• Insight

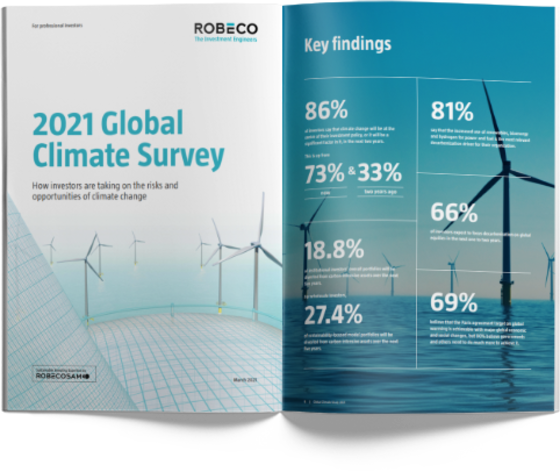

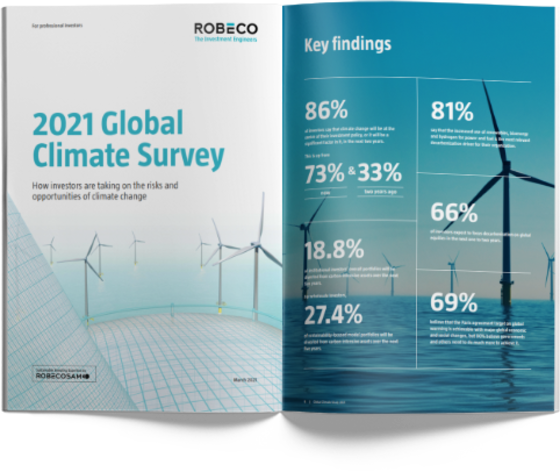

Global Climate Investing Survey 2021

Tackling climate change has become the number one priority for investors. But how is the asset management industry dealing with an issue that is both a threat and an opportunity? Are we ready for the biggest challenge facing humanity?

Summary

- 86% see climate change affecting their investment policy

- 81% see renewable energy leading decarbonization drive

- 66% will focus decarbonization on global equities in 1-2 years

To find out, Robeco commissioned a survey that asked probing questions to more than 300 institutional, wholesale and insurance investors accounting for about 20% of global assets. The results have been both encouraging and an indication that much still needs to be done.

Perhaps the biggest signal from those surveyed is that half of all assets under management will be committed to net zero in the coming years. Some 86% of investors saw climate change as a significant factor in their investment policy over the next two years, sending a massive message that decarbonization is well under way.

Most believe that renewable energy forms part of the solution: 81% said solar, wind and hydrogen power would lead the way in switching from fossil fuels. And 66% said they would focus portfolio decarbonization efforts on global equities as their preferred asset class for achieving this over the next one to two years.

But the results showed there is also a substantial knowledge gap when it comes to fully understanding the major issues, and many investors simply don’t knowing where to start with this, or how to make a difference.

The overall purpose of this survey is to show where we are as an industry and help investors understand the urgency of dealing with this. We hope it presents interesting insights into the current status of climate investing, as well as the challenges and opportunities that climate change presents.

Download the Global Climate Investing Survey report 2021

Global Climate Investing Survey 2024

Realism on the transition journey

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.