The balance of risks in the Middle East has shifted

On 13 April, Iran launched ‘Operation True Promise’ in retaliation for Israel’s attack on the Iranian consulate in Syria. This operation was the first-ever direct attack on Israel from Iranian soil, tilting the future balance of risks in the Middle East to the downside, in our view. The direct attack suggests Iranian hardliners no longer see strategic patience (as exercised via a long-standing proxy war with Israel) as the default choice, even as the Iranian official statement deemed “the matter concluded” with the 13 April barrage.

While the 300+ drone and missile attack didn’t cause any casualties, thanks to Israel’s Iron Dome air defense system, Benny Granz, a member of Israel’s war cabinet, said his country will retaliate “in a way and at a time that suits”. This leaves the risk of further escalation in the region, as the show of Iranian force could convince Israel to pre-emptively shift further up the risk curve by eliminating Iranian nuclear capabilities.

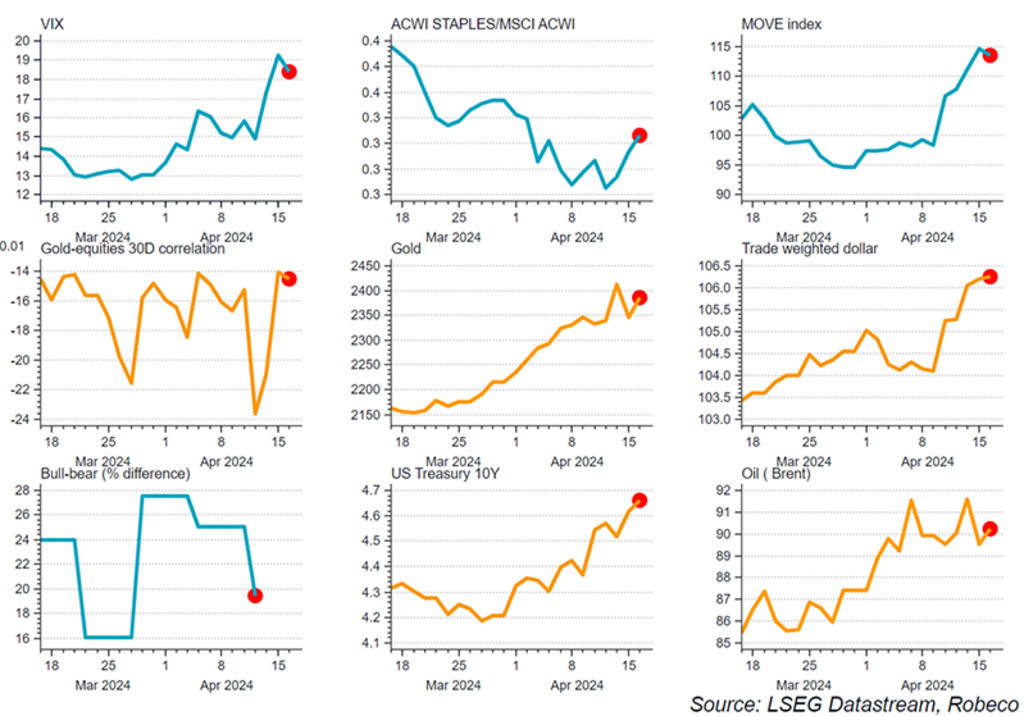

While the successful thwarting of the Iranian attack by Israel and its allies was followed by initial relief in financial markets, sentiment has grown more bearish since then, against a backdrop of stalling global disinflation and fading confidence by US Federal Reserve board members about their ability to cut policy rates sooner rather than later. Our risk dashboard shows volatility (both in equity and bond markets) has corrected sharply on prospect of higher-for-longer policy rates and Middle East turmoil.

Consumer Staples (a defensive sector) has started to outperform the broader market, an indication that the direction of travel of the equity market might be changing. Bitcoin, a bellwether of market liquidity, has plunged below its 30-day moving average for the first time since February. Rising geopolitical risk premiums in key commodities such as oil also reinforce the higher-for-longer rates view via unexpected commodity-led inflation.

