Three reasons to move from cash to investment grade credit

As flows typically follow returns, we are now starting to see investors moving out of cash and into credits. This raises the question: Is this a smart move, or is cash still king in the current environment?

Summary

- Better return potential

- Investment grade credit stands up in recessionary environments

- Greater diversification of risk exposure

This time last year many market participants were arguing that 2023 would be a great year for bonds. Instead, interest rates continued to rise for most of the year and flows into bond markets turned out to be surprisingly modest. In fact, 2023 turned out to be the year of cash; we saw record inflows in money market funds and short-dated treasuries as investors were able to achieve 4-5% returns without any credit or duration risk.

However, at the end of 2023 and into the early stages of this year we have observed the strong performance of bond markets as bond yields came down, reflecting that markets were embracing the soft-landing scenario for the US economy, i.e. a scenario of lower but not negative growth with inflation cooling significantly.

Last year the global investment grade credit1market delivered a total return of 9.1% (USD hedged) and 6.5% (EUR hedged) and global high yield delivered a total return of 13.8% (USD hedged) and 11.2% (EUR hedged). This highlights the attractive return potential of credit markets compared to money markets which delivered 5.2% (USD) and 3.3% (EUR) over the same period.

We believe that investment grade credit and cross-over credit (BB-rated credit) offer a compelling alternative to cash in the current environment for three reasons.

1) Investment grade and BB-rated credit offer better return potential

First, investment grade and BB-rated credit offer an attractive yield pick-up over cash, especially in an environment where we expect central banks to stop hiking and eventually start easing rates. Additionally, this approach protects investors against future rate cuts by central banks, which would immediately reduce the return on money market investments. Within the high-quality credit space, the return prospects, particularly for short-dated credit, look increasingly attractive as investors can lock in higher yields than cash for the next 12 months with limited interest rate or spread risk.

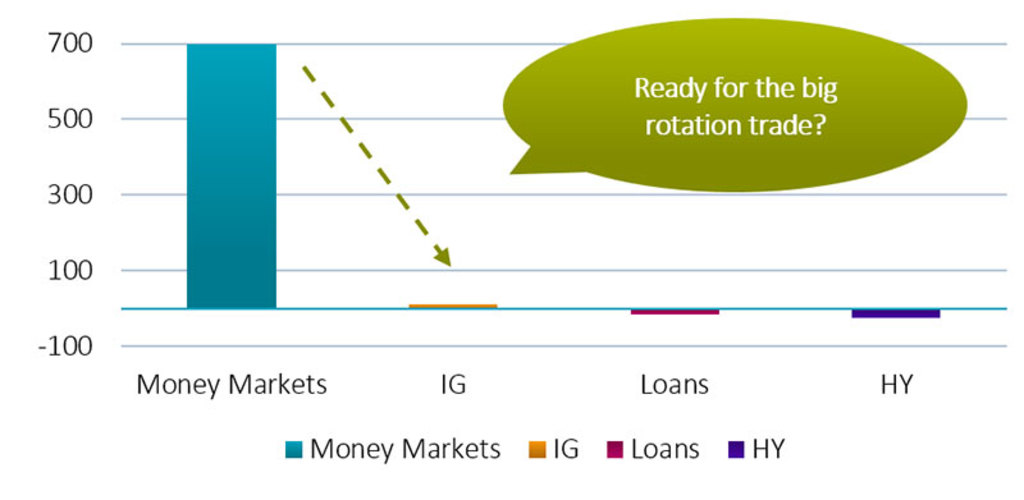

Figure 1 – Flows have started rotating from money markets

Source: Bloomberg, Morgan Stanley Research. Cumulative flows 2023 YTD (USD bn)

