USD billion, the market size of minerals needed for the energy transition (in 2023)

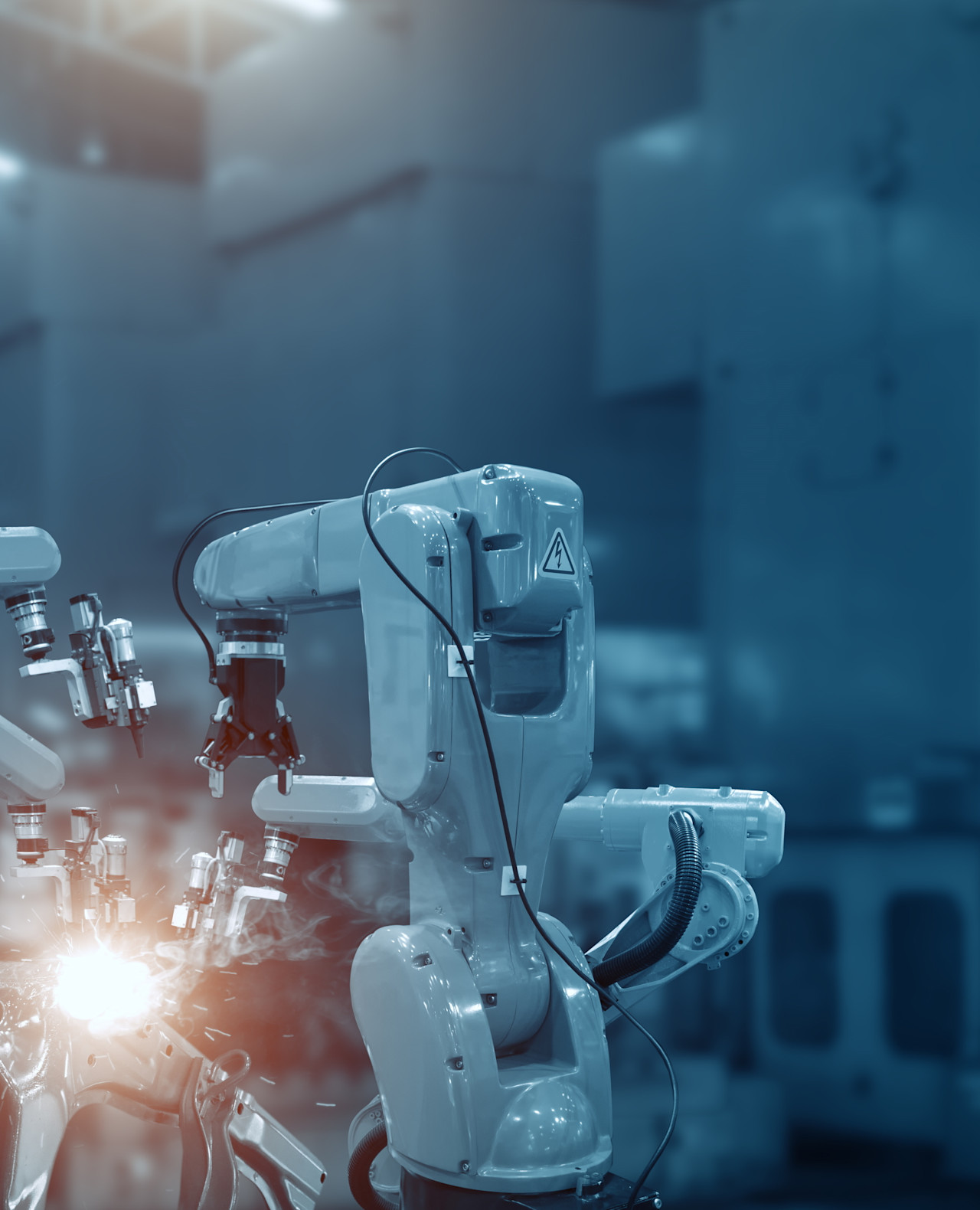

Growing populations and expanding industries are consuming more finite resources, generating more waste, and increasing emissions. Meanwhile, trade tensions and labor scarcity are driving factory reshoring, robotics, and automation trends. The Smart Materials strategy helps industries overcome these challenges so they can enhance output with less input and pollution.

- 325

- 30

million, expected shortage of manufacturing workers by 2025

- 137

USD billion, expected spending on semiconductor equipment in 2027

Why invest in smart materials?

Innovative materials involve specialized engineering to create new and better materials that reduce resource strain, energy use, and emissions. Beyond materials, smart manufacturing applies digital solutions to support high-tech developments that enhance manufacturing efficiency, reduce waste and improve product quality.

Critical minerals as tech enablers

This video isn't available to you because you have not accepted our advertising cookies yet. If you accept them, then you'll be able to view all content:

The strategy

The Smart Materials strategy invests in companies creating the building blocks that enable other emission-intensive sectors to become cleaner and leaner. These include lithium, batteries, and other energy-storage solutions needed to transition energy and transportation markets.

Similarly, it’s investing in suppliers of innovative building materials that enhance insulation and overall energy efficiency as well as industrial gases that lighten the environmental footprint across many hard-to-abate manufacturing processes. The strategy also invests in biobased materials that help reduce the consumption of traditional feedstock, lower industrial emissions, and create less environmental pollution when disposed. For the same reason, end-of-life recycling of materials is also a critical investment channel.

In addition, the Smart Materials strategy invests in CAD- and PLM-simulation software, robotics, and automation technologies to optimize product design, increase productivity and reduce waste and disruption along the entire manufacturing value chain.

Smart Materials has the right stuff to capture game-changing innovation for your portfolio.