Investing in defense as a sustainable investor

Investors are being urged to invest more in defense companies as European governments ramp up spending to counter Russia.

Summary

- Europe calls for higher defense spending to counter Russian threat

- Conventional weapons have always been investible for mainstream portfolios

- Controversial weapons like cluster munitions are always excluded

President Trump has called for all members of NATO to raise defense spending to at least 2% of GDP following Russia’s invasion of Ukraine, and for Europe to take more responsibility for its own security.

At an emergency summit in Brussels, EU leaders agreed on an EUR 800 billion ‘ReArm Europe’ plan to significantly boost defense spending to defend Ukraine itself, along with its own borders with Russia. This has led aerospace and defense stocks to outperform most other sectors as they benefit from the greater spending.

While investing in the makers of controversial weapons remains prohibited, it has always been possible at Robeco to invest in companies involved in conventional defense industries and their support services, and this may now increase, say Robeco’s multi-asset and sustainable investing specialists.

“We are trying to square a natural reluctance to invest in defense, due to its inherent association with unsustainable and undesirable conflicts, with the fact that we are multi-asset investors, and we want to balance the trade-off between risk, return and sustainability when it comes to defense spending,” says Aliki Rouffiac, Portfolio Manager with Robeco Sustainable Multi-Asset Solutions.

“Over the long term, we should position ourselves to benefit from the significant shifts in European policy to increase defense spending. The ReArm Europe plan means massive new investment to safeguard the security of the region.”

“If so, we expect that the weight of the aerospace and defense sub-industry sector will grow beyond the 2% current exposure in the Global Equity Index, while other parts of the market would also reap the benefits of higher spending.”

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

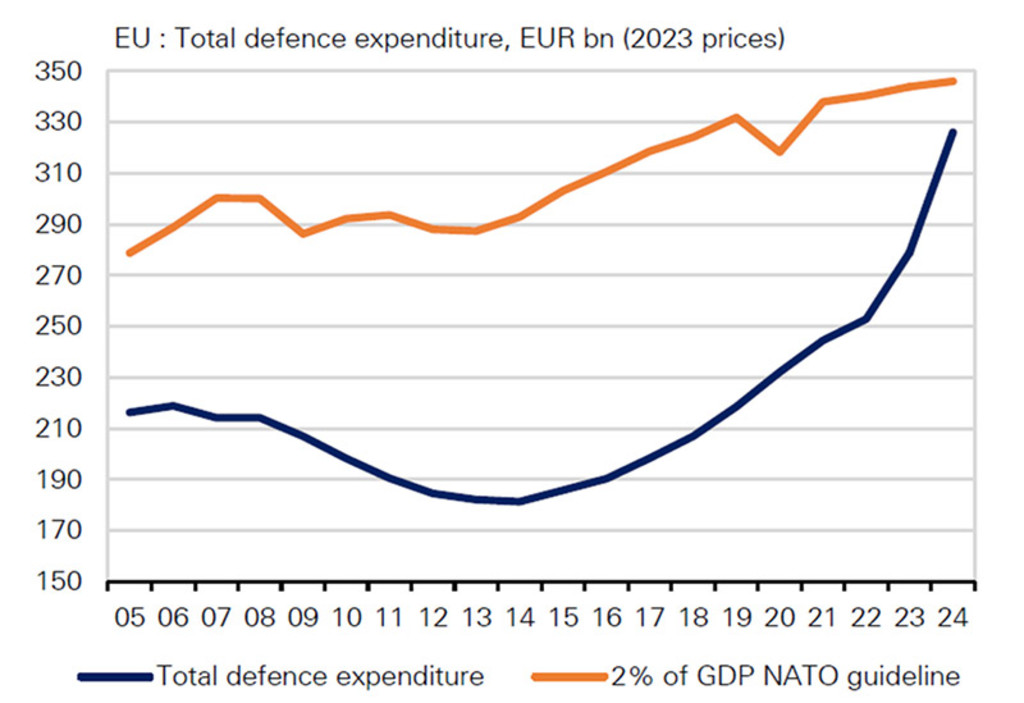

Source: Deutsche Bank, European Defence Agency. Note 2024 figure is estimate

Russia’s invasion of eastern Ukraine in February 2022, following its annexation of Crimea in 2014, changed not only the defense landscape, but also the global economy, triggering huge inflation in energy, food and commodities. Central banks are still battling with interest rates to tame the inflation.

