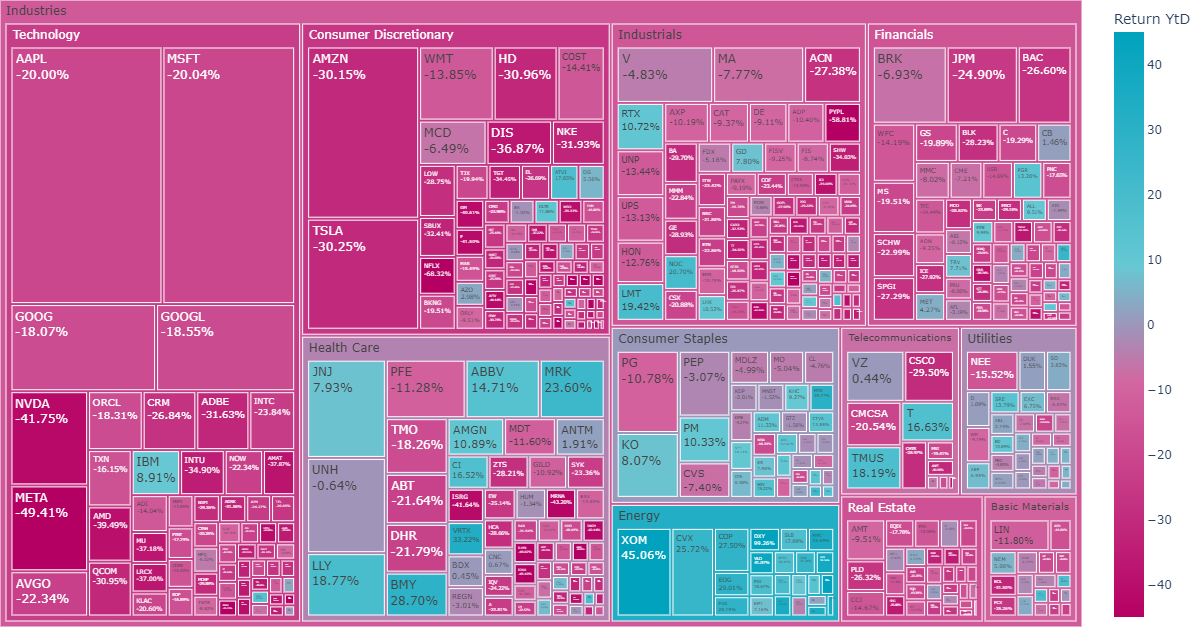

The S&P 500 Index officially entered a bear market in June after plunging more than 20% since the start of the year. While FAANG-type companies have led this pullback, several dozen stocks have emerged unscathed, posting positive double-digit returns. Oil producers and refiners account for most of the winners over this period, alongside some basic materials (fertilizers), consumer staples, healthcare (pharmaceuticals) and industrial (defense) stocks.

Figure 1 | Cornered by Big Oil

Source: Refinitiv, Robeco. The figure shows the year-to-date (YtD) performance of S&P 500 Index constituents categorized by industry classification benchmark (ICB) industries. The tile size represents the market capitalization. YtD performance and market capitalization are as at 27 June 2022.

Implications for fossil fuel-free indices

Earlier this year we touched on the implications of divesting from fossil fuel stocks and outlined how excluding these companies from a portfolio comes down to an active bet against the oil price. As oil prices generally weakened over the previous decade, this bet had a positive impact on the backtested performance of fossil fuel-free or Paris-aligned indices.1 But now that oil prices have risen sharply for the first time in over ten years, the live track records of these indices are suddenly being challenged. As expected, they have significantly lagged their parent indices year to date, with relative returns ranging between -1% and -4%.

Consequently, investors are now feeling the pain from ‘betting against oil’. The consolation, however, is that the expected long-term impact on returns from excluding fossil fuel companies appears to be neutral. This is because these stocks are typically neither outperformers nor underperformers over the long term. That said, oil prices tend to go through long cycles, with bull and bear markets potentially lasting up to ten years. In turn, this exposes fossil fuel-free portfolios to significant risk of underperformance in the short and medium term.

Footnote

1 For example, the S&P 500 Fossil Fuel Free Index and the MSCI World Climate Paris Aligned Index were launched on 28 August 2015 and 26 October 2020, respectively.