Disclaimer

BY CLICKING ON “I AGREE”, I DECLARE I AM A WHOLESALE CLIENT AS DEFINED IN THE CORPORATIONS ACT 2001.

What is a Wholesale Client?

A person or entity is a “wholesale client” if they satisfy the requirements of section 761G of the Corporations Act.

This commonly includes a person or entity:

who holds an Australian Financial Services License

who has or controls at least $10 million (and may include funds held by an associate or under a trust that the person manages)

that is a body regulated by APRA other than a trustee of:

(i) a superannuation fund;

(ii) an approved deposit fund;

(iii) a pooled superannuation trust; or

(iv) a public sector superannuation scheme.

within the meaning of the Superannuation Industry (Supervision) Act 1993that is a body registered under the Financial Corporations Act 1974.

that is a trustee of:

(i) a superannuation fund; or

(ii) an approved deposit fund; or

(iii) a pooled superannuation trust; or

(iv) a public sector superannuation scheme

within the meaning of the Superannuation Industry (Supervision) Act 1993 and the fund, trust or scheme has net assets of at least $10 million.that is a listed entity or a related body corporate of a listed entity

that is an exempt public authority

that is a body corporate, or an unincorporated body, that:

(i) carries on a business of investment in financial products, interests in land or other investments; and

(ii) for those purposes, invests funds received (directly or indirectly) following an offer or invitation to the public, within the meaning of section 82 of the Corporations Act 2001, the terms of which provided for the funds subscribed to be invested for those purposes.that is a foreign entity which, if established or incorporated in Australia, would be covered by one of the preceding paragraphs.

Quantitative investing

Momentum factor

Stocks tend to maintain recent price trends in the future, and the momentum strategy takes advantage of this phenomenon. When using a momentum strategy, it is important to be aware of the risk of trend reversals and of how that risk can be mitigated.

The momentum premium is one of the largest factor premiums, but it is hard to capture because of two practical problems. First, a substantial drawdown can occur if there is a trend break like a market reversal, as the strategy will select equities with high market sensitivity in a bull market. Second, the group of stocks with the strongest trends changes all the time, causing high turnover in the portfolio. The transaction costs that this turnover generates eat into the momentum premium.

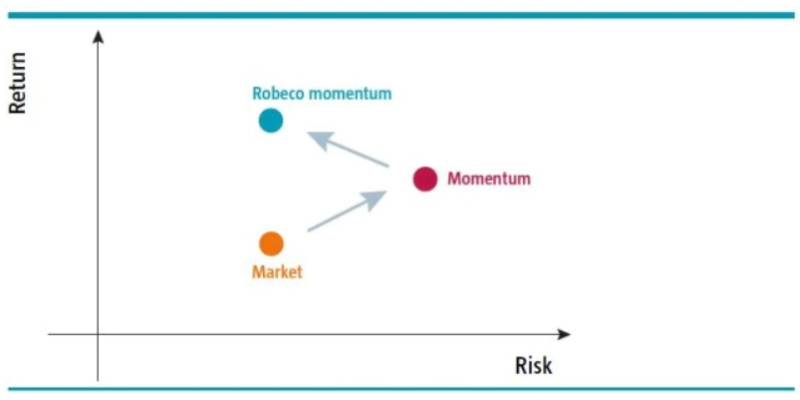

Figure: Improved risk-return ratio with Robeco's Momentum factor approach

Source: Robeco, Quantitative Research, 2014.

Invisible layers surface to deliver attractive returns

Unlike ‘traditional’ momentum based on total returns, Robeco calculates ‘residual’ momentum, adjusted for market risk in particular. This avoids the unrewarded risks of a traditional momentum strategy. Furthermore, smart portfolio construction rules ensure only necessary trades are done and transaction costs are minimised.