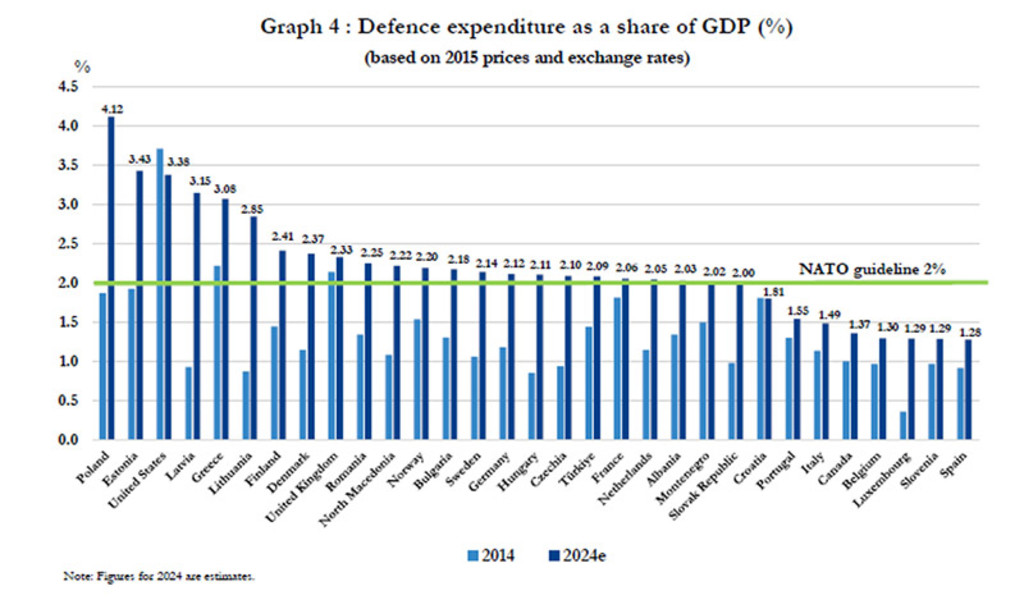

Western spending on defense has been much lower than in Russia, which spends 5.86% of its GDP a year on defense.1 Of the 31 NATO members, eight still do not meet the 2% of GDP guidelines, with Spain spending only 1.28% and Italy 1.49%. Belgium, where NATO’s headquarters are located, spends just 1.30%. 2

The highest European spenders are Poland and the three Baltic states which all border Russia; the US spends 3.38% of GDP a year and has the highest military budget in the world of almost USD 1 trillion.

Defense spending by NATO members. Source: Forces News, NATO

Defense in mainstream portfolios

“As a responsible investor, it has always been the case that we can invest in defense for our mainstream investment portfolios, and obviously it is becoming more relevant now,” says Carola van Lamoen, Head of Sustainable Investing at Robeco.

“Our mainstream investment portfolios can invest in the defense industry, excluding only controversial weapons. At Robeco, we acknowledge the changing geopolitical landscape and the increasing responsibility of European governments for the continent's defense. This shift also comes with greater investments in the defense sector.”

“At Robeco, we are committed to integrating ESG principles, and we balance our clients’ goals of return, risk, and sustainability by taking into account their objectives and tailoring the outcomes accordingly.”

Excluded weapons

Robeco deems controversial weapons to be cluster munitions, anti-personnel mines, white phosphorus and depleted uranium ammunition, along with chemical, biological and nuclear weapons. Nearly all are banned under international treaties.3 These are part of Level One exclusions at Robeco and apply across the entire investment range, making the companies ineligible for investment.

Level Two exclusions are used by Robeco’s bespoke sustainable portfolios and go further by specifically barring a company for activities that are classified as unsustainable. Here, from a defense perspective, military contractors are excluded above certain revenue thresholds.

“Our most sustainable investment strategy range does not invest in defense because we do not define weapons as sustainable investment,” Van Lamoen says. “In other words: investing in defense can be responsible, but not sustainable.”

Investing more indirectly

There are also opportunities to invest in the non-lethal support industries that back armies and their infrastructure. Napoleon once said that “an army marches on its stomach”, meaning opportunities in catering and the related companies supplying troops. Investors can also look for high-end military uniform suppliers, logistics firms, satellite technology, or in banking providing loans to any of them.

Modern warfare also isn’t just on the battlefield, as seen when a North Korean hacking team allegedly stole over USD 1 billion worth of cryptocurrency. This brings opportunities for cybersecurity.

“This also supports an active management approach, as this goes hand in hand with our sustainable investing principles, by allowing for differentiation between companies that are investable versus those that are genuinely part of our exclusionary policies,” Rouffiac says.

“It’s more of an evolution rather than a revolution. The proposed plans to raise defense spending still need to be ratified by governments, and this may take time. And there could be a peace deal between Russia and Ukraine coming up, which would lessen the urgency of it. It means we should stay flexible in terms of our approach.”

Footnotes

1 https://data.worldbank.org/indicator/MS.MIL.XPND.GD.ZS?locations=RU

2 https://www.forcesnews.com/news/world/nato-which-countries-pay-their-share-defence

3 The Ottawa Treaty (1997) prohibits the use, stockpiling, production and transfer of anti-personnel mines. The Convention on Cluster Munitions (2008) prohibits the use, stockpiling, production and transfer of cluster munitions. The Chemical Weapons Convention (1997) prohibits the use, stockpiling, production and transfer of chemical weapons. The Biological Weapons Convention (1975) which prohibits the use, stockpiling, production and transfer of biological weapons. The Treaty on the Non-Proliferation of Nuclear Weapons (1968) limits the spread of nuclear weapons to the group of confirmed nuclear weapons states (the US, Russia, UK, France and China).