The circular economy – a hub of innovation in AI's quest for commercial value

For Natalie Falkman, the circular economy provides limitless use-cases to productively (and profitably) apply AI’s game-changing potential. Falkman, the senior portfolio manager for Robeco’s Circular Economy strategy, describes how companies from diverse industries are already applying AI’s turbo-charged processing powers to create value-added solutions.

Summary

- Scale of resource loss and waste is unprecedented and unsustainable

- Companies are using AI to enhance resource- and cost-efficiency

- AI holds limitless potential for solving resource and waste challenges

Society is extracting natural resources and creating excessive waste at a rate never before seen in history. In the fast-moving consumer goods segment alone, USD 2.6 trillion worth of material value is thrown away and never recovered.1 And that’s just post-production waste. There’s plenty of waste that could be avoided entirely if companies applied circular principles from the outset. 2

Falkman says that resource use and waste at this scale can only be addressed by a complete paradigm shift in economic thinking. “A circular economy is a need-to-have rather than a nice-to-have. Its resource and cost-saving potential is why it is expected to grow at two to four times that of global GDP by 2050.” But despite economic and environmental appeal, uptake has been slow. With early success cases already emerging, Falkman thinks AI could be the game-changing tool industries need to boost adoption.

AI and circularity may seem like strange bedfellows, but Falkman explains that forward-thinking companies have used technological innovation to build circular solutions for decades. “Rapid advances in chips and connectivity were the first-generation enablers of circular adoption. IoT connectivity and ‘intelligent’ digital tools made it possible for physical things to sense, interact and communicate with their environments. That’s created huge opportunities to collect product and processing data for predictive maintenance as well as for efficiently tracking and moving parts and products around supply chains. It’s also being used to enhance product design capabilities.”

She adds that in addition to physical products, IoT is also being successfully used for product as a service (PaaS) models. PaaS-focused businesses deliver consistent revenue streams through enhanced services and product upgrades delivered as digital software rather than physical hardware.

Still, she says the cost of introducing new circular solutions can initially be high and many companies resist the need to rethink legacy business models. “Some businesses need to see circularity bring more value and that means scaling it enough to start making an impact on margins and profits. Though it’s still early, successful examples of the power of generative AI and machine learning to accelerate and scale circular innovation are already emerging.”

Explore the future of AI in investing

Learn how AI is shaping tomorrow’s investment landscape – learn the basics or dive into our AI course.

AI and circularity may seem like strange bedfellows, but forward-thinking companies have used technological innovation to build circular solutions for decades

Reducing resource use and pollution

Water scarcity is a critical concern as extreme weather and increased industrial consumption are straining supplies. To reduce costly water losses, Falkman invests in water-service companies that combine AI algorithms with sensors in pipes and valves. As a result, municipal utilities and commercial users can rapidly detect leaks based on water flow and pressure data as well as hazardous substances such as PFAS.3

She says buildings are another area where AI is constructively being used to cut resource loss. Here she’s investing in companies creating generative design models that can be used to avoid bottlenecks, minimize material use and waste, and optimize building execution by project developers and on-site contractors.

Circular Economy IH GBP

- performance ytd (31-12)

- 19.15%

- SFDR (31-12)

- Article 9

- Dividend Paying (31-12)

- No

- Current Price (12-2)

- 156.21

- Inception date (31-12)

Reducing waste

Falkman is also enthusiastic about AI’s possibilities for reducing waste by keeping products in use for longer. She says that suppliers of industrial parts and machinery are selling AI-boosted maintenance and modernization services that continuously collect operational data to anticipate repairs and upgrades. As a result, costly equipment breakdowns and damage can be avoided, and product lifetimes can be extended. Her holdings include a number of equipment and service providers with customer bases extended across data centers, network operators and industrial manufacturers, as well as healthcare and educational facilities.

Fragmented supply chains with little coordination are also ripe for resource-reducing AI interventions. Her investments here include companies that are feeding AI models with data on suppliers, inventories, distribution logistics, and even seasonal weather patterns. In return, companies are better able to predict demand, adjust inventories, and accelerate material sourcing while at the same time reducing bottlenecks, product waste, and transport emissions.

