Eye of the hurricane: The three headwinds for climate investing

Global warming is viewed as one of the biggest systemic risks facing investors – so why doesn’t climate investing enjoy 100% support? Trillions of euros in investment capital are needed to boost renewable energy infrastructure, transform mobility and decarbonize entire industries. And as the Earth warms, the urgency is only increasing.

Summary

- Support drops in North America, as the issue is a politicized ‘culture war’

- Oil and gas companies will reign until the energy tipping point is achieved

- Legislating for biodiversity didn’t live up to the promise of Montreal

Yet, there are still headwinds to achieving the unified response necessary, as Robeco’s fourth annual Global Climate Investing Survey discovered. The 2024 edition highlighted three areas in which enthusiasm has slumped or even gone backward: the anti-ESG sentiment in North America; continued support for fossil fuels; and a lack of commitment to biodiversity preservation.

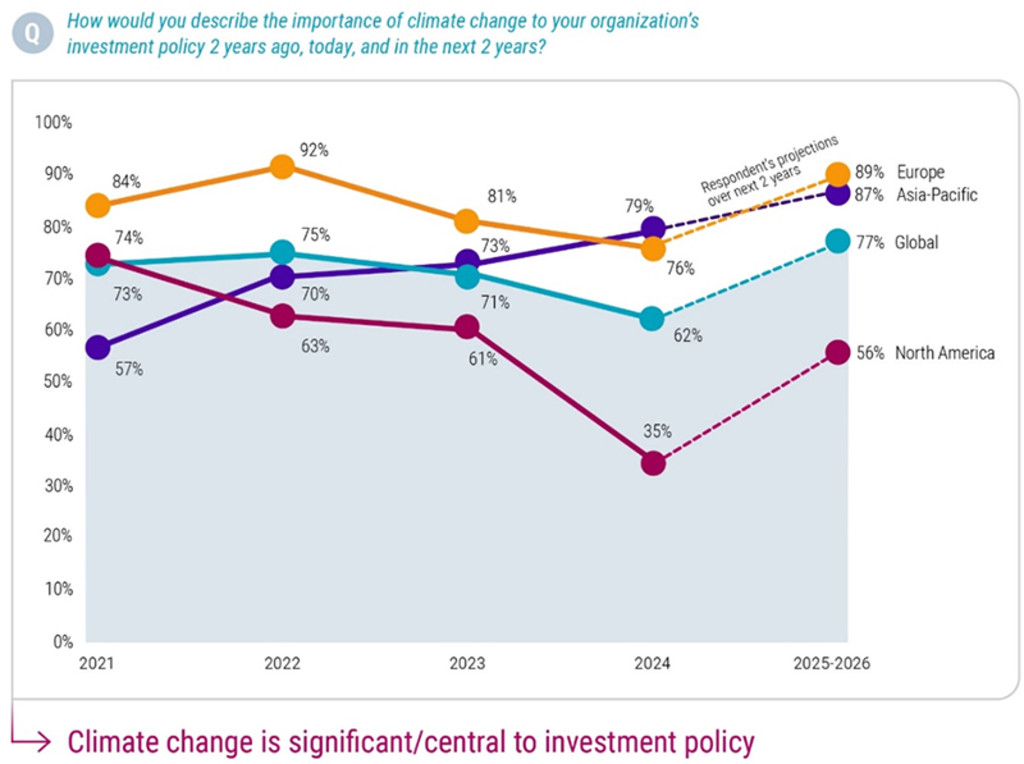

In North America, the number of respondents who said climate change was a significant or central part of their policy slumped from 61% in 2023 to just 35% this year. This was cited as being mainly due to a backlash against sustainable investing generally – in the belief that it hurts returns – that has grown in intensity in the past two years.

Source (for all charts): Robeco Global Climate Investing Survey 2024

In a stark reading of regional differences, this compared with 79% of Asia-Pacific investors and 76% of those in Europe. It brought the global average down from 71% to 62% last year. This was also seen in commitments to net zero, where North American interest fell from an already low 19% to 13%, while Europe remained steady at 37% and APAC’s interest rose from 20% to 26%.

Ironically, North America has suffered greatly from the more extreme weather that global warming is bringing, from deadly hurricanes and floods, to tornados turning up in areas previously free from them. Rising sea levels would submerge low-lying regions such as Florida.

“It’s become a politicized and polarized culture war between the Republicans and Democrats in the US, which has become disconnected from the facts and reality,” says Lucian Peppelenbos, Climate and Biodiversity Strategist at Robeco.