US inflation surprises have become positive on the back of rising gasoline prices. The elevated risk of positive inflation surprises (partly due to geopolitical event risk in 2024) has been one of our lines of reasoning to adopt an overweight position in commodities on 19 March, next to an expected cyclical recovery in global manufacturing. Yet, following the Iranian attack, we have not increased our commodity overweight, as we lack conviction on the nature and timing of future Middle East events.

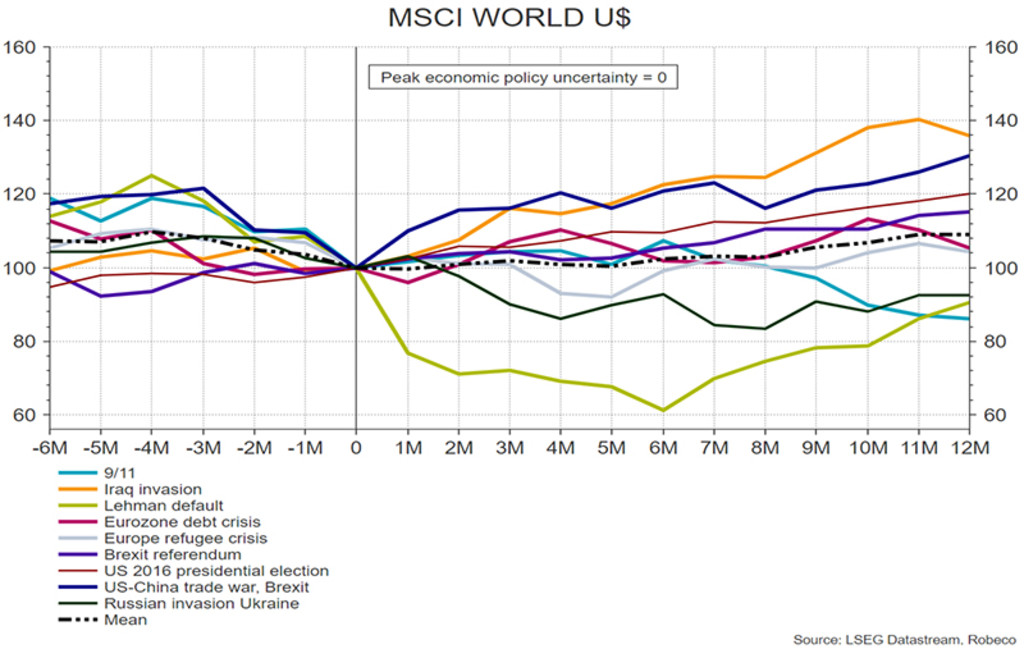

As investors, one should try to avoid becoming an ‘armchair general’. No one knows for sure whether the parties involved have the willpower to escape a self-defeating cycle of vengeance. Markets only can price in the level of uncertainty around macroeconomic outcomes, not the specific sequence of future geopolitical events that might trigger these macro shocks. Therefore, risky assets like equities typically tend to rally only once geopolitical uncertainty has peaked, something which can only be assessed in hindsight.

Change in view – take profit in equities as tactical risk/reward deteriorates

Following the above developments and observing the broad-based drop in risk appetite in financial markets, we have this week decided to take profit on our Japan equity overweight (TOPIX) and move the portfolio equity weighting towards benchmark neutral. As we inch closer to May, equity seasonality is about to turn negative, while the onus is now really on superior Q1 corporate earnings delivery to keep this market rally afloat. With around 8% of US companies having reported, this will prove challenging, as the first cracks on the earnings front are showing with some of the ‘Magnificent 7’ tech leaders like Apple and Tesla.

In bond markets, we are exercising patience with increasing duration in US Treasuries. More issuance might be needed if US tax revenues disappoint, while the current pace of quantitative tightening could continue for longer, along with the streak of positive US inflation surprises. This at the least counterbalances safe haven demand. According to our model, fair value for US 10-years sits now around 4.75% after the strong 3.8% March core CPI number.

Instead, we have added to our steepener trade in the 5-10-year segment of the curve, as this section is likely to steepen regardless of whether a no-landing or soft(ish) landing materializes. We have removed our short in 2-years from the initial butterfly trade, as the market on the shorter end of the curve has by now fully shifted towards our higher-for-longer 2024 outlook view. Of course, we will keep monitoring events closely in the coming weeks.

Risk dashboard

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.