marketing efforts increase, and product availability improves. Obesity, a severe form of being overweight, is associated with over 200 health complications, including type 2 diabetes, and puts a substantial strain on global healthcare budgets. Worldwide an estimated 750 million people are obese. Treating obesity-related diseases costs an estimated USD 425 billion across OECD nations every year. So, healthcare payors (individuals, employers or governments) have an incentive to reduce obesity prevalence, for example, with the help of novel pharmaceuticals.

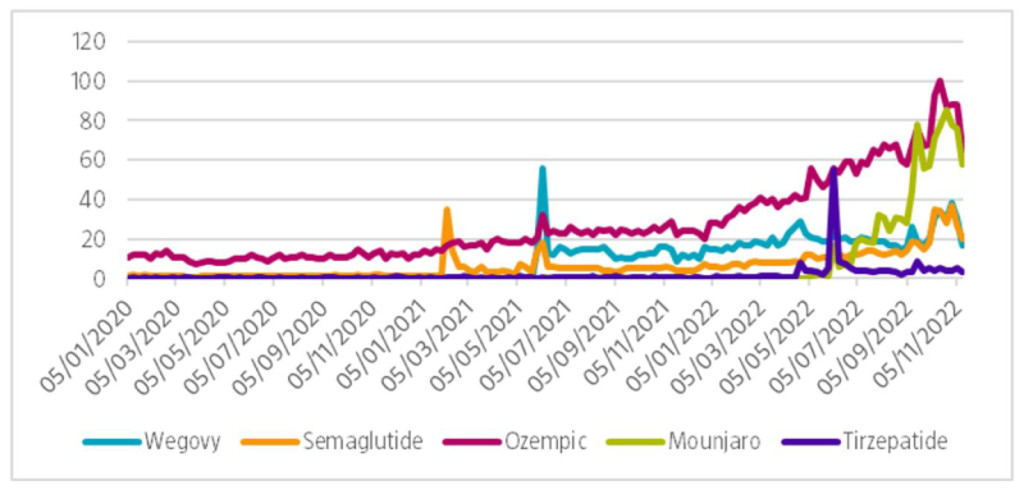

Currently, only some 2% of obese people are treated with obesity drugs. Consumer interest on social media, and on Google searches, for weight loss drugs is also increasing. Interestingly, in anticipation of regulatory approval and an increased supply of obesity drugs, type 2 diabetes drugs Mounjaro and Ozempic, which both also help weight loss, have seen rising interest from consumers.

Figure 1: Interest in new weight loss and diabetes drugs on Google search

Source: Google, 2022.

Consumer Trends

Five billion people require vision correction products and services

Companies treating poor vision have substantial growth opportunities thanks to the sheer amount of people needing vision correction to function as well as they possibly can in daily life. About 2.7 billion people live with uncorrected poor vision and another 2 billion live with corrected vision and regularly need new glasses or contact lenses when their vision changes, products wear out, better technology becomes available, or when their fashion tastes change. A small percentage of the combined 4.7 billion people will receive eye surgery for which equipment is being supplied by a small number of highly specialized companies. Future growth in the number of people needing vision correction is driven by changing consumer behavior including increased screentime, more intensive near-sight work, and demographic trends like population aging and population growth in Asia (where short-sightedness is more prevalent).

