Momentum is a self-fulfilling prophecy and therein lies its strength

The Momentum premium arises from mistakes in human reasoning. Despite being conceptually simple and publicly known, it remains a strong factor across numerous asset classes. Behavioral finance theories shed light on why it exists and why it has not been arbitraged away.

概要

- The Momentum factor has delivered strong returns over the long run

- The Momentum premium is explained by behavior, not risk

- Propensity for humans to err underpins factor’s persistence

As a concept, momentum investing is simple: buy (overweight) assets that have recently outperformed their peers and sell (underweight) those that have underperformed. Despite the relative simplicity of this investment approach, the factor has been able to generate strong long-term performance in equity markets.

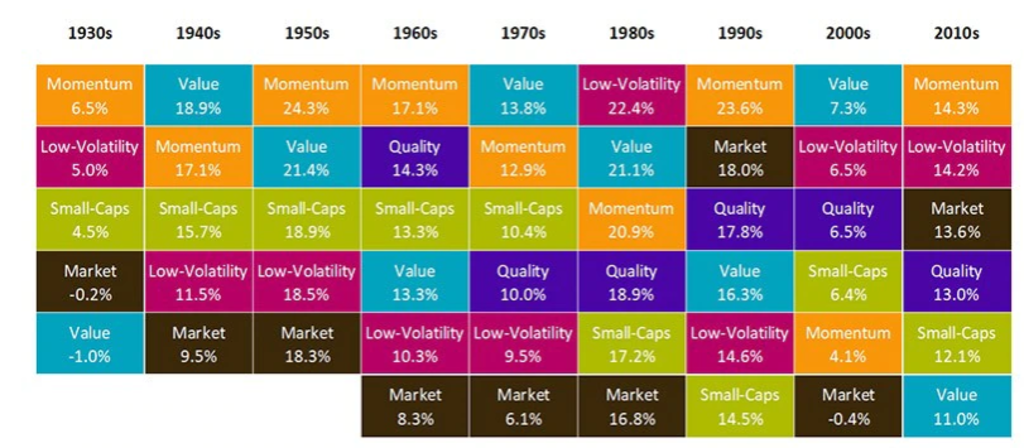

This is illustrated in Figure 1, which shows the 10-year returns of various factors since the 1930s. We have seen that momentum has delivered the highest gross returns in five out of nine decades and beat the market in all nine. Moreover, recent evidence indicates that it continues to be one of the strongest factors and that it has not been arbitraged away.1

Figure 1 | Historical performance of equity factor premiums

Source: Data library of Professor Kenneth French, Robeco. All factors are long-only portfolios of US stocks that are invested 50% in big and 50% in small top factor portfolio based on 2x3 size-factor sorts from Professor Kenneth French. The low volatility factor is constructed in the same way, but is obtained from Robeco.com/data. Quality is an equal-weight combination of operating profitability and investment portfolios of Professor Kenneth French. Sample runs from January 1930 till December of 2019 for all factors but quality, which starts in July of 1963.

To understand why momentum investing has performed so well and not been arbitraged away, one needs to understand why this phenomenon exists in the first place.

According to the neoclassical school of thought, the momentum premium is compensation for bearing some systematic risk. In practice, momentum is a fast-changing factor and the stocks it favors can change substantially from one month to the next. Therefore, from a risk-based perspective, the premium could stem either from the constant change in financial market risks or shifts in how much risk investors are willing to bear. However, real-world evidence suggests these components actually change slowly.

Another risk-based explanation is that the momentum premium could arise from investors expecting to be compensated for potential crash risk. Indeed, it is known that momentum strategies can suffer from sudden and devastating crashes, such as the one that occurred in 2009. However, research shows that risk-managed momentum strategies which do not exhibit crashes also have the potential to generate high returns for investors, clearly contradicting this theory.2

In acknowledgement of the lack of adequate risk-based explanations, even the father of the efficient market hypothesis, Eugene Fama, referred to momentum as the biggest challenge to his theory.