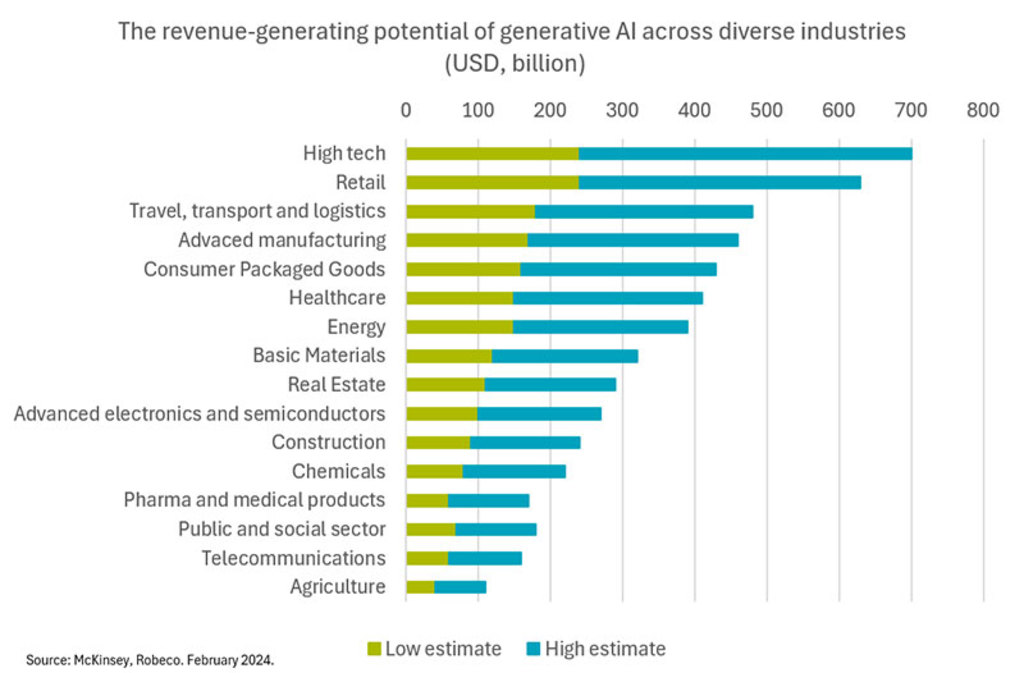

Figure 1 – AI’s value-add in revenue across diverse industries

The list of AI value-generating opportunities is not exhaustive. Only select industries with alignment with circular economy models are presented. For more detail, see McKinsey, Beyond the hype: Capturing the potential of AI and gen AI in tech, media, and telecom. February 2024.

Reducing emissions

Renewables are clean, regenerative and part of a range of sustainable solutions that support circularity. While Falkman doesn’t directly invest in energy markets, she has exposure through companies that supply electric utilities and network operators with the solutions to modernize infrastructure and to better manage power on increasingly complex grids.

Renewables share of the energy mix is increasing as governments, municipalities and companies seek to decarbonize. But the addition of solar and wind farms with fluctuating energy production is creating headaches (and in some cases blackouts) for legacy grids built for stable flows from fossil and nuclear power. “AI-equipped smart grids help operators dynamically switch between different energy types and source locations, including battery storage when needed. Not only does this improve energy efficiency but it also reduces the risk of destabilizing power surges that knock out power and damage critical equipment.”

AI is helping companies predict demand, adjust inventories, and accelerate material sourcing while at the same time reducing bottlenecks, product waste, and transport emissions

Outlook

In Falkman’s view, we are only at the very beginning of AI’s potential for accelerating circular solutions across the economy. “There is no shortage of companies trying to harness opportunities that some estimate to be upward of USD 1 trillion by 2050 in Europe alone. AI’s ability to turbo-charge simulations could be especially useful in a wide variety of applications – from smart manufacturing that minimizes resource use to combing the molecular properties of compounds to generate more sustainable materials.” She can also see AI and machine learning accelerate opportunities to identify, sort and disassemble products and components for up-cycling and recycling.

“The circular economy provides limitless use-cases for AI to apply its processing power for scaled innovation. Companies that can harness this power will create strong competitive advantages not just from lowering internal costs, but also from staying ahead of tightening regulations and attracting new customers.”

Circular economy

Footnotes

1 “What is circularity?” McKinsey Explainers. June 2024.

2 If a circular economy was implemented across key industries (manufactured goods and consumables, mobility and transport, food systems and the built environment), virgin material extraction could drop by around one-third (34%)—from 92.7 billion tonnes to 61.2 billion tonnes. The Circularity Gap Report. The Circle Economy 2023.

3 PFAS laws are becoming more stringent and broader in scope impacting utilities and industrial users. See “PFAS 2.0 – new waves of regulation will hit more than chemical producers.” Robeco. March 2024.