GLP-1 drugs give more weight to healthy living

GLP-1 drugs not only curb weight gain but also produce marked changes in eating behaviors and lifestyles. Consumption of calorie-dense packaged foods should decline while demand for healthy eating, physical fitness, and well-being should flourish, providing a boost to companies providing healthy living solutions.

概要

- GLP-1 drugs mark a turning point in the fight against the obesity epidemic

- Nutritious food markets are likely to grow rapidly, at the expense of indulgent foods

- Beyond nutrition, weight-loss drugs are boosting healthy lifestyle trends

Obesity is a debilitating condition in its own right, but it can also lead to a host of serious medical conditions, from sleep apnea, osteoarthritis and impaired mobility to diabetes, hypertension, and cardiovascular disease. It can even lead to certain types of cancer. Obesity’s prevalence in populations globally has ballooned, nearly tripling since the 1970s;1 so too have healthcare expenses. In the US, annual medical costs for obese adults are nearly USD 2,000 higher than for those with healthy body weights.2 Healthcare costs as a share of national GDP are steadily rising. In the UK, it has increased from 4% in 1990 to 12% in 2022.

But escalating costs are not limited to healthcare, societal costs are also rising. Obesity reduces worker productivity and employment; it also negatively impacts educational outcomes for younger cohorts.3 The World Obesity Federation predicts that the global economic impact of overweight and obesity will reach over USD 4 trillion per year by 2035, equivalent to almost 3% of global GDP, a scale comparable to the Covid-19 impact in 2020.

GLP-1: an effective tool against obesity

The now familiar Ozempic and Wegovy are prescription drugs knowns as GLP-14 agonists that stimulate insulin secretion. Recently, they’ve been heralded in the media for their efficacy, convenience and safety, but, in fact, GLP-1 drugs are nothing new. The US FDA approved first-generation GLP-1 meds to treat diabetes as far back as 2005. Prior to its role in countering obesity, Ozempic, was approved for use in patients with type 2 diabetes in 2017.

With 15%-20% weight loss in clinical trials, these next-generation drugs also boast better results than previous drugs and diet programs.5 In addition, trials have shown a 20% reduction in cardiovascular risk for certain categories of patients.6 That makes a single weekly shot, a sweet deal for many obese patients.

GLP-1 patients will eat better as they substitute bad foods for good ones, benefiting companies with healthy food portfolios

Healthy swaps – snacks out, proteins in

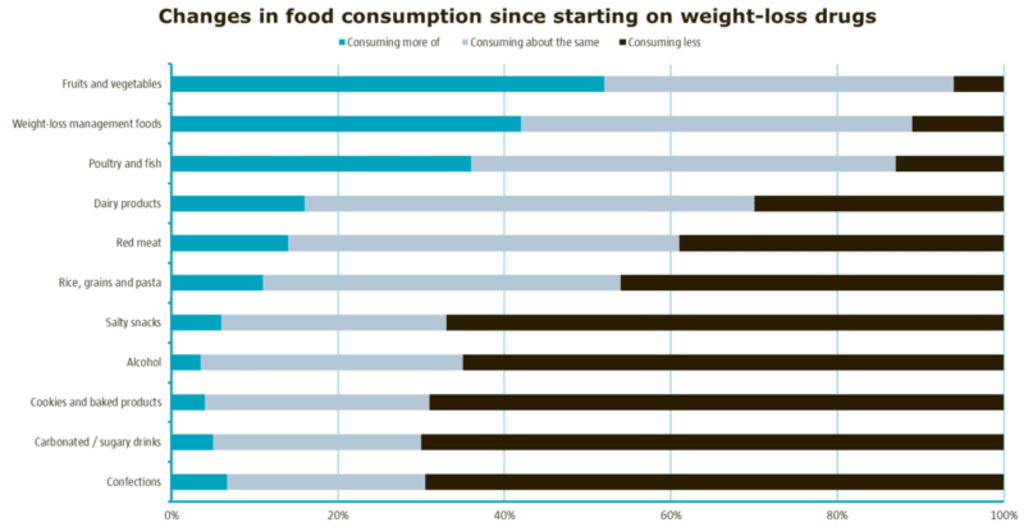

GLP-1 drugs not only stimulate the release of insulin, which lowers blood sugar and helps manage type 2 diabetes, they also slow stomach emptying, which prolongs a feeling of fullness and reduces appetite. Early data suggests patients taking GLP-1 drugs consume 15-30% fewer calories from smaller meals and less snacking. Patients report reduced intake of sugary drinks, sweets and salty snacks in favor of fresh produce, protein sources and weight-loss management foods (see Figure 1).

