Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Demand for green bonds has grown spectacularly, reflecting investors’ ambitious climate policies. But can investors accommodate green bonds in their portfolios without causing a shift in risk-return profiles?

Many institutional investors have stated ambitious climate policies for their investment portfolios. Financing the energy transition through investments in green bonds is one of the many routes that investors can take towards the path to net zero. And, indeed, investors’ appetite for these assets is reflected in the tremendous growth in the green bond market in recent years.

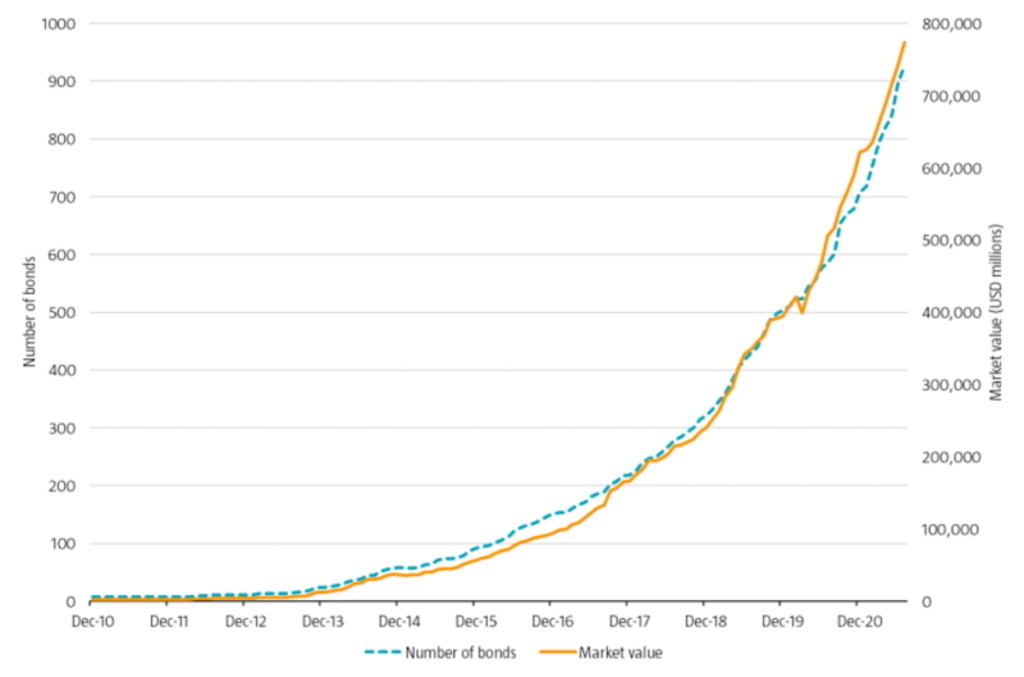

The Green Bond Principles were created in January 2014. At the launch of the green bond index that year in October, the number of qualifying bonds was 55, totaling USD 36 billion in market value. The market has since taken off and has been accelerating in recent years. There were 503 bonds in the index at the end of 2019, increasing to 707 a year later. The market value increased from USD 395 billion to USD 622 billion over the same year.

Despite this rapid growth, green bonds currently account for less than 1% of the global investment grade fixed income market.

Source: ICE BofA Green Bond Index. Index code: GREN. Sample period: 31 December 2010 to 31 July 2021.

In practice, incorporating a growing allocation to green bonds calls for careful portfolio oversight as it could lead to an alteration in the risk and return characteristics of an existing fixed income portfolio.

We researched which fixed income assets investors should sell in order to have the least impact on the risk-return profile of their portfolio (read the academic paper here). Our results robustly indicate that investors should see the current green bond market as a global aggregate portfolio with additional tilts to Eurozone assets and corporate bonds. This is therefore the profile of assets that investors should aim to replace when adding green bonds to a portfolio; such an approach would serve to keep the risk-return profile of the portfolio intact, while substantially improving its sustainability attributes.

Subscribe to our newsletter for investment updates and expert analysis.

Green bonds are a relatively new financial instrument that may facilitate the energy transition. These instruments can be issued by governments, supranational and government-related institutions or corporate entities. The issuance of green bonds is typically tied to specific green projects designed to avoid or reduce climate change, such as renewable energy projects that facilitate the energy transition away from fossil fuels.

A research question that has not yet been addressed in the academic literature on green bonds is the place of green bond investments in an overall fixed income portfolio. This research question is challenging for two reasons.

Firstly, since the market has seen a rapid development over the past years, historical data may not be representative for future risk and return characteristics. Secondly, the green bond market has different characteristics from a typical fixed income benchmark, as it has a different credit rating, currency, sector, and maturity composition.

Our empirical analysis shows that the green bond market is predominantly a market with bond issues denominated in euro and with less credit risk than a corporate bond portfolio. The sector composition is also tilted to government-related securities and includes emerging markets issuers.

An analysis of the data shows that returns data for green bonds going back to 2010 may not be representative for the future. The number of green bonds was limited in the early days, making idiosyncratic risk much more important in the early part of the sample period. In addition, the composition on the dimensions rating, currency, sector and maturity has changed considerably over time. Using returns data prior to the launch date of the green bonds index in October 2014 is therefore unlikely to help to better understand future risk and return of green bonds.

Using the data from 2014 onwards, we find that a green bond allocation strongly resembles a global aggregate bond portfolio, with a tilt to corporate bonds and euro-denominated assets. While investors could expand existing government bond mandates to now also include green government and government-related bonds, and expand existing corporate bond mandates to also include green corporate bonds, an alternative would be to allocate to a separate green bond strategy run by a specialized manager. The advantage of the latter may be that the investor can better monitor and control the amount invested in green bonds, which may be an important element of its sustainability goals.

Such investors should finance the green bond allocation by selling their aggregate investment grade fixed income portfolio, rather than only government or only corporate bonds. This way, the risk-return profile of the portfolio would be least affected, while the sustainability of their portfolio would be improved by contributing to the energy transition.