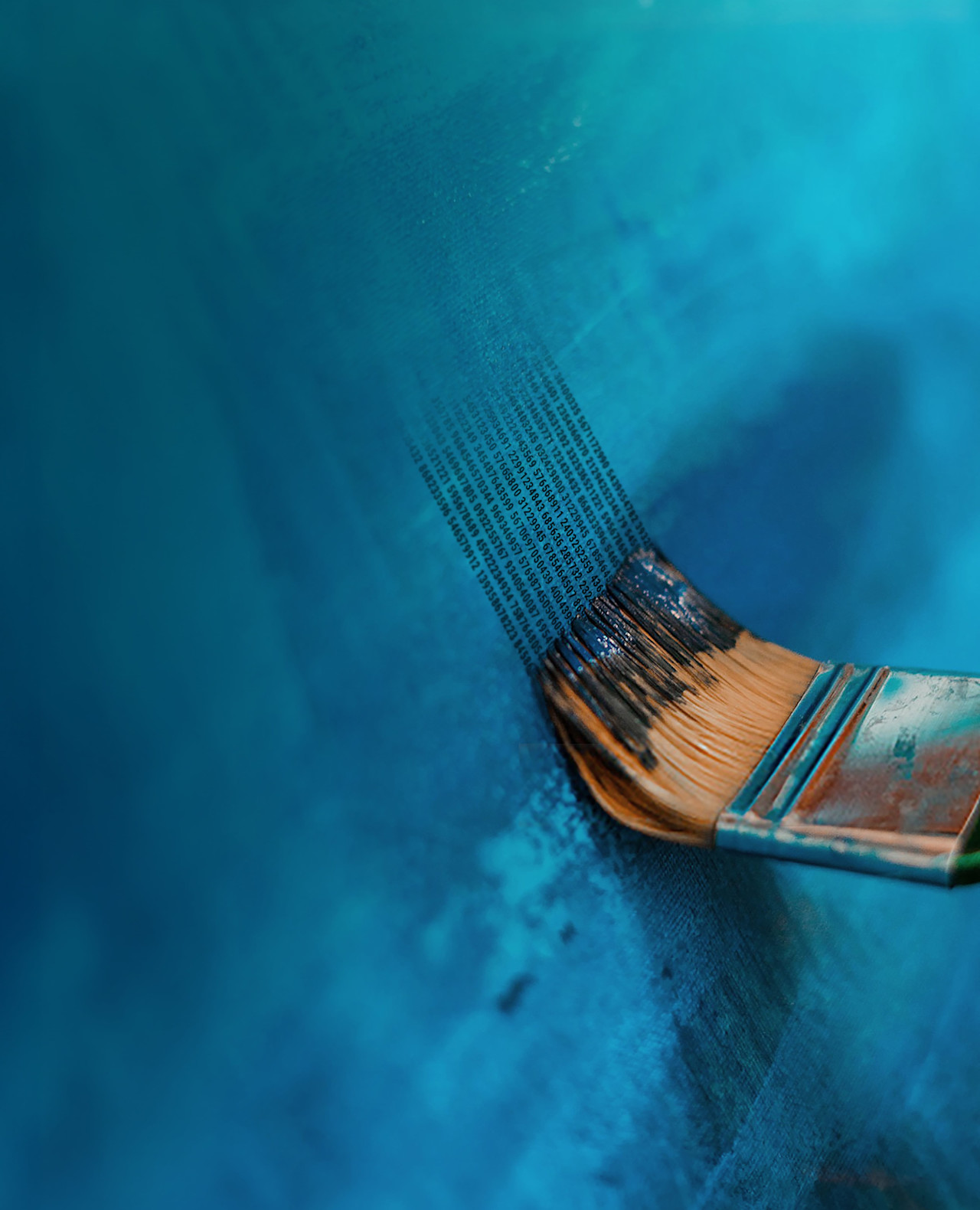

Quantitative investing

Downside risk represents the potential for undesirable events that can devalue an investment.

Naturally, investors aim to minimize risks that aren't compensated by higher returns. It's pivotal to differentiate between downside risk and volatility. While volatility indicates price fluctuations in both directions, downside risk is solely concerned with potential losses.

See also