Recent sell-offs in food and beverage stocks reflect fears that overall consumption and food volumes will take a hit as GLP-1 patients reduce caloric intake. However, reality is more nuanced. Even with a GLP-prescription base of 25 to 50 million patients (up from 1 million today), analysts predict only a low single-digit percent decline in food volumes. In addition, GLP-1 patients will eat better as they substitute bad foods for good ones, benefiting companies with healthy food portfolios. Indeed, consumer panel data shows that obese shoppers spend disproportionately more on unhealthy foods (e.g., candy, snacks and pastries) and less on healthier options (e.g., beans, legumes, lentils and grains) compared to individuals with normal body weights.7

Figure 1 – Gains from losses

GLP-1 patients are helping accelerate positive dietary trends away from sin foods and towards healthy options.

Source: AlphaWise, Morgan Stanley Research, Downsizing Demand: Obesity Medications’ Impact on the Food Ecosystem, August 2023.

Moreover, research confirms that eating habits are heavily influenced by social context. In other words, our behavior tends to converge with those of our peers, family and friends. That means healthy behavioral changes could extend beyond GLP-1 patients to a much wider social circle, amplifying healthier eating and living across broader populations.

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

More than a diet – real lifestyle change

Early data suggests that patients aren’t just injecting a drug but also taking charge of their long-term health. Studies show GLP-1 patients are exercising more and seeking resistance training to avoid muscle loss.8 Spending habits are following suit. A large US retailer which tracked the spending patterns of a small cohort of customers on GLP-1 drugs found that they spent less on food and more on health-enhancing products such as athletic apparel, wearables, fitness equipment, and even blenders for home-made shakes.

Less weight in the population should mean more weight into healthy living investments

Conclusion

The evidence so far strongly suggests that GLP-1 drugs will be a benefit not only to millions of patients but also a plethora of companies within the Healthy Living investment strategy. The strategy invests in companies producing and marketing natural foods including fruits and vegetables, as well as lean and high-protein meats and dairy. Its food focus also includes packaged food companies and their ingredient suppliers that have diversified into healthier food formulations and product portfolios. Both of which should benefit from creating healthier version of convenience foods that are hard to live without.

Moreover, many GLP-1 patients are making life-altering behavioral decisions that go well beyond eating to full-body health and wellness. Healthy living investments also cover companies that enable physical fitness, promote personal care and enhance overall health and well-being. And given good health is never a ‘one-and-done’ process, it also includes digital and virtual health providers that will help GLP-1 patients measure, monitor, and maintain their progress.

While near-term adoption faces supply shortages, take-up rates will accelerate as insurance coverage increases and oral forms, that replace injections, are launched. Though next-generation GLP-1 drugs are no cure-all for weight-loss, we believe prescription use will accelerate, creating steady tailwinds and long-term growth for companies that enable healthier lifestyles.

More succinctly, less weight in the population should mean more weight into healthy living investments.

Footnotes

1 https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight

2 https://www.cdc.gov/obesity/data/adult.html

3 https://www.oecd.org/health/health-systems/Heavy-burden-of-obesity-Policy-Brief-2019.pdf

4 GLP-1, Glucagon-like peptide

5 The average weight loss after a 6-month Weight Watcher program is 5%. https://www.weightwatchers.com/us/weight-loss-tips

6 With obesity and established cardiovascular diseases but no history of diabetes

7 This also aligns with research on mass-market food products that shows the majority (~70-80% of sales volumes are generated by a small sub-set (~20-30%) of consumers. The Pareto Rule for frequently purchased packaged goods: an empirical generalization. Kim, Baek Jung, Singh, V., Winer, R. Stern School of Business. New York University. 2017

8 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3969105/

https://news.harvard.edu/gazette/story/2021/04/our-co-workers-can-influence-how-we-eat-study-finds/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7033640/

https://www.aarp.org/health/healthy-living/info-2019/friends-influence-eating-habits.html

https://www.sciencedirect.com/science/article/pii/S235215461500131X

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.