Disclaimer Robeco Switzerland Ltd.

The information contained on these pages is solely for marketing purposes.

Access to the funds is restricted to (i) Qualified Investors within the meaning of art. 10 para. 3 et sequ. of the Swiss Federal Act on Collective Investment Schemes (“CISA”), (ii) Institutional Investors within the meaning of art. 4 para. 3 and 4 of the Financial Services Act (“FinSA”) domiciled Switzerland and (iii) Professional Clients in accordance with Annex II of the Markets in Financial Instruments Directive II (“MiFID II”) domiciled in the European Union und European Economic Area with a license to distribute / promote financial instruments in such capacity or herewith requesting respective information on products and services in their capacity as Professional Clients.

The Funds are domiciled in Luxembourg and The Netherlands. ACOLIN Fund Services AG, postal address: Leutschenbachstrasse 50, CH-8050 Zürich, acts as the Swiss representative of the Fund(s). UBS Switzerland AG, Bahnhofstrasse 45, 8001 Zurich, postal address: Europastrasse 2, P.O. Box, CH-8152 Opfikon, acts as the Swiss paying agent.

The prospectus, the Key Investor Information Documents (KIIDs), the articles of association, the annual and semi-annual reports of the Fund(s) may be obtained, on simple request and free of charge, at the office of the Swiss representative ACOLIN Fund Services AG. The prospectuses are also available via the website https://www.robeco.com/ch.

Some funds about which information is shown on these pages may fall outside the scope of CISA and therefore do not (need to) have a license from or registration with the Swiss Financial Market Supervisory Authority (FINMA).

Some funds about which information is shown on this website may not be available in your domicile country. Please check the registration status in your respective domicile country. To view the Robeco Switzerland Ltd. products that are registered/available in your country, please go to the respective Fund Selector, which can be found on this website and select your country of domicile.

Neither information nor any opinion expressed on this website constitutes a solicitation, an offer or a recommendation to buy, sell or dispose of any investment, to engage in any other transaction or to provide any investment advice or service. An investment in a Robeco Switzerland Ltd. product should only be made after reading the related legal documents such as prospectuses, annual and semi-annual reports.

By clicking “I agree” you confirm that you/the company you represent falls under one of the above-mentioned categories of addressees and that you have read, understood and accept the terms of use for this website.

Quantitative investing

Shapley values

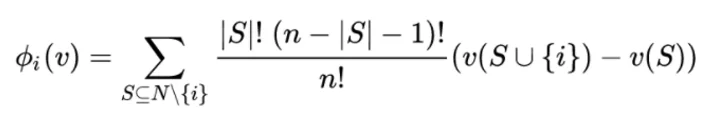

Shapley values are a concept borrowed from game theory. Regarding the latter, the game constitutes a setting in which players contribute to an overall outcome (payoff). In terms of this, Shapley values are used to distribute the gains or costs fairly across several players cooperating in coalitions. Effectively, they are the average marginal contributions (gains or costs) for all players, when all possible coalitions have been taken into account.

Where

φi is the Shapley value for player i

N is the set of all players and N\{i} is the set of all players excluding player i

n is the number of players in set N: the total number of all players

S is any subset of the set of all players excluding player i

v(S) is the payoff for a coalition consisting of the players in set S

For example, take two individuals (A and B) who would like to Uber home after work. If they do so separately, the cost for A is EUR 10 and for B EUR 15 given varying distances. However, if they share the ride, the fare amounts to EUR 20. With Shapley values, you can calculate how this should be split fairly between the two individuals. In this scenario, the players (A and B) form a coalition (carpool) and they play a game (Uber ride) to obtain a payoff/cost (EUR 20 fare).

In this setting, the Shapley values amount to the players’ average marginal contributions (or costs) across all possible orders in which the players can join the carpool arrangement, i.e., if A hails the ride first or if B is the first to request it. If A books the Uber, her marginal contribution will be EUR 10. Given that B joins the carpool as the second individual, his contribution will also be EUR 10 as that the total cost of the ride is EUR 20. But if B hails the ride, his marginal contribution will be EUR 15 and A will contribute the remaining EUR 5. Therefore, the Shapley values would then amount to EUR 7.5 for A – (10+5)/2 – and EUR 12.5 for B – (10+15)/2.

Shapley values have many applications, including machine learning (ML). In terms of our quant investing platform, we use them in interpreting our ML models. For example, they can help us to determine which variables (features) are the most impactful in our models and rank them in terms of importance. They can also shed light on the outputs generated by our models by deconstructing the marginal contributions of features, thus allowing us to better understand the economic rationale behind our model predictions.

See also

As technology advances, so do the opportunities for quantitative investors. By incorporating more data and leveraging advanced modelling techniques, we can develop deeper insights and enhance decision-making.