Restez informé des derniers développements en matière de durabilité

Abonnez-vous à notre newsletter pour découvrir les tendances qui façonnent l'investissement durable (ID).

Green bond issuance in the region has grown enormously. But the absence of harmonized ESG standards and taxonomies could become an obstacle to further growth.

The Asia-Pacific (APAC) green bond market has boomed in recent years, becoming the second-largest market after Europe and ahead of North America.1 Rising green bond issuance in the APAC region reflects the global trend toward ESG investing, but the momentum is especially strong in Asia. This boom is the result of the sense of urgency in the global political context on climate change mitigation, as well as the willingness in Asia to take a leadership role in the field of sustainable investing. While the strong growth in the market is positive, harmonization of green bond standards in the region will be critical in maintaining this momentum.

Abonnez-vous à notre newsletter pour découvrir les tendances qui façonnent l'investissement durable (ID).

The APAC economy is well suited to an expansion in green bonds. Its global leadership in electric vehicle, battery and renewable energy manufacturing makes it a positive environment for green bond issuance.

The growing support for the global climate agenda has also contributed to the burgeoning of the APAC green bond market. Since COP21 in 2016, most Asian countries have rolled out climate measures to help put them on a path towards a +1.5 °C world. Even though China was relatively late in announcing its 2060 carbon neutrality target, its robust top-down policy had in the meantime functioned as a massive leverage for the green bond market in the region.

Climate-related developments and regulation in other markets have also contributed to the expansion of the APAC green bond market. A key example can be found in EU regulation such as the Sustainable Finance Disclosure Regulation (SFDR), the EU’s proposal for a directive on corporate sustainability due diligence and the emissions trading scheme (ETS), which have indirectly put a new ‘green’ burden on Asian financials and corporates, who would need to comply with EU standards in order to maintain business ties with its member states. One way for Asia to align with the global transition trend is by enhancing its ESG disclosure and greening its capex through green bonds.

The green bond market aims at making a clear distinction between green and non-green projects. Today, taxonomies are widely recognized as the best instruments to distinguish genuine green projects from those that do not comply with science-based targets. While the EU has taken a big step forward with its EU Green Taxonomy, many Asian states like China, Japan, Singapore, South Korea, Malaysia and Thailand, have developed great initiatives to establish their own green taxonomies.

The increasing number of taxonomies does, however, create difficulties for green bond issuers and investors that now have to deal with conflicting standards. As European issuers are struggle to align with the EU Taxonomy, Asian issuers are in the meantime inclining towards the Chinese Catalogue or their own national classification. It may become a substantial concern for Asian as well as European issuers in future, as the definition of a green project may differ across regions.

In the context of mushrooming taxonomies that challenge the unification of the green bond market, the Common Ground Taxonomy (CGT) represents a glimmer of hope. The CGT was published during COP26 and resulted from the merger of the EU and Chinese taxonomies. While it is still at an early stage, it may become the standard in Asia. Hong Kong, for example, aims to align its own green taxonomy – which is under development – with the CGT, and may become a central hub for Chinese as well as European green bond investors as a result.

The development of taxonomies has raised the interest of investors in the Asian green bond market, and may have boosted its expansion. But the market can only consolidate properly if ESG disclosure is standardized. Disclosure by corporates and financials of reliable and comparable ESG data will determine the quality of green bonds, which is where Asia still lacks maturity. The vast majority of APAC countries have not yet set mandatory ESG disclosure requirements, making it difficult to compare issuers, and preventing bond investors from making well-informed decisions. But some countries are catching up with international standards.

China’s first Guidance for Enterprise ESG Disclosure was enacted in June 2022. These voluntary guidelines offer a glimpse of what to expect from future mandatory Chinese disclosure. China has emphasized its desire to synchronize its standards with the forthcoming global ESG standards from the International Sustainability Standards Board (ISSB). These steps mark the beginning of Chinese dominance within APAC on ESG-related matters.

At the same time, this reinforces the quality of its green bond issuers and highlights its growing appetite for the green bond market. ASEAN states are doing their homework and are also on the right path to implementing strict ESG disclosure requirements. Singapore, Hong Kong and Malaysia have recently turned the TCFD disclosure recommendations into a mandatory requirement. And Japan and Taiwan have implemented mandatory sustainability reporting. This momentum for ESG disclosure puts Asia in a very good position in the global race towards ESG and green bonds best practices.

