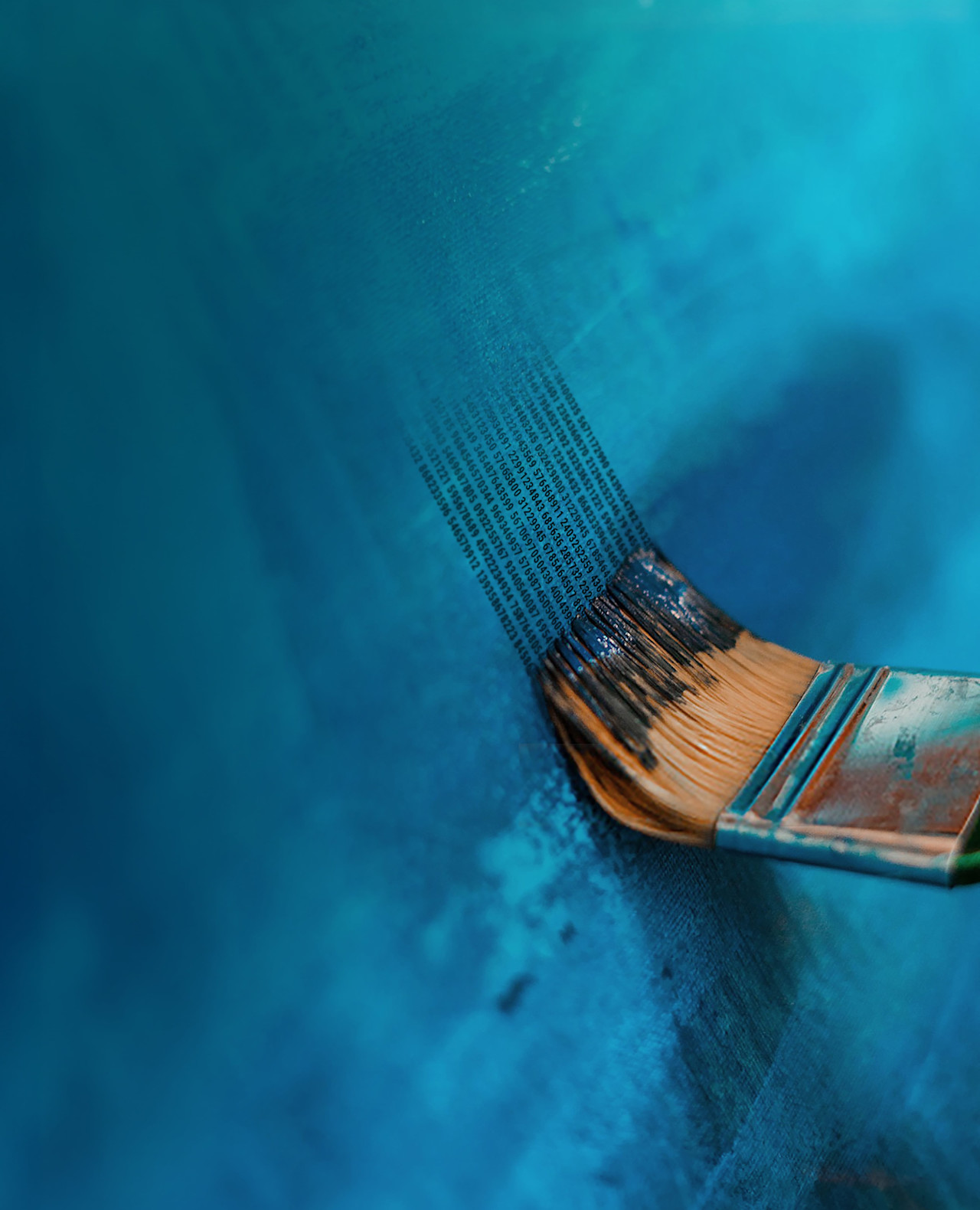

Quantitative investing

Factor investing, an intricate piece of the quantitative investing puzzle, targets academically-proven factor premiums for better returns.

Essentially, factors are distinct stock attributes that illuminate the potential risks and returns of a security cluster over extended periods. By leveraging these factors, investors can tap into unique market opportunities, diversify their portfolios, and position themselves strategically in ever-evolving financial landscapes.

See also