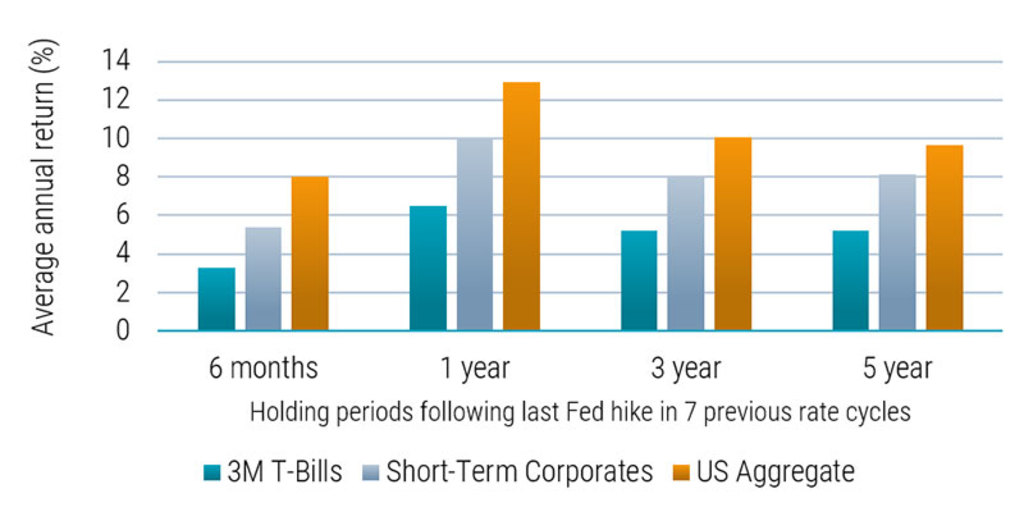

Money market funds and short-dated short term government bonds have been viewed as a lucrative place to park cash with yields north of 4%. Yet history has shown that these instruments have not been the best place to be when central banks eventually pivot to policy easing. This is illustrated in Figure 2 below which compares the performance of short-dated corporates with money market investments and longer dated aggregated bonds in periods following the last rate hike by the Fed.

Investors can lock in higher yields than cash for the next 12 months

On average, short-term corporates outperformed money markets by an average 300 bps over different investment horizons (holding periods). Longer duration bonds (US Aggregate) delivered higher returns, however, they come with increased duration risk, meaning that longer duration bonds would be more impacted if we continue to see interest volatility.

Our research2 has also indicated that shorter-maturity credits have a substantially lower credit return volatility compared to longer-maturity credits, and as a result, offer a higher risk-adjusted return. History also shows that cash is an attractive place to be when the Fed begins to raise rates, but once the central bank stops rate hikes, or begins to cut rates, investors are forced to reinvest proceeds of matured bonds at lower and lower rates. See our paper on short duration credits for more detail.

Figure 2 – Short dated bonds have historically outperformed cash

Source: Robeco, Bloomberg, September 2023

2) Investment grade credit stands up in recessionary environments

Second, investment grade and BB-rated companies should be able to perform well in a recession. We think that markets are too optimistic and that the probability of a recession is higher than markets are currently pricing in. As discussed in our recent credit quarterly outlook, history has shown that rate hiking cycles by central banks almost always lead to a recession, with the most recent exception being the 1990s. However, even in a recessionary environment with mild negative growth, investment grade credit and cross-over credit (BB-rated credit) offer a compelling alternative to cash.

There are parts of the credit market that are more vulnerable if the economy goes into a recession. Nevertheless, investment grade and BB-rated companies will continue to do well even in an environment of moderate negative growth. These companies have been more conservative with their debt levels and therefore are able to weather the negative impact of a recession on their profitability. Additionally, high interest rates will be manageable for these companies as they also typically have more longer-term debt outstanding, meaning there is no short-term risk of having to refinance at higher rates.