“The reality is that climate change has been impacting the US economy big time for years, and the costs of it are increasing. They are getting massive bills from natural catastrophes and if assets such as homes and businesses can no longer be insured, that will have a huge impact on the wider economy.”

“But the good news is the transition is also happening. The US has been decarbonizing since 2007, and the Inflation Reduction Act (IRA) has been a complete success in boosting green investments. That, frankly, is the most important piece of climate legislation in the history of the US.”

“And let’s remember that there’s a valid point that lay at the cradle of the anti-ESG movement, before it got politicised. This is the question that if the public sector doesn’t legislate to combat climate change, how far can the market go to do it instead? But all of these things come in waves, and so the ESG tide will turn again.”

The fossil fuel elephant

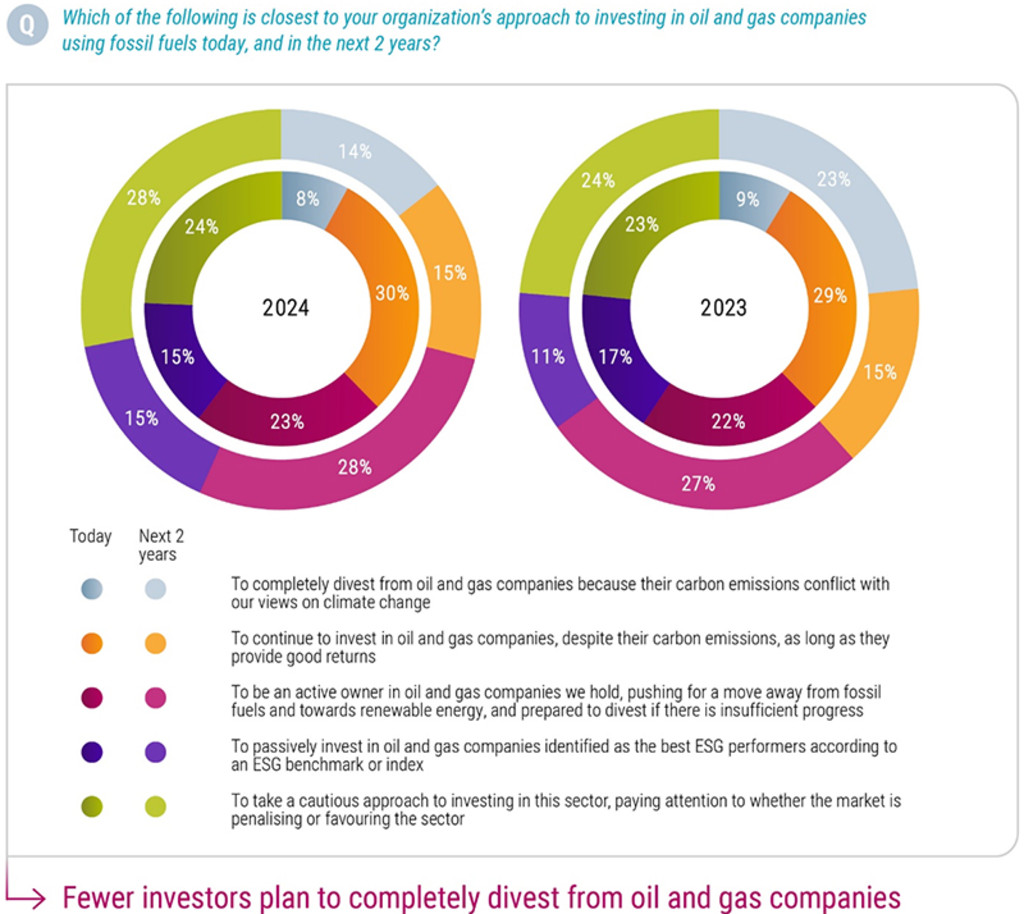

The second headwind is often described as the ‘elephant in the room’ for climate investing – whether to hold fossil fuel companies in portfolios. The number of investors pledging to completely divest from oil and gas companies in the short term dropped from 23% to 14% last year. Some 15% said they would continue to invest as long as they continued to generate returns.

The returns issue lies at the heart of the problem, since energy companies have been among the best performers on stock markets since Russia invaded Ukraine in 2022. While sustainable asset managers will seek to reduce emissions, they also have a fiduciary duty to make money for their stakeholders. Excluding fossil fuel companies would therefore cause underperformance.

