Quantitative investing

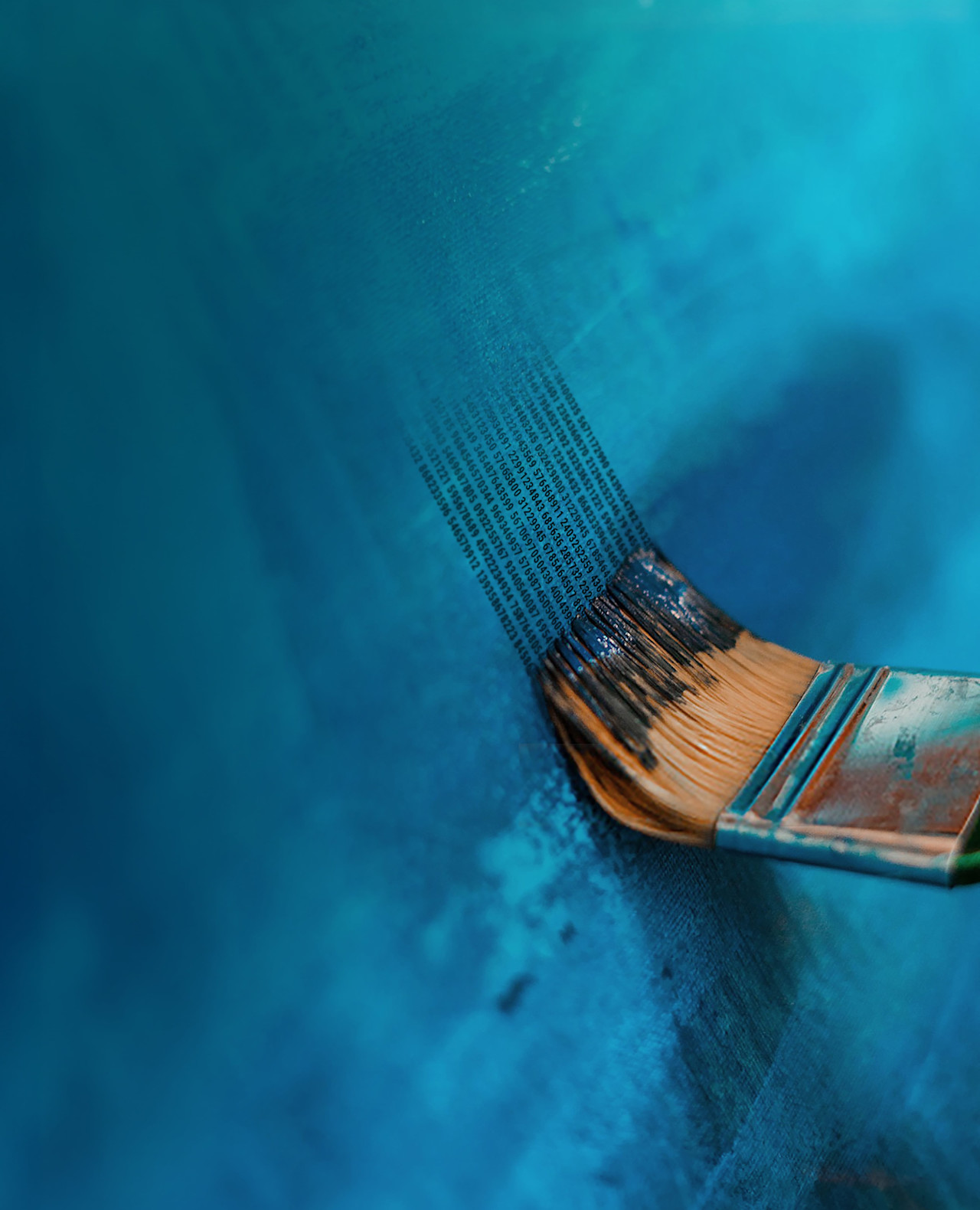

Harnessing the power of academic insights, evidence-based investing provides a rational approach to navigating the financial markets.

Behavioral finance delves into the psychological and sociological influences on investor behaviors and their market repercussions. A pivotal moment for factor investing emerged in 2009 when a research initiated by the Norwegian Government Pension Fund spotlighted investment performance. Institutions like Robeco champion the use of empirical evidence in uncovering the mysteries of factor premiums, bridging the gap between the academic world and practical investment strategies.