Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Conventional wisdom has it that long-term outperformance is often a matter of limiting losses in down markets. One way conservative investors seek to mitigate losses in down markets is to keep a part of their portfolio in gold. But is this really the most effective strategy? Our research shows there are alternative options available.

Warren Buffet’s first rule of investing is to never lose money; his second is to never forget the first rule. This golden rule is key for long-term capital protection and growth. One oft-used strategy to limit losses in turbulent markets is an allocation to gold. Gold investing is widely regarded as a safe haven during extreme macroeconomic downturns in periods of war, hyperinflation, or major recessions.

But do such allocations to gold really provide the expected protection in practice? And even if so, are there any better ways to mitigate risks? To answer these questions, we revisited the strategic role of gold in investment portfolios and focused on its marginal downside risk reduction benefits relative to bonds and equities.

Our analysis, featured in a new research paper, focuses on annual real returns starting in 1975, when gold became truly tradeable. We took the perspective of a US investor who could strategically invest in equities, bonds, and gold and would care about a wide range of downside risk measures, including downside volatility, loss probability and expected loss.

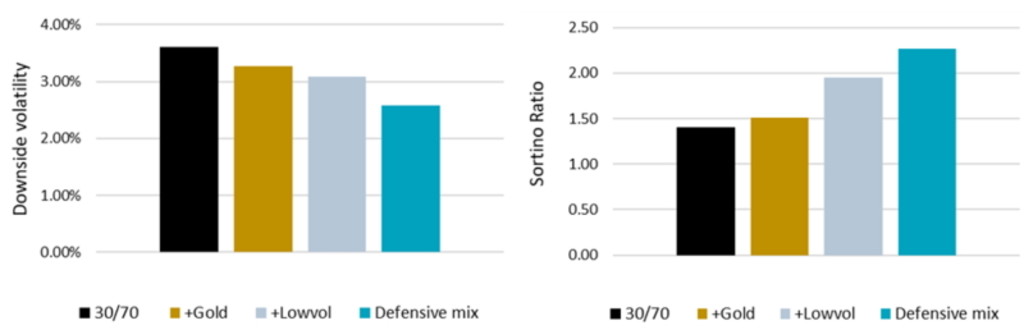

The key findings of our empirical study are that a modest gold allocation in a traditional mix of equities and bonds reduces the risk of capital losses by around 10% across a wide range of equity-bond allocations. Still, this also reduces the return, leading to a small increase in the return/risk ratio as shown in Figure 1 summarizing the main findings of this study.

Source: Lohre, H., and Van Vliet, P. (2023) “The golden rule of investing”, working paper.

Subscribe to our newsletter for investment updates and expert analysis.

Importantly, however, our simulations show that the downside volatility can be reduced further by adopting a low volatility style in the equity investment and letting this defensive equity allocation replace part of the bond allocation. The portfolio with the lowest downside volatility on a one-year horizon consists of 45% bonds, 45% low-volatility stocks and 10% gold.

Our simulations show that the downside volatility can be reduced further by adopting a low volatility style

As a result, this defensive mix has significantly lower downside risk than a traditional equities/bonds portfolio, with higher returns leading to a large increase in the Sortino ratio. This defensive strategy therefore proves to be an effective way for investors to adhere to Buffet’s golden rule, while still delivering long-term capital growth.

Moreover, additional simulations and robustness checks show that these key findings hold not just for the one-year returns initially considered, but also for a wide range of investment horizons, ranging from one month up to 36 months. While these results are robust when gold futures are used instead of a direct gold investment, adding gold mining stocks is less effective in reducing the downside risk of a low-volatility equity portfolio. Lastly, we document that, while the risk mitigation role of gold is muted in a mean-variance setup, low volatility investing is considered just as relevant as when evaluated through a downside risk lens.

Recorded webinar