“Oil and gas is a tricky issue, but the situation is that total energy demand is still growing quicker than what renewables can fill up,’ Peppelenbos says. ‘’Around two-thirds of the increased energy demand in 2023 was met by fossil fuels. While renewable energy has grown massively, its share is still only around 20% of total energy demand.”

Reaching a tipping point

“Fossil fuel demand will start to go down when there are more EVs on the road, for example, while renewable capacity will continue to be ramped up. Then we will reach a tipping point and investments in new oil and gas projects will dry up.”

“Don’t forget that we’re in the middle of a massive historical transformation in which reaching this tipping point will be beset with ups and downs. We’re moving from fossil fuels to net zero with this messy period in-between.”

“And of course, renewables have also had their own headwinds in terms of things like rising interest rates, which is difficult for a capital-intensive growth industry. Inflation means costs are going up in the supply chain, and we also need massive capacity enhancement to the grid. But the picture will look very different in a few years’ time.”

A back seat for biodiversity

The third headwind is declining interest in protecting biodiversity, which many believe to be the other side of the coin of tackling global warming, since nature is inexorably linked to climate change.

Deforestation exacerbates global warming, while almost half of global GDP is linked to nature in some way.

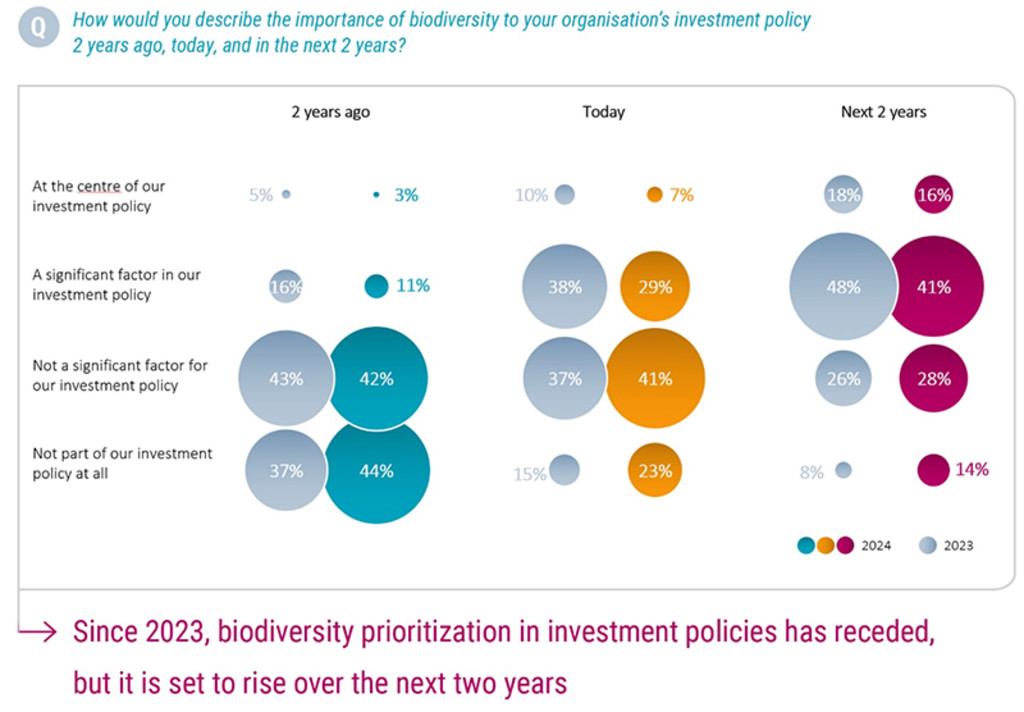

The number of investors for whom biodiversity is a significant or central part of investment policy dropped from 48% in 2023 to 36%, while those who said it formed no part of their policy at all rose from 15% last year to 23%, the Climate Survey showed.

Meeting Montreal

“We had a lot of momentum in 2022 with COP15 in Montreal, when governments agreed to halt and reverse nature loss by 2030; this was a pivotal moment,” Peppelenbos says. “But governments have not lived up to it, even in Europe, which has been struggling to legislate it. The lofty commitments from Montreal need to find their way into real legislation for nature to become more material, and for the markets to price in nature risks more seriously.”

“We do see attractive alpha opportunities in companies that are providing solutions such as wastewater treatment, and in polluting companies that are seriously transitioning. Resource efficiency, sustainable sourcing and closed-loop cycles go very well hand in hand with profitability and return.”

“However, to really shift the market and reach the scale of investments that are required, we need more serious policy action. The recent elections in Europe were more favorable than we had thought in terms of support for the green economy, but it’s still a bit on the back burner.”