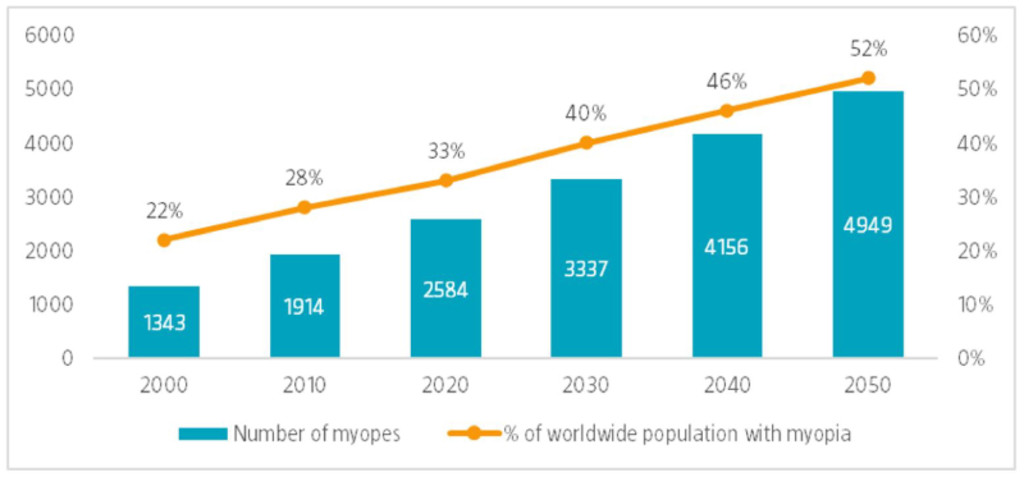

Two growth opportunities to highlight are short-sightedness and protection from the sun. First, zooming in on short-sightedness, also known as myopia, we find that the percentage of people being myopic is forecast to increase from 33% now to 40% in 2030 and 52% in 2050 or almost 5 billion people according to the Brien Holden Vision Institute (Figure 2). Second, approximately 6 billion people risk suffering sun damage to their eyes due to lack of protection. In some countries such as Australia, health insurers are already reimbursing consumers for sunglasses costs. In other words, there are plenty growth opportunities for vision correction companies.

Figure 2: Number of myopes and prevalence

Source: Brien Holden Vision Institute, 2016.

Dermocosmetics link consumer desire for beauty with health

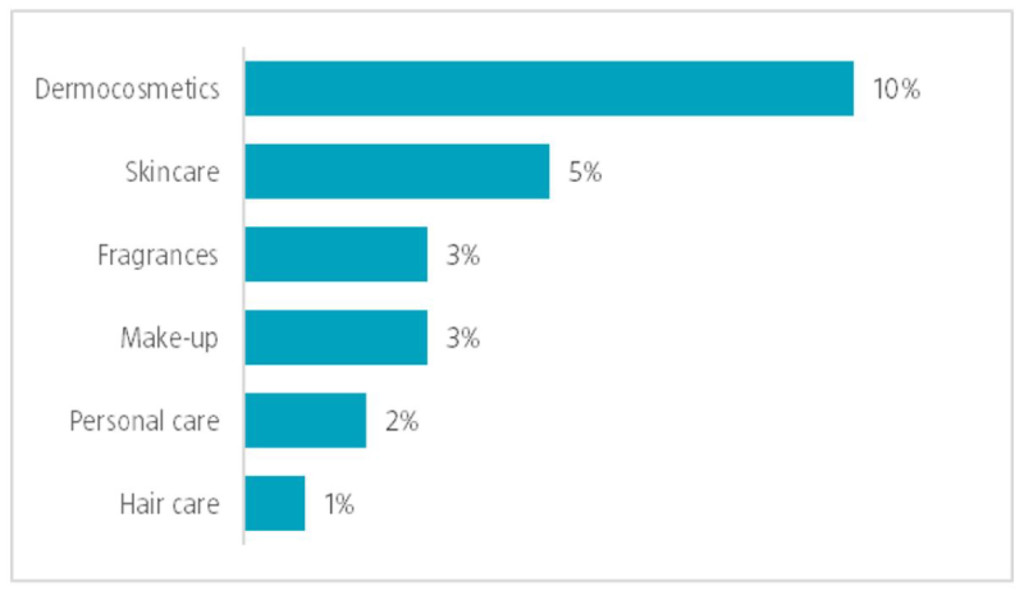

Depending on your presence on TikTok you may have seen the ‘DermDoctor’, a practicing dermatologist with a medical degree and 17 million followers who regularly educates his followers on basic dermatology and skincare. Dermocosmetics products sales are growing about 10% per annum, twice that of the overall beauty market, helped by influencers like the DermDoctor. Growth is mainly because these products are developed by pharmacists and dermatologists and offer solutions to specific skin problems such as sensitive skin, eczema or acne. Given that these products often treat clearly visible facial skin ‘imperfections’ they are also closely tied to consumers’ sense of beauty. Add recommendations by medical professionals and high service distribution via pharmacies, and one has a fast growing, profitable product category with loyal customers.

Figure 3: Beauty categories forecasted annual growth

Source: company results, Robeco estimates, 2023.

The resurgent sustainable consumer

Beyond their own health, increasingly consumers also want the choices they make to be sustainable for the planet too. In recent years, public sentiment, technological progress, and economic rationale have each reached a tipping point in favor of sustainably produced goods and services. We see a multi-year opportunity across a broad array of segments including automobiles, apparel, food, and energy for innovative companies to provide consumers with solutions that are not only sustainable, but also market competitive.

