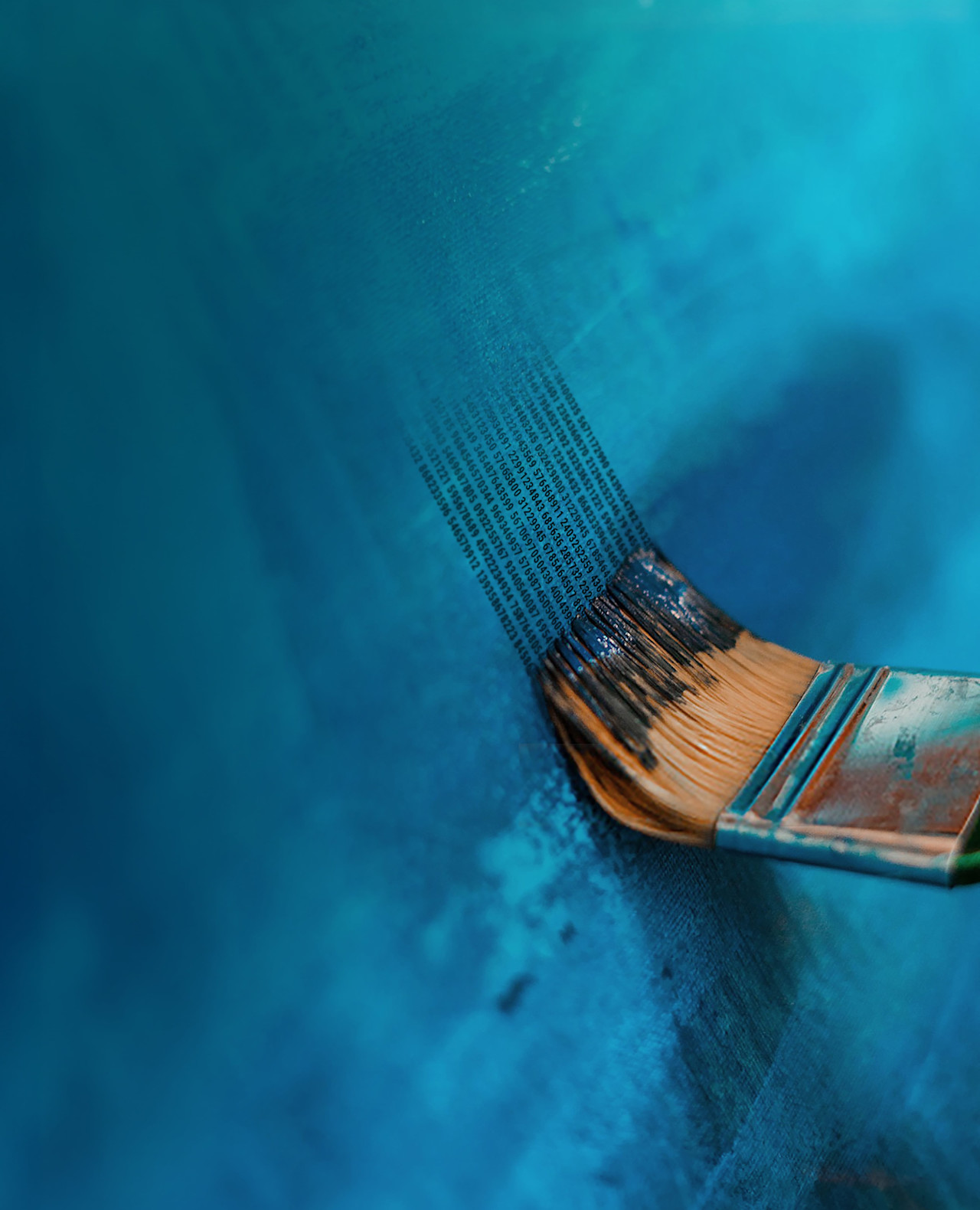

Quantitative investing

At the heart of factor investing lies the factor premium - the additional return investors gain by exposing themselves to specific risk factors.

While many attribute these premiums to compensation for risk, the realm of behavioral finance offers deeper explanations. Not all premiums arise from risk-taking. For instance, Robeco's research unveils that certain premiums emerge from other phenomena, highlighting the need for terms like 'factor premiums' over the traditional 'risk premiums'.

See also