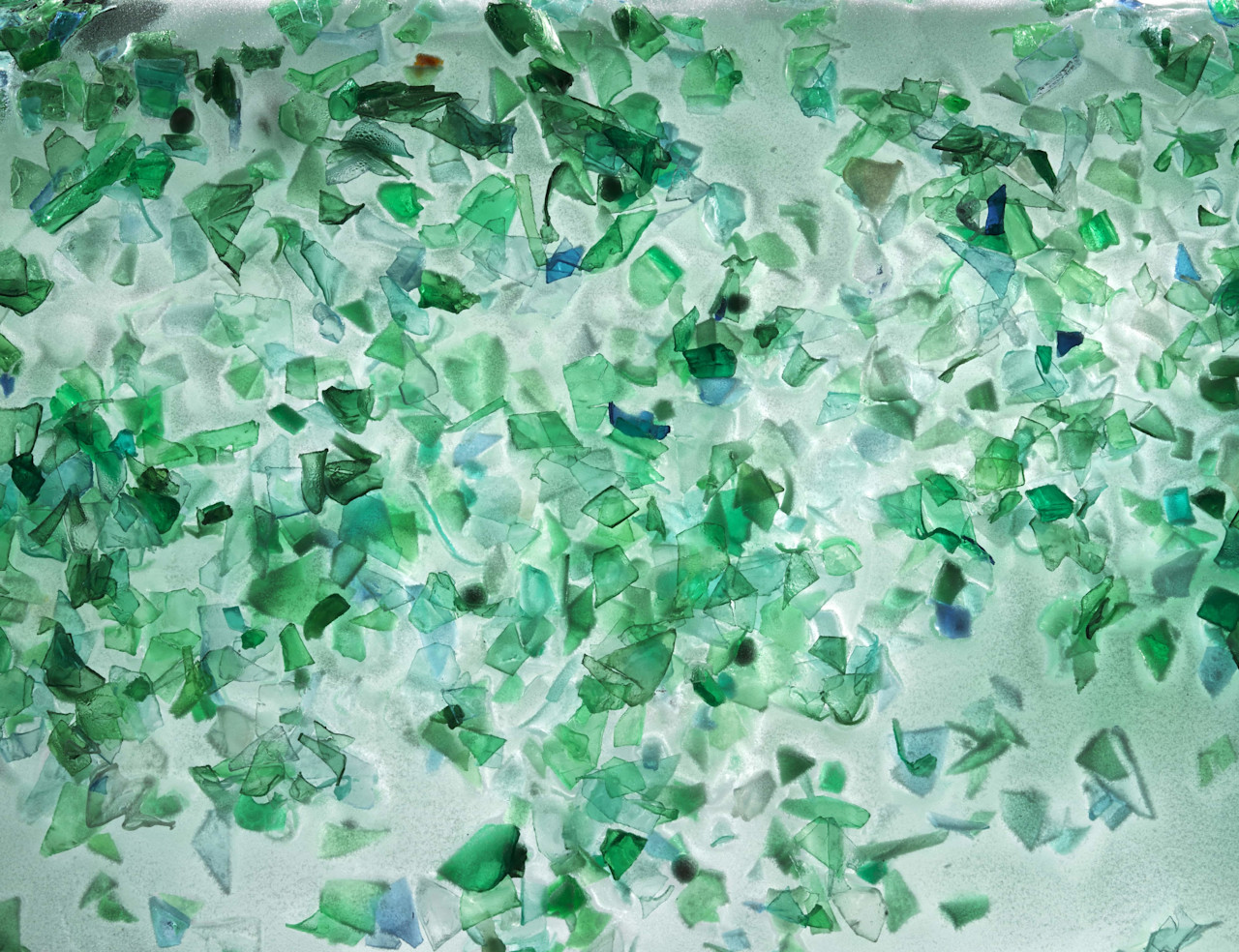

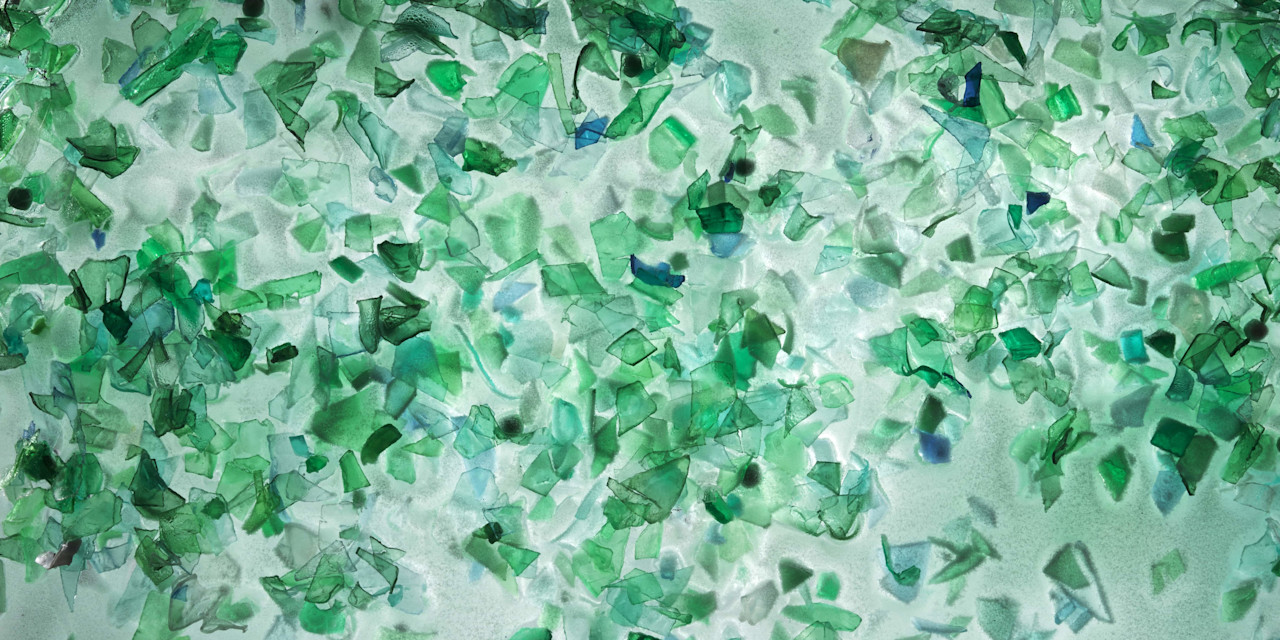

% of used materials recycled globally

Recycling at the end of a product’s lifecycle is not enough. Making a dent in resource destruction on the front end and waste on the back end requires a complete overhaul of manufacturing and production chains. Circular solutions extend product life and also reincarnate resources for reuse.

- 8.6

- 3

the number of Earth’s resources we are expected to consume by 2050

- 4.5

USD trillion, additional GDP growth by shifting to a circular economy

Why invest in circular economy?

The linear “take, make, dispose” economy is depleting natural resources and generating waste at an unprecedented pace. As populations grow, cities expand and living standards increase around the globe, resources are becoming even scarcer, and waste generation is intensifying. Without change, by 2050, society will need the equivalent of three planet Earths to sustain our rates of consumption. In contrast to linear production, circular solutions focus on maximizing product lifespans and resource efficiency.

The strategy

The Circular Economy strategy invests in enablers and champions of the circular economy. Circular enablers are companies that provide the tools that “enable” other companies to become more circular. Circular champions are those that are leaders in implementing circular practices within their own operations. Both enablers and champions have a natural place in a circular world.

Circular enablers include repair & maintenance organizations (MROs) and predictive maintenance solutions to help firms avoid costly breakdowns, extend equipment life, and reduce unnecessary replacements. Simulation software and digital tools help design product prototypes and optimize product features and manufacturing using fewer physical and more sustainable resources. Moreover, the power of AI and IoT is expanding the opportunity set even further by using embedded sensors in smart buildings, smart cities and smart factories to dynamically monitor and optimize resource use while reducing emissions and waste. They also help companies to cut logistical inefficiencies across entire value chains.

Renewable feedstock, recyclable and even bio-degradable input materials significantly reduce the environmental impact of products. While end-of-life solutions such as recycling and recirculating materials are important; a truly circular economy requires a holistic approach that tackles waste at every stage of the value chain.

Circular solutions are not just a nice-to-have but a need-to-have to sustainably grow economies and portfolios.

Celebrating five years of investing for healthy returns and a healthy planet

The Circular Economy strategy is coming full circle

This video isn't available to you because you have not accepted our advertising cookies yet. If you accept them, then you'll be able to view all content: