Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

After more than a year following the short squeeze in so-called meme stocks, the informational advantage of short-selling data resurfaces.

It is well documented that short-selling information has predictive power for future stock returns that goes beyond established factors such as low-risk, momentum, quality and value.1 However, the risk of short selling (for example, in the form of a short squeeze) and high lending fees have cast doubt on the risk-adjusted net profitability of shorting individual stocks.

That said, short-selling information can also be used in long-only applications by either (i) investing in the least shorted stocks, (ii) underweighting the most shorted stocks, or (iii) discriminating between similarly attractive low-risk, momentum, quality or value stocks.

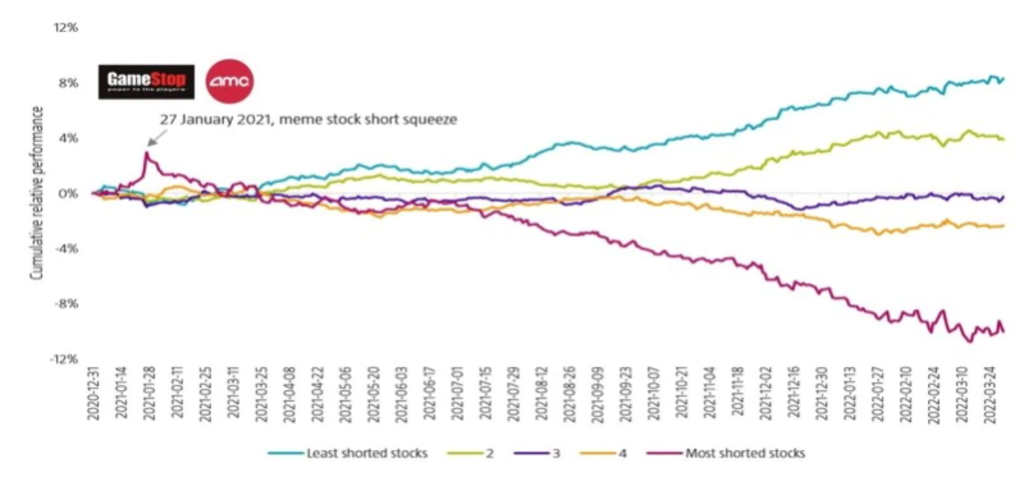

In January 2021, however, the Reddit-fueled retail trading frenzy in highly-shorted ‘meme stocks’ such as GameStop and AMC Entertainment Holdings2 called into question the validity of the informational advantage gained from short-selling data. So did these events of January 2021 constitute a short-term phenomenon, or did they mark the end of an investment signal that had been successful for a long time?

Source: Refinitiv, Markit, Robeco. The figure shows the cumulative returns of stock quintile portfolios based on a composite of short-selling information. The quintile portfolios are equal-weighted and the outperformance is measured against the equally-weighted universe. The investment universe consists of MSCI Developed Index constituents. Region and sector neutrality are applied by independently ranking stocks within each region/GICS level 1 industry (11 sectors) bucket. Developed market regions are North America, Europe, and the Pacific. The sample period is January 2020 to March 2022.

Subscribe to our newsletter for investment updates and expert analysis.

Figure 1 shows the cumulative outperformance of stocks sorted into five quintile portfolios based on a composite of short-selling signals. These signals include the shorting ratio, but also take into account several criteria such as demand, supply, fees and liquidity.

In January 2021, the most shorted stocks outperformed by about 3%. However, after that, they underperformed leading to a cumulative underperformance of about -10% over the sample period. By contrast, the least shorted stocks only marginally underperformed in January 2021, before rebounding and generating an outperformance of around 8% over the same period. These results, therefore, suggest that short-selling data still offers investors valuable information beyond common factors.

1See: Boehmer, E., Jones, C. M., and Zhang, X., April 2008, “Which shorts are informed?”, Journal of Finance; Engelberg, J. E., Reed, A. V., and Ringgenberg, M. C., August 2012, “How are shorts informed?: Short sellers, news, and information processing”, Journal of Financial Economics; and Engelberg, J. E., Evans, R. B., Leonard, G., Reed, A. V., and Ringgenberg, M. C., November 2020, “The Loan Fee Anomaly: A Short Seller's Best Ideas”, SSRN working paper.

2See: Lee, J., January 2021, “Short sellers crushed like never before as retail army charges”, Bloomberg.