Behavioral finance has been more successful at explaining the existence of the momentum factor

Behavioral biases give rise to Momentum premium

Where neoclassical, risk-based theories have failed, behavioral finance has been more successful at explaining the existence of the momentum factor. Unlike in mainstream, neoclassical finance, where investors are considered to be ‘rational’ agents that understand risks and opportunities in financial markets, behavioral finance builds on the assumption that investors are not fully rational and they make decisions based on heuristics, which can lead to mistakes and therefore ‘anomalies’.

The overconfidence investors have in their ability to analyze securities, and tendency to attribute success to skill and failure to bad luck, can help explain the existence of momentum. For instance, if positive newsflow emerges that affirms the views of private investors, they will tend to push the stock price of the related company above its fundamental value i.e., over-extrapolate. But this is eventually rectified when fresh newsflow highlights the overreaction of the investors, typically leading to a long-term correction in the stock price.

Underreaction can also contribute to a momentum premium. This is based on the conservatism bias that implies investors tend to change their beliefs slowly.3 In this scenario, the bias would restrain a firm’s stock price from initially adjusting adequately in response to newsflow. But this underreaction can instigate momentum as the price moves slowly towards its correct (fundamental) value, due to the good news being taken into account progressively.

The psychology of overreaction and underreaction was conceptualized in a unified manner, in a 1999 academic paper.4 The researchers developed a model with two types of investors with different information: news watchers who determine the value of a firm based on fundamental news, and momentum traders who extrapolate patterns from historical price changes.

If positive newsflow is disseminated about a firm's fundamental value, the news watchers would trade on it first. They found this would lead to an insufficient increase in its stock price as the news would spread slowly in the market i.e., underreaction. The momentum traders would then extrapolate this trend only after observing the initial uptick in the price, resulting in an overreaction. As in the other cases of overreaction, a long-term correction would then follow.

Why hasn’t Momentum been arbitraged away?

If momentum-linked anomalies have delivered robust returns on the back of mistakes in human reasoning, the natural question is why have they not been arbitraged away.

Firstly, momentum is not an easy factor to harvest. Unlike value, for instance, which can be implemented with a modest turnover of 10-20% per year, the traditional momentum factor typically has a turnover of a several hundred percentage points a year. Clearly, in order to effectively harvest this factor after costs, one needs to apply smart trading strategies.

Secondly, while the momentum premium has been linked to behavioral biases as opposed to risk, exploiting it may not be completely painless. Momentum strategies have been shown to be prone to rare but severe crashes. Therefore, momentum investors also need to be able to commit their capital over a longer-term period and be ready to face challenging times.

Humans consistently make errors, even when they have been previously informed of them

Thirdly, there is no one correct way to define momentum. Even simple price momentum is often defined using different lookback periods, ranging from three to twelve months. Also, an investor can choose to implement one version of momentum or to combine multiple factors such as residual momentum or connected analyst momentum.

Lastly, human psychology and our propensity to make cognitive mistakes should not be underestimated. Much of the experimental work in finance shows that humans consistently make errors, even when they have been previously informed of them. One does not need to dig deep to find examples of over-extrapolative markets, fueled by human enthusiasm. Time and time again, these patterns emerge and lead to predictable patterns that only systematic and patient investors may be able to exploit.

In the next paper of this series, we will discuss the low volatility factor through a behavioral finance lens.

Footnotes

1Please see: Blitz, D.C., May 2021, “The Quant Crisis of 2018:2020: Cornered by Big Growth”, Journal of Portfolio Management.

2Barroso P., and Santa-Clara P., April 2015, “Momentum has its moments”, Journal of Financial Economics.

3Daniel, K., Hirshleifer, D., and Subrahmanyam, A., December 1998, “Investor psychology and security market under- and overreactions“, Journal of Finance.

4Hong, H., and Stein, J. C., December 1999, “A unified theory of underreaction, momentum trading, and overreaction in asset markets“, Journal of Finance.

探索量化價值

訂閱我們的電子報,獲取尖端的量化策略和見解。

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.