Global Consumer Trends F GBP

- performance ytd (31-12)

- 3.89%

- Performance 3y (31-12)

- 14.03%

- morningstar (31-12)

- SFDR (31-12)

- Article 8

- Dividend Paying (31-12)

- No

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Interest broadens across consumer groups

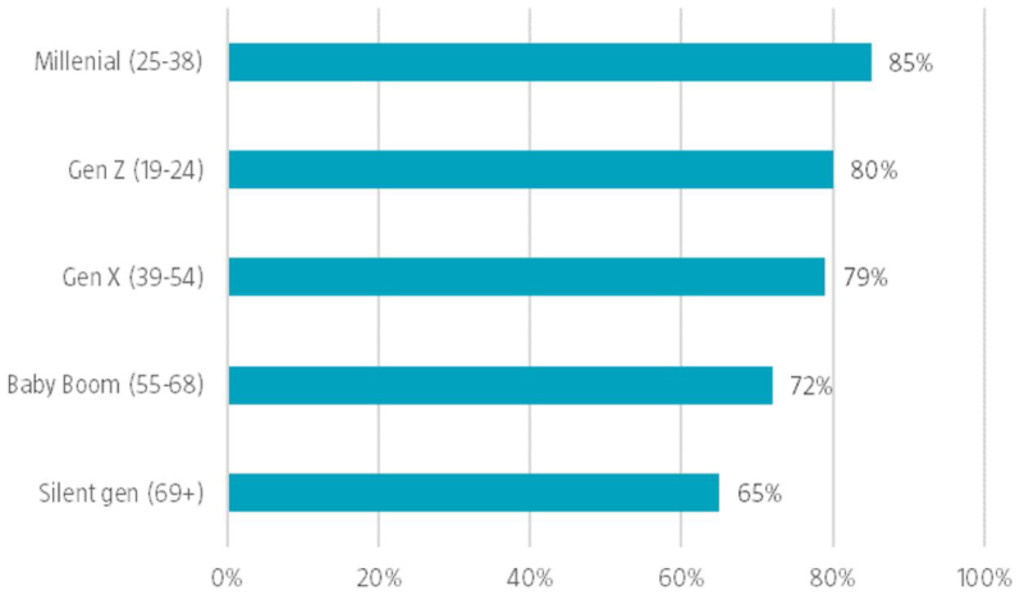

Once constrained to nature lovers and young idealists, the market for sustainably produced products has expanded across generations, geographies and political affiliations. According to The Conference Board Global Consumer Confidence Survey, 85% of Millennials say it is extremely, or very important that companies implement programs to improve the environment. Those in the Generation Z and X brackets express similar levels of environmental support at 80% and 79% respectively. Notably, even older generations have gotten behind the cause, with 65% of the silent generation also indicating strong support for corporate environmental programs. Similarly, even in the politically divided US, 76% of Americans have a positive view of wind energy and 82% see solar energy in a favorable light according to a Morning Consult poll. This positive public view of environmental concerns was underscored last year by passage of the US Inflation Reduction Act (IRA) which directs nearly USD 394 billion in funding to support renewable energy, electric vehicles, related manufacturing, and other environmental programs.

Figure 4: Percentage of consumers that believe it is extremely or very important that companies implement programs to improve the environment