These companies have been more conservative with their debt levels

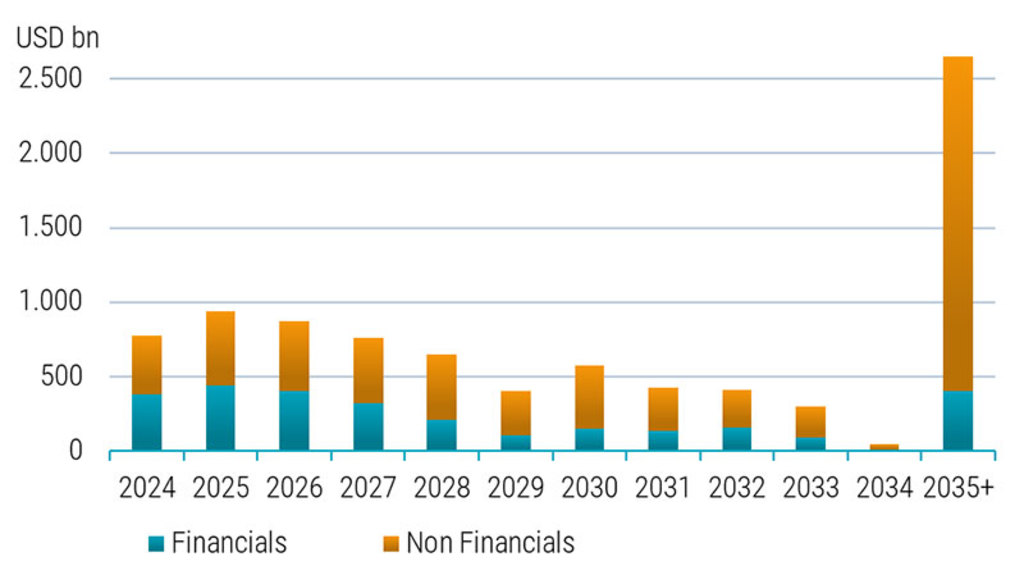

This is also visible in Figure 3 below which shows the outstanding debt for US investment grade companies (financials and corporates). A large part of the outstanding maturities is for the year 2035 or beyond, so a significant part of the outstanding debt for investment grade companies only needs to be refinanced after ten years or beyond. Therefore, these companies will not see higher rates translated into higher interest rate costs any time soon.

This is a very different scenario for lower rated (CCC) high yield companies where in the next four years, more than 50% of outstanding debt will need to be refinanced. These companies will most likely face a significant increase in their interest rate expenses at a time when the economy is slowing down. In this space of the credit market we expect negative credit events as these companies will need to refinance their debt at much higher rates. Consequently, this is a part of the market we want to avoid in the current phase of the credit cycle.

Figure 3 - Refinancing risk is not a concern for investment grade companies

Source: BofA Global Research. USD bn equivalents

3) Better diversification of risks

The third reason we encourage investors to move from cash to investment grade and cross-over credit is that it allows for better diversification of issuer risk. Typically, money market investments comprise more concentrated holdings in a small number of issuers or counterparties. While these issuers are of high credit quality, there can be significant exposure to only a few issuers. Investing in high quality investment grade and BB-rated credits allows for more diversification across issuers. For example in our Global Credits – Short Maturity strategy we invest in more than 130 different companies across the global investment grade credit market.

Investing in credit markets is about avoiding the losers

Furthermore, we would not advocate a passive approach to investing in credits as this exposes investors to potentially lower quality companies with a higher risk of default. Investing in credit markets is about avoiding the losers through active management and fundamental bottom-up research. As discussed in our recent podcast, this will be key in the current environment.

We think investing in high quality credits is a smart move in today’s dynamic market environment. Not only does it offer investors an alternative to cash and short-dated government bonds, but as we approach the end of one of the most aggressive rate hiking cycles by central banks, investors can capitalize on opportunities and mitigate risks.

Footnotes

1 Indices quotes are the Bloomberg Global Aggregate Corporate Index (EUR hedged and USD hedged), Bloomberg US Corporate High Yield + Pan Euro HY ex Financials 2.5% Issuer Cap. (EUR hedged and USD hedged). Money Market: ICE BofA ESTR Overnight Rate Index (EUR) and ICE BofA SOFR Overnight Rate Index (USD)

2 Houweling, Van Vliet, Wang & Beekhuizen, 2015, ‘The Low-Risk Effect in Corporate Bonds’

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.