Monthly Outlook - Emerging markets debt: Coming of age

A weakening dollar and improving fundamentals are making emerging markets debt an attractive asset class in its own right, says fixed income specialist Meena Santhosh.

Summary

- Shift in US exceptionalism weighs on upward dollar strength

- Emerging markets bonds are now a USD 8 trillion asset class

- Picking winners, avoiding losers vital for navigating EMD portfolios

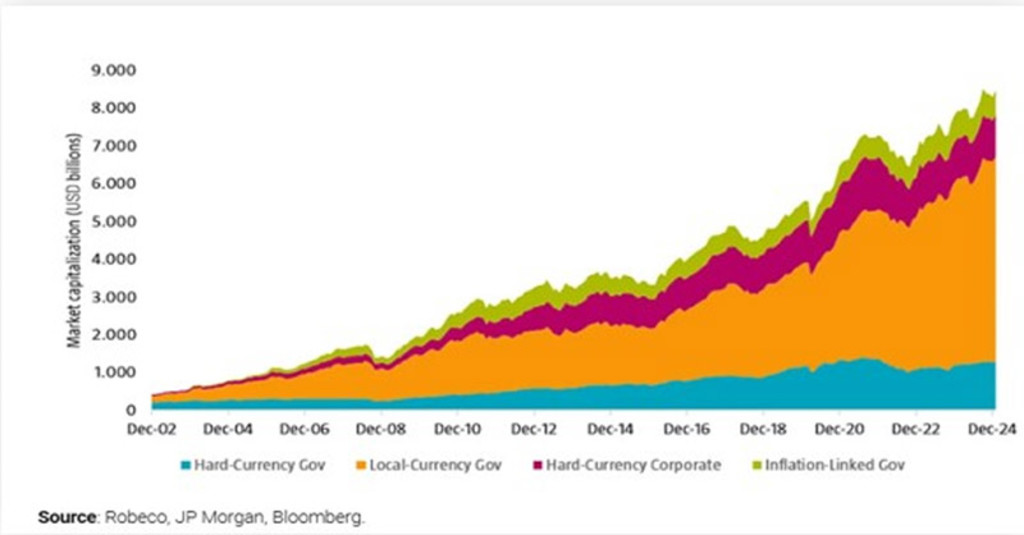

Once seen as a niche area due to the instability of some developing nations, bonds issued by countries and companies across Asia, Africa and Latin America now have a market value of more than USD 8 trillion.

And now a potential weakening of the US dollar due to uncertain trade policy, the introduction of a universal tariff level, and the threat of additional tariffs from President Trump are set to benefit emerging markets, many of which are exporters of commodities. This boosts their revenue when sales in dollars are converted into the local currency.

US exceptionalism

“The US dollar currently stands at its strongest level since the 1980s when adjusting for inflation differentials,” says Santhosh, Client Portfolio Manager with the Robeco fixed income investment team. “Now, US policy uncertainty and a shift in US exceptionalism as seen with Trump 2.0 are weighing on that long-standing upward dollar trend.”

“This policy unpredictability and trade war uncertainty, combined with progressive changes in Europe’s fiscal and defense policies, creates scope for reallocations away from the US that could start to dampen the two-decade-long USD bull market.”

“EMD has had a difficult performance over the past 15 years, but that weakness has primarily been a function of dollar strength, rather than overall emerging market weakness. This may be set to change.”

“Emerging markets have strong potential to benefit from this, particularly the commodity-linked regions, while also providing strong growth prospects for those countries in Central Europe, the Middle East and Africa (CEEMEA) that are integrated into Europe’s industrial supply chains.”

The EMD universe has grown enormously in the past two decades

Source: Robeco, JP Morgan, Bloomberg

Post-pandemic aftermath

The EMD asset class was badly hit by both the Covid pandemic and Russia’s invasion of Ukraine that badly disrupted supply chains and led some countries to default on their sovereign debt repayments. This brought a high number of bond rating downgrades.

“Many of these countries that went into debt distress on the back of these shocks, along with countries that have also faced persistent headwinds more broadly such as Argentina, have since had restructurings finalized, and in some cases, fully resolved,” says Santhosh.

“Emerging market fundamentals are now back on improving trajectories as economic growth has recovered, national reserves have been rebuilt, and countries have worked with the IMF to improve their fundamentals. This is reflected in the ratings trend, which is now showing strong net upgrades.”

“Spreads – the difference between the yield on EMD and that of top-rated developed market government bonds – are trending tighter as a reflection of a more stable and robust asset class. This is paving the way for a healthier overall outlook for the emerging market landscape going forward.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Picking winners, avoiding losers

Any future imposition of US tariffs will lead to asymmetric effects across different industries and sectors in both cost and supply chains. Emerging markets are leading producers of commodities ranging from palm oil and rice, to oil, precious metals and timber. Manufactured goods range from textiles and cars to chemicals and higher-tech semiconductors, all of which have attracted tariffs.

“A reliance on emerging market exports of manufactured goods to the US can become much more of a vulnerability compared to commodities,” Santhosh says. “Commodity exports might be less affected as they are harder to replace domestically, and generally are less subject to end-market industrial policy.”

“Generally, those emerging market companies that do export manufactured goods are more developed than the commodities exporters, and so their bonds trade at tighter spreads, which makes them relatively more stable.”

Alpha opportunities in EMD

“Over the last 10 years, a large proportion of active managers outperformed the passive products such as Exchange-Traded Funds (ETFs) after fees within EMD,” adds Colin Graham, co-head of Robeco Investment Solutions. “So there is definitely a stronger case for deploying active management in the EMD space, versus asset classes at the other end of the spectrum such as US equity.”

“Some countries are also less likely to be affected by tariffs or a future trade war, or have more bargaining power to get around them,” Santhosh says. “This makes it important to be more selective when choosing which emerging market bonds to buy.”

“It remains a case-by-case analysis, given that some countries, including Mexico, may be more likely to be able to reach agreements with the US compared with geopolitical rivals such as China.”

An expansive EMD universe

The EMD asset class has grown over the past two decades, reaching a market capitalization above USD 8 trillion at the end of 2024. This now represents about 11% of the global bond market, with debt issued in local currency rather than hard currencies such as the dollar leading its growth.

“Many large countries, such as Brazil, China and India have been able to issue government debt in their own local currency, meaning they no longer rely solely on the narrower market for hard-currency funding,” Santhosh says.

“Compared to conventional asset classes that make up most of a global multi-asset market portfolio, the average returns of hard-currency EMD can provide higher additive returns and diversification from other high yielding assets alongside a multi-asset portfolio,” Graham adds.

“Our research has shown that on a historical basis, a mix of EMD and high yield tends to offer a more stable overall excess return profile, especially when accounting for performance differences over time between local and hard-currency debt. This perhaps makes the case for EMD to be considered more seriously as part of the long-term strategic asset allocation for balanced multi-asset portfolios.”