Source: The Conference Board, Nielsen, Bernstein Research

Strong trends, still early in the adoption cycle

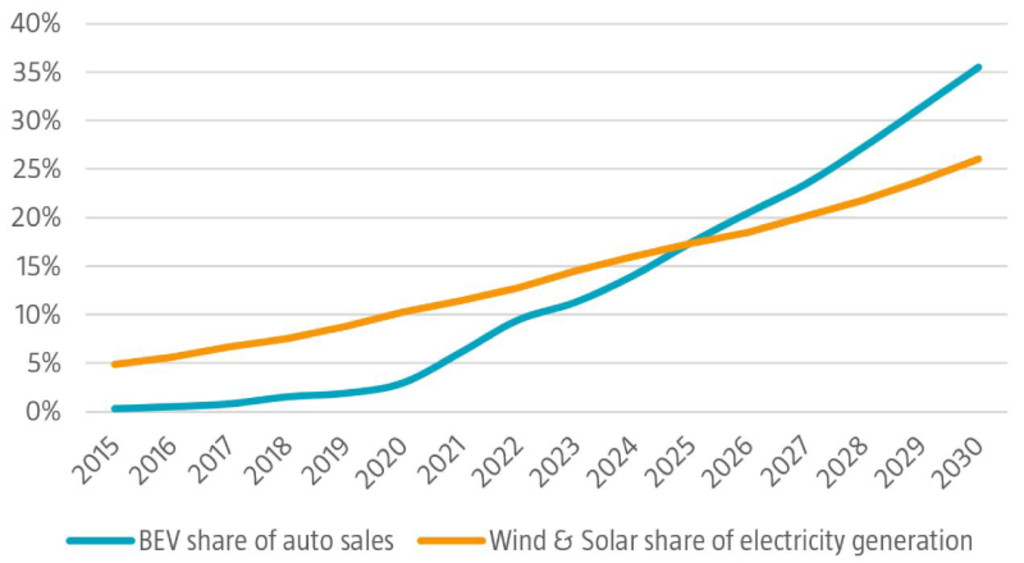

While there is often a gap between consumers’ stated preferences and how they spend, the growth in sales of electric vehicles and the installation of solar panels demonstrates that interests and actions can converge under the right conditions. Over the last five years, sales of passenger battery electric vehicles (BEV) rose at a 61% compound annual growth rate versus sales of petrol powered vehicles which declined at a 5% CAGR over that period. Notably, in 2022, in spite of ongoing semiconductor shortages, Bloomberg New Energy Finance (BNEF) estimates BEV sales rose 66% year on year to 7.6 million, accounting for 9.4% of the global market. Similarly, with a 15.3% CAGR, wind and solar generation has expanded at more than 10 times the rate of total electric power generation over the past five years. BNEF estimates the combined share of those renewable energy sources reached 12.7% of the global electric power in 2022 and will account for more than a quarter of the market by 2030.

Figure 5: Battery electric vehicle share of passenger vehicle sales & combined wind and solar share of electricity power generation, worldwide

Source: Bloomberg New Energy Finance, 2022

Economics increasingly drive sustainable purchases

Driven by technological advancement, new business models, and renewed incentive programs, electric vehicles and renewable energy are increasingly not only the most climate-friendly options, but also the most economical choice for consumers. Over the last decade, renewable energy development costs have decreased substantially with the unsubsidized cost of solar and wind energy down 77% and 46% respectively, according to Lazard. Combined, the average price of utility scale solar and wind power generation is 39% less expensive than gas, and 67% less than coal. Similarly, while the upfront purchase price of a BEV is still higher than a comparable petrol-powered vehicle, the annual running costs are nearly 30% less given the lower costs of fuel (electricity), and lower maintenance costs (fewer moving parts).

While environmental concerns and social values continue to play a role in consumer motivation to shop sustainably, quality ranks higher. According to a 2022 survey conducted by First Insight and the Wharton School of the University of Pennsylvania, 29% of consumers cited quality as the leading factor driving consumer preference for sustainable products. Similarly, craftmanship and durability combined rank nearly as high, with 25% of consumers citing those attributes as their primary rationale for shopping sustainably. Product durability is likely the key factor driving 68% of respondents in the First Insight survey to indicate a willingness to pay more for a sustainable product. A similar dynamic is found in the luxury market where high-end automobiles, handbags, and watches retain significantly greater value at resale than mass market products. The longer useful lifespan of well-made products contributes to the circular economy with less waste and reduced demand on natural resources.

New business models are also helping to drive the benefits of the circular economy beyond the luxury market. Leveraging the broad infrastructure and payment systems developed to support traditional ecommerce, new marketplaces like ThredUp and Vinted bring the cluttered thrift store to the digital age. Although Lithuania-based Vinted has more than 75 million registered users across 18 countries, the company is just scratching the surface of the USD 860 billion global apparel market.

Cautious consumers won’t derail long-term outlook

With inflation and recessionary fears currently top of mind for consumers, the premium that sustainable products are able to charge and consumers’ willingness to pay up to do good will both likely erode. Indeed, according to Deloitte’s Global State of the Consumer Tracker, citing cost as the primary factor, the percentage of consumers who had recently purchased a sustainable product fell from 49% in their March 2022 survey to 40% in September. Nevertheless, as new technologies develop, quality improves and prices decline helping to drive adoption over time. Given the vast market opportunity, material progress to date and the early stage of adoption for technologies like renewable energy and electric vehicles, the sustainable consumer shift should present multiple years of growth and opportunity for both innovative entrants and agile incumbents.