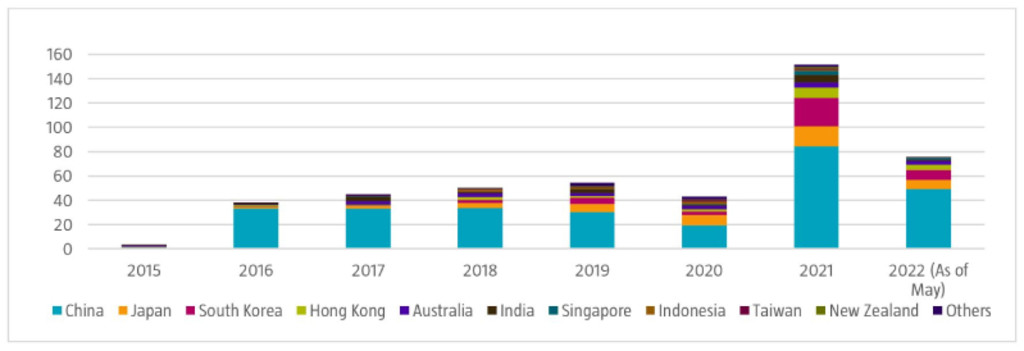

In 2021, APAC became the second most prolific green bonds market, reaching USD 390.44 billion in outstanding value by year end.2 With an additional USD 151.76 billion of green debt in 2021, the market expanded by 3.5 times compared to its 2020 volume. China leads the field, followed in joint second place by Japan and South Korea; see Figure 1. The top three largest issuing countries originated 81.6% of the total green bond market volume.

Source: BloombergNEF

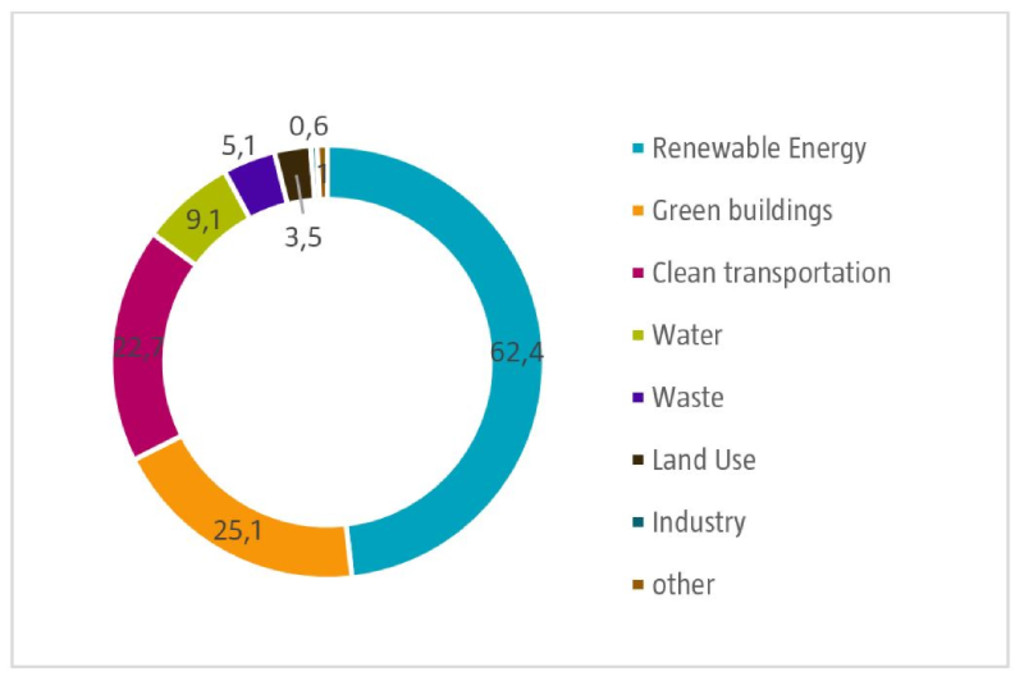

Representing only 8% of the volume, sovereigns remain quite shy in green bond issuance compared to corporates. Figure 2 shows that energy, green buildings and clean transportation are the three largest sectors benefiting from green bond proceeds, and represent the vast majority of the total volume of outstanding green bonds in 2021.

Source: Climate bond initiative (website public data)

With China in the lead and other countries in the region keen to participate in the powerful drive towards sustainability, the APAC green bond market is thriving. APAC’s position on the global green bond market may even be a means for the region to show its leadership in a new financial system in which ESG is fully integrated.

The region’s developing taxonomies and growing interests in ESG disclosure send very positive signals. But to establish its leadership, the APAC market would need to standardize its sustainability standards to create coherence among its participants. Our view is that, with the prospect of further improvement and growth, the APAC green bond market now represents an attractive investment opportunity.

1 This article is based on a more detailed paper, entitled Time for the APAC green bond market to step up to the challenge”, July 2022 We wish to thank Bertille Cormery, Green Bonds Intern, for her valuable work and contributions to the paper.

2 BloombergNEF